U.S. Initial Claims higher, Q2 Unit Labor Costs consistent with falling inflation

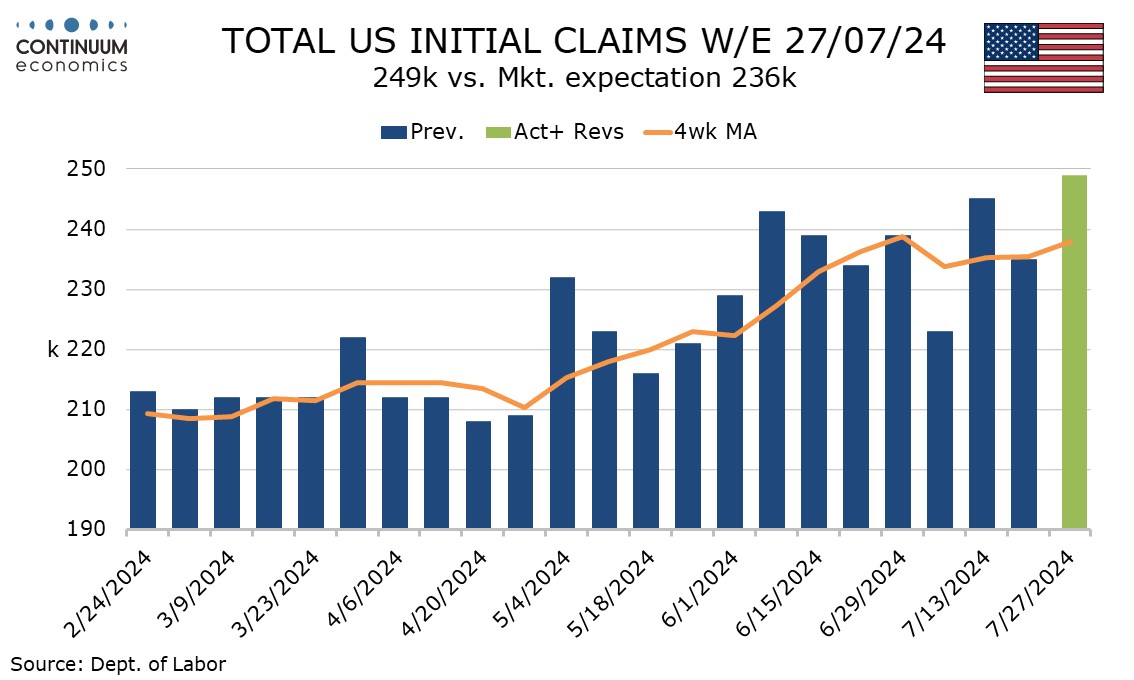

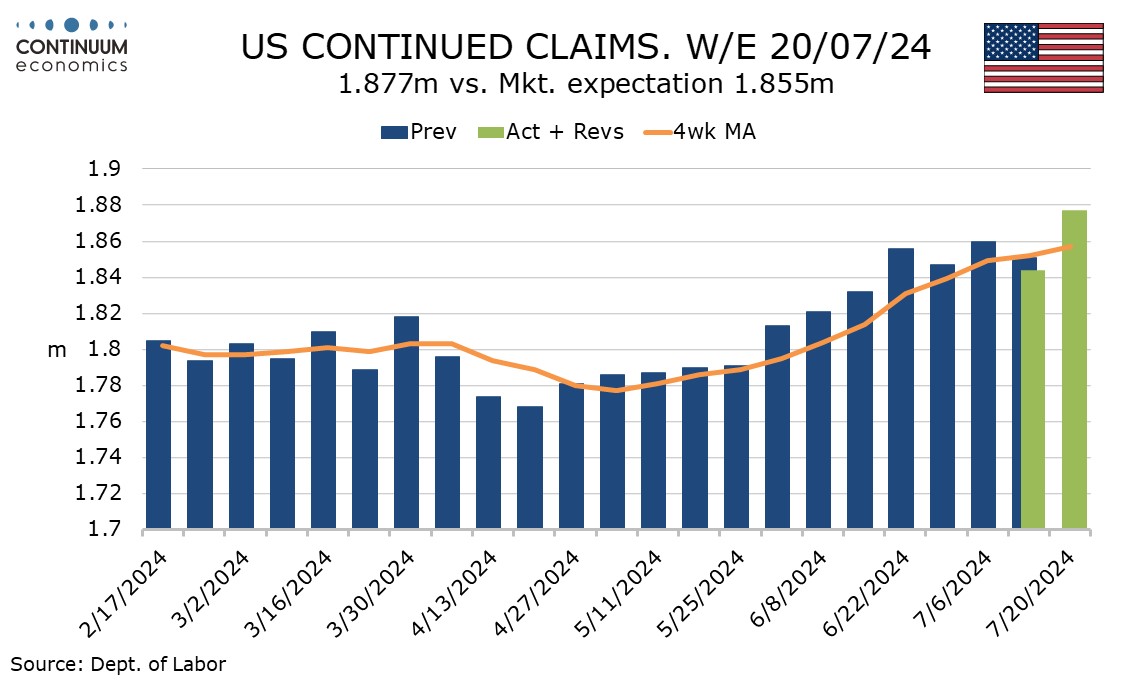

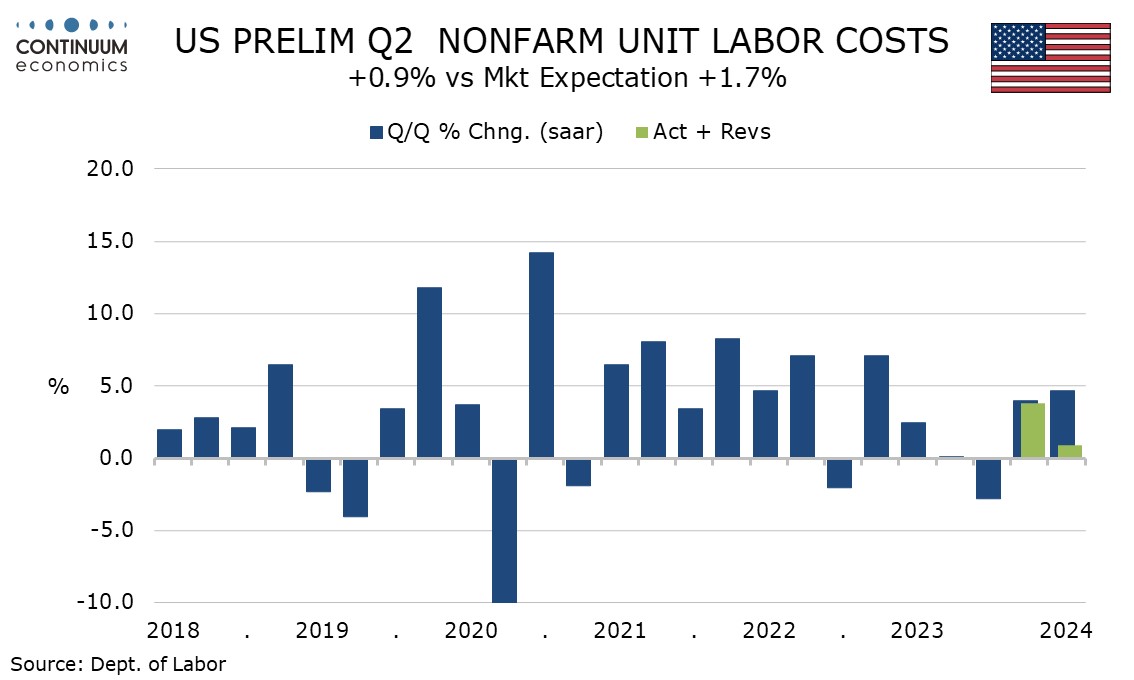

Weekly initial claims with a rise to 249k from 235k are higher than expected and the highest since August 2023, while continued claims at 1.877m from 1.844m are the highest since November 2021, both suggesting labor market cooling. Q2 productivity shows a healthy 2.3% annualized increase and until labor costs at a weaker than expected 0.9% are consistent with falling inflation.

The jobless claims data comes after the survey week for July’s non-farm payroll, two weeks after for initial claims and one week after for continued claims, so should not significantly impact payroll expectations for tomorrow, but does suggest downside payroll risk heading into August.

The 14k rise in initial claims follows a 10k decline in the preceding week, but the 245k outcome two weeks ago was inflated by Hurricane Beryl. There are no obvious special factors this week, though initial claims did fall 10k before seasonal adjustment. Continued claims rose by 33k after a 16k decline, resuming an uptrend, and also rose by 29k before seasonal adjustments.

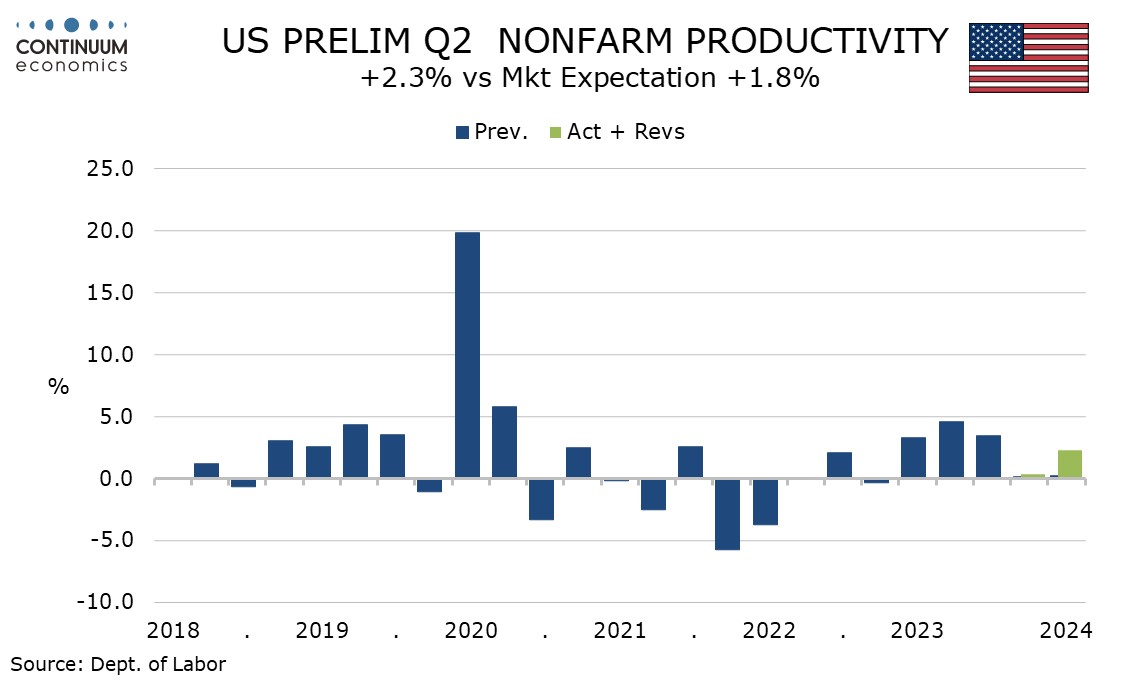

The 2.3% rise in Q2 non-farm productivity come from a 3.3% rise in non-farm business output as already seen in GDP detail and a 1.0% rise in hours worked, which was in line with non-farm payroll detail. While the quarter was healthy yr/yr growth of 2.7% is stronger still.

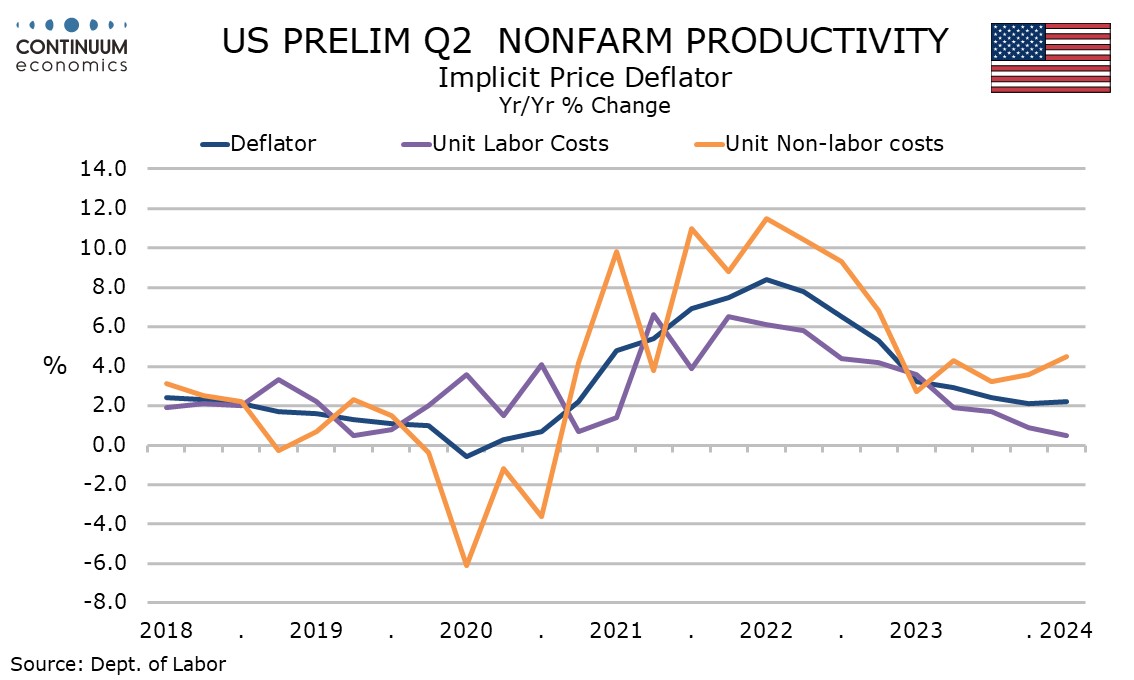

The productivity gain coupled with a 3.3% rise in compensation left unit labor costs up by a lower than expected 0.9% and on a yr/yr basis unit labor costs ate softer still at 0.5%.

Non-labor costs were firmer at 3.2% in the quarter which left the overall deflator up by 1.9% on the quarter and 2.2% yr/yr, which looks broadly consistent with inflation near the 2.0% Fed target.