FX Daily Strategy: Asia, April 3rd

US tariff announcement the main focus

Significant increases already priced in but JPY still looks to have potential for gains

ADP unlikely to move market

Scandis staying strong, NOK favoured

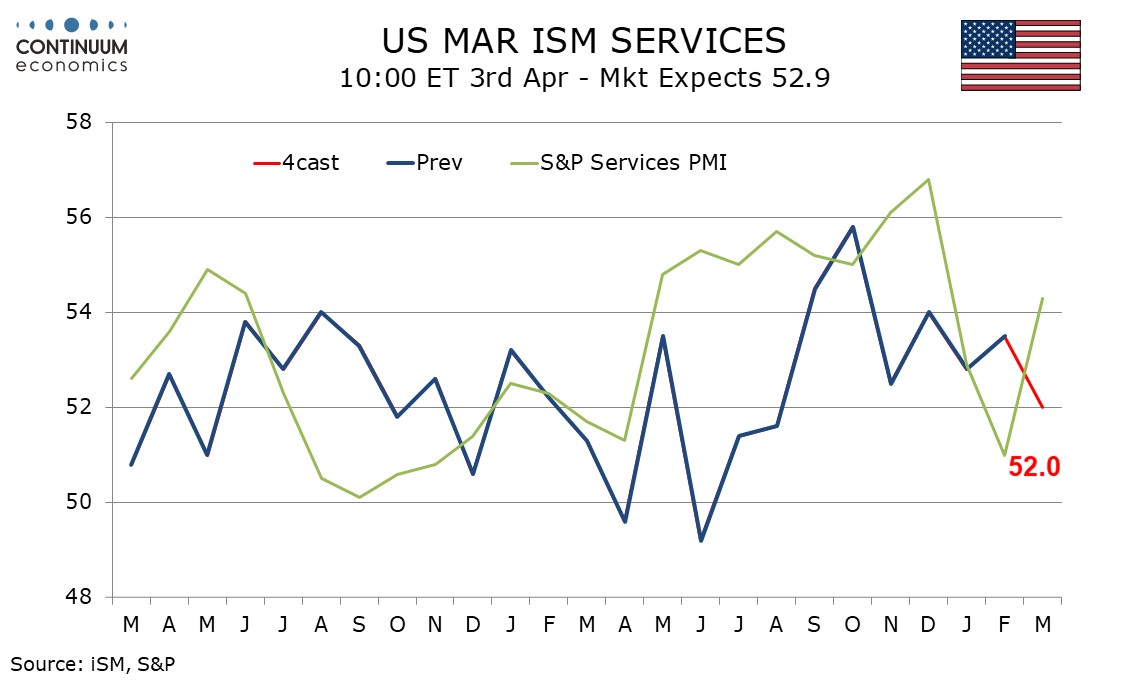

ISM services survey could provide more negative news on the US economy

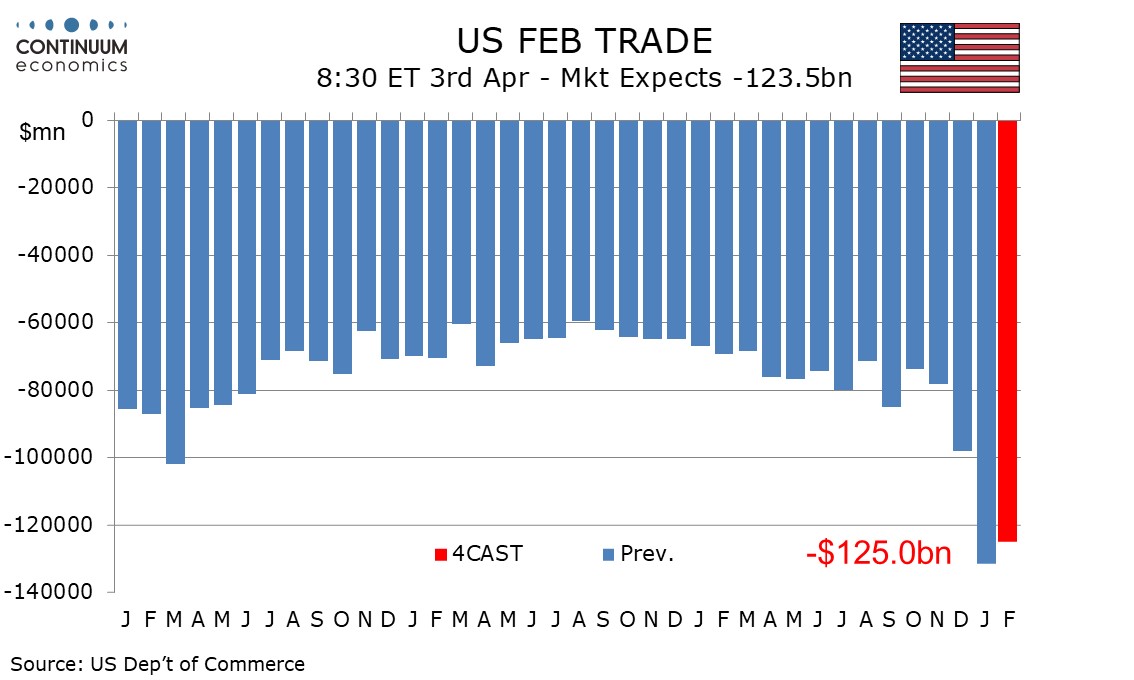

Trade data also likely to emphasise weakness in Q1 GDP

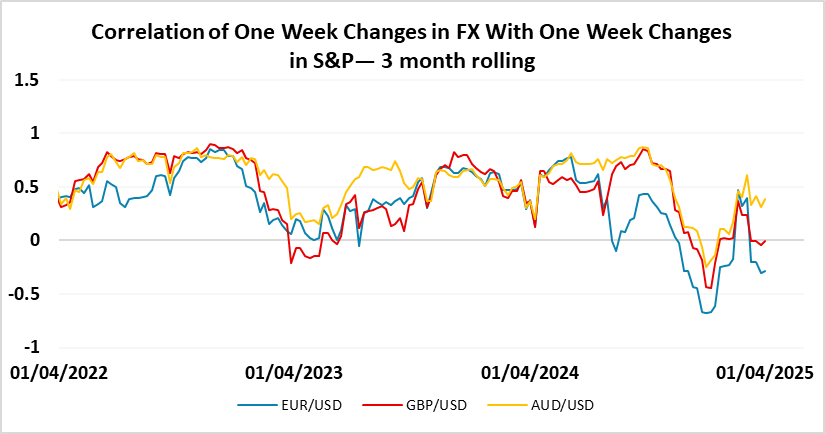

USD can weaken even in a risk negative environment

CHF CPI unlikely to have much impact, but CHF/JPY vulnerable

Thursday sees the non-manufacturing ISM, which will take on somewhat greater significance given the weak manufacturing ISM earlier this week and the big trade deficits in January and February which suggests a negative Q1 GDP outcome is very possible. We expect March’s ISM services index to slip to a 7-month low of 52.0 from 53.5, contrasting a stronger S and P Services PMI. The market consensus is also for a slight decline in the ISM services index, but only to 53.0, so there is scope for a negative market reaction. Much will depend on the mood of the market after the US tariff announcements, but it’s quite hard to see a positive story emerging from the current situation. Even if the tariffs are seen as more moderate than expected, the US equity market already looks expensive against a background of weakening growth (with potentially a negative Q1), and even moderate tariffs will tend to further weaken the economy.

We also have February trade data, although this is unlikely to produce much of a surprise as we have already had advance goods trade data for February. Even so, the services numbers could disappoint due to a reduction in tourism from Canada. The numbers are potentially significant because of the impact on Q1 GDP, with the current Atlanta Fed nowcast suggesting a negative number is possible, largely due to the widening trade deficit.

In recent years weakness in risk sentiment has tended to be most negative for the historically more risk sensitive currencies like the AUD and scandis, but the USD has show less resilience to the dip in equities seen in the last couple of months. Some of this relates to the fact that the USD gained 5% on optimism after the election, gains which it has now retraced. But there is also a perception that the Trump administration doesn’t welcome a strong USD, and while USD gains would normally be a natural corollary of US tariff increases, the focus has been on whether the US economy can maintain soldi growth against this background. So even though the growth hit may well be greater abroad, we continue to see the USD remaining under pressure as long as US growth expectations remain weak.

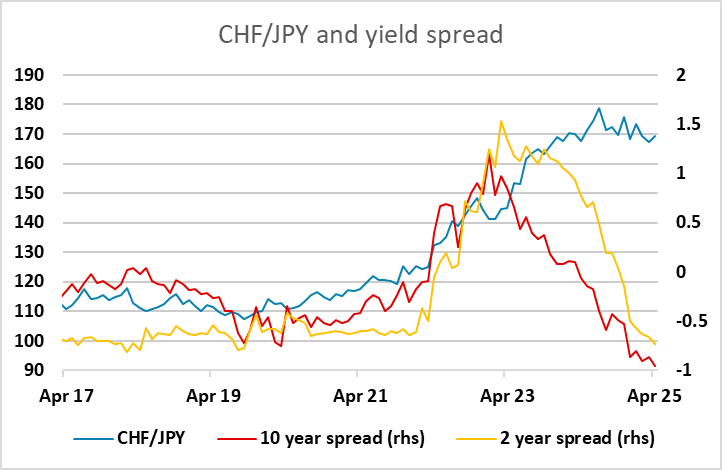

There isn’t much of note on the European calendar, with just final services PMIs for the Eurozone and the UK, but there is Swiss CPI data which could have a CHF impact. Having said this, the SNB has already cut the policy rate to 0.25%, so there isn’t much more downside. CPI is expected to increase slightly on a y/y basis to 0.5%, but the CHF is likely to be driven more by the European growth sentiment than the Swiss data. A European equity recovery could see EUR/CHF head back toward 0.96, but the low level of Swiss inflation in recent years means that even though the nominal level of EUR/CHF looks low, in real terms it is close to the middle of the range seen in recent years, so we wouldn’t see a substantial move in EUR/CHF from here. However, we continue to see CHF/JPY as the most obvious value trade in the market, with the move in yield spreads in the JPY’s favour and similar risk characteristics suggesting substantial downside scope for CHF/JPY.