USD flows: Little changed after mixed employment report

USD little changed after US employment data shows slightly stronger private payroll growth but higher unemployment and weaker average earnings.

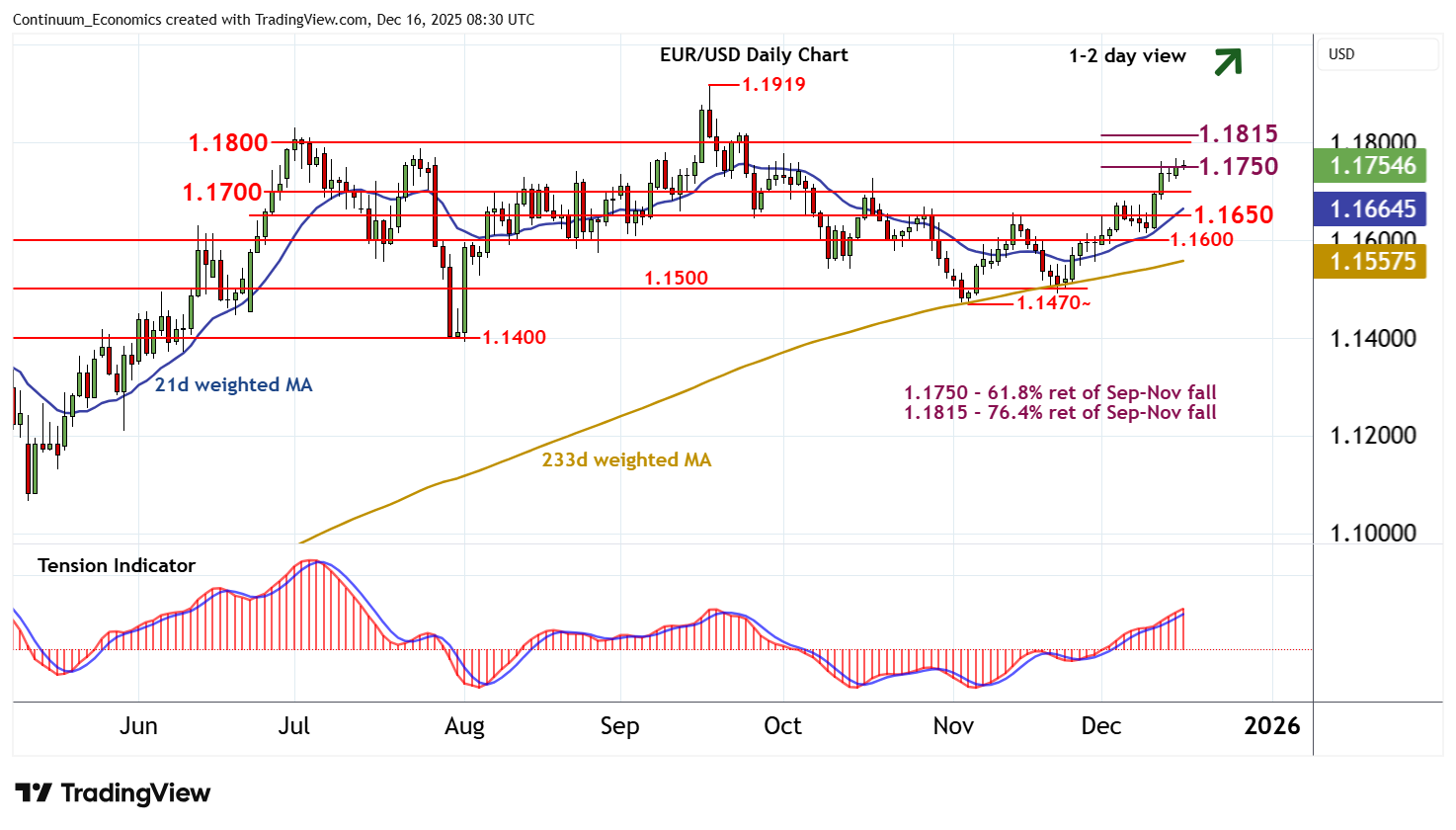

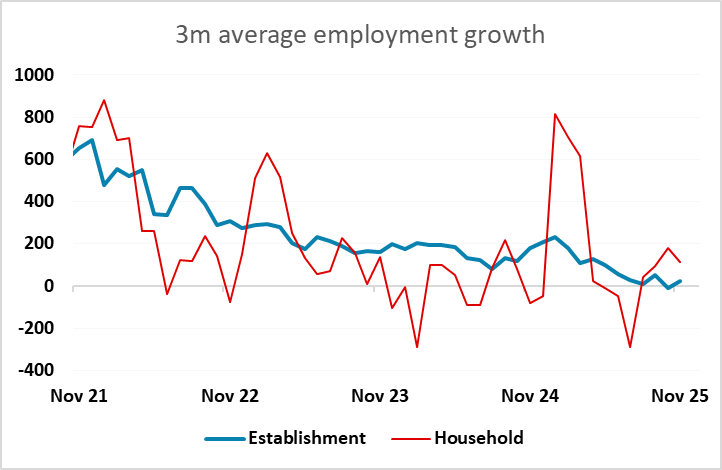

The US employment data is mixed with private payrolls coming in net stronger than expected with gains of 69k and 52k in November and October, but total payrolls falling 105k in October due to the DOGE related loss of government jobs. The unemployment rate also rise to 4.6%, and given that Fed chair Powell has said that he expected the payroll data to be revised lower, we would see the numbers as net slightly on the weak side, with the 0.1% gains in average earnings in November also weaker than expected. US yields are net marginally lower after the data, but the USD is little changed. We would see some downside risks for the USD from here, but we still prefer the AUD and JPY over the EUR, with the EUR approaching the resistance area at 1.18.