FX Daily Strategy: Europe, April 30th

Wednesday a huge day for data, with US GDP the main focus

Net exports are likely very weak in Q1, but focus may be on final domestic demand

Eurozone GDP could undershoot consensus, undermining the EUR

AUD has upside scope if CPI fails to decline

Wednesday a huge day for data, with US GDP the main focus

Net exports are likely very weak in Q1, but focus may be on final domestic demand

Eurozone GDP could undershoot consensus, undermining the EUR

AUD has upside scope if CPI fails to decline

Wednesday is a huge day for data. There is GDP data from the US, Canada, Germany, France, Italy and the EU as a whole, and provisional HICP data from Germany, France and Italy, as well as CPI from Australia. There is also ADP employment data from the US.

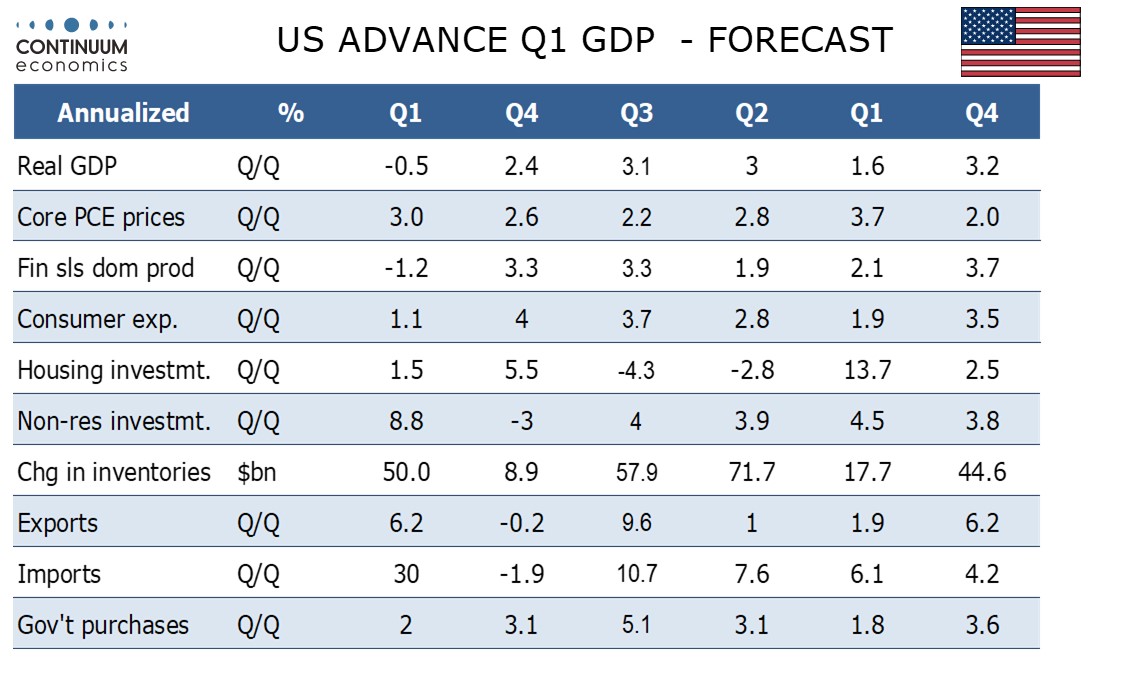

The US GDP data is likely to get the most attention and trigger the biggest reaction, but is also likely to be the hardest to interpret. Calculations based on the components suggesting a significant decline, largely due to a surge in imports. However, with non-farm payrolls showing a 0.5% rise in aggregate hours worked a steep fall looks unlikely. We predict a modest GDP decline of 0.5%, while the market consensus is for a rise of 0.4%. This would still be the first decline in GDP since Q1 2022, though Q2 2022 was also originally reported as a decline before being revised to a modest positive. Special factors, notably a pre-tariff surge in imports and bad weather will be behind the weakness in Q1 2025, though a rebound in Q2 is far from certain given the downside risks coming from tariffs.

This makes it hard to gauge the market reaction. Any weakness in Q1 is likely to primarily reflect pre-tariff trade flows, with net exports the only component that is expected to drag on growth. We may well see more weakness in final demand in Q2 when the impact of tariffs kicks in. The market reaction may therefore depend on whether final demand was still strong in Q1. We look for a fairly modest annualised rate of growth in consumer spending of 1.1%, following a 4% pace in Q4. Anything above 2% may well be seen as positive.

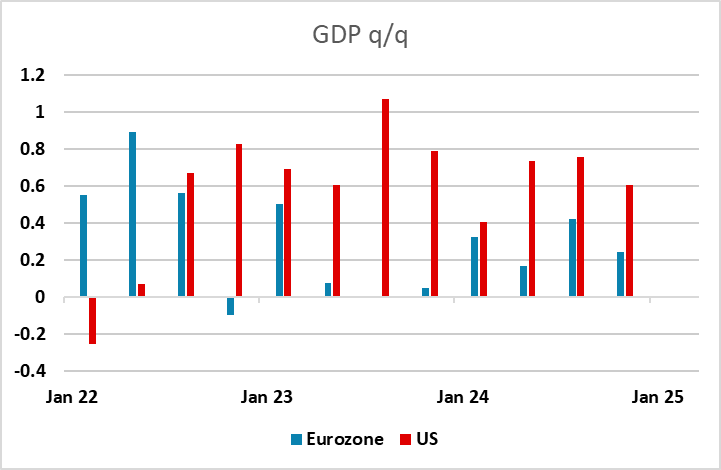

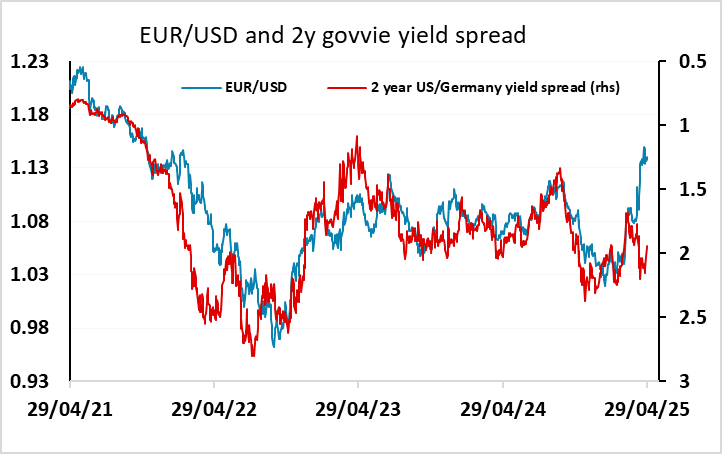

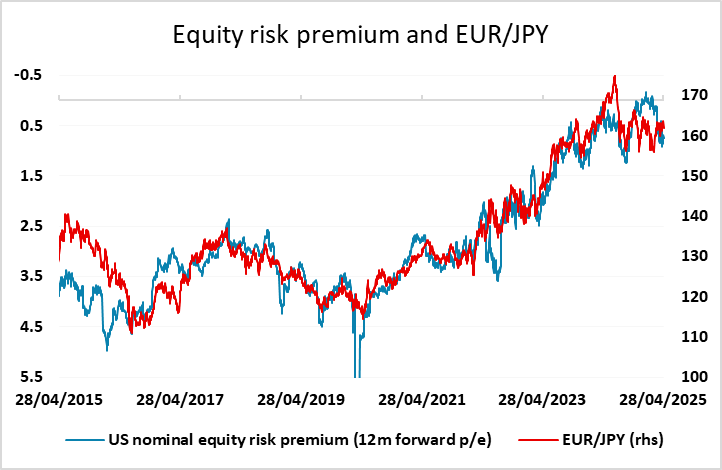

Before the US data we have the Eurozone numbers, which we expect to show a 0.1% q/q rise, slightly below the market consensus of 0.2%. If the US manages the consensus 0.4% annualised rate (0.1% q/q) this may be a little disappointing for the EUR, as this quarter does offer the possibility that the EU grows faster than the US for the first time since 2022. Market reaction will depend more in the US data, but if the Eurozone fails to reach the 0.2% consensus, expect the JPY to outperform the EUR. EUR/USD will depend more on whether the US data is positive, but EUR/JPY still looks capped near 164, and any general return to risk aversion could trigger a renewed decline.

For the Eurozone CPI data the risks are on the downside due to lower fuel prices. The Eurozone numbers aren’t released until Friday, but the German and French numbers should show a small decline in the headline HICP. We wouldn’t expect a major reaction to the CPI data, unless it is well away from consensus, as the focus is more on how the tariff increases will affect things going forward.

Q1 Australian CPI is expected to edge lower on a y/y basis, and this should support expectations of of an RBA rate cut in May. A 25bp cut is already fully priced in, so the risks may be that stronger CPI leads to some pricing out and a stronger AUD. As it stands, AUD/USD continues to struggle to gain a foothold above the 0.64 level, but we continue to see cope for substantial AUD/USD gains if that level is breached, although the AUD is still likely to struggle on the crosses unless equities extend the rally of the last few weeks.

The Q1 Australian headline inflation stayed at 2.4% with trimmed mean dropped past 3% to 2.9% y/y. While headline is a tad higher than estimate, trimmed mean has tread lower within the target range. However, it is not sufficient to indicate an imminent cut from the RBA as they have their eyes on the mid range from trimmed mean CPI.