FX Daily Strategy: Asia, Oct 29th

CAD risks on the upside with BoC cut nearly fully priced

FOMC likely to provide little new, but risks weighted towards a more hawkish take

Equity strength weighing on JPY but valuation very stretched

AUD firm and may benefit from CPI, but vulnerable to dip in risk sentiment

CAD risks on the upside with BoC cut nearly fully priced

FOMC likely to provide little new, but risks weighted towards a more hawkish take

Equity strength weighing on JPY but valuation very stretched

AUD firm and may benefit from CPI, but vulnerable to dip in risk sentiment

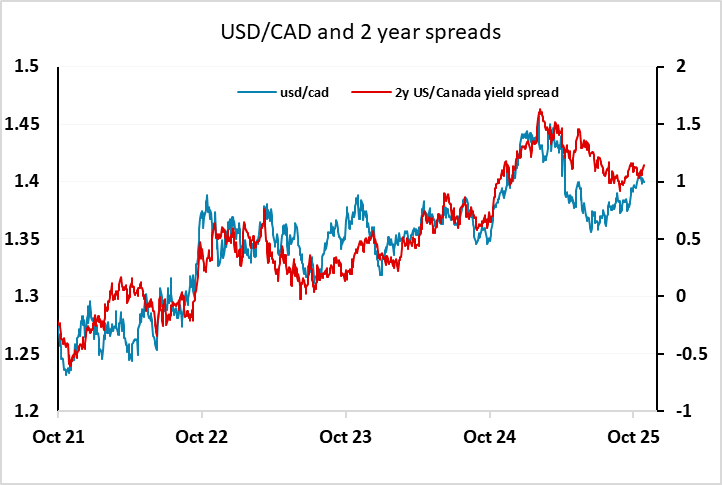

Wednesday sees policy meetings for both the Fed and the BoC The BoC is first up, and could potentially be influenced by the weekend deterioration of US/Canada relations which led to the announcement of a further 10% US tariff on Canada. This may not finish up being levied for long, if at all, but some see it as an extra reason for a BoC rate cut, which is now 90% priced in. However, we still see the BoC decision as a close call after some recent stronger Canadian data, and we slightly prefer a no change decision, which suggests significant CAD upside risks, while the downside risks are modest given the current market pricing. However, USD/CAD fell back on Tuesday as all commodity currencies rallied in the North American session, and this may limit the upside scope in the event of no change, while a rate cut could see it back to 1.40.

For the FOMC, a 25bp cut in the funds rate target to 3.75%-4.0% is fully priced in, and it would be a major surprise if it didn’t materialise, particularly after September’s CPI came in on the low side of expectations. There is no update to the dots this time, so the focus will be on the statement. This is still likely to express concerns over inflation while the scale of downside risks on activity are uncertain, and not only because of the government shutdown. Little forward guidance is likely, but with 115bps of easing already priced in by the end of 2026, it’s hard to see how the Fed can lead the market to increase its expectations of rate cuts. The risk is that the Fed sees current broadly solid activity data and still elevated inflation as reasons for a less dovish rate path than is currently priced in. If the Fed do give this impression, the USD can be expected to benefit, primarily against the riskier currencies, as a more hawkish tone would lead to higher yields and weaker equities. However, given the lack of official data in recent weeks, we would expect any statement to be fairly non-committal, so the market reaction will probably be modest.

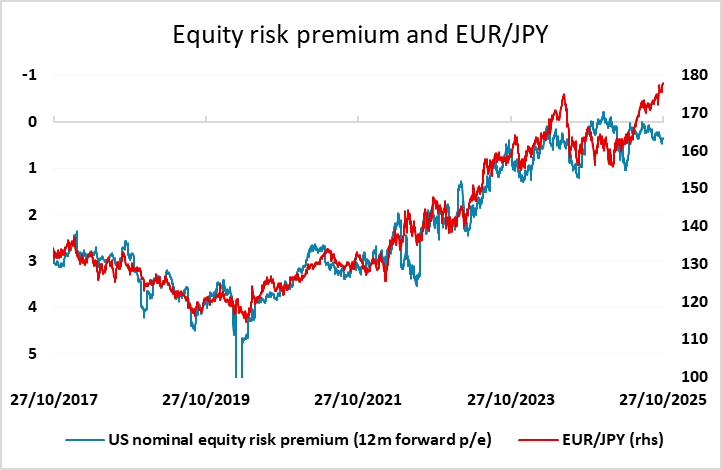

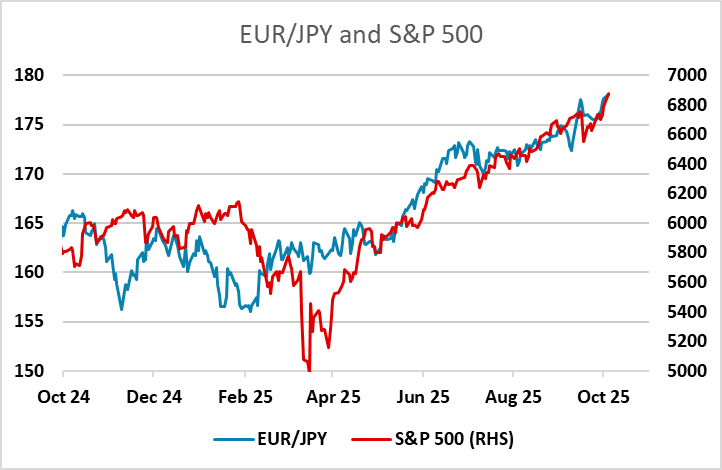

Also on Wednesday we have quarterly results from Microsoft, Meta and Alphabet after the close. The strength of equity markets in recent weeks and through much of the year is a bog factor behind the weakness of the JPY. Historically, the JPY has tended to be positively correlated with equity risk premia, and these fell for much of the year. Recently, implied risk premia have risen slightly due to declining US yields, but the JPY has continued to decline, broadly in line with the rise in equity indices, helped also by some concerns about the new Japanese administration. Equity market reaction to the Fed and the tech results could thus be crucial for the JPY ahead of the BoJ meeting on Thursday. We saw a modest JPY recovery on Tuesday, helped by some comments from the US treasury around the Bessent/Katayama meeting, but there is scope for much greater gains if we see any significant equity market correction. After the gap higher on Monday due to the expectation of a US/China trade deal, equities look vulnerable to any negative news, and quite limited on the upside, so we would see JPY risks as being on the upside.

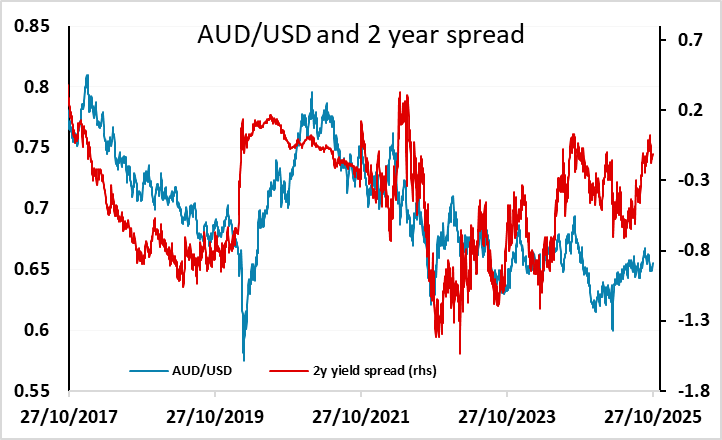

Before the monetary policy meetings and he tech results we have Q3 CPI data in Australia and provisional Q3 GDP data in Spain and Sweden. We wouldn’t expect much market impact from any of these as the AUD is currently more driven by global risk sentiment, and the Swedish GDP data has been choppy and unreliable in the provisional release. But the AUD has performed well this week and continues to underperform historic yield spread relationships, so any CPI strength could extend AUD/USD gains towards 0.66. Even so, we would be wary of AUD strength given the equity market risks.