FX Daily Strategy: Europe, January 13th

US CPI the focus

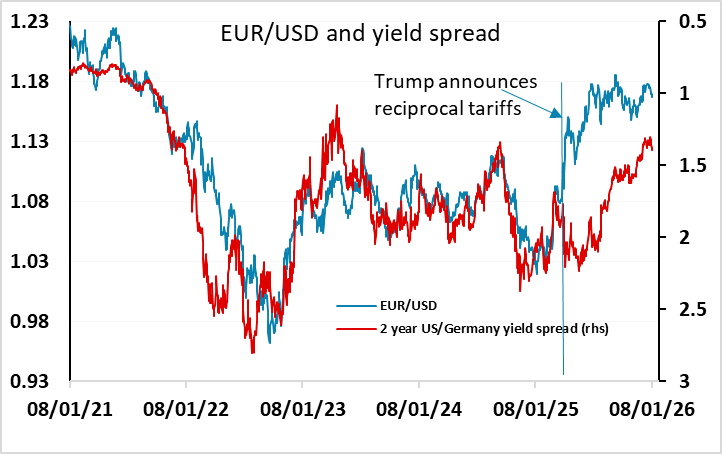

Fed independence concerns take the shone off the USD

Geopolitics and Supreme Court ruling increase uncertainty

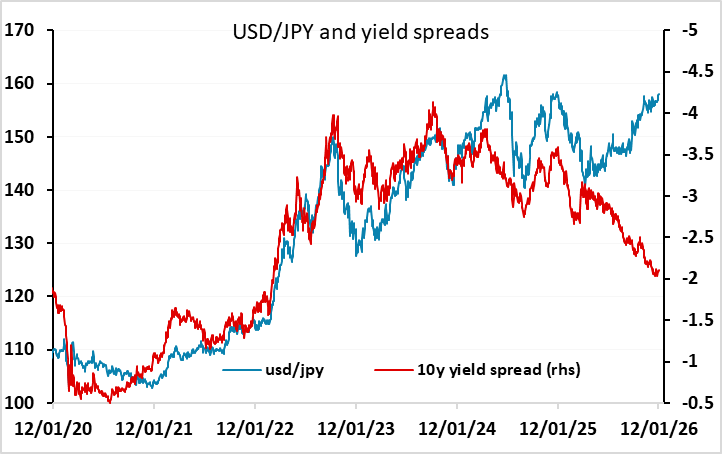

Little fundamental case for JPY weakness

US CPI the focus

Fed independence concerns take the shone off the USD

Geopolitics and Supreme Court ruling increase uncertainty

Little fundamental case for JPY weakness

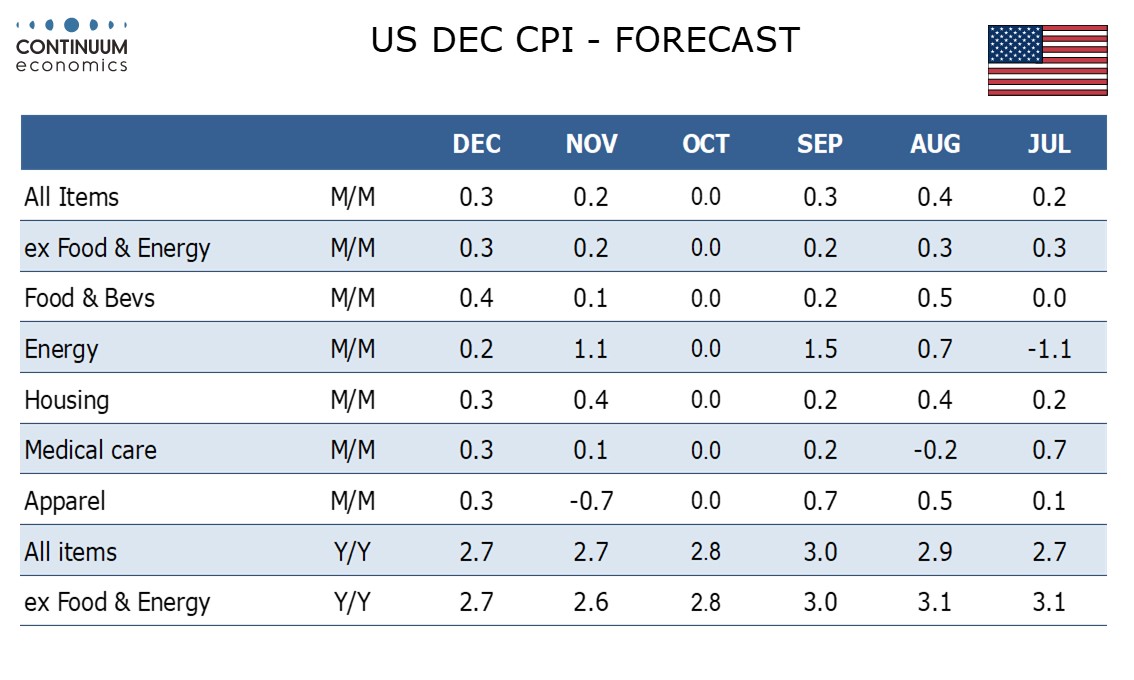

US CPI will be the main focus for Tuesday. We expect gains of 0.3% in both December overall and ex food and energy CPI, with the gains being close to 0.3% even before rounding. There is extra uncertainty over this release as it is unclear whether the surprisingly soft data for November, after a missing October, represented a slowing in trend or simply measurement errors related to the government shutdown. The market consensus is in line with our forecast of 0.3%, so we don’t anticipate a significant market reaction. But the risks may be to the USD upside as there is a danger that the December number sees more payback for the November weakness than we are forecasting.

In general, the USD was a little softer on Monday due to concerns about Fed independence as the U.S. Department of Justice threatened to indict Federal Reserve Chair Jerome Powell over comments to Congress about a building renovation project. Powell called the action a "pretext" to gain more influence over interest rates that U.S. President Donald Trump wants cut dramatically. The USD’s reaction was quite modest, but reminds the market that Powell will be gone as Fed Chair in May and the administration is likely to appoint a dovish successor and pressure the Fed to ease. As it stands the Fed is priced to ease in June and December, which is a fairly dovish read given recent US data, so there may not be much more downside to yields. But the USD is still likely to struggle to sustain the firmer tone seen so far this year if Fed independence concerns persist.

There are also other potential events to impact the USD, although the direction of the impact is unclear. The Supreme Court could yet reach a decision on the legality of Trump’s tariffs this week, with Wednesday the next possible date, and while it is unlikely that any ruling will significantly impact revenues, another clash with a major US institution is unlikely to be USD positive. There are also geopolitical events to consider, with Venezuela, Iran, Greenland and Cuba all being talked about. Such uncertainty is typically USD positive, but in the current situation may lead to some stagnation in FX markets unless we see a major event.

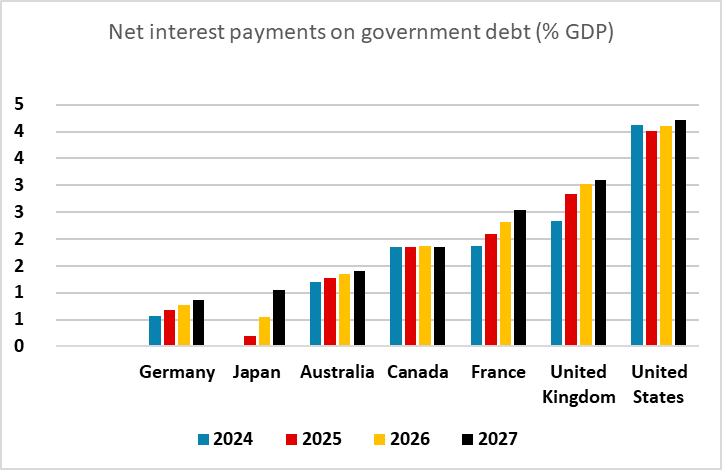

While the USD was generally a little softer on Monday, the JPY also continued to weaken following the rumours of a snap election being called in February that surfaced on Friday. While such an election is certainly possible, we struggle to see it as a JPY negative, both because it is unlikely that the Takaichi government will be able to significantly increase fiscal spending, and because even if they did, such increases would normally be seen as currency positive as they would typically result in either stronger growth or higher rates (or both). But the market seems to be seeing any increase in Japanese fiscal spending as a negative for the JPY because of the already high level of Japanese government debt. We think this misunderstands the situation. Japanese government debt is high, but it is almost all domestically owned, and interest payments on the debt are very low by comparison with other developed countries. The fiscal deficit is also currently well below all the other major countries. It is consequently very hard to see why a modest fiscal expansion should be seen as a JPY negative. JPY weakness still looks to us to be mainly a story of momentum, and needs to be opposed by intervention as the market is not reacting to fundamentals.