FX Weekly Strategy: APAC, January 29th - February 2nd

FOMC the main focus

Risks biased towards higher US rate expectations and a higher USD

JPY less vulnerable than the riskier currencies

GBP likely to see some corrective pressure out of the BoE MPC meeting

Strategy for the week ahead

FOMC the main focus

Risks biased towards higher US rate expectations and a higher USD

JPY less vulnerable than the riskier currencies

GBP likely to see some corrective pressure out of the BoE MPC meeting

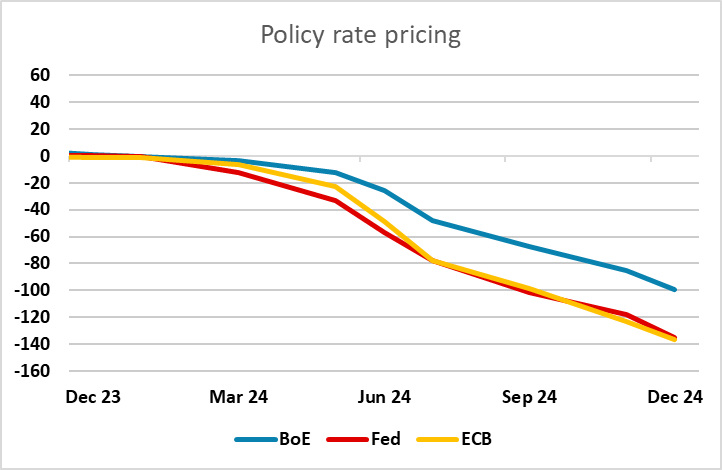

The FOMC meeting will be the main focus this week. Although there is no expectation of any change in policy, the Fed’s tone will be important as currently the March meeting is priced as representing a 50-50 chance of a cut in rates. The risks look to be on the side of higher US rate expectations, as having raised expectations for 2024 easing in December, the FOMC is likely to adopt a cautious tone at this meeting, changing little in the statement other than to note recent resilience in the economy. Progress in reducing inflation will be noted but the Fed is not ready to declare victory. We expect the statement to maintain a reference to potential further tightening. While we doubt the market will price in a risk of tightening, this sort of Fed stance, leaning against market easing expectations, could be expected to push short end yields higher as the market pushes expectations of the first easing out to May.

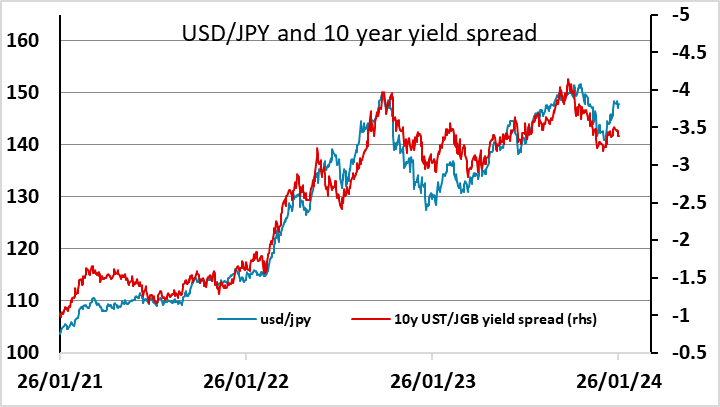

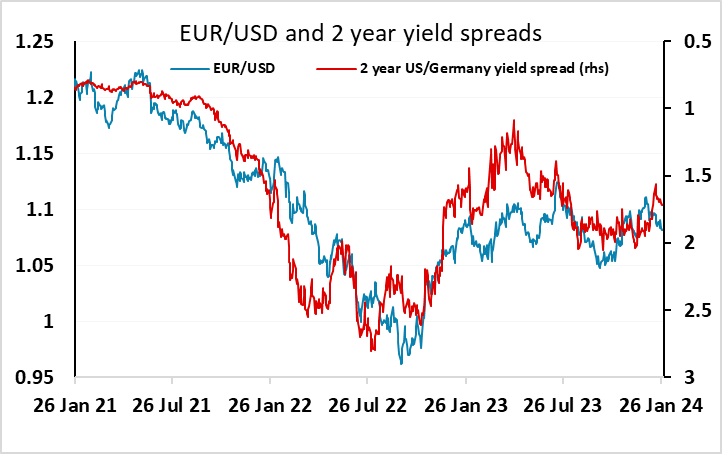

For FX, this ought to be generally USD positive. However, although USD/JPY has been the most responsive pair to rises in US yields in recent years, we see more scope for USD gains against European currencies from here. This partly reflects the fact that the market took a more dovish view of the ECB after the latest meeting, and partly because equity markets may react negatively to any expectation of a tighter Fed. It also takes into account the current level of USD/JPY looking rather high relative to current yield spreads. Nevertheless, rises in front end US yields could be expected to benefit the USD across the board. But we wouldn’t expect a big move, as any reduction in rate cut expectations would represent a delay rather than a cancellation. The market will still expect US rates to fall significantly sub-4% as inflation returns to target.

The FOMC is followed by another US employment report on Friday, and there is little reason to expect any evidence of weakness given the low levels of jobless claims we have seen in recent week, with declines in continuing claims as well as initial claims dipping below 200k. Such numbers should support a firm USD tone, with solid US growth still offering a significant contrast to effectively zero growth in the Eurozone.

Thursday’s Bank of England MPC meeting and Monetary Policy Report also has potential to impact the market. Currently, the BoE is expected to ease considerably less than the Fed or the EC, despite the starting point for the policy rate being only 25bps below the fed, and the economy still only bumping along at close to zero growth. There is a perception that UK inflation is more persistent than that in the US or Eurozone, but the latest data has clearly undershot BoE expectations, and this is likely to be acknowledged at the MPC meeting. Of course, no change in policy is expected at this meeting, but the market will focus on whether the three hawks who voted for a rate hike last time continue to do so. We would expect at least one and probably all three of the hawks to vote for no change this time.

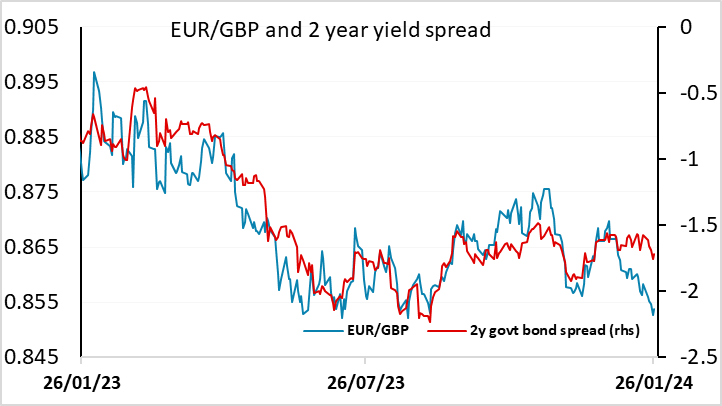

GBP has been firm at the beginning of the year, and EUR/GBP is approaching the 2023 lows below 0.85 seen in August. This has come without much movement in short term yield spreads, with GBP benefiting from an impression that he UK is outperforming the Eurozone. While the PMI data have suggested some UK outperformance, this is less evident in the official data, and the PMI data have not been a reliable relative growth indicator in recent years. We therefore see some risks of a GBP correction lower out of the MPC meeting, although we wouldn’t see a move back above 0.86 in EUR/GBP.

Data and events for the week ahead

USA

The US week is a busy one with Wednesday’s FOMC meeting and Friday’s non-farm payroll the highlights. The week starts quietly with little due on Monday though on Tuesday December JOLTS data on job openings and January consumer confidence will be watched, the latter coming after a strong preliminary January’s Michigan CSI report. November house price data from S and P Case Shiller and the FHFA are also due.

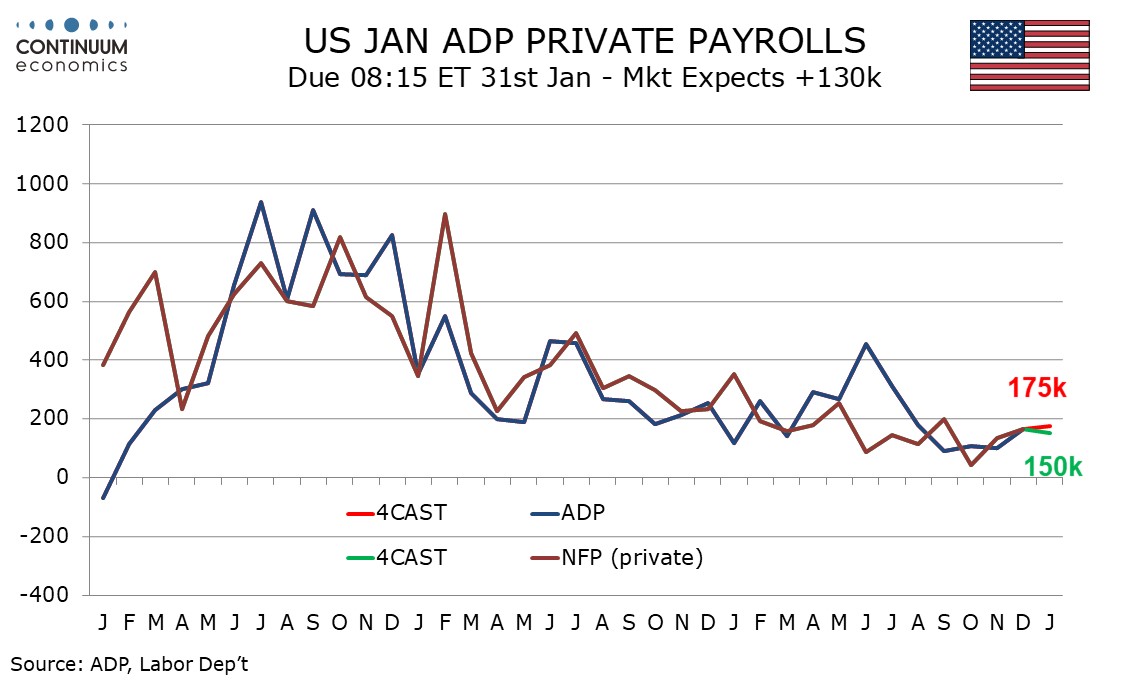

On Wednesday we expect a 175k increase in January’s ADP estimate of private sector employment growth, extending an acceleration seen in December. We also expect a slightly slower 0.9% increase in the Q4 employment cost index, a number that the Fed will be watching closely. January Chicago PMI data is also due. Wednesday’s FOMC meeting looks sure to leave rates unchanged and we expect the statement will note continued resilience in activity and leave a tightening bias intact, signaling that near term rate cuts should not be expected. The policy dots will not be updated at this meeting but Powell at his press conference is unlikely to suggest that the view has changed much from December, when the median dot looked for 75bps of easing in 2024.

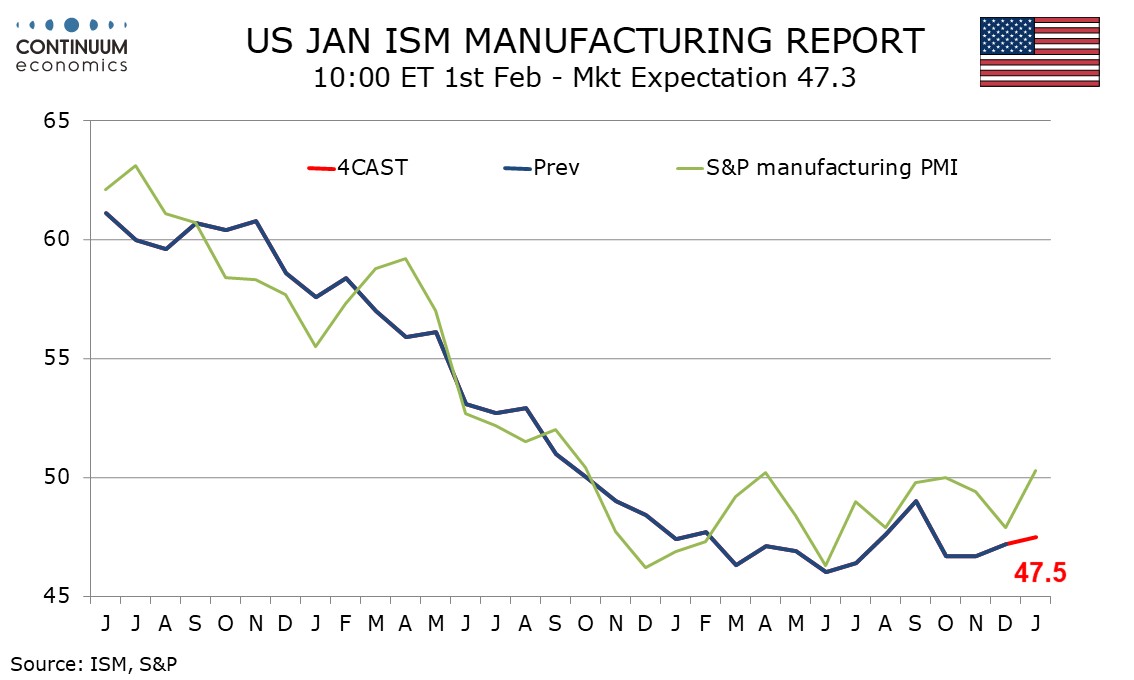

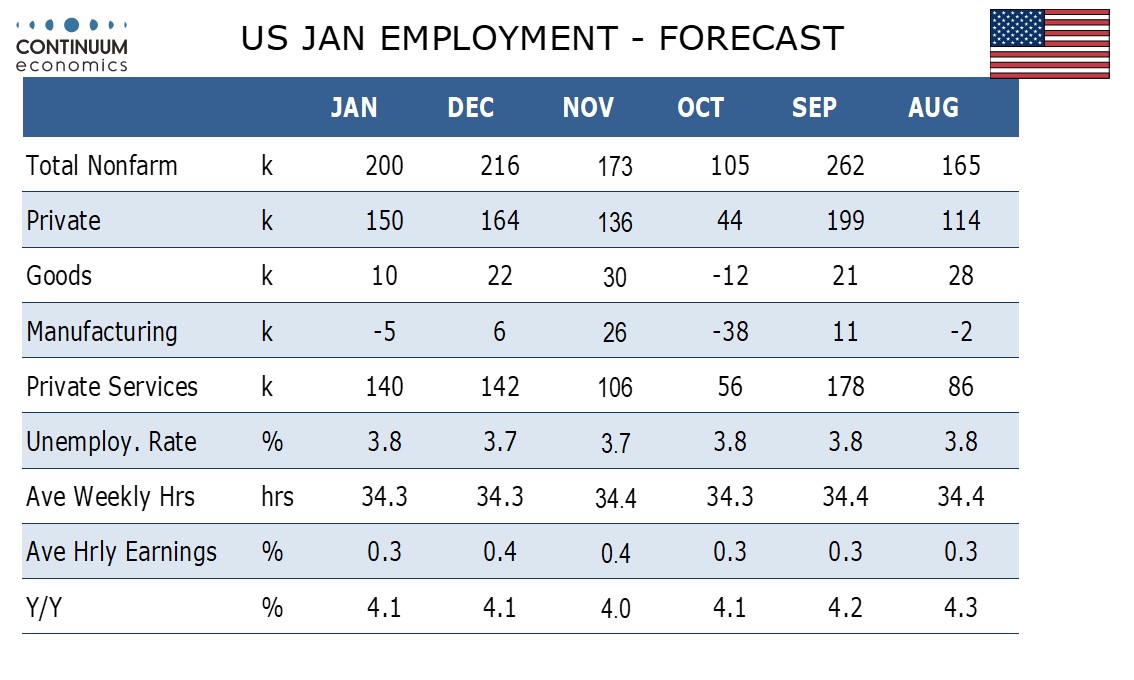

Thursday sees weekly jobless claims and Q4 productivity and cost data. December construction spending and January ISM manufacturing follow. We expect the latter to see a marginal rise to 47.5 from 47.2. For Friday’s non-farm payroll we expect a 200k increase to confirm a strong labor market persists, though we expect unemployment to edge up to 3.8% from 3.7% and average earnings to show a slightly slower 0.3% rise on the month. Our forecast for private payrolls is 150k, slightly slower than our ADP call. December factory orders and final January Michigan CSI data follow.

Canada

The highlight of the Canadian calendar is November GDP on Wednesday, where we expect a 0.2% increase, slightly above a 0.1% estimate given with October’s data which would hint at a stronger Q4 than the BoC’s recent flat forecast. January’s S and P manufacturing PMI follows on Thursday.

UK

The obvious highlight this week is the BoE decision on Thursday. As is widely expected, the BoE is likely to keep policy on hold for a fourth successive meeting. But as with other DM central banks the interest is less on what is done, but more on what is said, especially given the manner in which market interest rates have fallen. Notably, and despite the softer interest rate assumption, the updated Monetary Policy Report may see the inflation outlook even softer, possibly embracing our view of the headline rate falling below target by mid-year.

As for data, Tuesday’s money and credit data are of increasing importance. Firstly, they will show the extent to which cash-strapped households are increasingly turning to borrowing to fund everyday spending. But secondly, they will highlight how BoE balance sheet reduction is having a wider impact, given the drop in bank deposits that is continuing, the question being to what extent is this adding to downward pressure on private sector credit

Eurozone

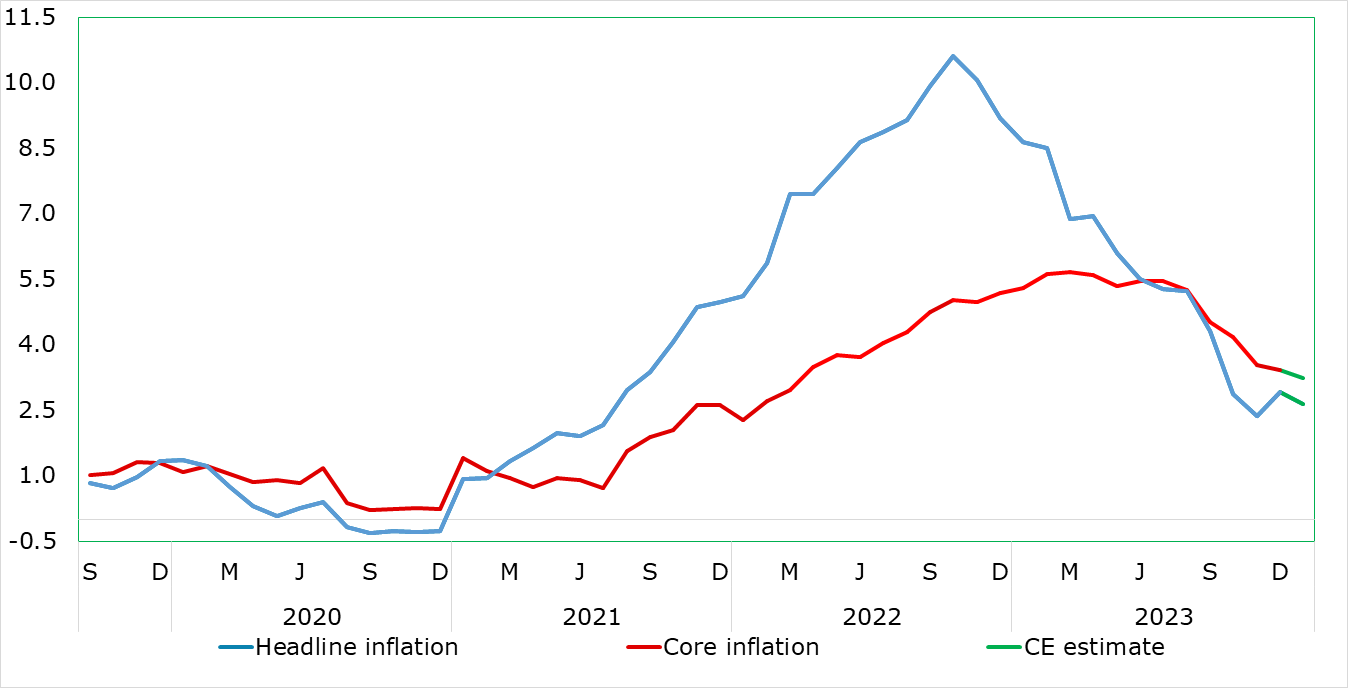

Data are the focus this week. Underlying inflation is falling faster and more broadly than had been ECB thinking, now encompassing not only falling core rates but also softer persistent inflation signals, the latter a key consideration for the ECB. This is likely to have continued with the January HICP data where lower fuel costs should more than outweigh modest VAT hikes. Indeed, we see the headline down to 2.6% and the core down to a 21-month low of 3.2% in Thursday’s January numbers. German HICP precede on Wednesday: we see the headline HICP rate falling 0.5 ppt in the January numbers despite a small VAT hike.

Headline and Core Inflation Falling?

Source: Eurostat, Continuum Economics

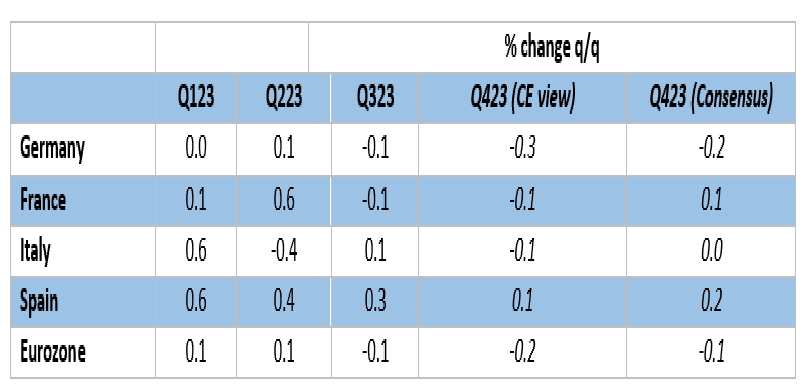

Also of note on Tuesday are flash GDP estimates. According to official national accounts data, the EZ economy has been in near recession, having seen GDP move sideways in the year to Q3, albeit with a decline of 0.1% q/q in that latter quarter. We see another such drop occurring in the Q4 flash figure (down 0.2% q/q). Such a result, involving two consecutive quarters of GDP declines, would constitute a formal recession and would undershoot the small (ie 0.1%) growth that the ECB pencilled in for last quarter. Also of note the EZ national account data has masked clear divergences among member economies with Germany faring poorly while Spain has seen clear growth. This is likely to have continued, albeit with even Spanish real activity momentum having faded in the last quarter.

Q4 EZ GDP Picture

Otherwise, European Commission survey data (Tue) may paint a still sobering message, perhaps less wary about price pressures than the PMI figures suggested. Thursday’s jobless data may still suggest the rate is near record-lows but this masks still clear rapid labor force growth. As for the ECB, Chief Economist Lane speaks on Wednesday.

Rest of Western Europe

There are key events in Sweden, starting with the monthly GDP indicator where a clear correction back is seen after the surprise Oct/Nov bounce. But the focus is on Thursday’s Riksbank decision. It is ever clearer that the Riksbank has finished its hiking, this borne out by the unchanged policy decision last month and by the same decision due this time around. The question now turns to policy easing. Recent data have continued to be been mixed, but the much weaker underlying inflation picture and growing weakness in bank lending and deposits have argued for the policy rate staying at the 4.0% level it rose to in September. Indeed, they argue for an easing in policy, something we think may occur in by the next quarter, this made all the more possible by the more frequent Board meetings that the Riksbank Board has reverted to.

Japan

Few critical releases for Japan next week. We have unemployment rate on Monday, and Retail Trade on Tuesday. Some other tier two data spread throughout the week but none should be market moving.

Australia

We will have the Q4 CPI for Australia on Tuesday. It is expected the CPI to further moderate after the spike in Q3, thus any surprise to the upside would see the Aussie capitalizing on it to speculate more RBA tightening but it is not our forecast. We also have the Retail sales on Monday and the rest are tier 2-3data.

NZ

The Trade Balance on Monday will be the key release for NZ next week.