EUR, JPY flows: USD/JPY downside risks, EUR focus on IFO, ECB

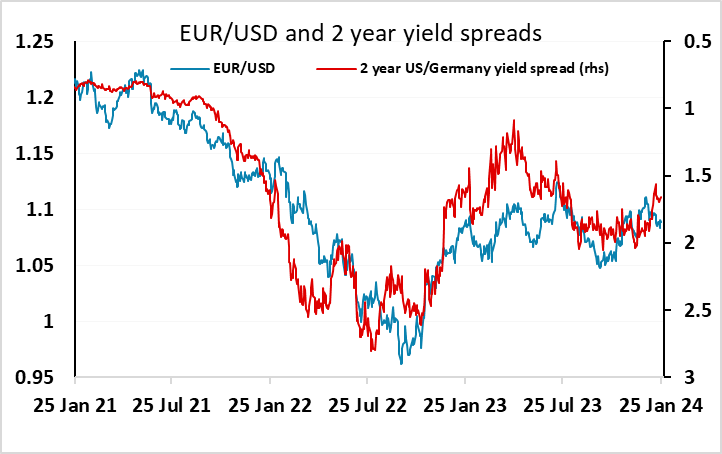

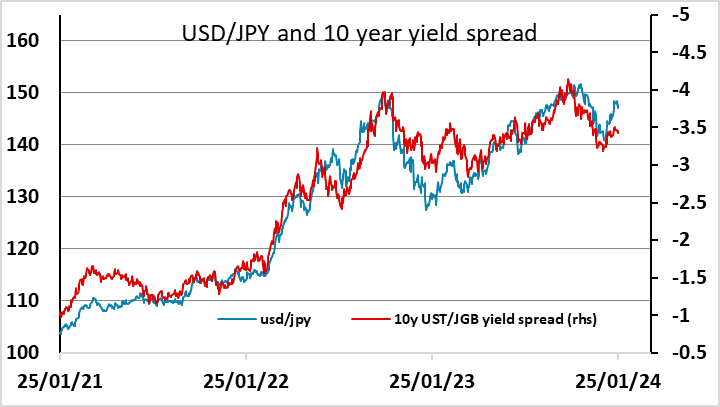

USD/JPY remains too high relative to yield spreads. EUR to show mild upside bias into ECB

A quiet overnight session saw little FX action, although there was a little JPY weakness, which drew a reaction from the MoF’s Kanda, as there was from Finance minister Suzuki on Friday. However, there is little fear of actual FX intervention this side of 150, so these verbal interventions will have little impact. Nevertheless, JGB yields were modestly higher, and USDJPY continues to look too high relative to spreads. JPY crosses are getting some support from continued firmness in equities, but yield spreads suggest that USD/JPY risks are to the downside unless we see some reduction in Fed easing expectations.

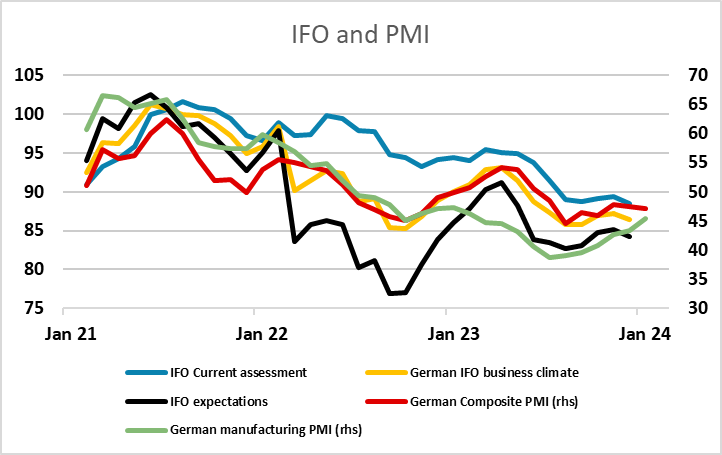

This morning’s focus will likely be on the IFO survey ahead of the ECB meeting later, but this has had very limited impact of late as the business climate index has been very well correlated with the composite PMI, so has added little new information. Last month the IFO underperformed a little, so the expectation of a small rise this month is still consistent with the weaker composite PMI released yesterday. EUR/USD still looks well supported by yield spreads, and we favour the upside going into the ECB as we doubt that Lagarde will show any willingness to endorse the market’s pricing of an 80% chance of a rate cut in April, still preferring to guide the market towards the summer.