FX Daily Strategy: APAC, March 27th

No policy change seen at Riksbank meeting…

…but SEK risks may be on the upside

Spanish CPI may limit downside for EUR

CHF the preferred funding currency as threats of JPY intervention increase

No policy change seen at Riksbank meeting…

…but SEK risks may be on the upside

Spanish CPI may limit downside for EUR

CHF the preferred funding currency as threats of JPY intervention increase

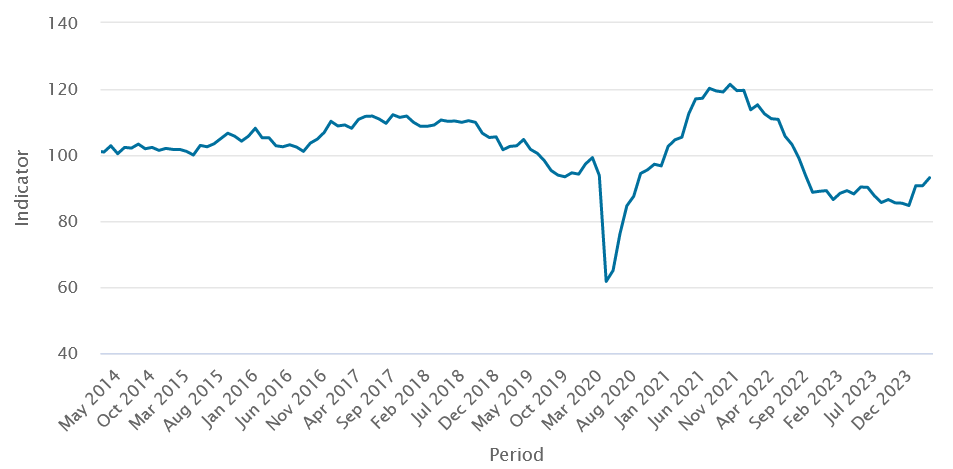

Swedish economic tendency survey

Wednesday sees the Riksbank monetary policy meeting, which no-one expects to produce a change in policy, but which is nevertheless important for the guidance given for the next meeting. Currently, the May meeting is priced at slightly better than a 50-50 chance of producing a rate cut. In the February Monetary Policy update, the Riksbank said that “the Executive Board assesses that the policy rate probably can be cut sooner than was indicated in the November forecast. If the prospects for inflation remain favourable, the possibility of the policy rate being cut during the first half of the year cannot be ruled out.” The November forecast didn’t envisage a rate cut until 2025, but the inflation assessment has clearly improved since then. Nevertheless, the economic tendency survey released on Tuesday did show a significant improvement in prospects, and while the share of firms anticipating a rise in selling prices was largely unchanged from February across the business sector as a whole, it increased again in the service sector after dropping back to normal levels in February.

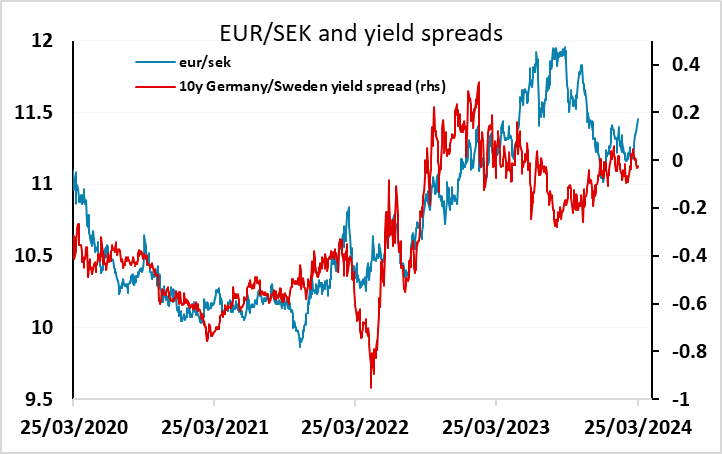

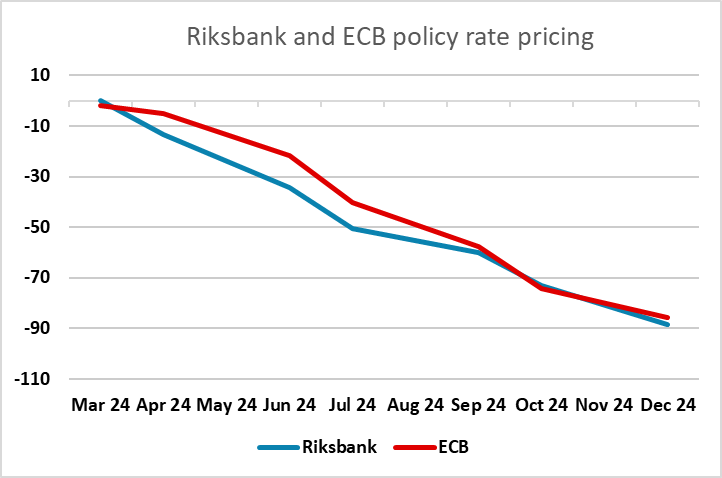

As it stands, the Riksbank is priced to conduct somewhat easier policy than the ECB, with 34bps of cuts priced by June against 21bps priced for the ECB. EUR/SEK, meanwhile, has traded higher in the last couple of weeks, even though longer dated yield spreads have moved in the SEK’s favour. After the Economic tendency survey the risk may now be that he market prices in a path for Riksbank policy more similar to that of the ECB. With EUR/SEK already trading on the high side relative to yield spreads, this suggests EUR/SEK risks are clearly on the downside.

Elsewhere, there isn’t a great deal on the calendar, although there is provisional Spanish CPI for March, the first take on Eurozone inflation. Easter holidays mean the Eurozone numbers as a while aren’t coming until next week. Spanish inflation does sometimes provide a lead, and this month is expected to produce a relatively sharp m/m rise of 1.2% m/m in HICP, taking the y/y rate up to 3.3%. This probably won’t have much impact on expectations of Eurozone inflation as a whole, but may limit the downside scope for EUR yields and the EUR.

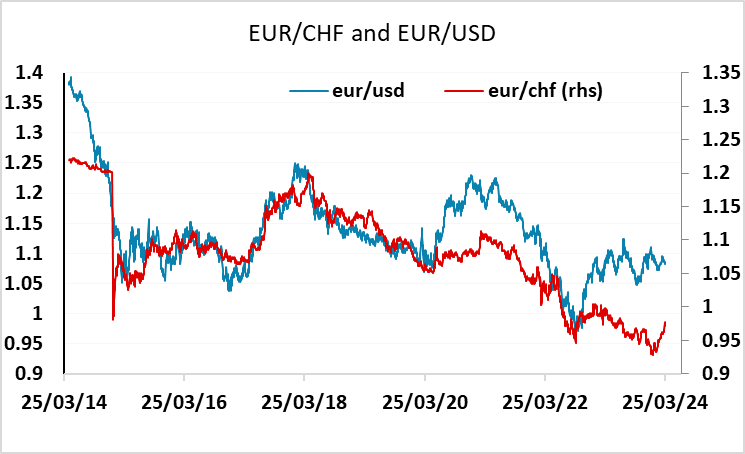

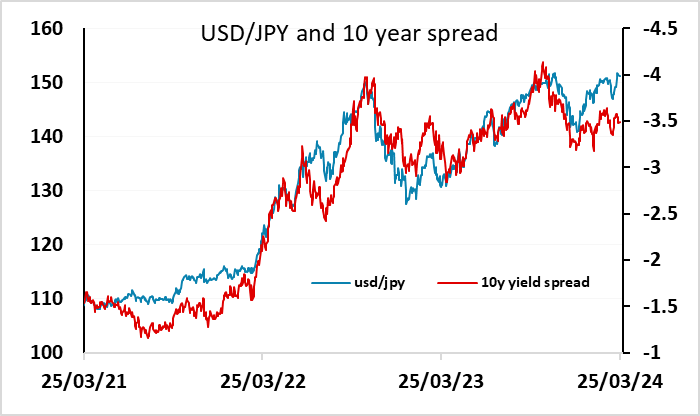

The USD was modestly firm on Tuesday in generally quiet trading, and although there were no major moves, it is notable that USD/JPY closed the European session just around 40 pips below the 24 year high of 151.94, despite the increasing volume of threats of intervention from the MoF and BoJ. This meant the JPY was also generally soft on the crosses, although not quite as soft as the CHF, which also fell back against all the higher yielders. After the SNB rate cut last week, the CHF now looks like the preferred funding currency, with JPY downside likely limited by intervention concern, and value very much suggesting there is a lot more downside for the CHF.