FX Daily Strategy: N America, February 28th

NZD sunk after RBNZ signals no hike

Swedish data has little impact, but NOK/SEK looks too low

EUR/USD tsting low end of the range ahead of the inflation data on Thursday and Friday

NZD sunk after RBNZ signals no hike

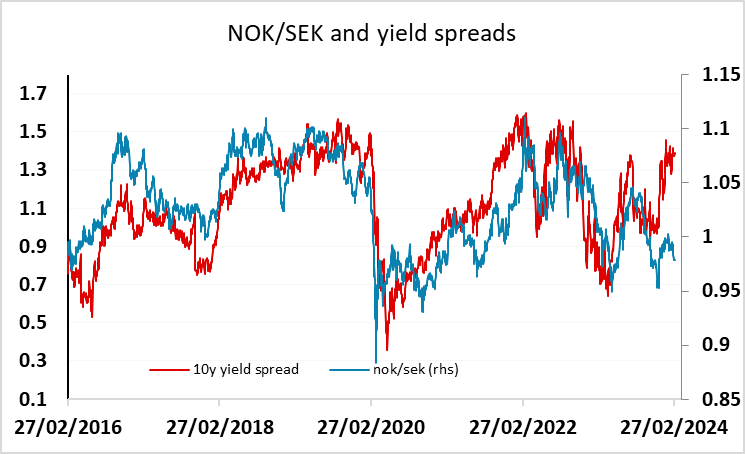

Swedish data has little impact, but NOK/SEK looks too low

EUR/USD tsting low end of the range ahead of the inflation data on Thursday and Friday

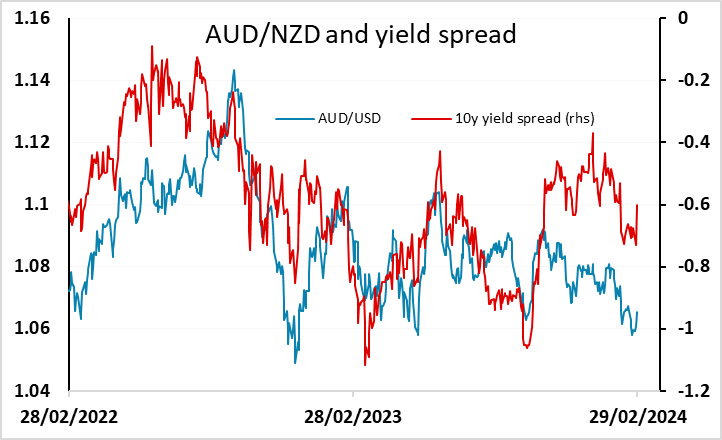

Wednesday kicked off with the RBNZ monetary policy decision. The vast majority of forecasters expected no change in rates, but the market was pricing in a more significant risk at around a 25% chance. As per our forecast, the RBNZ has kept rates unchanged but revised 2024 inflation forecast higher and OCR forecast lower. The hawkish speculation (2 rate hikes) from TD and ANZ was disappointed as the RBNZ recognized higher inflation in 2024 but does not see it to be significant in preventng inflation coming back to target in 2025. RBNZ now see OCR at 5.59% in June 2024 with prior at 5.67%, at 5.47% in March 2025 with prior at 5.56%. It seems to suggest hawkish speculators are wrong for the coming OCR path from RBNZ as they are signalling no more rate hikes. They also see annual CPI to be higher throughout 2024 and at 2.6% by March 2025 from prior 2.4%. The key forward guidance has been changed to "The Committee remains confident that the current level of the OCR is restricting demand....The OCR needs to remain at a restrictive level for a sustained period of time to ensure this (ensure headline inflation returns to 1-3 percent)occurs." The forward guidance from RBNZ suggested that they are comfortable the current OCR will bring headline inflation back to target range, which kills hawkish speculation. Yet, they also reinforce the need for OCR to remain at current level for a longer period of time, signalling rate cuts will not arrive as soon as their American counterpart.

There was no significant change in the Swedish economic tendency survey in February. The index fell to 90.5 from 90.6 in January. There were generally only minor changes, except in the construction indicator which gained more than 3 points. Selling prices in the business sector as a whole are less widely expected to rise than they were in January, and pricing plans are only just above the historical average.

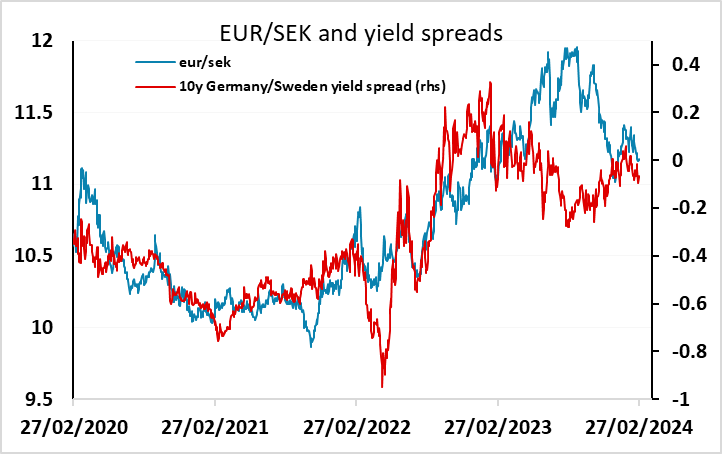

Unsurprisingly, these numbers haven’t had any significant impact on EUR/SEK, which edged a little higher overnight. We still see NOK/SEK as having potential to rise medium term, but the NOK is currently soft, in line with the softer tone to commodity currencies overnight. NOK/SEK gains are likely dependent on EUR/NOK declines rather than any rise in EUR/SEK, which looks likely to hold steady close to 11.20.

The European Commission survey for the Eurozone is also due, but rarely provides any new impetus. The bunsienss and consumer survey has improved modestly in the last couple of months, but the business climate index continues to just bump along the bottom. We doubt we will see any significant move, but the risks are probably slightly to the downside given the weaker French consumer confidence number released on Tuesday. Even though there is pressure on the bottom end of the recent range, with EUR/USD dipping below 1.08, we don't see significant downside ahead of the inflation data in the next couple of days.

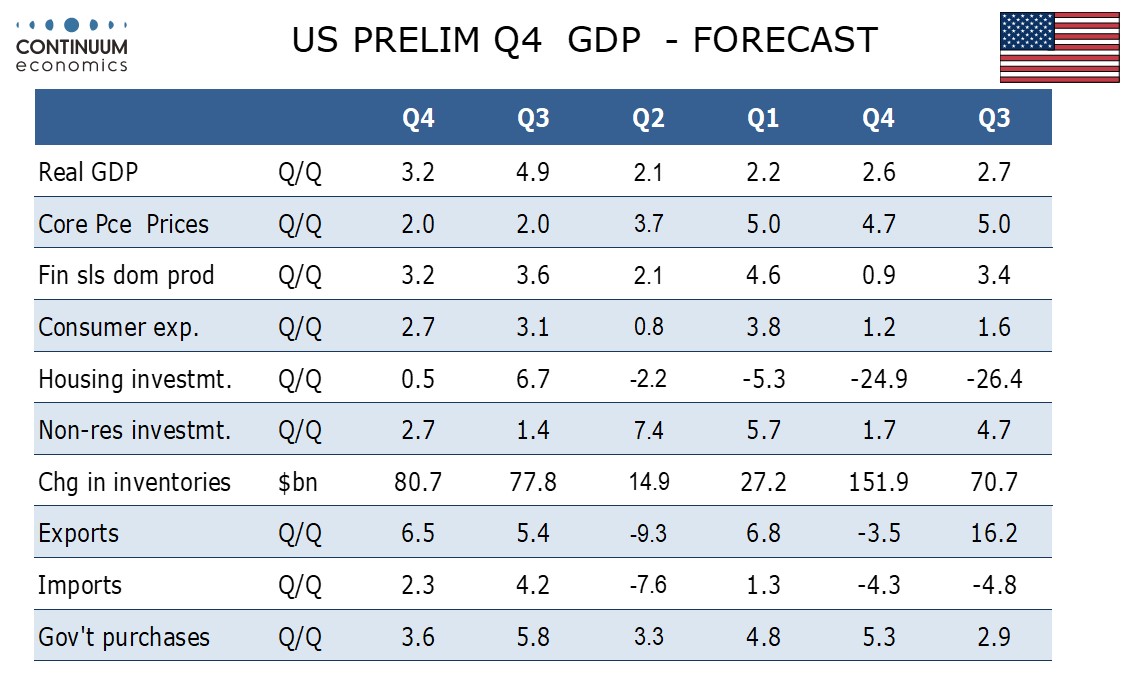

US revised GDP data is similarly unlikely to have a big impact, with the market more interested in the PCE price data for January due on Thursday. The anticipaion of the inflation numbers from Europe on Thursday and Friday is also likely to preclude any big EUR move today.