FX Daily Strategy: Europe, February 26th

USD struggling as confidence weakens

European currencies supported by better equity performance

JPY still looks to have the most upside potential

AUD preferred to CAD

USD struggling as confidence weakens

European currencies supported by better equity performance

JPY still looks to have the most upside potential

AUD preferred to CAD

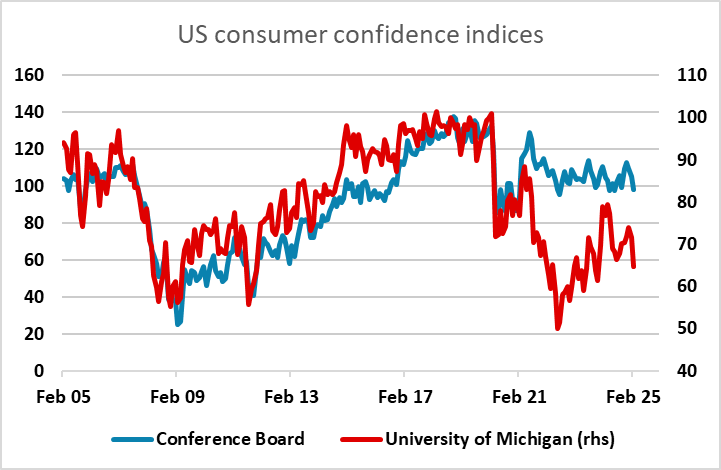

Wednesday is another very quiet calendar, with no data of any major significance in any of the G10 countries. There is new home sales and building permits data due in the US, but these are unlikely to alter the impression of a weaker tone to US data that has emerged in the last few days. Monday saw a weaker Conference Board (CB) consumer confidence index to go with the weaker University of Michigan (UoM) index seen last week. The CB index has been much stronger than the UoM index in recent years, despite a strong previous correlation, related to the CB index being much more focused on the labour market. The decline in the February index was still quite modest, but takes it back to near the lows of the last few years, and maintained the downward pressure on US yields.

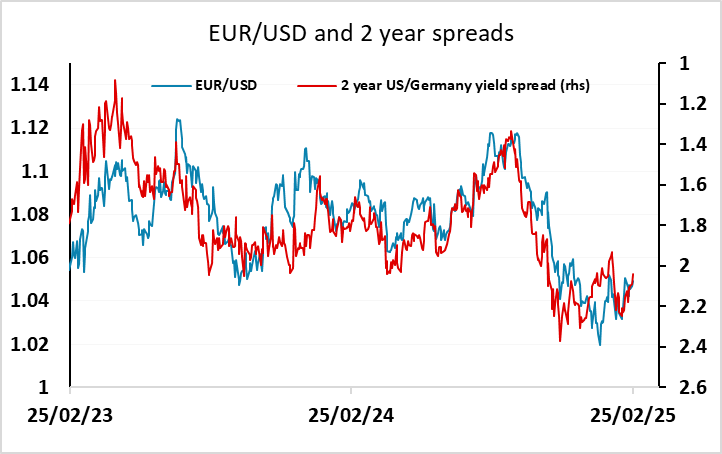

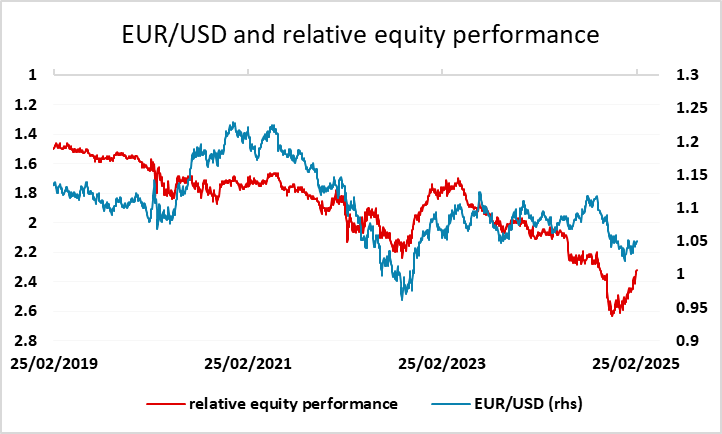

Lower US yields are putting general downward pressure on the USD, which for the moment is favouring the European currencies slightly more than the JPY or the commodity currencies. There may be some support for the European currencies from the perception that more defence spending will be seen from Germany and perhaps others as part of the new order of things if a Ukraine peace deal is done. But the strength is probably more due to outperformance of European equities which have now recovered all the post-US election losses relative to the US. This may also reflect some switching from fund managers towards the more reasonably valued European equity market, some of which may not be currency hedged.

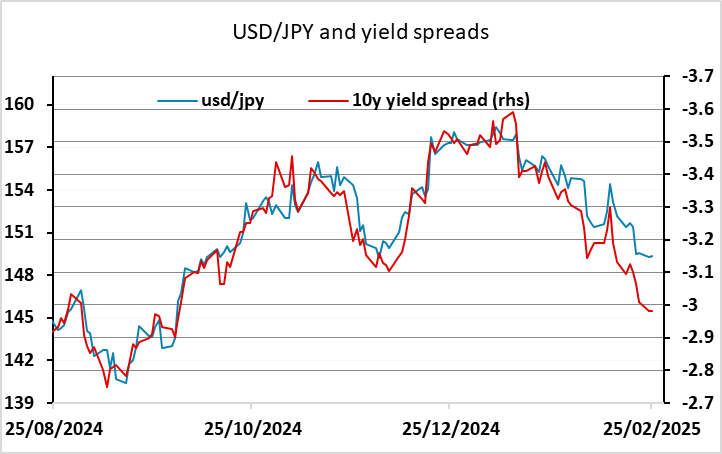

However, the general USD weakness is mostly about lower US yields. This is down to a combination of the latest softer data, reduced expectations of a fiscal boost from tax cuts, increased expectations of DOGE related spending cuts, and some potential for the Fed’s QT to end sooner than expected. The tariff impact is unclear, both because no-one is sure whether tariffs will be imposed, and if they are when, on who and how large, and because any tariffs will be growth negative as well as raising inflation. For now, it seems the economic optimism that accompanied the Trump victory is fading. We still don’t see huge upside for the EUR in the short run, as the European economy remains very sluggish and a weaker equity outlook in the US will also cap gains in Europe. USD/JPY still looks to have significant downside potential if it can break the 148.65 low from December 3.

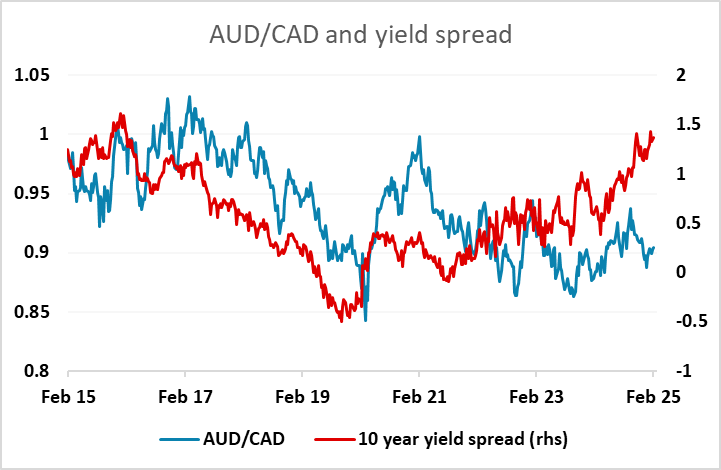

The commodity currencies underperformed on Tuesday, but we still see upside scope for the AUD, although there is significant resistance in AUD/USD at 0.64, and AUD/USD gains will also depend on a reasonably positive risk tone. Inasmuch as this depends on tariffs, AUD/CAD may be a better trade for AUD bulls. There isn’t much real risk of tariffs priced into the CAD, which continues if anything to outperform current yield spreads. If tariffs are imposed, Canada will likely suffer most of the major countries, so while there may be some negative impact on AUD/USD, AUD should outperform CAD, and already looks cheap against CAD based on yield spread correlations.