FX Daily Strategy: N America, April 25th

JPY might struggle despite rise in Tokyo CPI

GBP has scope to recover modestly

USD may struggle if University of Michigan confidence weakens again

JPY might struggle despite rise in Tokyo CPI

GBP has scope to recover modestly

USD may struggle if University of Michigan confidence weakens again

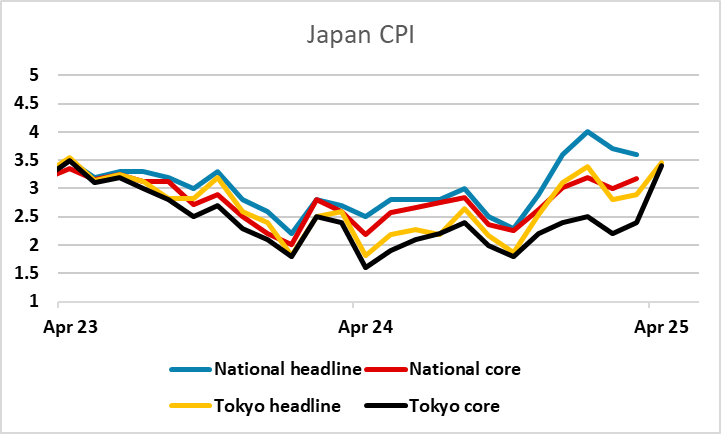

Friday started with Tokyo CPI. There is less focus on data as the markets await the impact of the tariffs, but the Japanese CPI data is nevertheless crucial for BoJ policy going forward. The consensus was for a fairly sharp rise in the Tokyo core CPI data to 3.2% y/y, but the outcome was even stronger at 3.4% y/y. This would suggest an even higher rate for the national CPI, which has been running well above the Tokyo level in recent months, and would maintain some pressure on the BoJ to tighten, even though they feel little urgency to act until there is more clarity on the tariff situation.

As it stands, the market isn’t fully pricing a BoJ hike this year, and even with the rise in the CPI data, this isn’t likely to change near term. However, if the world economy is hit hard enough by tariffs to prevent a BoJ hike, the likelihood is that it would favour the JPY due to weakness in risk appetite. Conversely, if the shock is absorbed and growth remains solid, there is more reason to expect tighter policy from the BoJ than from anyone else. So we still expect the JPY to perform well in most scenarios in the medium term. But in the short run, the markets have quietened down awaiting developments on trade deals, and lower volatility will tend to favour the higher yielders. With the CFTC data also showing record speculative long JPY positioning, there is certainly a risk of some unwinding of positions in calmer markets, so we may yet have some more near term USD/JPY upside towards 144.

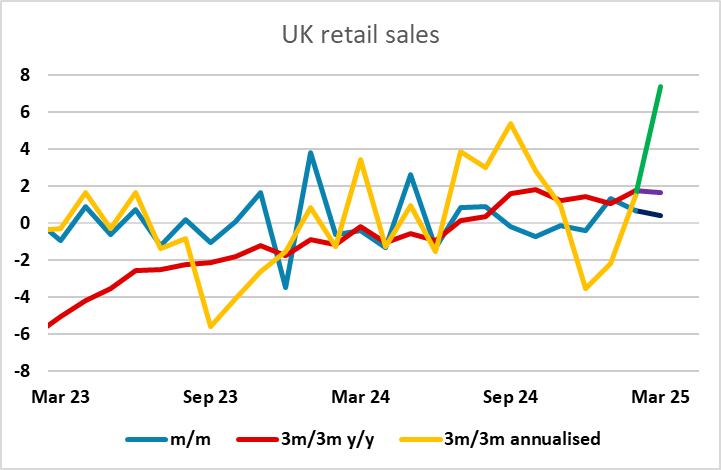

UK retail sales once again come in much stronger than expected in March, rising 0.4% m/m, and 0.5% in the core, although the strength was slightly moderated by a downward revision to February. Even so, the quarterly gain of 1.6% is the strongest since the recovery from the pandemic in 2021. But the numbers haven’t had any impact on GBP, in part because a lot of the strength in March was in clothing and footwear sales which were boosted by good weather, and the strength of Q1 GDP in the UK is already known, but feared to be temporary with the latest survey data showing a sharp dip. However, GBP and the EUR are both firm against the JPY and CHF this morning, both of which have softened as volatility has declined. GBP/JPY may still have scope for gains above 191, supported by the more positive risk tone, but if we do see a Q2 downturn the longer term risks are very much on the downside.

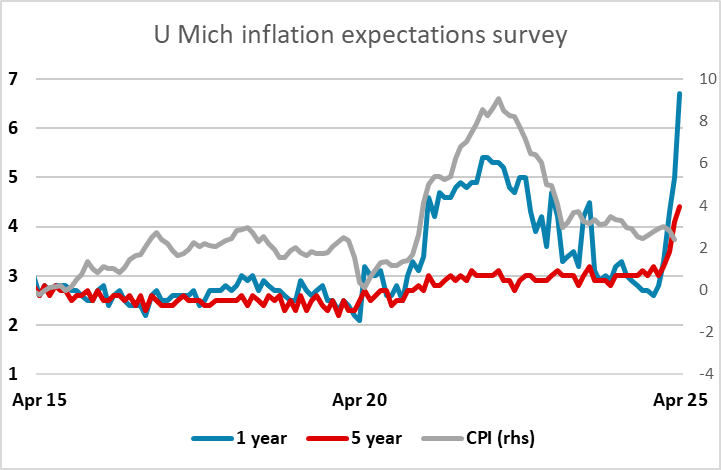

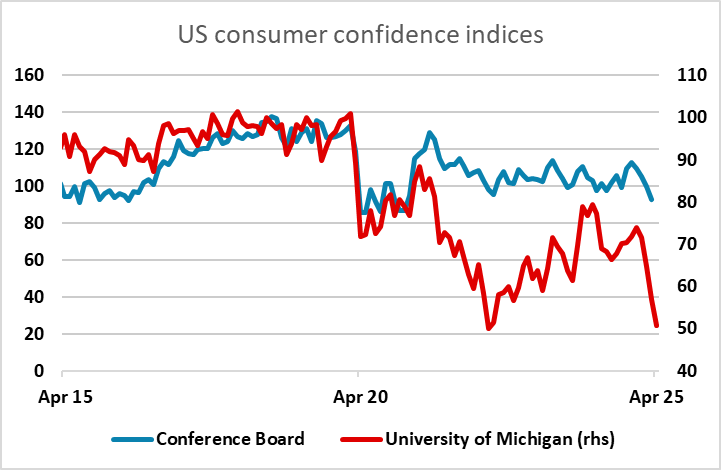

Late in the session we have the University of Michigan confidence data. The last few months have seen some very weak results on confidence and a sharp rise in inflation expectations. These are not fully matched in the conference board confidence survey, so must be taken with a little pinch of salt. But further weakness might well see the USD suffering into the end of the week.