FX Daily Strategy: N America, Sep 4th

Focus on US data

ADP of greater interest than claims this week

ISM may be mildly USD positive

SEK and CHF weaker after CPI

Focus on US data

ADP of greater interest than claims this week

ISM may be mildly USD positive

SEK and CHF weaker after CPI

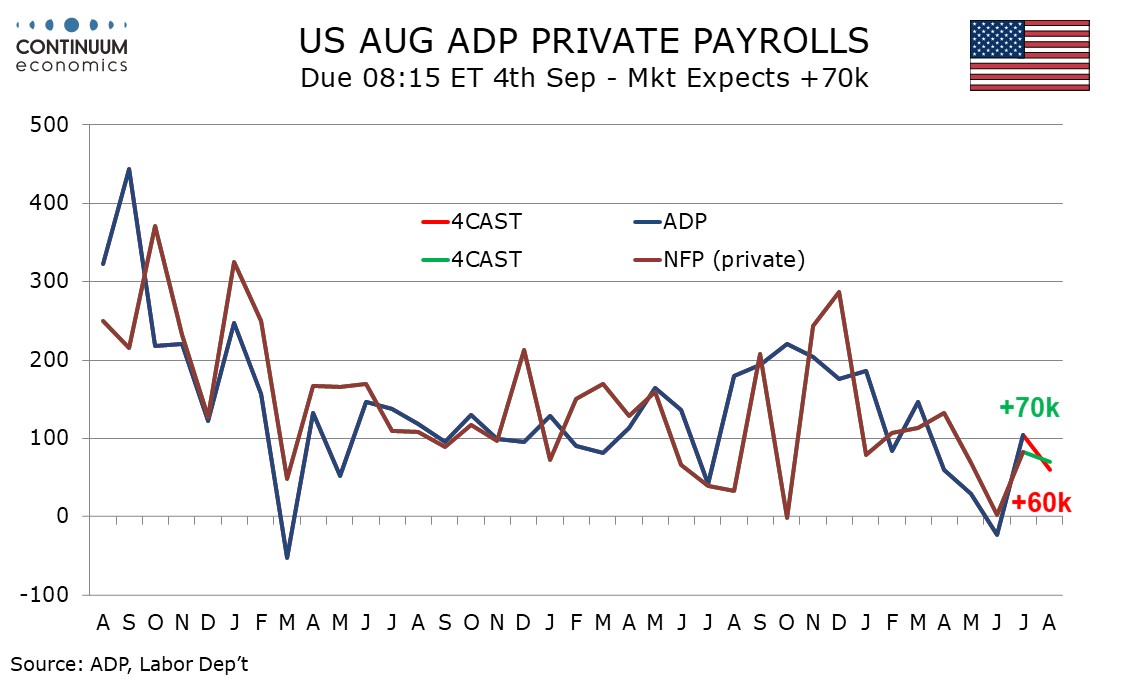

US data will be the main focus on Thursday. We have the ADP employment data, jobless claims and the ISM services index for August. The labor market data will be a focus ahead of the employment report on Friday. Since the claims data for the survey week was released last week, the ADP data may be of greatest interest.

We expect a rise of 60k in August’s ADP estimate for private sector employment growth. This would be a slowing from 104k in July which outperformed the non-farm payroll, with July’s improved data looking in part corrective from a 23k decline in June. ADP data has tended to underperform non-farm payrolls in recent months, though the sharp downward revisions to May and June non-farm payrolls released with July’s report made the two series look more consistent. We expect ADP data to marginally underperform a 70k rise in August’s private sector non-farm payroll. We expect overall non-farm payrolls to increase by 65k. Given the potential for revision in the payroll data, and the lack of strong correlation between ADP and the initial release of the official data, there is unlikely to be a huge reaction to the ADP data unless it is outside the 0-100k range. The risks are two way. There is a lot of Fed easing priced in and the risk may be that there is too much on our central view, but the risks are weighted to the downside from our central view.

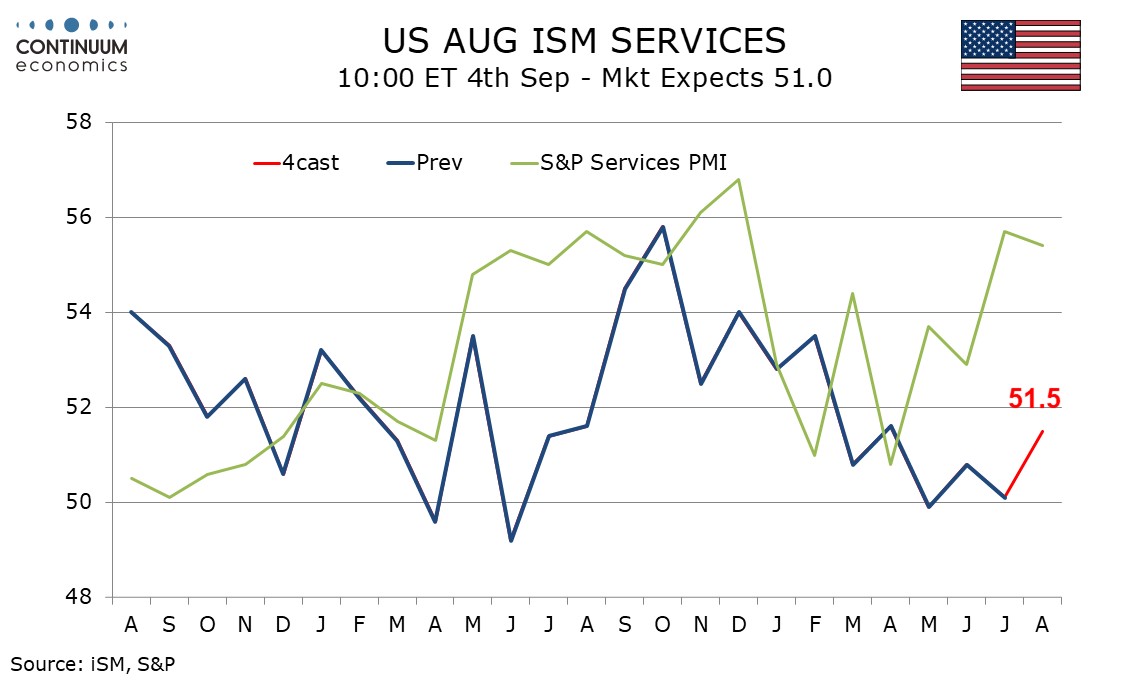

For the ISM, we expect an increase in August’s ISM services index to 51.5, up from 50.1 in July but still keeping the index in the subdued 49.9 to 51.6 range that has been seen since March. Regional service sector surveys are mixed with the Dallas and Richmond Fed surveys slightly improved and slightly positive but the Philly Fed and Empire State surveys increasingly negative. The S and P services PMI has however been quite strong, above 55 in both July and August, and while not a reliable guide to the ISM index does suggest a move below the neutral 50 is unlikely. The market consensus is less positive view than our forecast, suggesting some USD upside risk on the data.

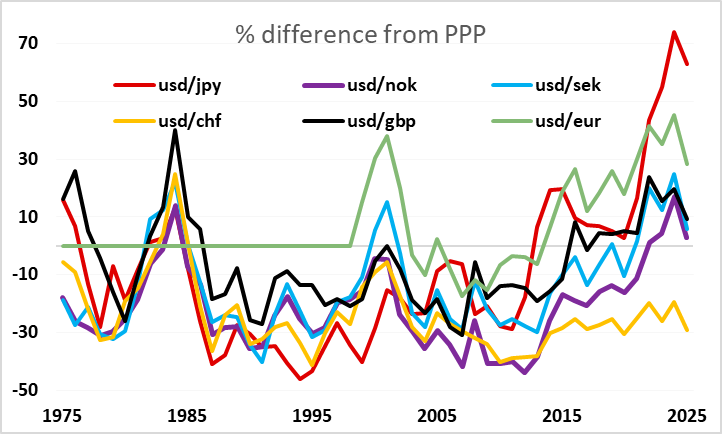

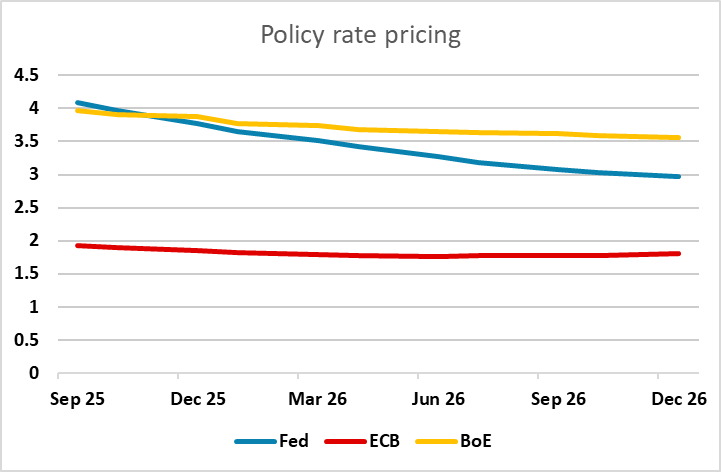

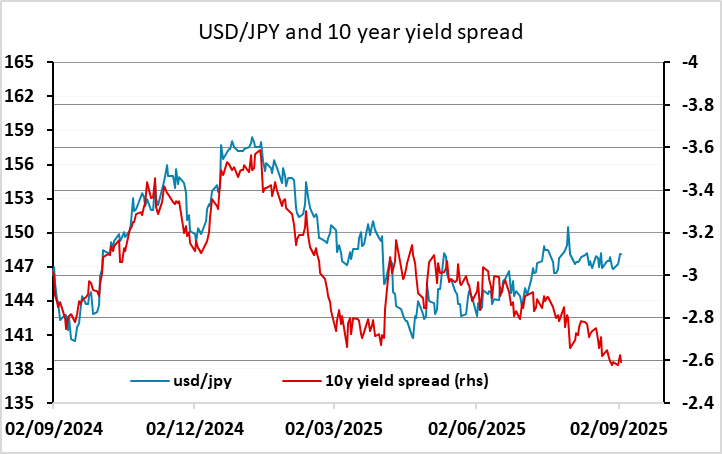

From an FX perspective, we continue to see USD/JPY as the most vulnerable pair, with yield spreads pointing clearly lower and only the resilience of equity markets (and the consequent low level of implied risk premia) supporting the JPY’s weakness. We are approaching the season when accidents tend to happen, so risks are growing of a sharp move. The USD risks elsewhere are less clear, with substantial risk negative news unlikely to be significantly USD negative against the riskier currencies. The EUR and CHF would likely benefit, but with the EUR already well above the level implied by risk premia, gains are unlikely to be substantial, with EUR/JPY vulnerable. However, for today we wouldn’t expect major moves.

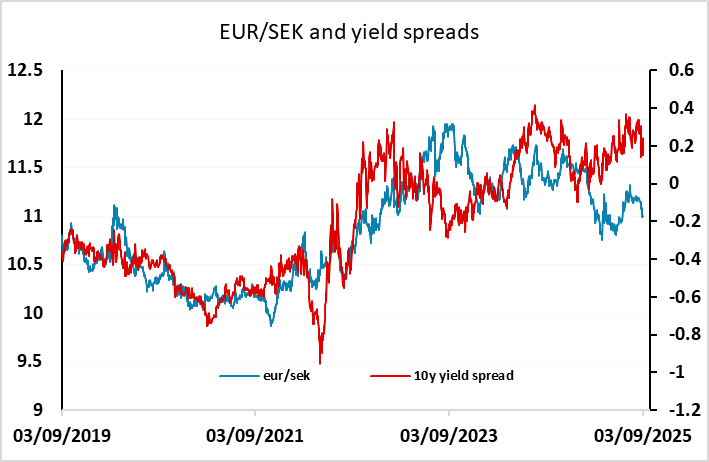

Swedish CPI has come in marginally stronger than expected with the targeted CPIF measure at 3.3% y/y in August, above the 3.2% expected and up from 3.0% in July. EUR/SEK has nevertheless traded slightly higher, but remains close to the 11.00 level, which still looks low relative to recent yield spread moves.

Swiss August CPI has come in weaker than expected on a m/m basis at -0.1%, but y/y is still in line with consensus at 0.2%. This won’t trigger any action form the SNB, as there is a high bar to clear to convince them to move the negative rates. But EUR/CHF is a little firmer on the news, gaining around 10 pips. We still see the CHF as clearly the most overvalued G10 currency, and a major correction does look likely at some point, especially since the high US tariff on Switzerland argues for a weaker currency. But some sort of positive Eurozone growth view may be necessary to propel EUR/CHF higher.