FX Daily Strategy: N America, June 21st

US PMIs a focus after May jump

Modest dip expected but unlikely to be enough to trigger much reaction

JPY weakness continues and may bring the BoJ into action

GBP could fall further but big EUR/GBP recovery unlikely ahead of French election

US PMIs a focus after May jump

Modest dip expected but unlikely to be enough to trigger much reaction

JPY weakness continues and may bring the BoJ into action

GBP could fall further but big EUR/GBP recovery unlikely ahead of French election

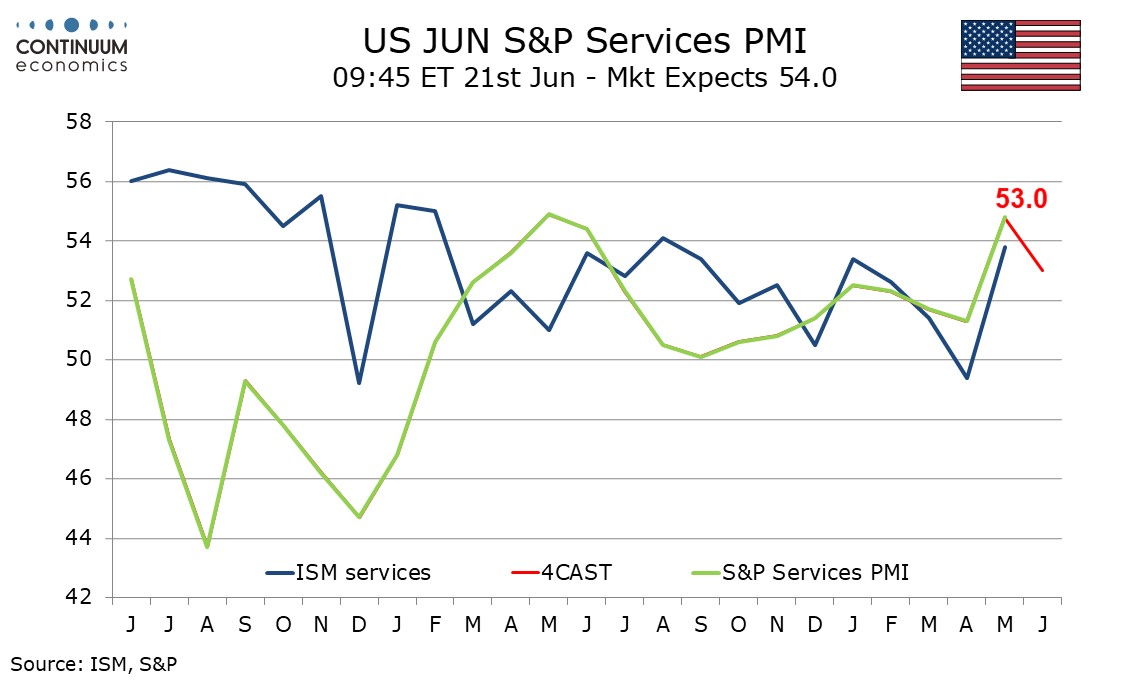

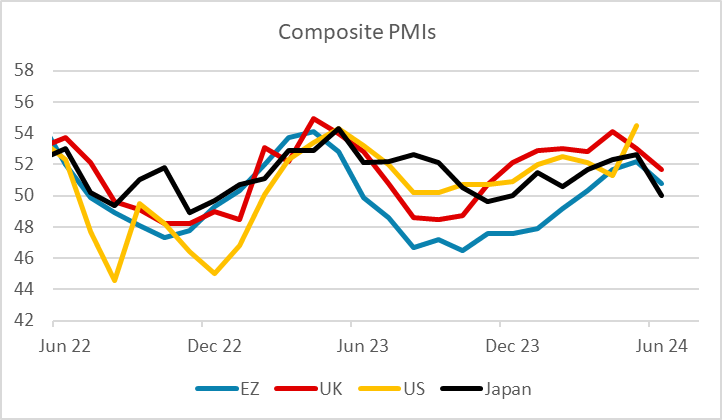

June PMI data will be the primary focus on Friday, after the unexpectedly strong rises seen in May. There is usually more focus on the European PMIs than the US PMIs, but after the sharp rise in the US PMIs in May, this may be less the case in this month’s data. In the US, we expect manufacturing to return to April’s neutral 50.0 level after bouncing to 50.9 in May. This would resume a move off the recent 19-month high of 52.2 seen in February. ISM manufacturing data in April and May has also been edging off a March move above neutral. We expect the services index to correct lower to 53.0 from a 12-month high of 54.8 seen in May. The strength of May’s bounce was difficult to explain, but it was backed by a bounce in the ISM services index and there is no strong reason to expect a sharp reversal in June. An index of 53.0 would still be stronger than the 10 months that preceded May’s bounce. The market consensus looks for a slightly smaller correction lower, so numbers in line with our forecast should mean a slightly negative USD reaction, but our forecast is still indicative of a quite solid performance, so unless the data is a lot weaker than anticipated, any USD correction lower should be modest.

In Europe, the PMIs have been weaker than expected, as they were in Japan, and this suggests downside risks for the US data as well.

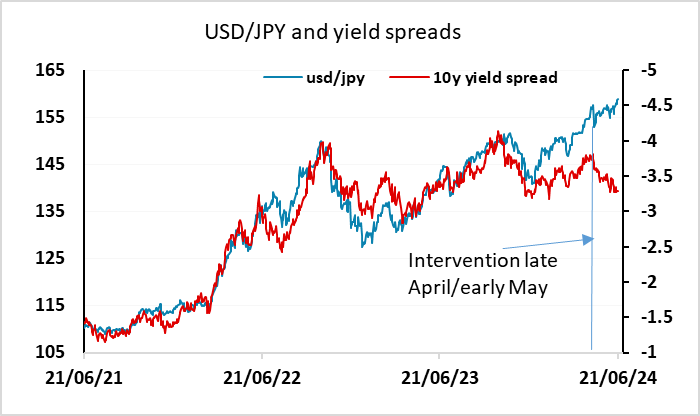

Another day, another decline in the JPY. The seventh consecutive day of JPY declines sees USD/JPY trade above 159, once again without an obvious trigger. The verbal intervention from the Japanese authorities has increased, but there is as yet no sign of actual intervention. Perhaps they are wary of intervention since last time they intervened the JPY responded by falling further despite yield spreads moving in its favour (see chart). Even so, the market is currently too one way for them to allow it to continue with the JPY at record real terms lows, especially since they will lose face if it declines further given their public opposition. Action is still possible today. Although it is less likely once we leave Japanese hours, it has been done before. Co-operation from the US would make an enormous difference, but there is little sign that this is on the cards at this point. The Japanese CPI data did cause a brief and modest JPY rally, but was broadly as expected and with the Tokyo data having provided a strong lead was never likely to change the tone.

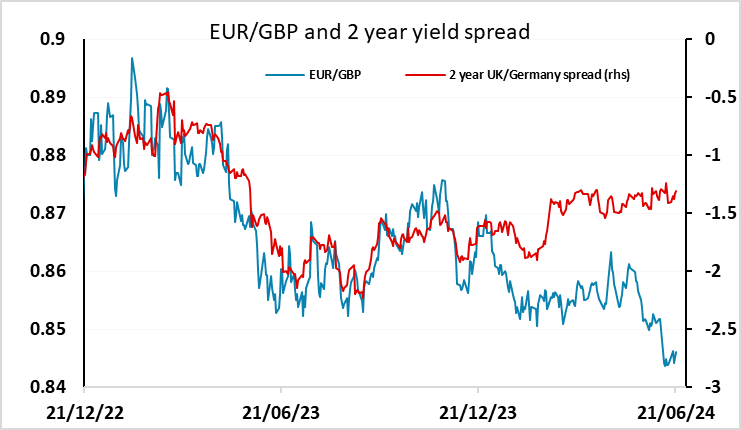

UK retail sales have come in stronger than expected in May, rising 2.9% and more than fully reversing the revised decline of 1.8% in April. GBP briefly rose on the news but ER/GBP declines have been more a consequence of weak EZ PMIs than UK retail data.. In reality, the recovery in May is of little significance, with the April/May average still below the level seen in March. The underlying trend has certainly improved in recent months, but latest three months are still broadly flat compared to a year ago. The data is unlikely to affect BoE thinking, which yesterday’s MPC suggested is leaning towards an August rate cut. EUR/GBP remains more driven by EUR sentiment, with scope for recovery if the French political uncertainty fades.