FX Weekly Strategy: February 17th - 21st

USD weakness may fade if market reconsiders recent events

Tariff threats remain despite delays

Ukraine hopes are still speculative

JPY and AUD look the best placed currencies

We have a relatively quiet week for data this week and with the US on holiday on Monday the initial moves should involve a reassessment of the events last week and the market reactions. The key developments were the increased expectation of a peace deal in Ukraine, the stronger US CPI data and the delay to reciprocal tariffs. The CPI data triggered some USD gains, but these were more than fully reversed against the riskier currencies by the end of the week due to the influence of Ukraine and tariff announcements. These will continue to be major influences this week, and there is some scope for the initial USD weakness on these factors to be challenged.

On the tariff front, the market seemed most encouraged by the delay until April 1, but given the complexity involved in imposing reciprocal tariffs, it was never practical to introduce them immediately, and a delay until April 1 looks like the minimum necessary. However, the market may be taking the view that Trump will continue to maintain the threat of tariffs, and keep delaying implementation. We will see when the deadline for Canada and Mexico comes on March 1, but it seems dangerous to assume he won’t carry through any threats. The USD decline after the tariff announcement consequently looks a little overdone.

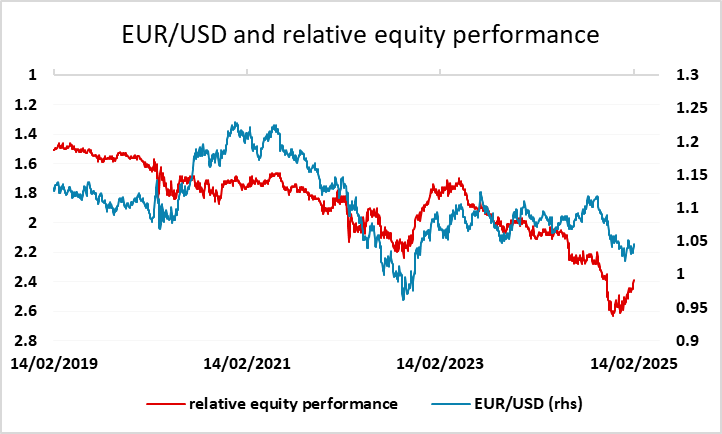

On Ukraine, the European markets in particular have benefited from the hope that the war will come to an end. But a lot still has to happen for the European economy to benefit. First of all, the deal that Trump appears to be agreeing with Putin is not one that Ukraine currently sees as acceptable. If Trump continues along these lines, there will be some difficult political decisions to be made by Zelensky and by other European leaders. Ukraine may not be prepared to accept the current terms, and if this means reduced military support from the US the implications become very unpleasant. It is certainly far from clear that the road to peace will be smooth. Furthermore, the economic benefits of peace may not initially be very great. The main economic negative of the war for most of Europe was the loss of Russian gas and the consequent rise in gas prices. It is far from clear that Russian gas imports would quickly resume, both for political and practical reasons.

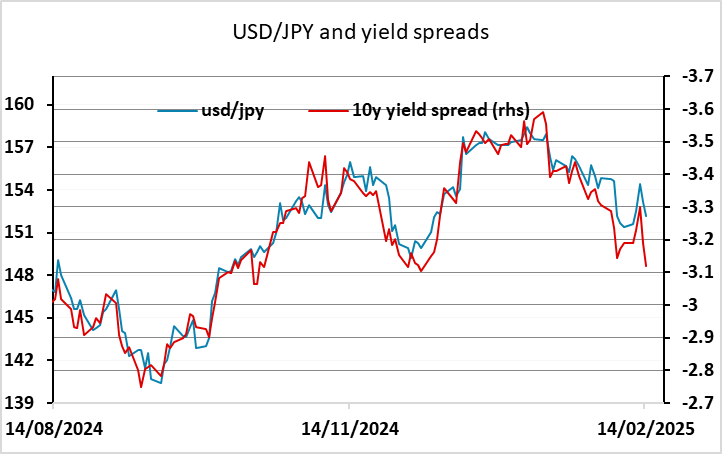

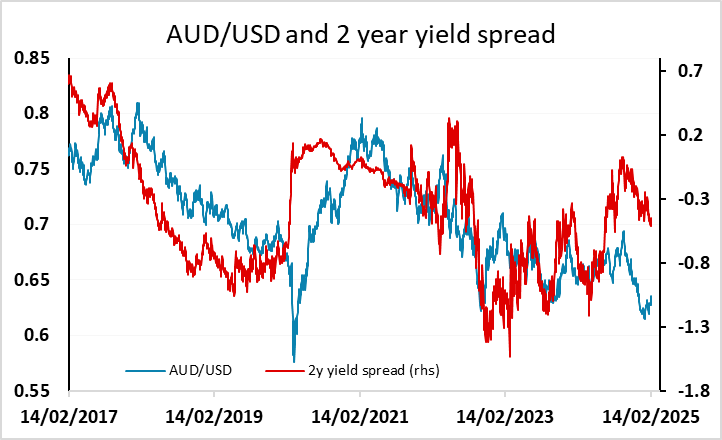

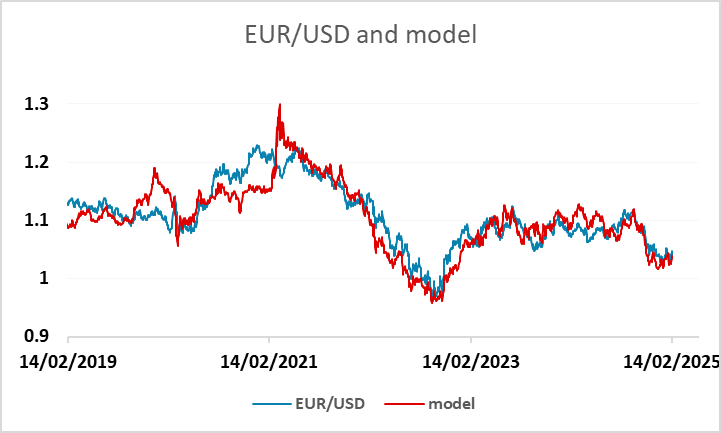

So some of the drivers of the recent USD weakness may not be as USD negative as they initially appear. From a currency perspective the picture looks most uncertain for Europe, as the recent strength of the EUR is based largely on the strong performance of European equities. The case for USD weakness against the JPY and AUD is much more firmly based. In both cases, yield spreads point strongly to further USD declines, and while the AUD is vulnerable to any reversal in risk sentiment, the JPY can be expected to benefit if equities fall back.

This week’s Japanese GDP data on Monday could determine the short term direction for the JPY. It is hard to see much upside for USD/JPY, given current yield spreads, but weak Japanese GDP could potentially undermine JPY sentiment in the short term. Even so, we see the risks for the JPY as being more on the upside, especially since there is still not much risk of further early tightening from the BoJ priced into the curve. The next hike is not fully priced until September, but a strong GDP number could increase market expectations of a hike in March or May. Even with current yield spreads, there is scope for a move to 150, so USD/JPY risks look to be on the downside.

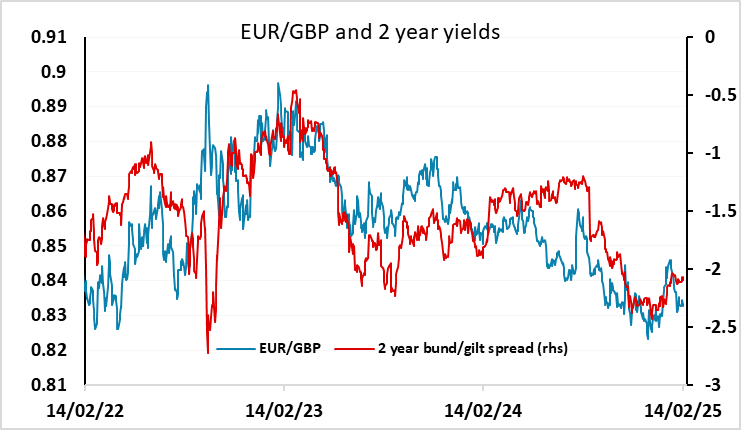

Otherwise. UK CPI is another significant data point this week. EUR/GBP continues to trade in the 0.83-0.84 range, but we feel the risks of a break of this range remain on the upside, with scope for more BoE easing to be priced in than is currently in the market. However, this may not be the week for it, as we see risks to the upside for UK CPI relative to market consensus. On Friday, we have PMI data which could also be important, particularly for European currencies. While there is some optimism based on Ukraine and the delay in tariffs, the Euroepan data has remained sluggish up to now, and for any serious EUR recovery some evidence of real economic improvement will be necessary.

Data and events for the week ahead

USA

US markets will be closed for Presidents’ Day on Monday, though Fed’s Harker and Bowman are scheduled to speak. The calendar is fairly quiet through the rest of the week. Tuesday sees February’s NAHB homebuilders’ survey and Fed’s Daly will speak. On Wednesday we expect January housing starts to fall by 8.6% to 1.37m but we see little change in permits, down by 0.1% to 1.48m. Wednesday sees FOMC minutes from January 29, and are likely to show a consensus that there is no hurry to ease existed even before January’s strong CPI report.

Thursday’s initial claims data will cover the survey week for February’s non-farm payroll. February’s Philly Fed manufacturing survey and January leading indicators are also due while Fed’s Goolsbee and Musalem are due to speak. On Friday we expect increases in February’s S and P PMIs, manufacturing to 52.0 from 51.2 and services to 54.5 from 52.9. We also expect January existing home sales to fall by 0.9% to 4.20m. Final February Michigan CSI data is also due.

Canada

Canada’s key release is January CPI on Tuesday, where we expect yr/yr growth to fall to 1.7% yr/yr from 1.8%, depressed by a temporary sales tax holiday. Canada also releases January housing starts on Monday, January existing home sales on Tuesday and January’s IPPI/RPMI on Thursday. Friday sees December retail sales, where the preliminary estimate was for a strong 1.6% increase. Bank of Canada Governor Macklem is also due to speak on Friday.

UK

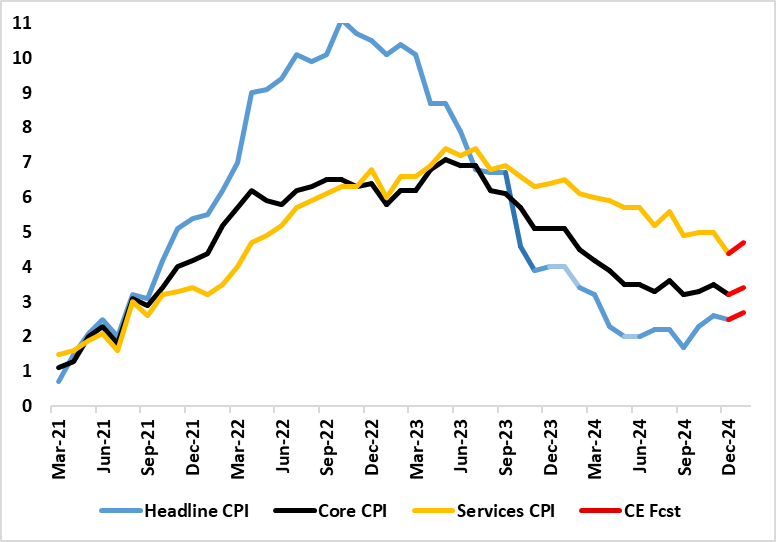

The focus data wise will be on Wednesday’s CPI numbers. We see the headline rate nudging up 0.2 ppt to 2.7% but with upside risks towards BoE thinking of a 2.8% figure – some see the rate hitting 3%-plus. But the December figure will be driven by higher petrol costs and a higher energy price cap but there may still be some rise back in the core as volatile services edge back up. The MPC will probably be very much keen to see labor labour market figures (Tue) which may show more signs of job losses, alongside what may be mixed to higher hints regarding earnings. The data on payrolls is becoming ever more important, both given the repeated falls they have reported of late but also questioning the validity of the BoE’s interpretation of how tight the labor market actually is, as they suggest far less inactive workers than official ONS numbers and very much conflict with ONS employment data.

January Inflation to Spike Higher?

Source: ONS, Continuum Economics

Friday sees PMI data which are already pointing to slumping business optimism – we see the headline edging back down slightly, these coming just after GfK consumer confidence readings but alongside retail sales data for January where cold and stormy weather may result in another soft outcome. Also Friday, come public borrowing numbers, the latter still likely to show borrowing in the first ten months of 2024-25 is running both above the year-before and above the monthly profile consistent with the OBR’s October forecast.

Eurozone

The week sees little in terms of data although German ZEW figure (Tue)will provide more cause for concern in light of growing tariff worries. The later may filter into consumer thinking thereby affecting the EZ consumer confidence update (Thu). EZ construction data (Thu) may add to sigsn that the economy was weak at the end of 2024. Indeed, on Friday, INSEE business survey data may suggest a continued weak start to 2025 as may the flash PMIs. January’s Composite PMI rose 0.6 point to 50.2., suggesting the first monthly increase in private sector business activity since August last year. A slower fall in factory production was central to January’s overall tepid expansion, sector data showed, as services activity posted a slightly softer rise on the month. We see no further improvement in the composite.

Next week ends on Sunday with the German federal election, where the CDU will emerge as the largest party but may find forming a stable coalition difficult after making what have been seen as supportive gestures to the right-wing AfD.

Rest of Western Europe

There are few events this week but, in Sweden, final CPI data (Tue) should detail the source of the upside surprise in the flash release, while labor market numbers (Mon) may again be mixed. In Switzerland, flash Q4 GDP numbers (mon) may suggest q/q growth halved to around 0.2% last quarter.

Japan

Preliminary GDP is released on Monday. It will likely show a modest growth for Q4 as wage grows and consumption slightly recovers. We also have the trade balance on Wednesday where we expect positive in both export and import with headline likely lower from stronger import. The key national CPI is on Friday but we doubt the strength could persist with transitory factors fades.

Australia

The RBA will likely to keep rates on hold on Feb and signalling the first cut will come earlier as inflation has returned to target range on Tuesday. There is a good likelihood the Q4 wage price index will surprise to the weak side on Wednesday despite tight labor market to be shown on Thursday, as per preliminary surveys.

NZ

To the contrary of RBA, the RBNZ will continue on their easing path on Wednesday. The only difference is whether they will continue front loading cuts or keep it nimble. It will be a close call if the RBNZ viewed the latest spike in CPI to be not transitory.