EUR, CHF, JPY, AUD flows: AUD recovers, EUR and CHF vulnerable

Weak German production and a rise in Swiss FX reserves suggests EUR and CHF could come under pressure

A fairly quiet overnight session with Tokyo CPI dropping in line with market expectations, though still above the 2% target, with the ex-food and energy measure stubbornly high. USD/JPY initially fell back after the data but recovered to Asian opening levels by European open. AUD was fimer on the back of better Australian retail sales.

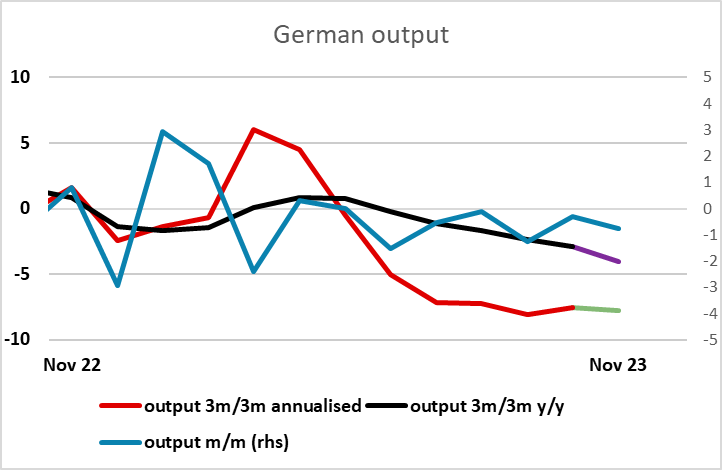

This morning sees German industrial production significantly weaker than expected, falling 0.7% m/m in November, maintaining the negative trend of recent months. While the OMIs suggest a mild recovery may be underway in the services sector, the manufacturing sector still looks very weak, and the EUR may come under pressure as the session goes on, although it is initially little changed.

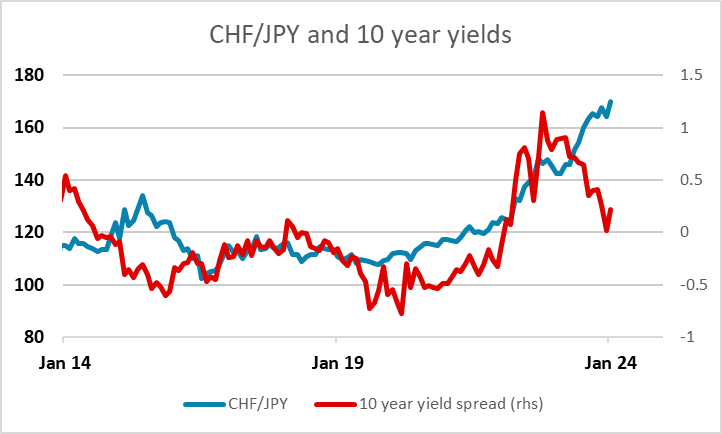

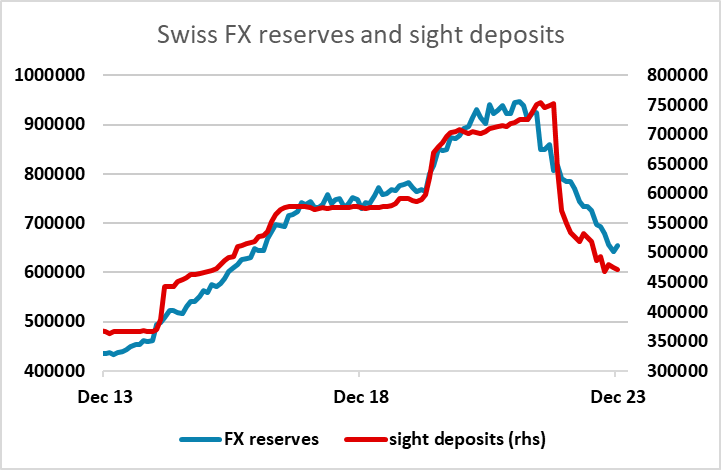

Swiss FX reserve data showed a rise in December, the first such rise since May, confirming the SNB’s decision to halt the sale of FX reserves that they communicated at the December meeting. EUR/CHF is firmer after the data, and the CHF may now be more generally vulnerable. We continue to see CHF/JPY as the best value trade.