FX Weekly Strategy: January 5th-9th

US employment report the main focus, mildly stronger than expected gain seen

EUR could slip on weaker HICP

CAD strength could fade after recent outperformance

JPY weakness still needs intervention to reverse it

NOK looks attractive near long term lows

Strategy for the week ahead

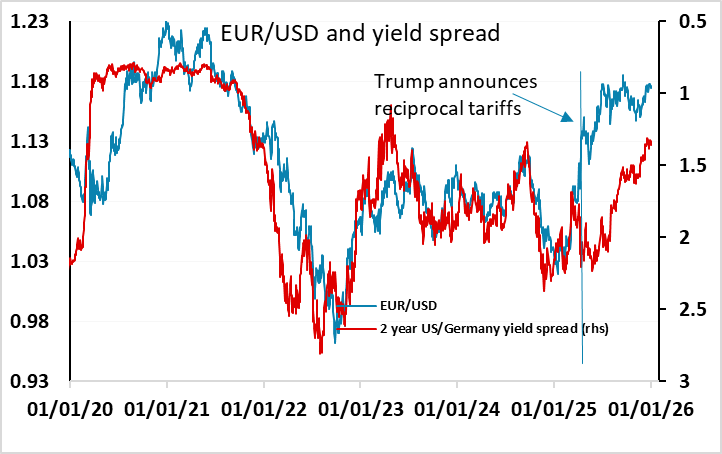

The US employment report and the Eurozone provisional December HICP data are the main numbers due this week, and our forecasts suggest some downside risks for EUR/USD, with our payroll forecast above consensus and our HICP forecast below consensus, albeit relatively modestly. As it stands, EUR/USD remains one of the few USD pairs in which the USD is underperforming the movements in yield spreads over the past year, and with the EUR curve completely flat, there is scope for softer inflation numbers to lead to some decline in EUR yields from here. While the correlation of EUR/USD with yield spreads has been fairly weak in the last year, we would expect any emergence of expectations of ECB easing to lead to a softer EUR.

Since December 11 EUR/USD has been in a 1.17-1.18 range but the numbers we are forecasting suggests scope to break the bottom end of the range and head towards the significant support area around 1.1650. Bigger picture, the 1.14-1.19 range which has contained most of the activity since April doesn’t look to be in any real danger, but we could see a drift back towards the centre of this range around 1.1650.

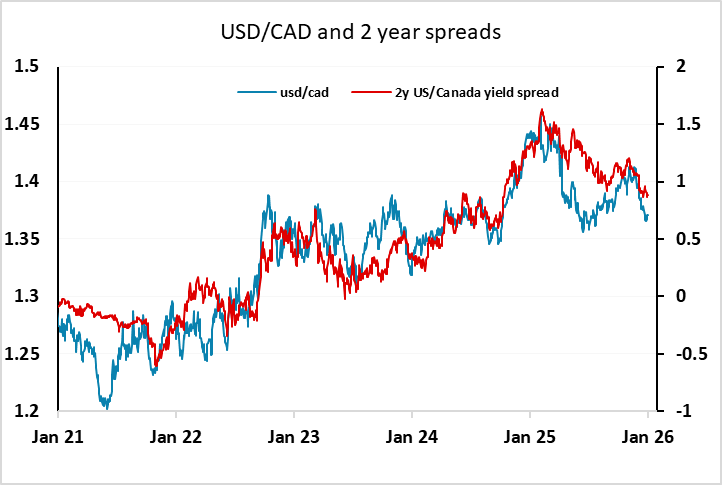

We also have the Canadian December employment report and the CAD has been one of the better performer in recent weeks, helped by much improved Canadian data, with employment gains averaging 60k in the last 3 months and the Canadian unemployment rate falling sharply. The CAD has outperformed the usual yield spread correlation in recent weeks, helped also by the positive risk tone to the markets. We and the market both see some correction to the recent strength in the Canadian employment data, with a rise in the unemployment rate following the sharp dip in November and an employment gain close to zero. But even though it is expected, the combination of a strong US number and the fact that the CAD has been strong and outperformed yield spread moves in recent weeks suggests USD/CAD upside risks.

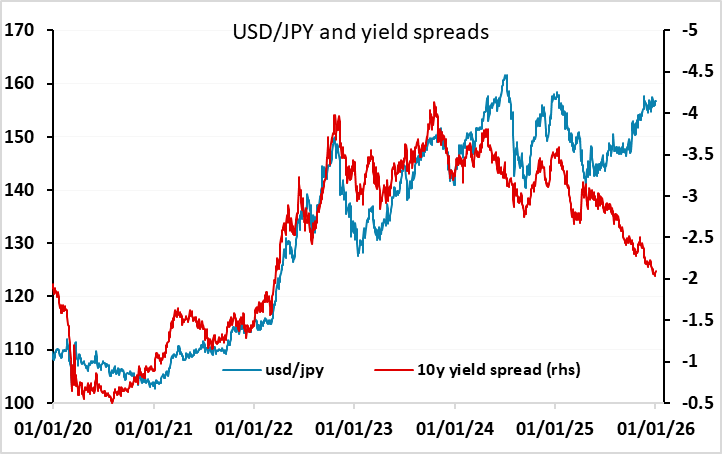

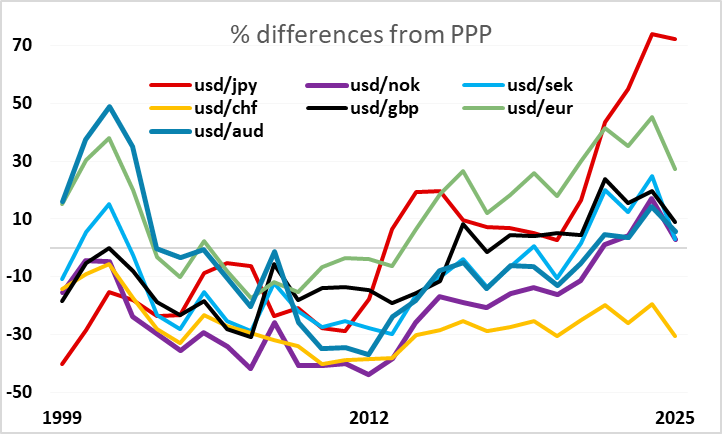

The JPY remains the great imponderable of the FX market. There is no doubt that it is dramatically undervalued both from a pure fundamental basis and based on the metrics that usually guide it, but the JPY bulls have received several bloody noses in the last year and may not have the appetite for further attempts this year unless there is some clear positive trigger. The most obvious possibility remains intervention from the Japanese authorities, which looks very possible or even overdue given the JPY’s decline and its failure to benefit from the usual drivers, notable the yield spread moves in its favour. Much more modest divergences from the spread relationship were enough to trigger intervention in April and May 2024. However, with USD/JPY trading in the middle of the 155.50-157.80 range seen on the day of the BoJ rate hike on December 19, and having held within that range since, we doubt we will see any immediate action from the Japanese authorities. But USD gains through the top of the range, which could result from a strong employment report, might well trigger a response.

Elsewhere CPI data is due in Switzerland and Scandinavia. We continue to see scope for a NOK revaluation against the CHF, EUR and SEK, given its low historic level, attractive yield spreads and underlying solid Norwegian economy. However, market confidence has, much like the JPY, been undermined by recent poor performance, and there is always concern that the Norwegian government pension fund always has a lot of NOK to sell on any recovery. Even so, EUR/NOK looks toppy at 12, NOK/SEK has never traded below 0.90 for any length of time, and CHF/NOK looks toppy at 13, so risks should be on the NOK upside.

Data and events for the week ahead

USA

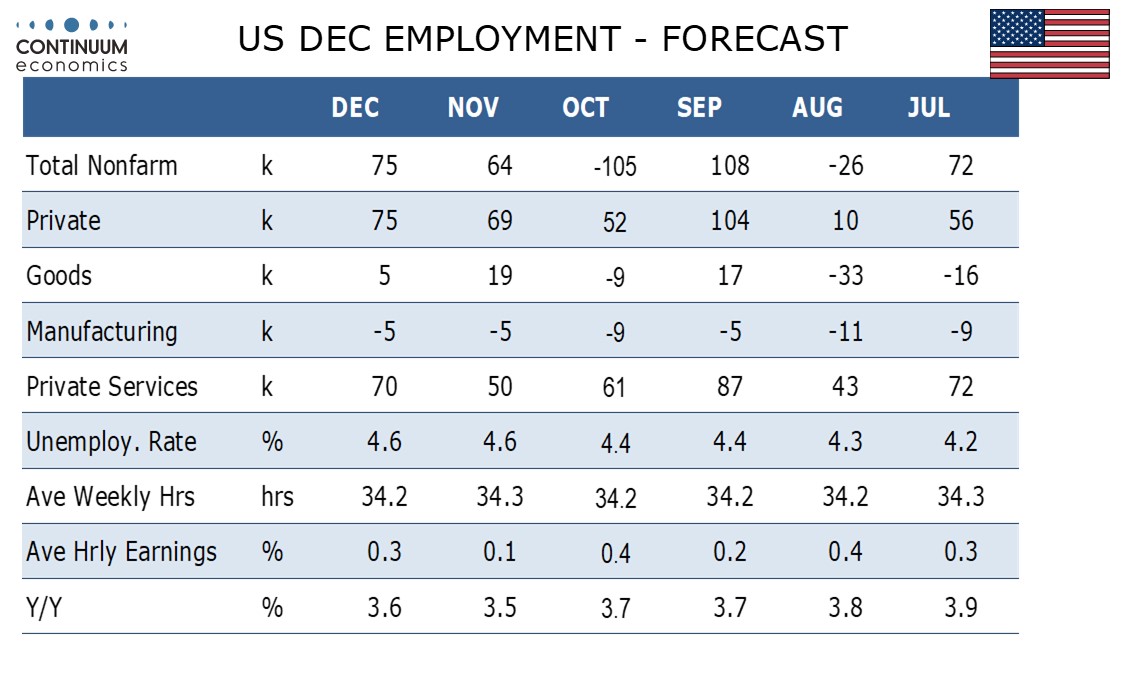

The first full week of 2026 will see focus on December non-farm payrolls on Friday January 9, for which we expect a slightly stronger 75k increase both overall and in the private sector. We expect unemployment to be unchanged at 4.6% and an in line with trend 0.3% increase in average hourly earnings. Other labor market indicators to watch are December’s ADP employment report and November’s JOLTS report on job openings on Wednesday, and weekly initial claims on Thursday, though the latter may face holiday seasonal adjustment issues. Thursday also sees Q3 productivity and costs.

December’s ISM surveys are due. We expect manufacturing on Monday to be unchanged at 48.2 and services on Wednesday to slip to 52.0 from 52.6. Also due on Wednesday are October factory orders. Thursday sees October’s trade balance, October wholesale data and October consumer credit. Housing starts for both September and October will be released on Friday, as will January’s preliminary Michigan CSI. Fed’s Barkin will speak on Tuesday.

Canada

Canada releases December employment data on Friday January 9. We expect a 10k increase, slowing after three straight surprisingly strong gains, with unemployment correcting higher to 6.7% from 6.5% in November, though still below October’s 6.9%. Tuesday sees December’s S and P Services PMI and December’s Ivey manufacturing PMI is due on Wednesday. October’s trade balance is due on Thursday.

UK

There is the BoE money and credit data (Mon) where housing market volatility and distortions may again be the order of the day but with further signs of an underlying weakening. Otherwise, no appreciable revisions are expected in final PMI numbers (Wed) but perhaps with more interest in the first insight for the month into the Construction PMI (Thu) and then the labor market from REC survey data (Fri).

Eurozone

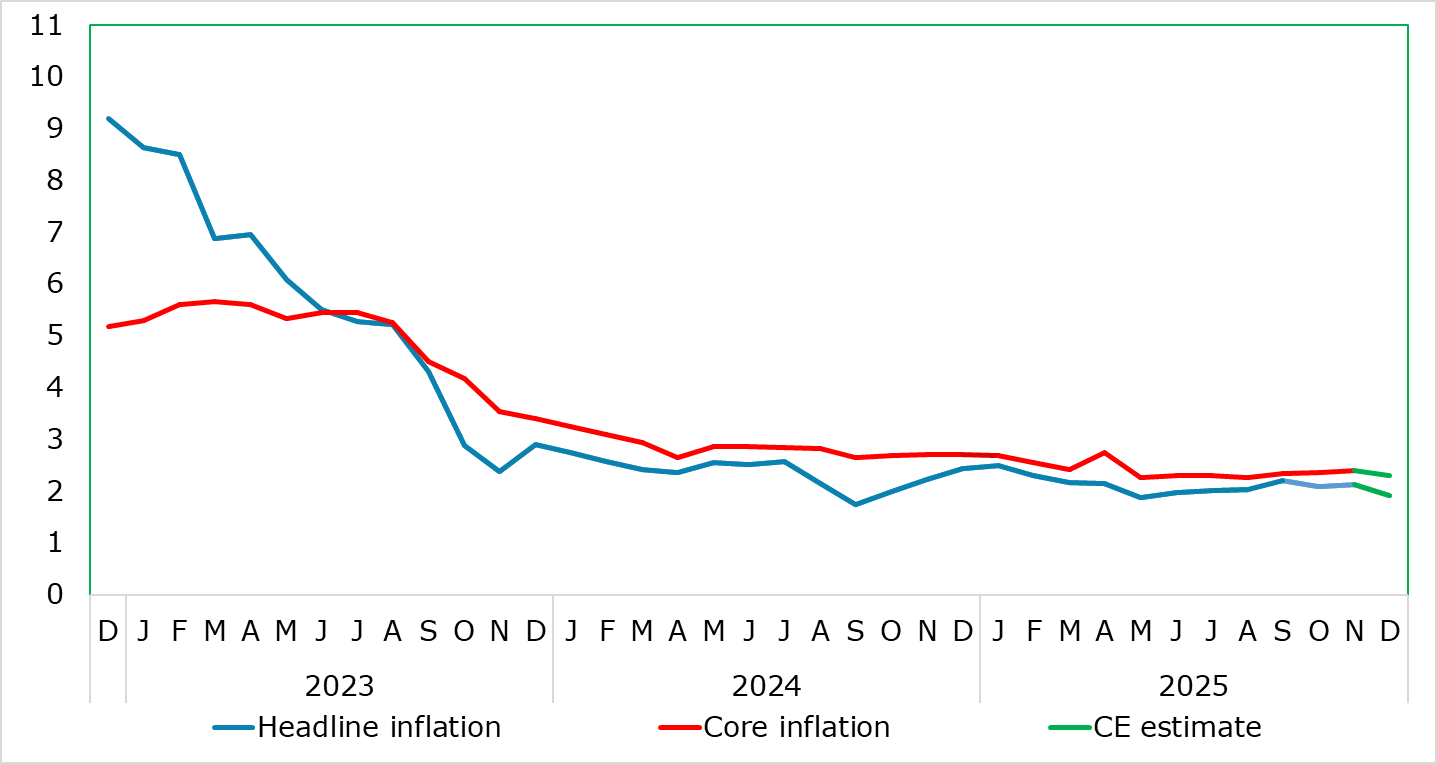

Flash December HICP data (Wed) should see the headline drop to 2.0% and possibly even 1.9% from the 2.1% final November figure. This will be partly energy-induced with the core rate dropping just a notch. German and French CPI data (Tue) will give some early insight.

Headline and Services To Fall?

Source: Eurostat, CE

Otherwise, there is more survey data from the ECB on consumer expectation and then from the European Commission (Thu). And the week ends with German orders (Thu) and industrial production on Friday, the latter likely to see a m/m correction back.

Rest of Western Europe

There are few events in Sweden, most notably flash CPI numbers (Thu), where the targeted CPIF rate may rise a notch. The same day sees Swiss CPI figures where a small rise from the zero y/y November figure is seen to chime with SNB thinking. Friday sees Norway’s CPI, where the CPI-ATE rate may inch a notch lower.