FX Weekly Strategy: December 15th-19th

Employment report may have small USD positive impact

Strategy for the week ahead

Employment report may have small USD positive impact

There is a lot of information due in this, effective the last full week of the year for the markets. The US employment reports for both October and November, the CPIs for November for the US, Canada and the UK, and central bank meetings from Japan, the UK and Sweden are the main highlights.

Our forecasts for the US employment numbers are similar to the market consensus, so we wouldn’t expect too much reaction. However, with Fed chair Powell noting that he expected the NFP numbers to be revised lower, the market may take any strong data with a pinch of salt, suggesting the risks are a little on the downside. But there has been more focus on alternative private sector indicators in the period of government shutdown, and to some extent this will reduce the power of the official employment report to have a market impact. It looks hard for the market to significant move their expectations of Fed policy from here, but with a little more than two rate cuts priced in for 2026, the risk is likely slightly on the upside for rates and the USD on neutral data. We would also see some modest upside risks on the CPI data, where we expect the November data to show a 0.5% rise over September after the October release was cancelled.

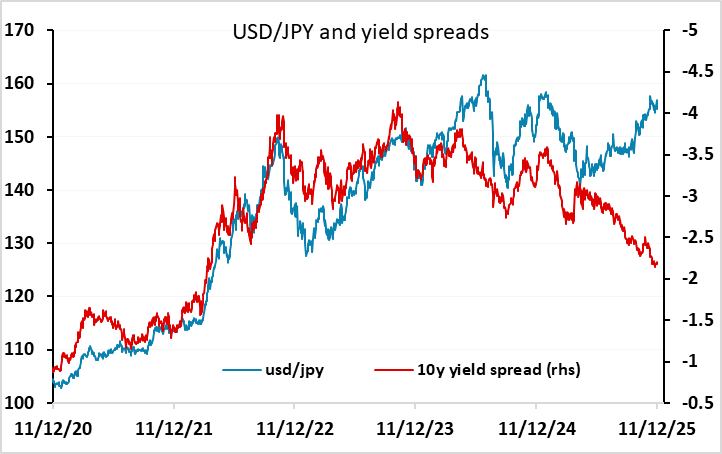

The BoJ meeting on the 19th is probably the most likely trigger for volatility on the week. Even though a rate hike is now widely expected, with the Reuters survey seeing more than 90% of forecasters expecting a hike, a reaction is likely depending on the tone of the BoJ presentation. As it stands the market is pricing in a total of 67bps of tightening by the end of 2026, and while there is potential for two more hikes to be fully rather than partially priced in, the risk may be that Ueda sounds non-committal to further moves as he has tended to in recent press conferences. Having said this, the JPY remains dramatically too weak against a range of currencies, and intervention must now be a danger as by our calculations the real effective JPY hit an all time low on Friday.

Data and events for the week ahead

USA

Highlights of the US calendar are employment reports for October and November on Tuesday and CPI for November on Thursday. Before that Monday sees December surveys from the Empire State on manufacturing and the NAHB on homebuilding. Fed’s Miran and Williams will speak on Monday.

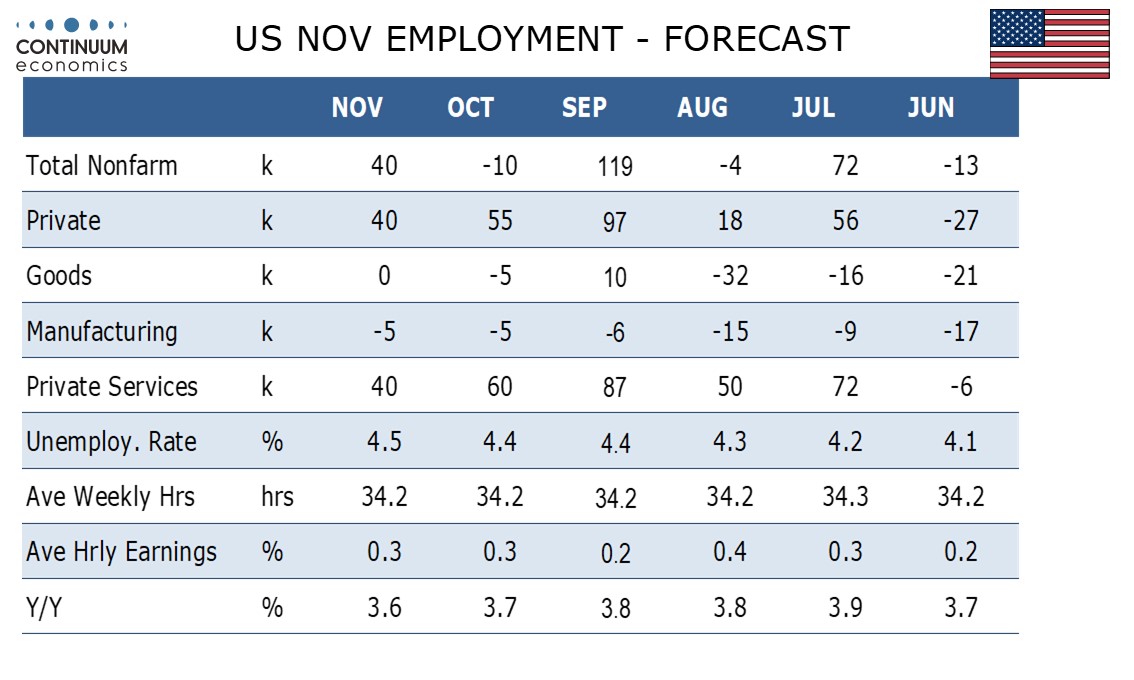

We expect November’s non-farm payroll to rise by 40k both overall and in the private sector after an October where we expect a 10k decline overall, on delayed DOGE layoffs, but a 55k increase in the private sector. We expect gains of 0.3% in average hourly earnings in both months. Unemployment will only be released for November. We expect a rate of 4.5%, up from 4.4% in September. Tuesday also sees October retail sales where we expect a 0.4% decline due to an expiry of a tax credit for electric vehicle sales, with a 0.1% increase ex autos. December S and P PMIs follow, and we expect marginal declines to 52.0 from 52.2 in manufacturing and to 54.0 from 54.1 in services. September business inventories are also due and will contribute to Q3 GDP forecasts.

Wednesday sees little data but Fed’s Williams again and Bostic will speak. Thursday sees November CPI, with October’s release canceled. We expect November’s CPI will be up by 0.5% from September, assuming October at 0.2% and November at 0.3%, while the ex food and energy rate will also be up by 0.5% over the two months, this time with both months at 0.26% before rounding. Also on Thursday weekly initial claims are likely to return to trend after recent holiday-induced volatility . December’s {Philly Fed manufacturing survey is also due. On Friday we expect November existing home sales to see a third straight rise, by 1.5% to 4.16m. Final December Michigan CSI data is also due.

Canada

Canada releases November CPI on Monday. We expect a rise to 2.3% from 2.2% yr/yr as soft year ago data due to a tax holiday drops out, though we expect little net change in the Bank of Canada’s core rates. November existing home sales and housing starts are also due on Monday, as are October manufacturing shipments, where preliminary data showed a decline of 1.1%. BoC Governor Macklem will speak on Tuesday. Friday sees October retail sales, for which the preliminary estimate was unchanged.

UK

The coming week sees several important economic updates looming, most notably the CPI (Wed). Although the October figure fell a little less than the consensus to 3.6%, the November numbers may show a same-sized 0.2 ppt fall to 3.4%, a six-month low. This chimes with BoE thinking, the latter getting advance insight into the data. We see the core rate seen also dropping 0.2 ppt but to an 11-month low of 3.2%.

As for the BoE, that the MPC will deliver a fifth 25 bp rate cut (to 3.75%) on Thursday is almost certain, even after a Budget that did not accentuate current emerging demand weakness. The question is whether the MPC vote will be as close as the 5:4 split seen last month but with Governor Bailey switching sides. However, we think dissents may be less than four this time around unless the November CPI provides a negative surprise. Even hawk Chief Economist Pill may opt for an easing he still openly advocates as long as it is delivered slower than hitherto (as it would be).

Contributing to the BoE debate and also with the MPC getting advance insight into the numbers, Tuesday sees ever-more important labor market numbers. Apparent wage resilience has perturbed some MPC members but where even the hawks are starting to re-think. But this data release, now encompassing updates not just from the long-standing ONS but also real time figures from the HMRC (which we suggest are more authoritative data and are now officially accredited) is likely to see further and clear drops in the official earnings data, at least for private sector regular earnings which may fall (possibly well) below 4% on the official 3-mth rolling basis measure. Otherwise, the HMRC numbers are likely to show that employment is continuing to contract and maybe more broadly so as far as the private sector is concerned, such data possibly taking greater precedence than CPI numbers for some MPC members.

Friday sees monthly public borrowing numbers which are running well above year-before levels. Friday also sees October retail sales data where a further) m/m correction is seen with it unclear if wetter and warmer than average weather may have affected spending adversely as may apprehension ahead of the Budget. Earlier that day, GfK consumer confidence data may show still subdued sentiment as may CBI industry numbers (Thu). But as far as survey numbers are concerned, the PMI flashes (Tue) take precedence at least in market eyes, especially after the weaker outcome last time around which we think will be repeated in this December update.

Eurozone

With some eyes on the German ZEW survey (Tue), the IFO figures (Wed) and the French INSEE update (Thu), the focus will be on the flash PMI data (Tue). In November, the Composite PMI rose for a sixth month in succession in November to the highest since May 2023, apparently indicative of a solid and accelerated rise in private sector business activity and at 52.8 was above the survey’s long-run average of 52.4 once again. We see a correction but underscore that the composite measure ignores what still looks like recession bound construction.

The main focus is on the ECB on Thursday. A fourth successive stable policy decision will be the almost inevitable outcome, with the discount rate left at 2.0%. The likely unanimous vote will mask splits about whether policy has troughed or not, this mainly a result of differences within the Council as to where inflation and even growth risks lie. But the ECB Council is likely to reassert that downside growth risks have dissipated somewhat, so that the current policy stance ‘in a good place’. Regardless, we think that the ECB may be overlooking a backdrop where the monetary transmission mechanism is not running as smoothly as it alleges and where tariff related uncertainty persists.

Rest of Western Europe

There are a key events in Sweden, most notably the Riksbank policy verdict (Thu). The Board promise of no change was adhered to last time around, and will repeated again for this December verdict. Against this almost certain unchanged policy picture, the focus will be on the updated projections, albeit these still likely to be little changed too. It is likely that the Board may have early access to the Economic Tendency Survey and Retail Sales due on Friday.

In Norway, after what was to some a surprise (and seemingly far from a formality) move in September, in which the Norges Bank cut is policy rate by a further 25 bp to 4.0%, we see no change at Thursday’s verdict, this being consistent with the Board’s repeated assertion that ‘the policy rate will be reduced further in the course of the coming year’. This December meeting will have both new forecasts and data for the Board to peruse, not least inflation and lending numbers.

Japan

National CPI for November will be released on Friday, likely before BoJ’s interest rate decision. It will likely be a read close to 3%, though destined to be shadowed by the BoJ rate decision. We expect a 25bps hike and forward guidance of at least one more in 2026. Forward guidance, we believe would be more critical. However, it is also not surprising to see no forward guidance at all. Other tier two data are scattered throughout the week are unlikely to be market moving.

Australia

We have the PMIs and consumer confidence on Monday, consumer inflation expectation. That is it.

NZ

Kickstarting the week with Business PSI, followed by good price index on Tuesday, current account on Wednesday. The important GDP will be on Thursday where it does not have the brightest prospect. There are also consumer survey and trade balance on Friday.