Preview: Due February 28 - Canada Q4/December GDP - A solid quarter outside weaker inventories

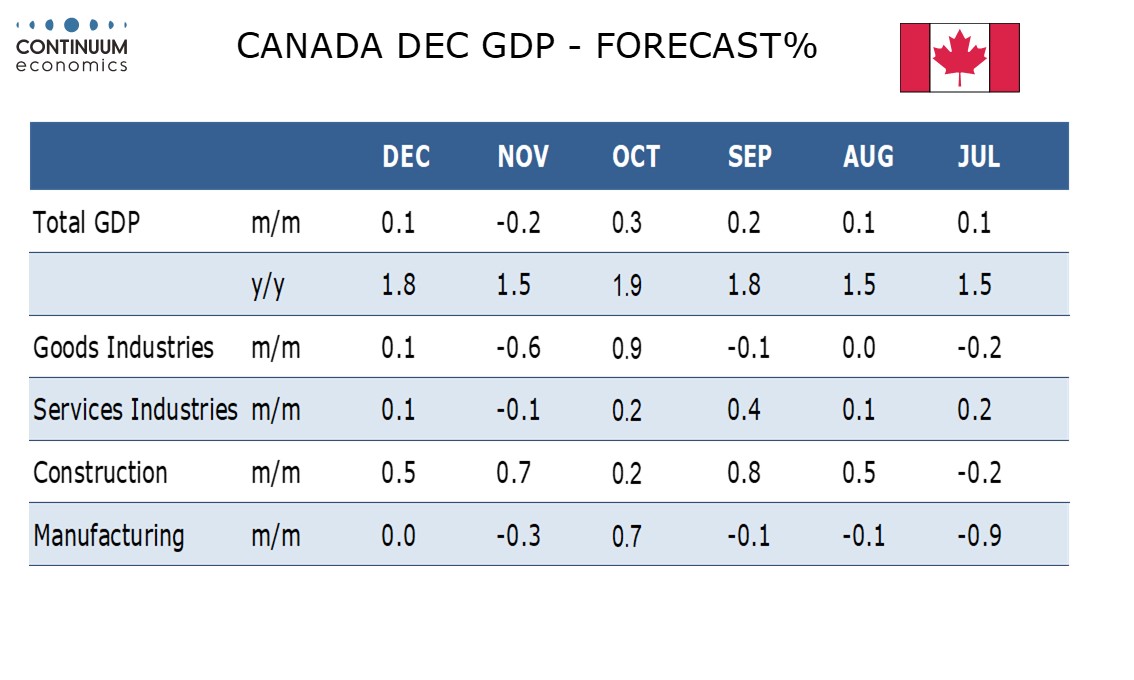

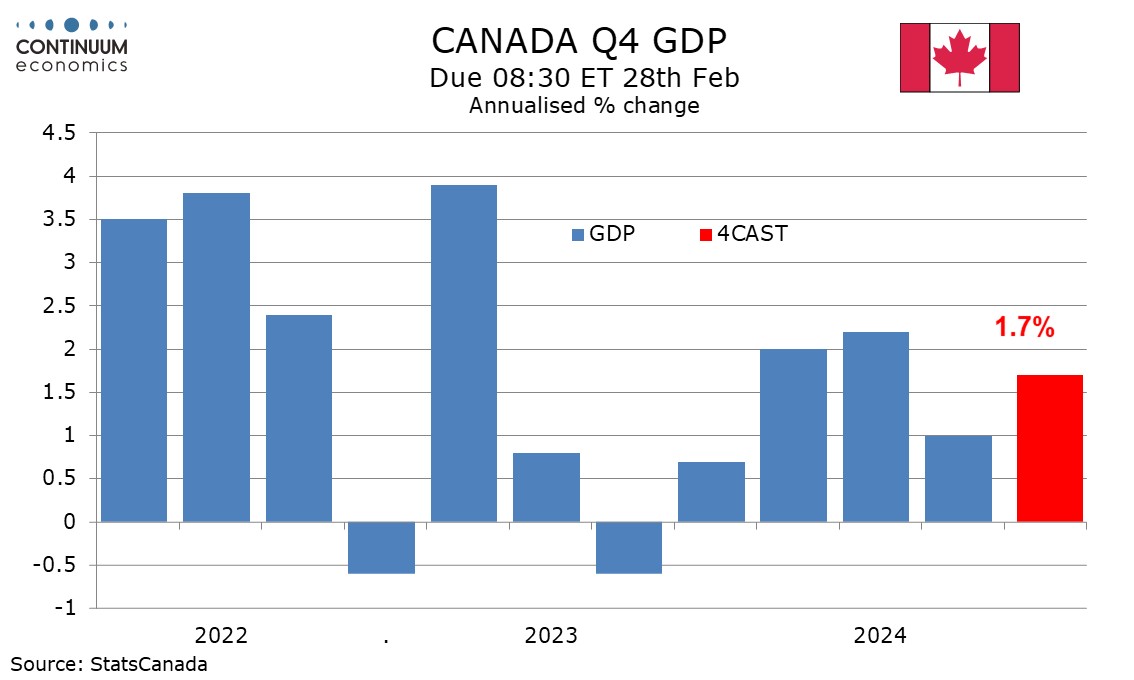

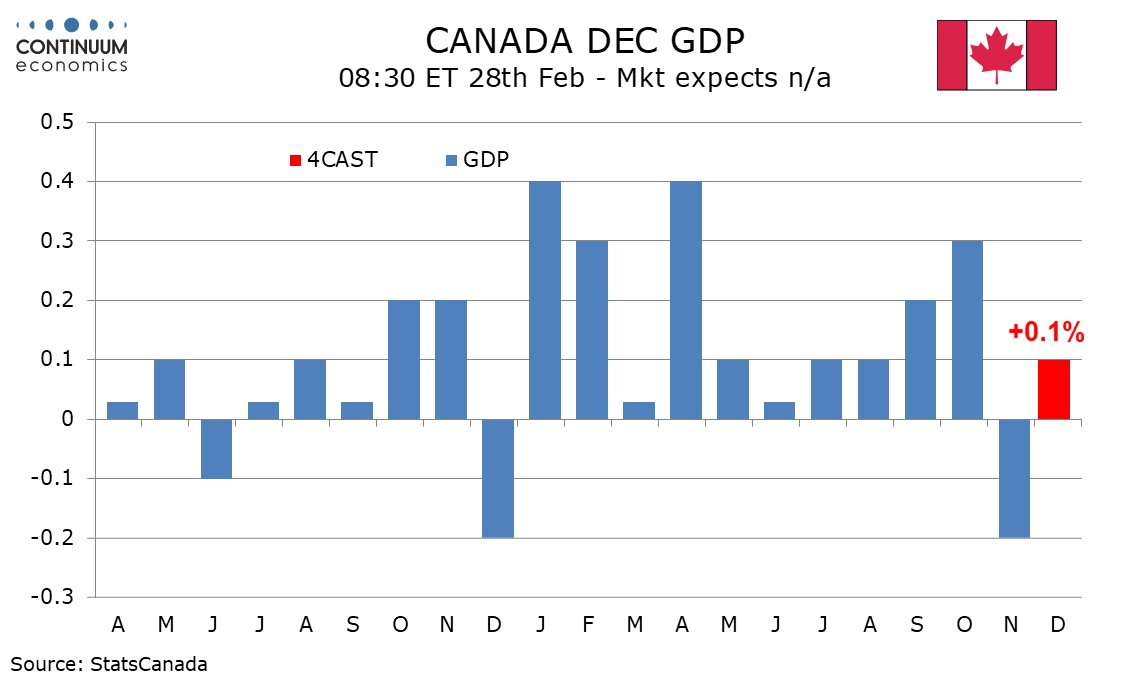

We expect Q4 Canadian GDP to rise by 1.7% annualized, marginally below a 1.8% estimate made with the Bank of Canada’s January Monetary Policy Report but with positive details outside inventories. We expect a 0.1% increase in December GDP, slightly below a 0.2% estimate made with November’s data.

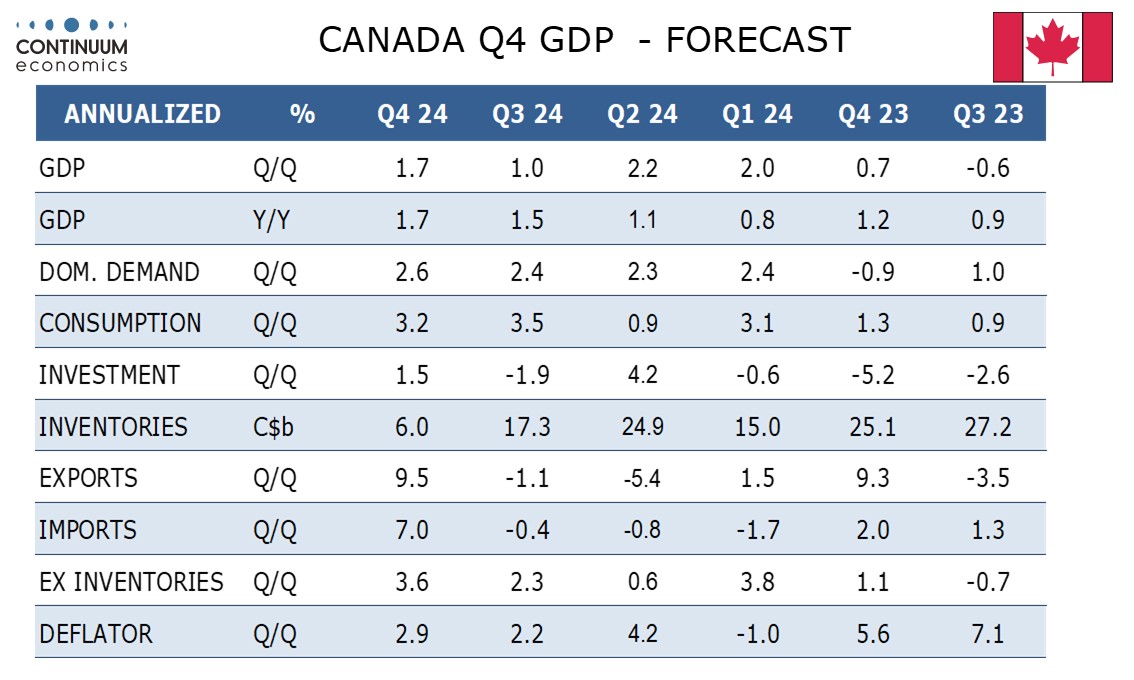

We expect the Q4 data to show a 2.6% increase in domestic demand, similar to but slightly firmer than the preceding three quarters, led by a 3.2% rise in consumer spending. Fixed investment will be more subdued though we do not expect a second straight negative, and exports will outpace imports, with both rebounding from modest slippage in Q3. Only slower inventory growth will restrain the data.

We expect a 0.7% quarterly rise in the GDP deflator (2.9% annualized) supported by export prices rising at a faster pace than import prices.

On the month we expect both goods and services to rise by 0.1% in December, with goods led by construction. Manufacturing data was quite subdued in December despite November’s GDP report looking for a rise in the sector. Services will get a boost from retail, but two other large components, transportation/warehousing and real estate/rental/leasing, are expected to decline.

The Q4 data will show Canada’s economy with some momentum even if December’s monthly data is less than convincing, with Bank of Canada easing having some impact. However continued progress in 2025 will be dependent on Canada avoiding the imposition of heavy tariffs from the US.