JPY, EUR, AUD flows: USD dips as yields edge lower

USD slips lower against the JPY. AUD has upside scope

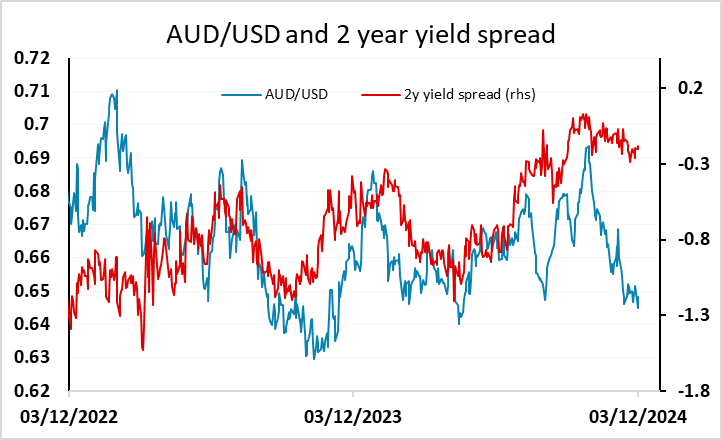

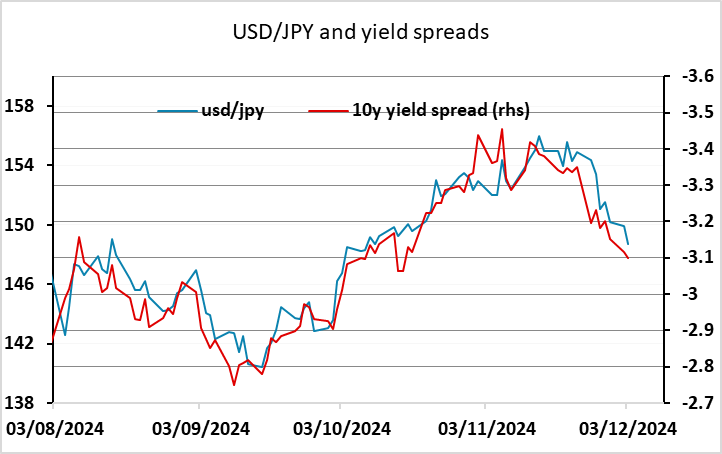

USD/JPY has come under some pressure in early US trading as US front end yields have slipped lower. While there has been no news of significance, it may be that the markets are starting to see a Fed rate cut on the 18 as more likely. This is now priced as a 73% chance, perhaps reflecting some less hawkish than expected Fed comments of late and Fed minutes that also suggested that a cut was on the cards. USD/JPY has been the biggest beneficiary, in part because the market is still concerned about the possibility of a collapse in the French government after a vote of confidence tomorrow, but mainly because yield spreads are more clearly supportive of JPY gains than ERUR gains. Given the uncertainty around Europe, we would prefer the AUD and NOK among the riskier currencies, which have both significantly underperformed their yield spread relationships this year.