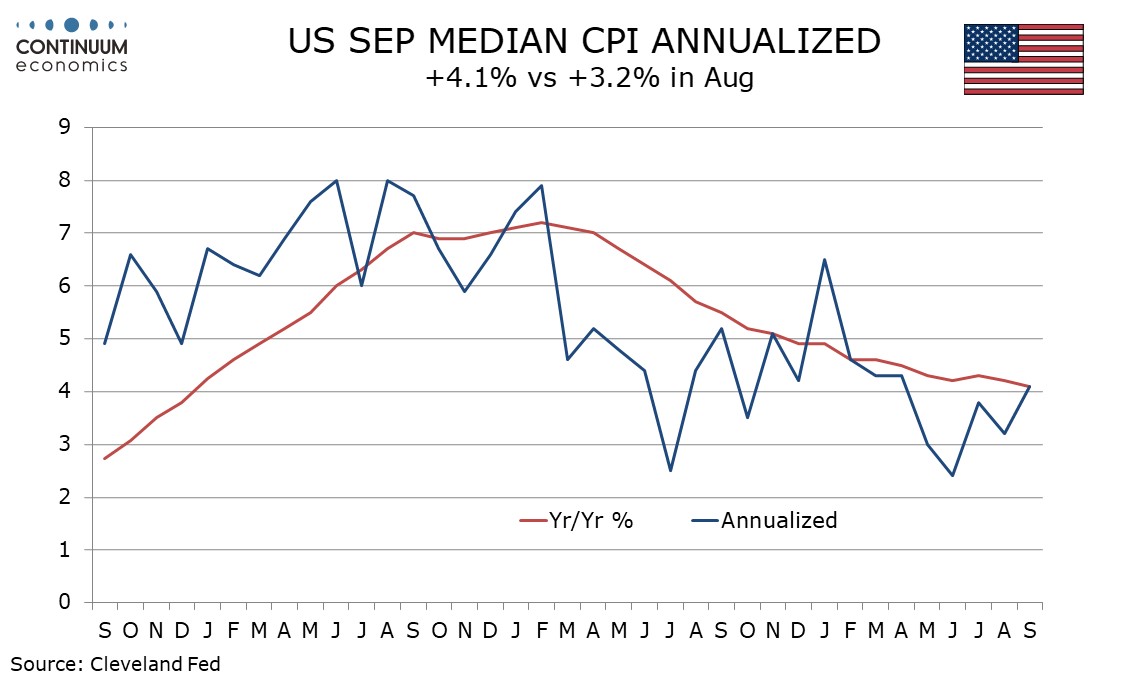

U.S. September Median CPI +4.1% annualized and yr/yr

While the September CPI with a gain of 0.2% overall, 0.3% ex food and energy, looked very similar to August’s on the headlines, we saw the details as different, with the modest September upside surprise being more broadly based than that of August. This view is backed by a stronger Cleveland Fed Median CPI at 4.1% annualized, up from 3.2% in August.

August’s core CPI was led primarily by shelter, with a boost also coming from air fares. August’s core PCE price index, up by only 0.1%, proved to be significantly softer. September’s core CPI maintained August’s pace, and was marginally stronger before rounding despite some loss of momentum in shelter, with above trend data coming from apparel, used autos, medical care and auto services, while strength in air fares persisted. This appears to be reflected in the stronger Median CPI.

September’s Median CPI saw the strongest monthly increase since April, though yr/yr data continued to slow, to 4.1% from 4.2% given a strong September 2023. While core PCE prices look unlikely to be as soft in September as they were in August, September 2023 saw an above trend 0.3% rise in core PCE prices, limiting the scope for stronger yr/yr data this month.