FOMC Notes Lack of Further Inflation Progress, QT to be Tapered in June

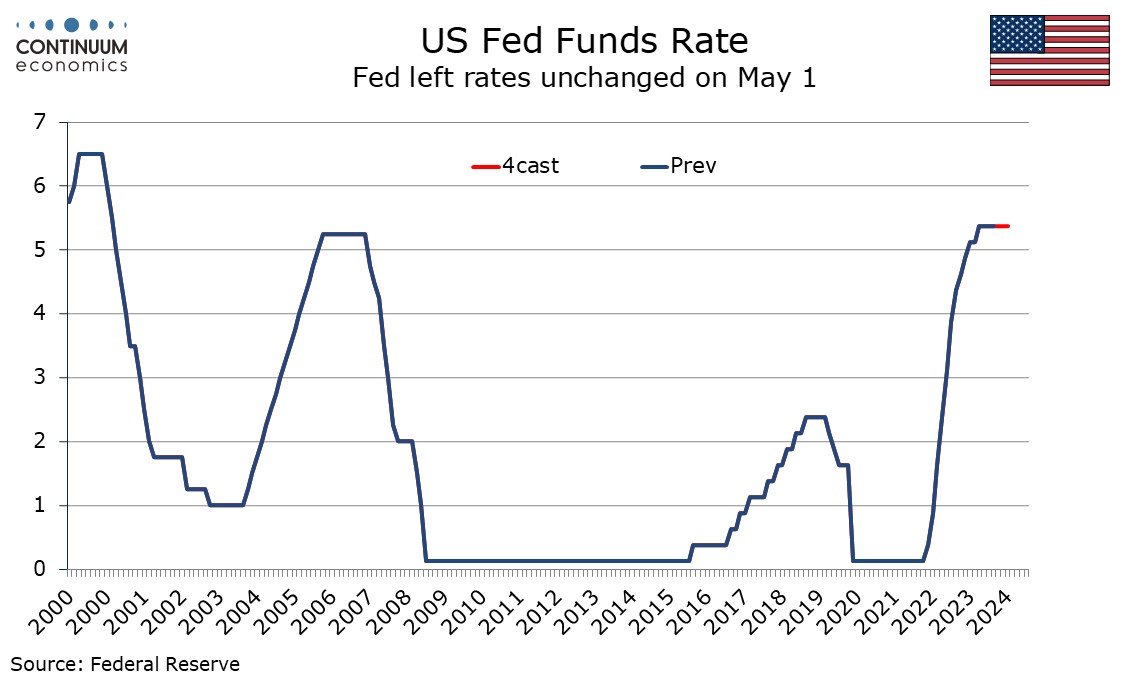

The FOMC has left rates at 5.25%-5.50% as expected and added to its statement that in recent months there has been a lack of further progress towards the 2% inflation objective. Otherwise the changes to the statement were fairly minor other than announcing a slowing in the pace of balance sheet reduction, the monthly cap for USTs to be cut starting in June to $25bn from $65bn, though that for agencies will be left at $35bn.

The minutes from the last meeting had suggested that the pace of QT would be cut by around half, and for USTs and agencies combined the cap has come down by a little less than that, to $60bn from $95bn. The decision on the balance sheet does not come as a major surprise though some may have expected the tapering to be phased in a little more slowly.

The other most notable change in the statement was to state that risks towards achieving the employment and inflation goals are judged to have move towards better balance over the past year rather than stating in the present tense that they are moving into better balance, thus emphasizing the point that progress has not continued given recent inflationary disappointment. There were no dissenting votes.

By changing the statement more through addition rather than removal the FOMC has avoided signaling a strong pivot in its stance while noting inflationary disappointment. The key phrase, not expecting to reduce the target range until there is greater confidence that inflation is moving sustainably towards target, is maintained. The implication is that the next move is still expected to be an ease, but improved data on inflation will be needed before that happens, and there is no signal as to when that is expected. Easing will decided according to data rather than the calendar.