U.S. Initial Claims still low, March Philly Fed slower but still positive

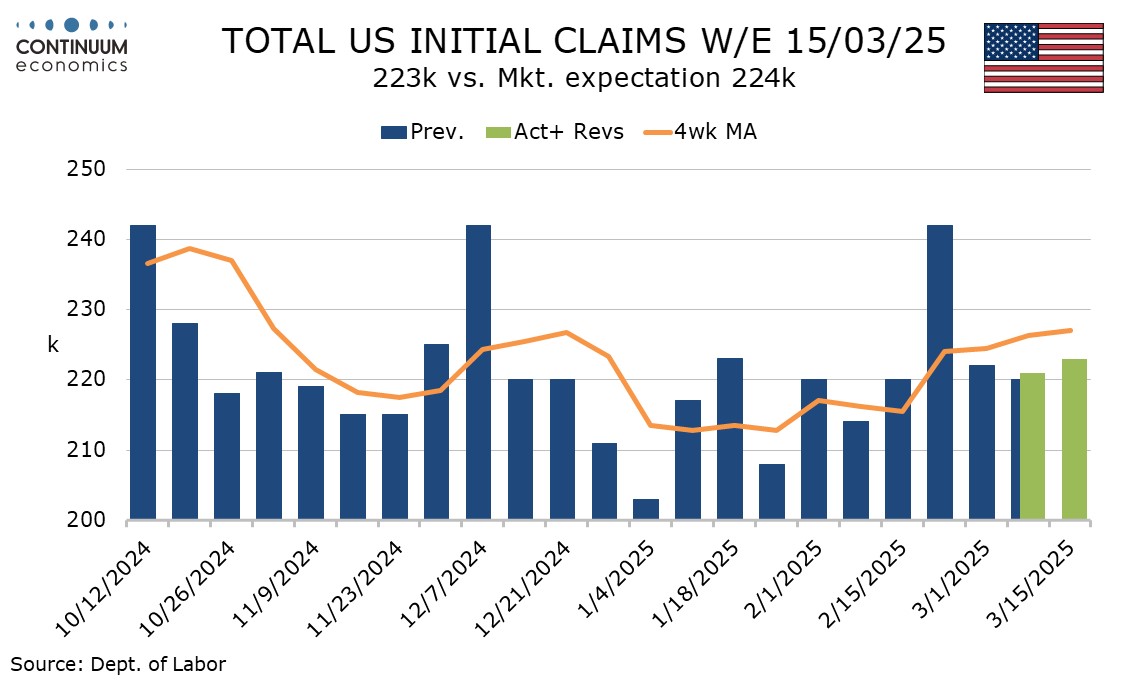

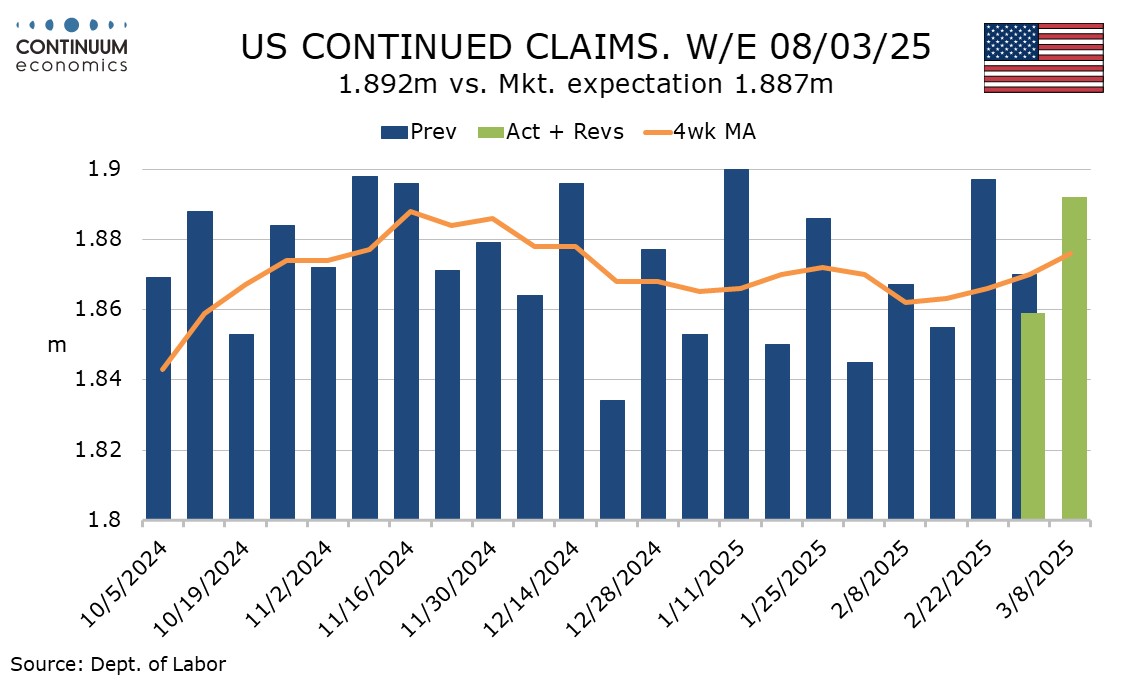

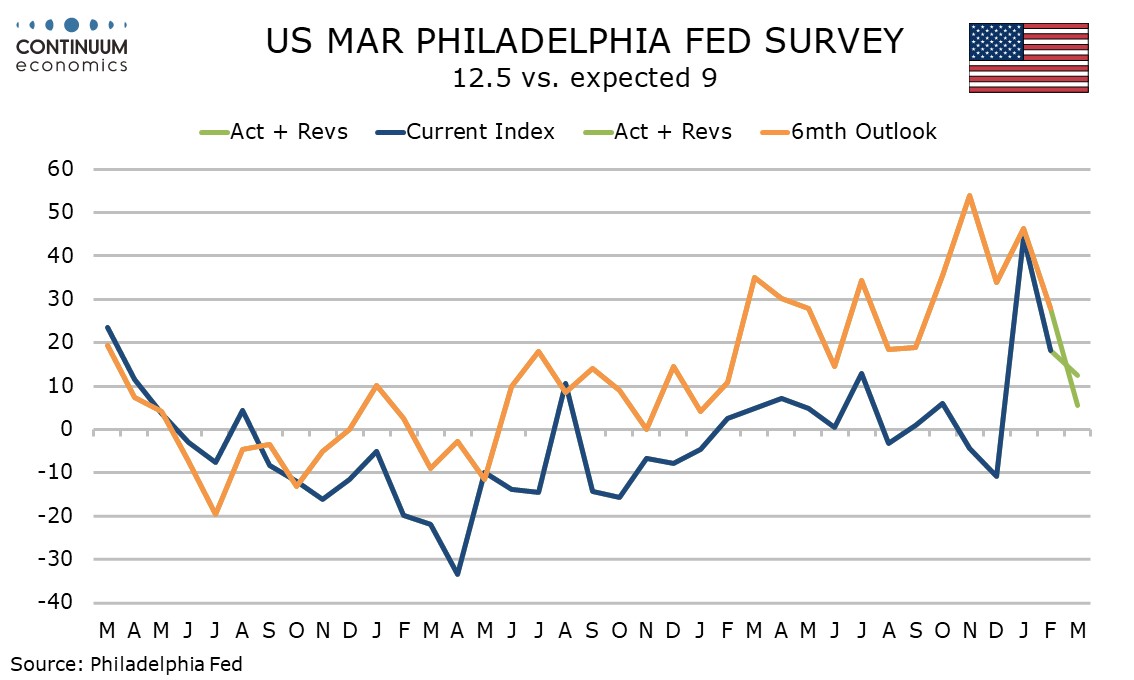

Initial claims at 223k from 221k remain low in the survey week for March’s non-farm payroll but continued claims for the preceding week are higher at 1.892m from 1.859m. March’s Philly Fed index of 12.5 from 18.1 is slower, but still expansionary, contrasting Monday’s very weak Empire State index.

Initial claims have seen limited movement in recent weeks with the only weeks significantly out of trend coming in weeks that included public holidays, with a high 242k in the week that included President’s Day and numbers below 210k in the weeks including New Year and Martin Luther King Day. This suggests the labor market remains broadly stable and healthy.

The 4-week initial claims average of 227k is however the highest since November 2 and up from 215.5k in February’s payroll survey week, and 213.5k in January’s, but similar to 225.5k in December’s. The continued claims 4-week average is the highest since December though moves have been modest.

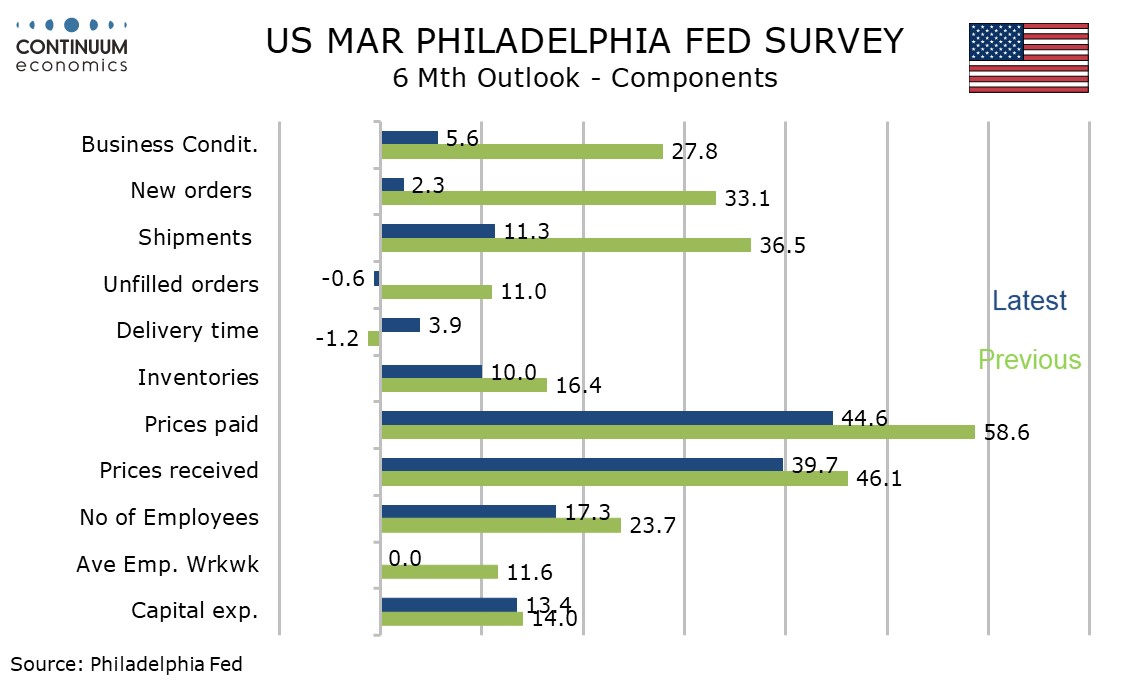

While the Philly Fed headline of 12.5 is far from weak 6-month expectations have taken a significant hit, to 5.6 from 27.8, to their lowest since January 2024. New orders are slower at 8.7 from 27.8 but employment saw a surprising bounce, to 19.7 from 5.3.

Price indices are mixed. Prices paid at 48.3 from 40.5 are the highest since July 2022. Prices received slipped to 29.8 from 32.9 but the last three months, all near 30, are significantly stronger than the 2024 range of 5.6 to 19.8.

Six month expectations for prices are however slower, paid at 44.6 from 58.6 the slowest since August 2024 and received at 39.7 from 46.1 the slowest since September 2024.

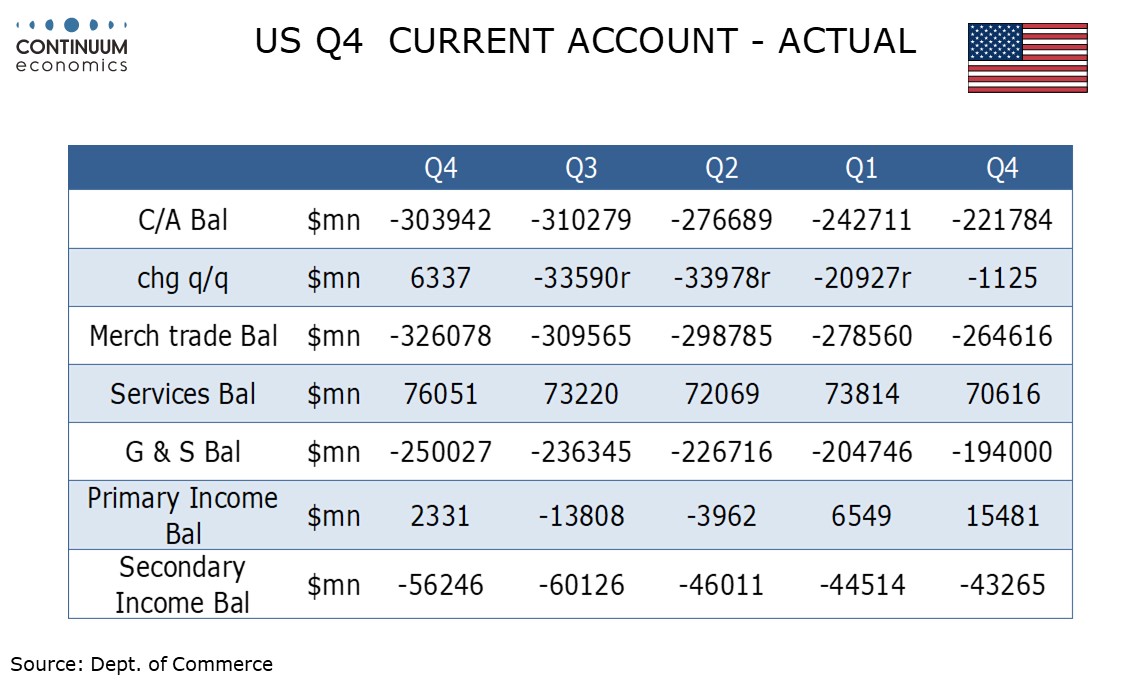

The Q4 current account deficit of $303.0bn unexpectedly narrowed from $310.3bn in Q4. Corrections from sharp Q3 deteriorations in the balances on primary (investment) and secondary (transfers) income outweighed an already known deterioration in the Q4 trade balance.