FX Daily Strategy: Europe, June 28th

CPI data in focus on Friday

Japanese authorities under pressure on JPY weakness

Eurozone CPI data could impact July ECB expectations

Some upside risk in US PCE

CPI data in focus on Friday

Japanese authorities under pressure on JPY weakness

Eurozone CPI data could impact July ECB expectations

Some upside risk in US PCE

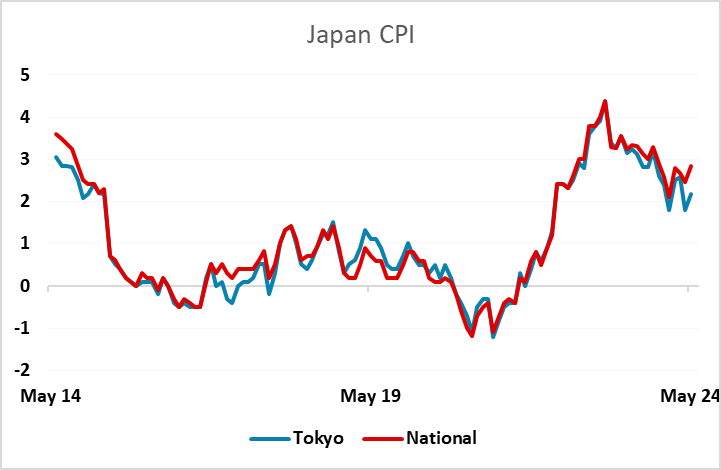

There is a fairly full calendar on Friday, with Tokyo CPI (which is effectively preliminary Japanese CPI) for June, preliminary June CPI from France, Italy and Spain, and the PCE price index for May from the US. There is also German retail sales and unemployment data, and revised UK Q1 GDP, but these are less likely to have an impact.

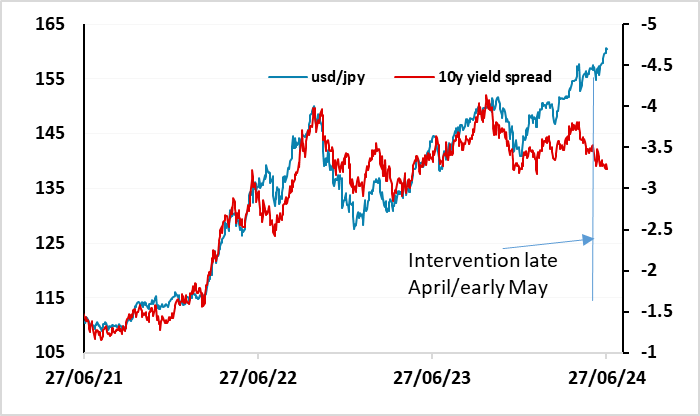

The Tokyo CPI numbers could be the most important of these given the new lows seen in the JPY on Thursday in EUR/JPY and GBP/JPY, while USD/JPY barely retreated from the highs. There is little let up in JPY weakness despite repeated warnings from the Japanese authorities, which suggests they will have to act soon or see further substantial JPY losses. In an ideal world they would co-opt the support of the Fed and maybe even other central banks in co-ordinated intervention, but if they are unable to secure this they will need to act aggressively and repeatedly on their own to stem the JPY’s decline. The intervention in April/May had only a very temporary effect, so any action this time will need to be more persistent if it is to halt JPY weakness. The Tokyo CPI data could be a trigger from this if it comes in above expectations. The consensus looks for a small rise in the core to 2.0% from 1.9%.

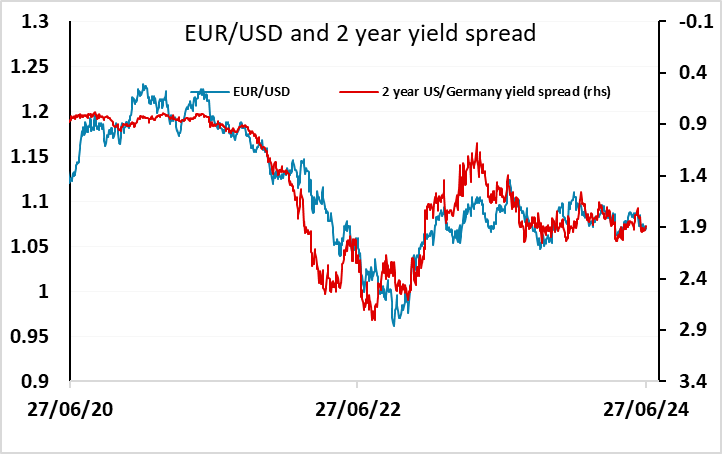

European CPI data could impact expectations of the next ECB easing and consequently impact the EUR. Currently, the market sees around a 40% chance of an ECB rate cut in July, and the consensus for the CPI data is mixed, with small falls seen in France and Spain and a small rise in Italy. A generally softer tone to the CPI data could push expectations of an easing above 50% and trigger some EUR softening, although in practice it looks very hard for the EUR to move far from the 1.07 level at the moment.

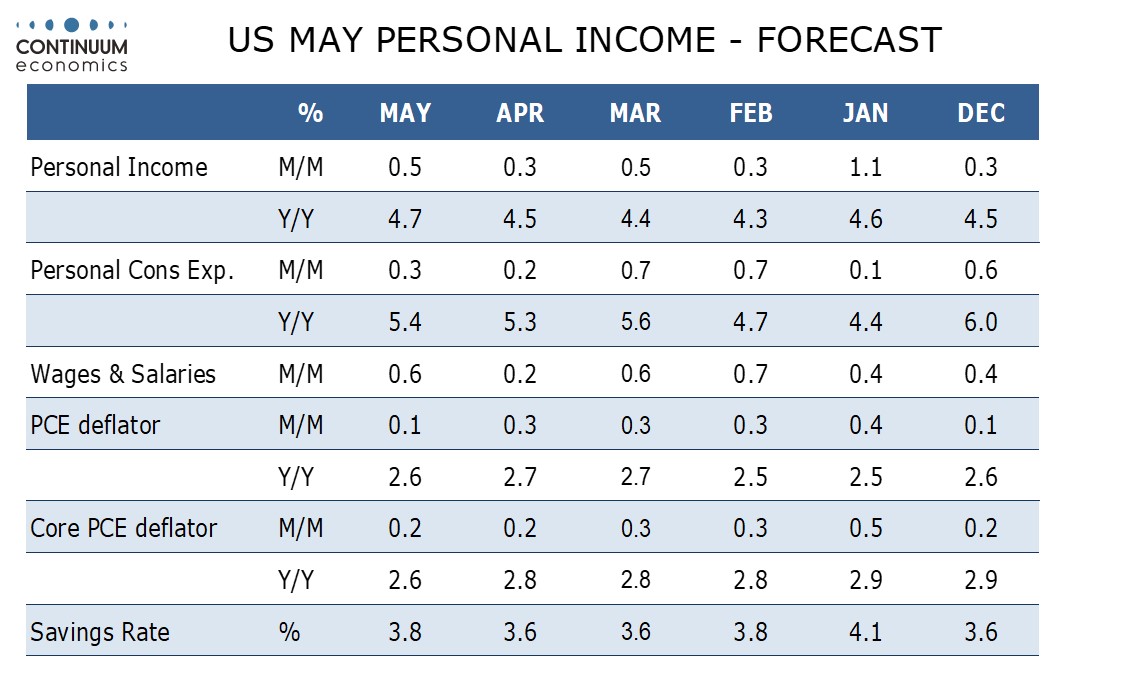

We expect a 0.2% increase in May’s US core PCE price index, consistent with the core CPI though like the CPI we expect the gain to be on the low side of 0.2% before rounding. We expect a 0.3% rise in personal spending, underperforming a 0.5% rise in personal income. The market consensus is for a 0.1% rise in the PCE price index, so we are slightly on the high side of expectations, and our numbers could provide some support for the USD. However, Thursday’s US data was on the weak side, with the trade data particularly notable, so we wouldn’t expect any major USD reaction.