FX Daily Strategy: Asia, February 18th

AUD well supported into the RBA meeting

GBP may be vulnerable to more weak employment data

SEK risks on the downside on CPI after rise in Swedish unemployment

CAD could slip lower with dip in core inflation rates

AUD well supported into the RBA meeting

GBP may be vulnerable to more weak employment data

SEK risks on the downside on CPI after rise in Swedish unemployment

CAD could slip lower with dip in core inflation rates

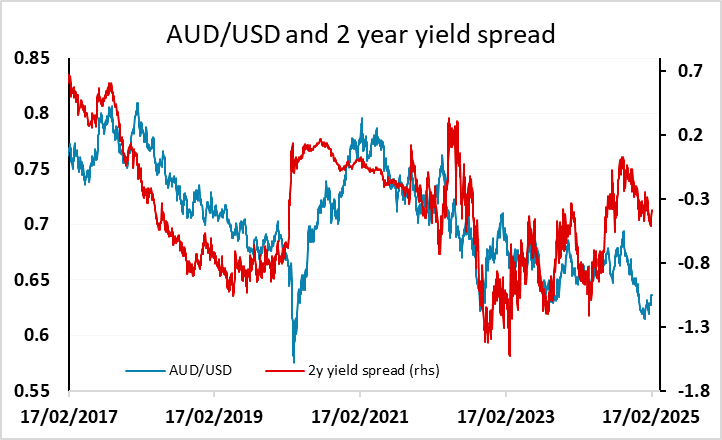

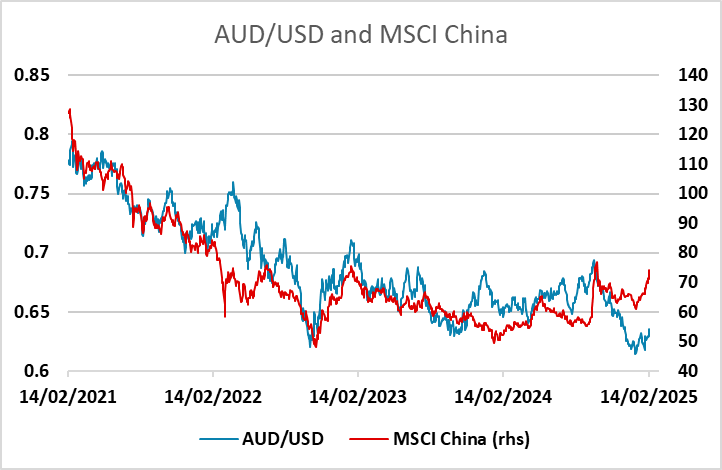

The RBA meeting is first up on Tuesday, with the market around 90% priced for a 25bp rate cut, so as usual it will be what they say rather than what they do which is likely to have most impact. As it stands, the market is pricing in two further rate cuts over the rest of the year, but given the general shift to less aggressive rate cutting around the world in the last few weeks, the risk might be towards the RBA signalling more gradual easing. In any case, we are biased towards a stronger AUD here, with both yield spreads and the strength of equity markets suggesting there is plenty more upside. There will be resistance in the 0.64 area, and longer term the main question is whether the positive risk sentiment we are seeing at the moment continues. But as it stands it’s hard to oppose AUD strength, and it seems unlikely that the RBA will go against the global grain and signal more aggressive rate cuts this year.

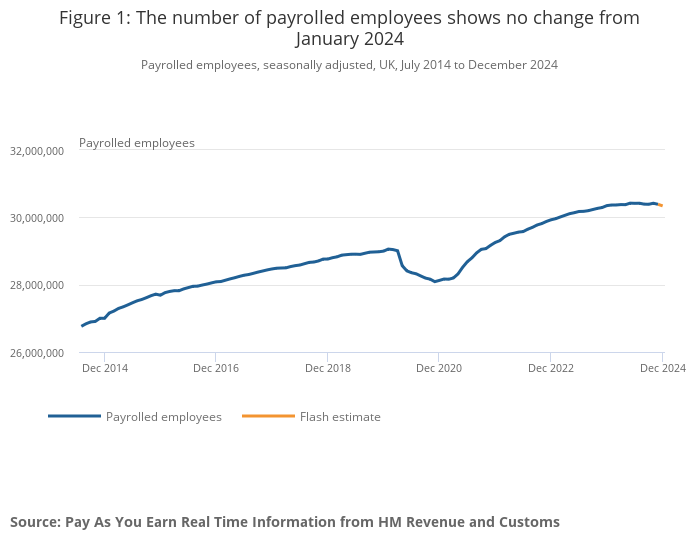

In Europe we have UK labour market data, Swedish CPI and the German ZEW index. The UK labour market data will as usual be if interest to the Bank of England, with wage growth still running at uncomfortably high levels and representing a significant barrier to more dovish policy. However, Catherine Mann, one of the established hawks on the MPC, changed her spots last time around on the view that weakening demand would start to lead to lower wage growth this year. Even so, we wouldn’t expect much evidence of weakness in earnings this time around, although there may be some further evidence of weakening employment growth. The HMRC payrolled employment data certainly suggests that employment growth is turning negative, and if this accelerates it is likely to put some downward pressure on GBP. EUR/GBP continues to trade heavily but there is little value sub-0.83 and the recent declines look to be based on a combination of positive global risk sentiment and relatively favourable tariff treatment for the UK, neither of which looks certain to continue.

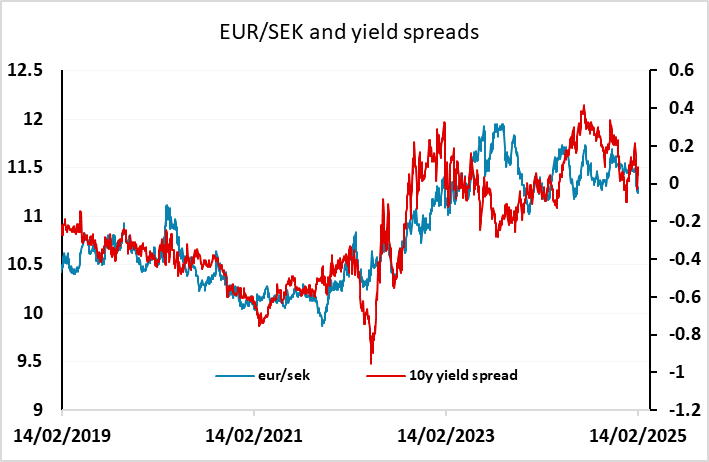

The Swedish CPI data could be more important after the big rise in Swedish unemployment reported on Monday. As it stands, the market isn’t pricing in any more easing from the Riksbank, but the rise in unemployment suggests pressure for more easing may emerge if inflation remains subdued. The market is anticipating a sharp rise in the targeted CPIF measure of inflation to 2.2% y/y from 1.5% y/y, but if this doesn’t materialise the risks may switch towards a weaker SEK after the gains in recent weeks which have been supported by rising SEK yields.

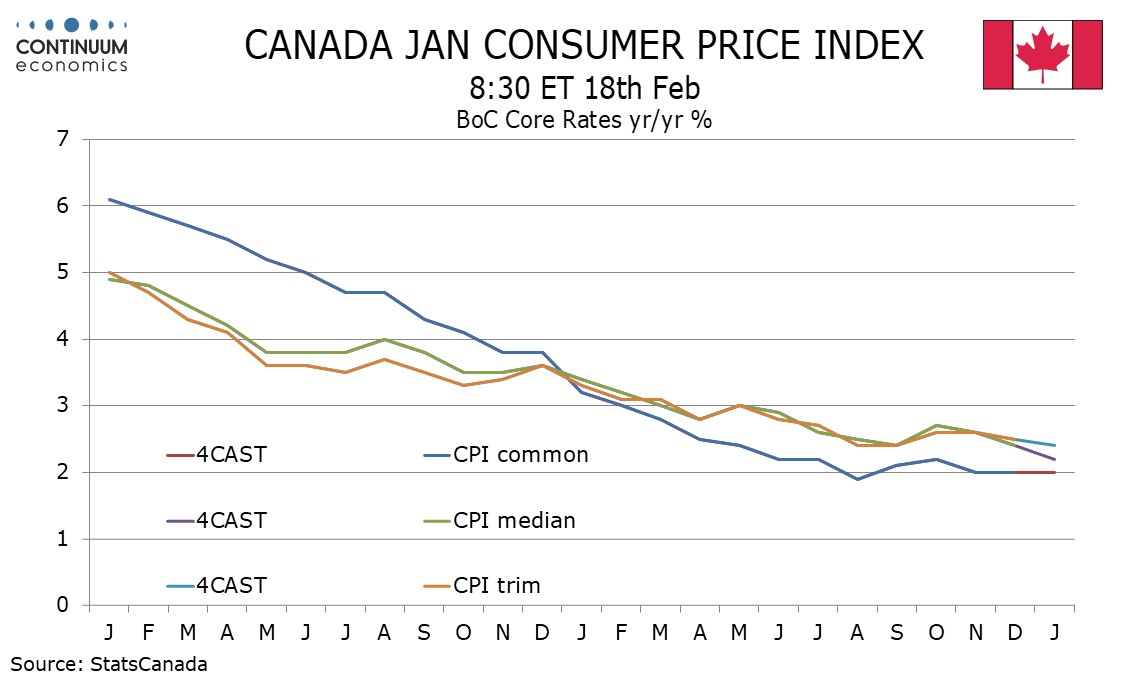

In North America we have Canadian January CPI which we expect to slip to 1.7% yr/yr in January from 1.8% in December, the fall largely due to a temporary suspension of the Goods and Services Tax that will ran from Mid-December through Mid-February. Before slightly disappointing data, Bank of Canada Governor Tiff Macklem stated that the tax suspension is expected to move inflation down to a low of around 1.5% in January. Soft data a year ago will restrain improvement in yr/yr rates. For the BoC core rates we expect CPI-Common to remain at 2.0% for a third straight month, CPI-Median to fall to 2.2% from 2.4%, repeating a 0.2% slowing in December, and CPI-Trim to fall to 2.4% from 2.5%, repeating a 0.1% slowing in December. Our numbers for the core rates are below market consensus, suggesting recent CAD strength could see something of a reversal.