U.S. December ISM Services strength probably outweighs weaker November Job Openings

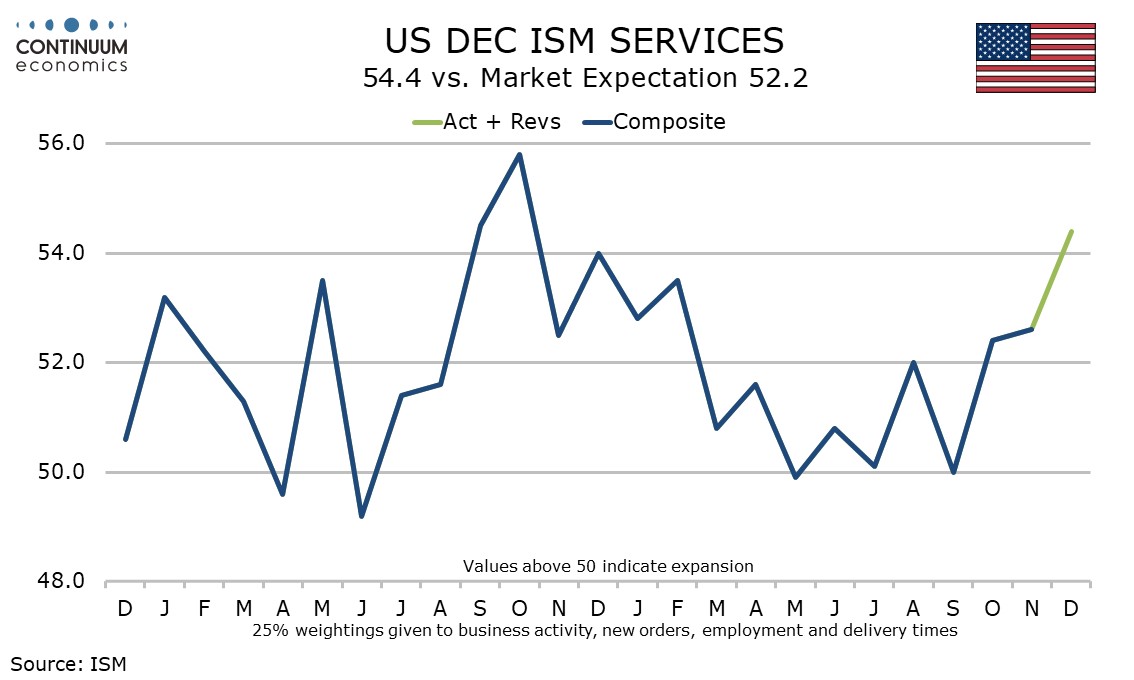

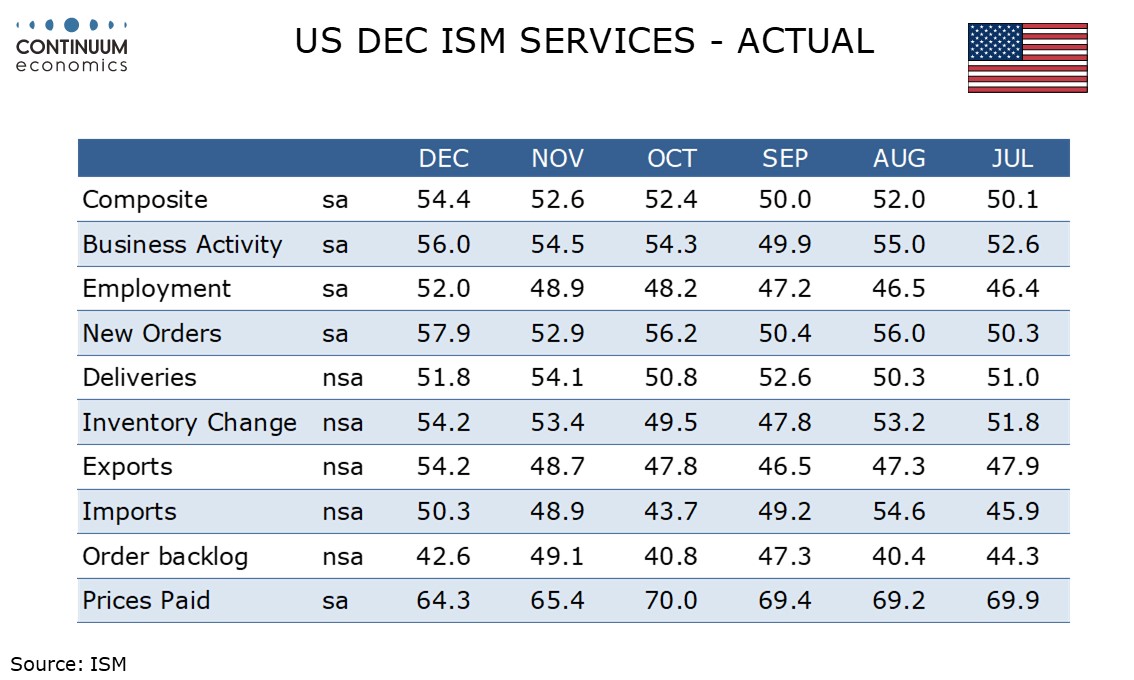

December’s ISM services index at 54.4 from 52.6 is the strongest since October 2024 with positive details. While some caution is needed with other surveys less impressive the ISM services strength probably outweighs weakness in November’s JOLTS report, where openings fell by 303k to 7.146m.

Three of the four components that contribute to the ISM services composite increased in December. New orders at 57.9 from 52.9 are the strongest since September 2024, employment at 52.0 from 48.9 is the strongest since February, and business activity at 56.0 from 54.5 is the strongest since December 2024.

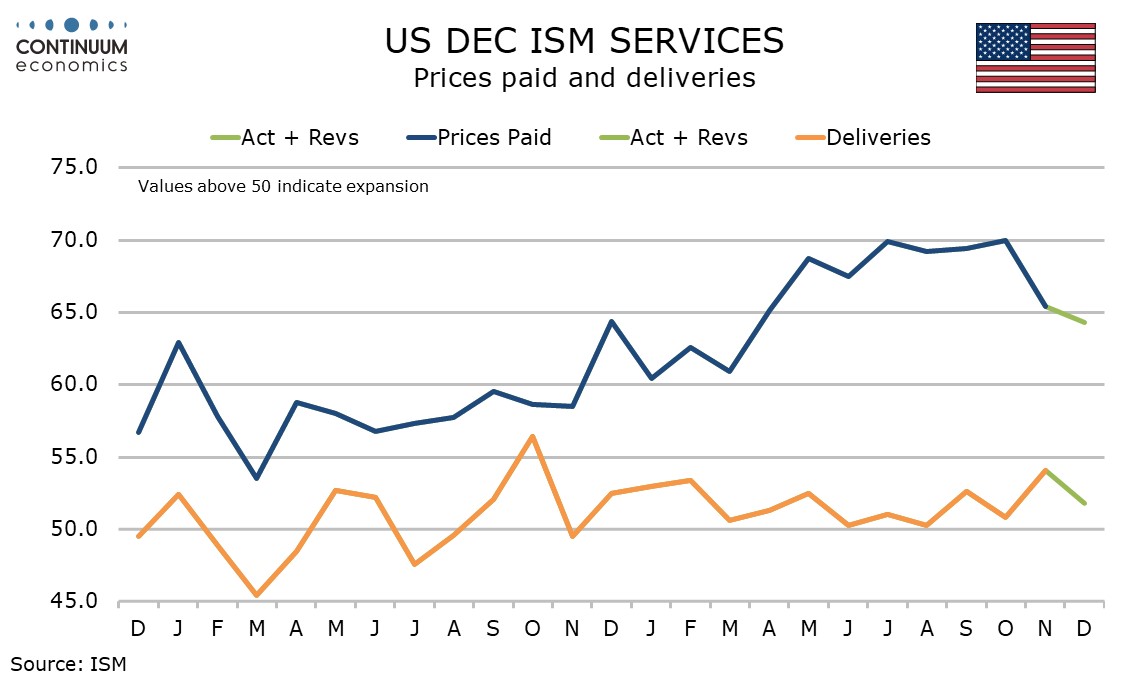

The only component of the composite to slip is delivery times, to 51.8 from a strong 54.1 in November. This could hint at reduced inflationary pressure. So do prices paid, which do not contribute to the composite, down only modestly to 64.3 from 65.4, but the lowest since March before the tariff announcement.

Export and import indices also do not contribute to the composite but were surprisingly strong, particularly exports at 54.2 from 48.7, the highest since September 2024. Imports at 50.3 from 48.9 were higher as recently as August. While the data is positive, with most Fed regional service sector surveys remaining negative, and the S and P services PMI at 52.5 at its lowest level since April, the strength of the ISM index needs to be treated cautiously.

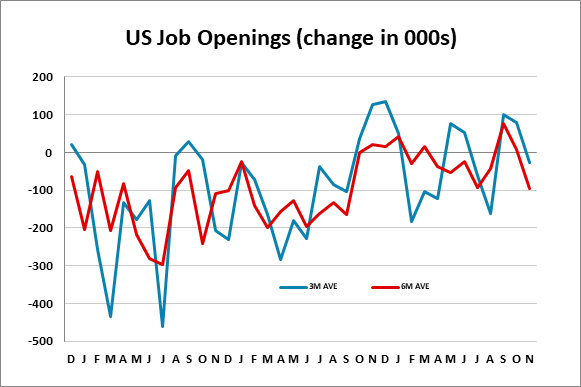

November’s JOLTS data shows job openings down by 303k after a downwardly revised 209k decline in October, which more than fully reverses a 431k increase in September. This turns the 3-month and 6-month averages negative again after both turned positive in September and October but the message of the data is more that September’s strength was misleading than the subsequent slippage is alarming.

Elsewhere details in the JOLTS report are quite soft, with hires falling by 213k which also corrects September strength while separations rose by 11k, keeping trend in both series subdued. Quits rise by 188k, which could be seen as a sign of optimism on the labor market, but it does little more than erase a 155k decline in October.