FX Daily Strategy: N America, February 15th

US retail sales unlikely to have a big impact.

USD remains well supported, but USD/JPY extended

AUD vulnerable after weaker employment data

GBP has further downside risks after UK GDP

US retail sales unlikely to have a big impact.

USD remains well supported, but USD/JPY extended

AUD vulnerable after weaker employment data

GBP has further downside risks after UK GDP

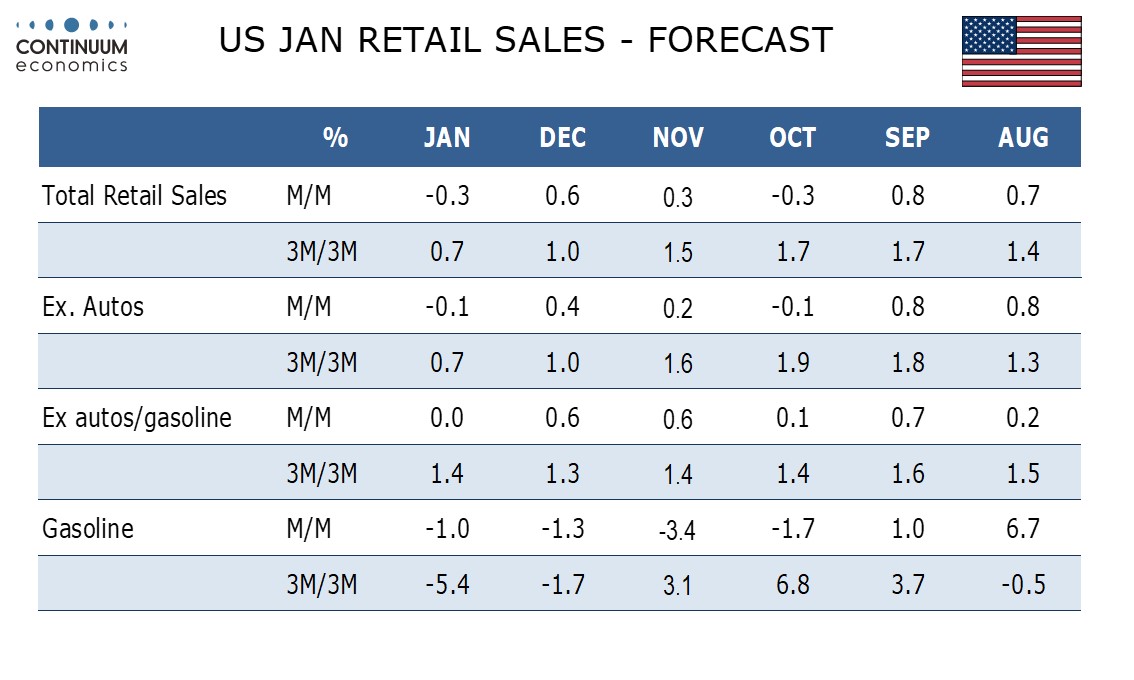

Thursday sees a variety of data from around the world. The US retail sales data will be the main global focus. We expect a 0.3% decline in January retail sales, with a 0.1% decline ex autos and an unchanged outcome ex autos and gasoline. The data should be seen alongside a strong December with weather probably providing some restraint in January. The consensus is slightly more optimistic, although at -0.2% headline, 0.2% core it is insignificantly different for a relatively volatile and likely weather affected number. While the retail sales trend has been slowing a little, and will slow a bit further if the consensus forecast is correct, it seems unlikely that this will have much impact on the USD with the focus still very much the unexpectedly large rise in CPI in January. While the Fed’s Goolsbee provided a dovish take on the CPI data on Wednesday, he is on the dovish side of the Fed debate and most will see the latest CPI data as a barrier to early rate cuts.

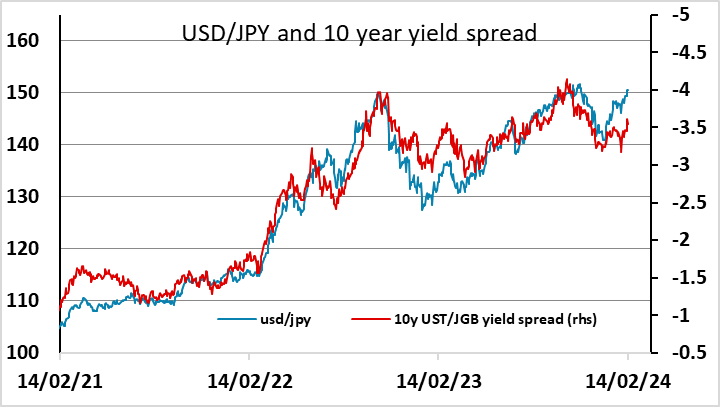

However, with only around 40% chance of a rate cut now priced in for May and a little under four rate cuts priced in for the year, there isn’t a lot more upside for US yields at this point. That being the case, USD/JPY in particular looks stretched as it has outrun the rise in yield spreads this year, and the comments from Japanese Finance minister Suzuki on Wednesday suggested the possibility of intervention if JPY weakness extends. This might only have a temporary impact, but if the BoJ tighten in the spring there may be a more fundamental support for the JPY down the road.

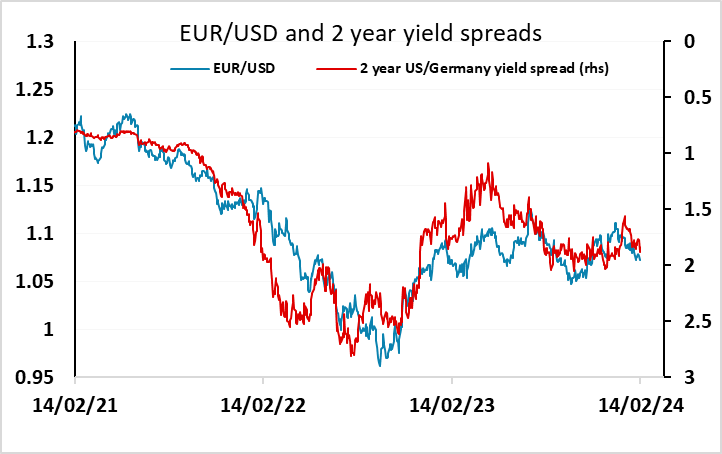

There may be slightly more downside for the EUR, as the rise in EUR yields that has followed the rise in US yields in the last week or two is not supported by the European data. While there hasn’t been a lot of news from the Eurozone, the sharp decline in Swiss CPI and the lower than expected UK CPI this week underline that price pressures are easing in Europe, and the case for ECB easing remains much stronger than the case for the Fed. While there is now more ECB easing than Fed easing priced in, there is scope for yield spreads to move further in the USD’s favour.

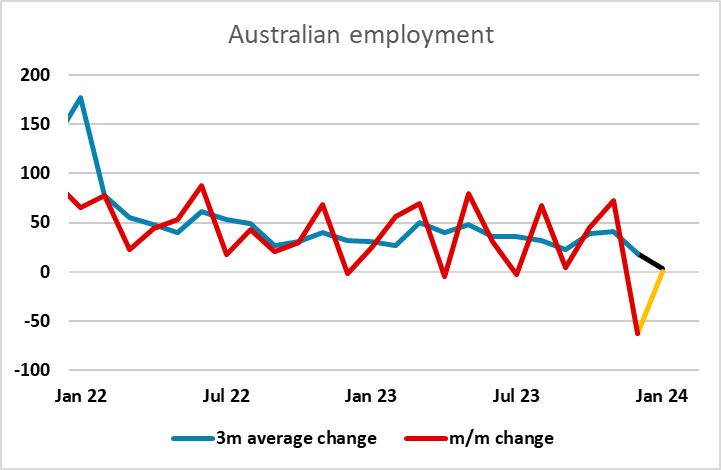

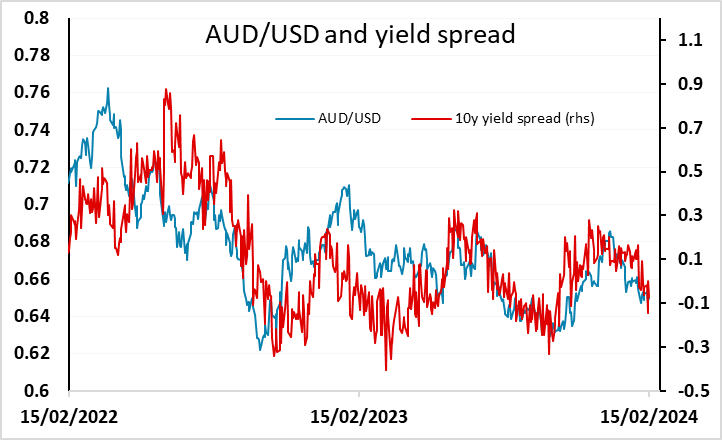

Before the US retail sales data, we have had Australian employment numbers and UK GDP data. The sharp decline in the Australian employment numbers in December was expected to be partially corrected, but while the headline employment change for Jan kept its foot in positive territory of 0.5K, this was well below expectations, and the unemployment rate rose to 4.1% from 3.9%. It seems to suggest the strength of Australian market maybe seeing a turn after peaking in early 2023 and feeling the effect of cumulative hikes. There is also a huge negative full time employment change revision. While AUD recovered overnight after an initial dip, the risks are shifting to the AUD downside, with AUD yields lower after the report.

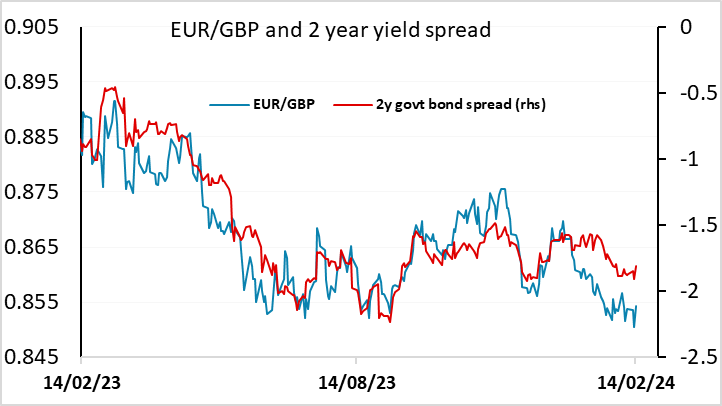

While UK December GDP was less weak than expected, falling 0.1% m/m, Q4 GDP was weaker than expected at -0.3% q/q due to back revisions, confirming a UK recession in H2 2023. This makes the strength of the UK PMI data in the last few months look rather misleading, and the strength of the pound this year similarly.

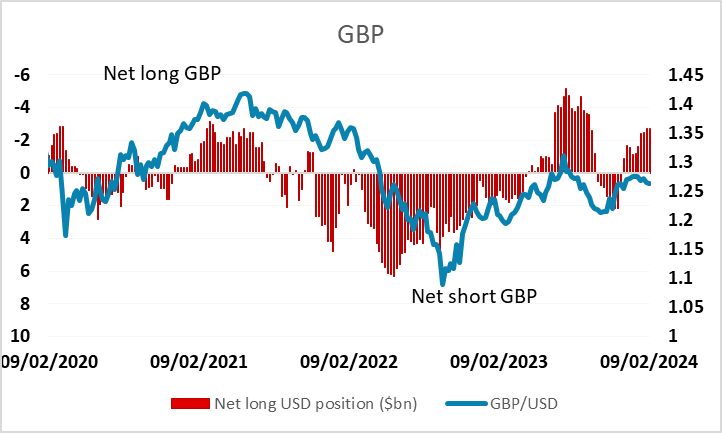

EUR/GBP has so far only risen modestly in response, but given the starting point, which was a little low relative to the recent correlation with yield spreads, and the net long positioning evident in the CFTC data, the risks look to be towards further GBP losses. While the BoE MPC may not be much swayed by the GDP data, focusing more on inflation prospects, the weaker than expected CPI data yesterday and the evidence in the labour market data that earnings are stabilising suggests there is likely to be a more dovish take at the next meeting in March, preparing for a potential May rate cut.

CFTC net speculative positioning