FX Daily Strategy: N America, January 8th

ADP the focus but major reaction unlikely

Monthly CPI Unlikely To Change RBA's Mind But Trimmed Mean Might

BoJ Will Keep Crying for the Wolf

And Put a Lid on USD/JPY

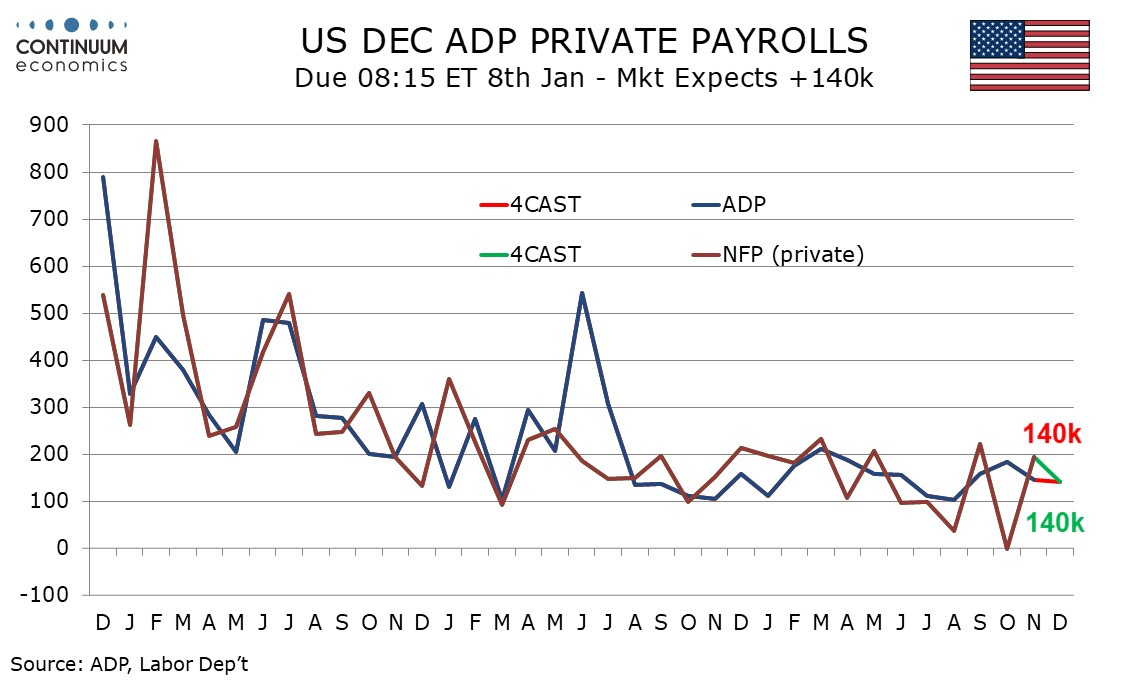

The main US data today is the ADP employment data andn the initial claims data. We expect a 140k increase in December’s ADP estimate for private sector employment growth, which matches our estimate for private sector non-farm payroll growth, though we expect overall non-farm payrolls including government to increase by 175k. Recent Labor market signals, most obviously initial claims, have been healthy. Initial claims will be released on Wednesday this week with government offices closed on Thursday due to President Carter's funeral. ADP data has recently had a tendency to outperform payrolls, with underperformances of 48k in November and 63k in September failing to fully offset a 186k ADP outperformance in October, when payrolls showed more sensitivity to hurricanes than did the ADP report. The payroll data is obvluisly the main focus this week, but market reaction to ADP is unlikely to be large, as there is little trust in ADP providing an accurate guide to the official data on a monhly basis.

The Australian Monthly CPI is expected to continue treading inside target range, following the momentum after the lift of energy rebates. But it is unlikely to change the RBA's mind, unless there is a big miss where we see such CPI data to be below 2%, as they have pivoted their focus towards the RBA trimmed mean CPI. The RBA's current forecast of first cut in mid 2025 sounds too pessimistic and should be revised soon to Q1 2025 but the magnitude of revision remains determined by the pace of CPI moderation. As monthly CPI has been treading closer to 2%, a few steady months of sub 2% CPI should convince the RBA that inflation is indeed entering the target range, thus began their easing. While monthly CPI edged slightly higher to 2.3% from 2.1% y/y, the RBA preferred trimmed mean CPI has moved slowly to target range at 3.2%. It may convince the RBA to ease earlier than May 2025 if the quarterly data by the end of month confirms.

The BoJ is another tough nut to crack. Labor cash earning has been more or less steady above 2% almost for the past year. Yet, the BoJ is still looking for more supportive evidence before they tighten further. The labor cash earning data to be released is likely to remain above 2% but unlikely to reach higher percentage. There is a good chance the BoJ would like to wait for the spring wage negotiation in March before another step and from early reports, we are hearing labor unions to be requesting a bigger package than 2024. While it is possible for large corporation to compile a similar magnitude of hike as in 2024, SMEs will unlikely be able to afford another round of big hikes, given the only gradual change in price setting behavior and subsequently squeezed profit margin. A beat in the headline labor cash earnings may stir the BoJ into action for they are running out of reasons to procrastinate.

And to keep speculators in check, the BoJ officials or Japanese FM will need to keep up with their verbal intervention if they would like to keep a lid on USD/JPY. The lack of verbal intervention could signal that the BoJ is unlikely to intervene soon and allow speculators to challenge highs.

The fate on USD/JPY will be affected by the result of wage data to an extent. Despite supportive wage growth, the BoJ has been giving little commitment in their follow through tightening even when inflation now reached a sustainable. wage driven stage. There maybe a knee jerk reaction if we see a good labor cash earning. But for such (JPY strength) to persist, the BoJ has give the market a strong rhetoric to reinforce their stance in rate hike. Still, market participants/speculators maybe reluctant to go long JPY after being wrong footed by the BoJ multiple times in 2024.

On the chart, the pair turned up from the 156.75/156.00 support area to pressure the upside and break of the 157.85/158.08 highs opening up further extension of gains from the September low. Daily studies remains positive and clear break here will see scope to the 158.85 resistance. Gains beyond this, if seen, will open up the 160.00 figure to retest. However, divergence showing up on daily chart caution corrective pullback with support at the 156.75/156.00 area to watch. Would take break here to open up room for deeper pullback to retrace strong run-up from the 148.64 low of December.