FX Daily Strategy: APAC, October 17th

ECB meeting to deliver the expected rate cut

Hard to see much change in expectations, so EUR/USD to maintain mild downside bias

Risk slightly to the USD upside on US retail sales

ECB meeting to deliver the expected rate cut

Hard to see much change in expectations, so EUR/USD to maintain mild downside bias

Risk slightly to the USD upside on US retail sales

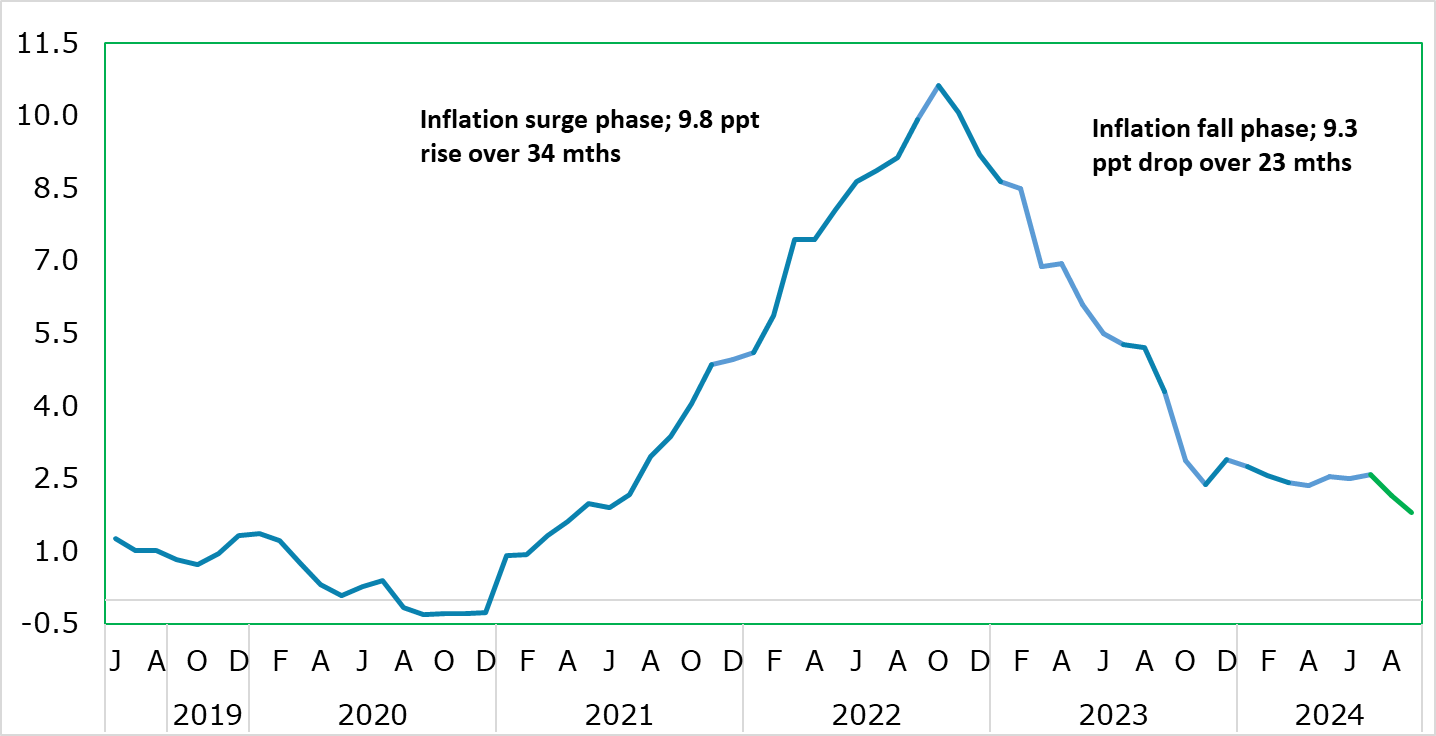

EZ Inflation – What Goes Up….?

Source: Eurostat, EZ HICP headline, % chg y/y

The ECB meeting will be the main focus for Thursday, but it is hard to see any real surprises coming out of it. The market is fully priced for rate cuts at each of the next two meetings, and it is unlikely Lagarde will say anything to discourage this view (although she will also not officially confirm it). To date the ECB has allowed the impression that it would ease only every other meeting, i.e. once a quarter, partly to give it access to what it sees as key labor cost numbers. But yet another downside inflation surprise, alongside business survey data highlighting both fresh stagnation risks and much reduced cost pressures, have changed the ECB mindset. Thus we and the market 25 bp cuts at both the next two meetings. After all, that is how policy was tightened amid the marked jump in inflation, but the subsequent fall has actually been faster.

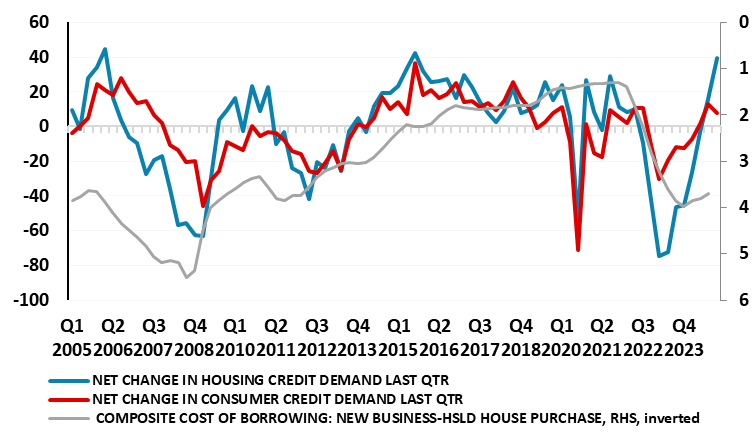

Household Loan Demand Recovering Strongly?

Source: ECB, net percentage balance in Bank Lending Survey. Note: Higher number equates to increase in demand

The ECB will be able to point to some brighter signs from its latest Bank Lending Survey (BLS). While still suggesting banks remain cautious about lending, the data suggested a clear improvement in the demand for loans reflecting an increasing perception that interest rates have started to fall and have further to go. On the consumer side, with households having built hefty savings afresh of late in reaction to higher interest rates, more signs of easing to come may start to unlock those savings and provide a much needed boost to demand – just as policy easing is supposed to do! So we don’t necessarily expect the faster pace of easing to persist into 2025, but at this meeting this is unlikely to be a major market focus.

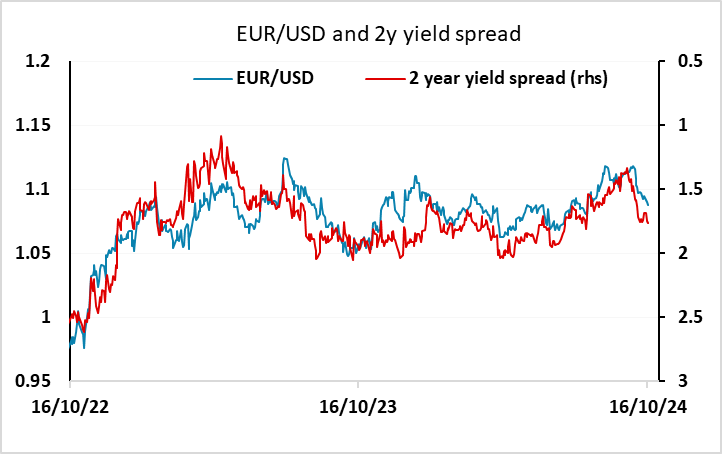

Yield spreads still suggests there is some downside risk for EUR/USD, although we wouldn’t see any substantial move lower from here unless the market starts to reduce their expectation of Fed easing in the near term. 1.08 should be out of reach, with technical support coming in the 1.0800/35 area.

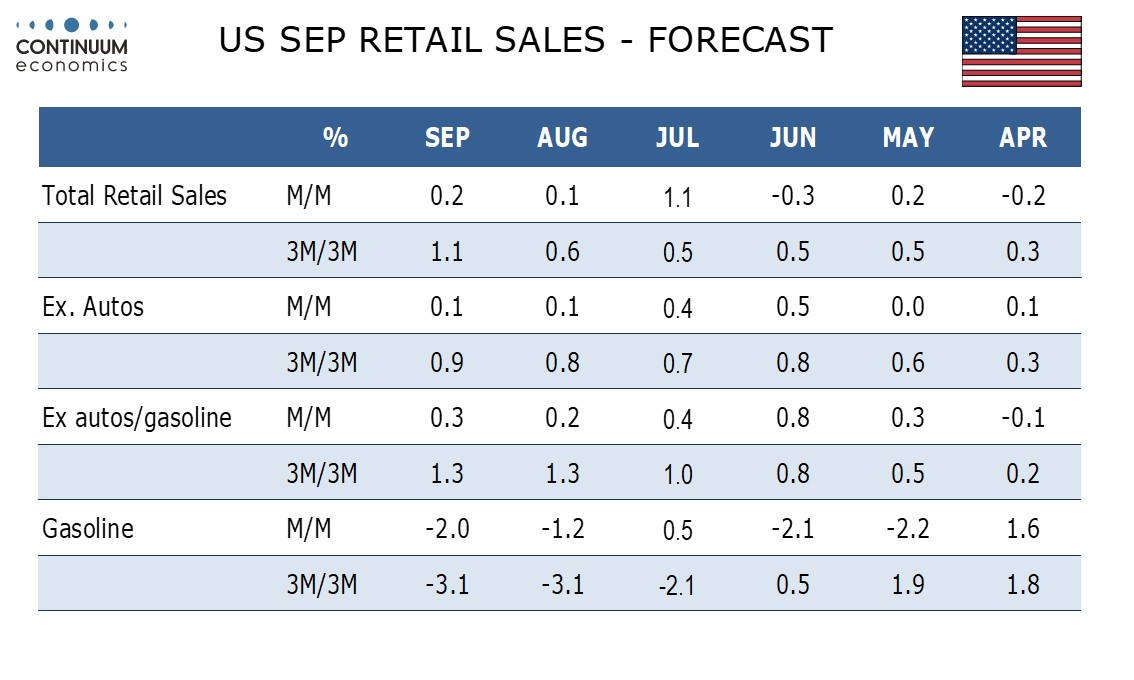

Otherwise, we have US retail sales, which may be the most significant US data of the week. The US jobless claims data will also be of interest, but are still likely to be distorted by the hurricanes, so should have less impact than usual. We expect a 0.2% increase in September retail sales with a 0.1% increase ex autos, similar to the 0.1% increases seen in both series in August. Ex autos and gasoline we expect a 0.3% increase, slightly stronger than August’s 0.2% but not quite matching a 0.4% gain seen in July. Our numbers are close enough to market consensus to suggests there wont be much impact. But after the recent run of solid data, and the pickup in the 3m/3m rate of growth, there might be more impact from strong numbers than weak numbers, suggesting risks remain slightly on the USD upside.