German Data Preview (Jan 31): More of Them Pesky Base Effects?

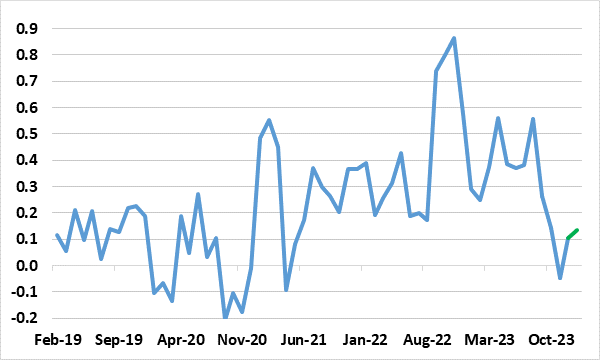

More base effects will distort the upcoming January HICP/CPI readings, pulling the headline back down, but the core rate higher, all adding to recent volatility. Indeed, the headline HICP in November eased 0.7 ppt to 2.3%, a 29-month low, with the core dropping by 0.7 ppt to 3.5%. However, last month, and despite a further fall in fuel prices, recreation-sourced and particularly energy-related base effects, pushed up the headline rate back to 3.8%, a little lower than consensus and with the core down further (Figure 1) and where the headline CPI rate rose by far less. We see the headline HICP rate falling 0.5 ppt in the January numbers despite a small VAT hike. Regardless, the disinflation backdrop is underlined by what may be still-soft core seasonally adjusted trend (Figure 2) which may be running just above zero in m/m terms. Regardless, the headline y/y rate is likely to have resume a downtrend even with some tax rises now due.

Figure 1: HICP Inflation Drops, But Core |Jumps?

Source: German Federal Stats Office, CE

More energy related base effects and lower fuel prices will be the main factors pulling headline inflation back down in January, while other base effects and VAT rise on eating out pull core inflation higher, albeit only for a month before a downtrend there resumes too

Disinflation Continues Meanwhile

Regardless, a further insight into the disinflation backdrop is provided by the seasonally adjusted data which we compute – the Bundesbank does its own measurement on this basis. As Figure 2 shows there has also been a clear slowing in the trend m/m changes on an adjusted basis, most notably for the core. This seemingly continued in December albeit with the smoothed (3-mth avg) adjusted rate edging up to just 0.1% m/m where we thin k it will stay in January.

Figure 2: Adjusted Core Rate Falling Clearly

Source: German Federal Stats Office, CE, % chg m/m, smoothed

This is important amid the jump in the y/y rate, reflecting largely energy related base effects – mainly attributable to a reduction in government subsidies on gas and electricity that began last year.

Some Fresh Upside Price Risks?

Regardless, amid the clear fall in headline and core rates in recent months, fresh upward price pressure risks have emerged of late, albeit little to do with demand. Events and shipping risks in the Red Sea clearly pose such a risk, albeit hard to estimate and possibly more likely to curb output than boost prices. More specifically to Germany, upside price risks stem fiscally as the German government is being forced to scrap several subsidies and increase taxes in order to help fill a circa-€ 60 bn hole in its budget plans left by a constitutional court ruling against its use of off-balance sheet funds. One example is that the government has already raised the VAT rate on restaurant meals from a temporarily reduced level by 12 ppt to 19% at the start of this year, something that has prompted us to revise up out current quarter CPI profile. Importantly, this also has the ability to affect core numbers, although any such impact may add to already clear pressures on spending power which we think ill erode pricing power further.

Against this backdrop we now see German HICP inflation slipping a notch this quarter to 2.9% but then fall to below 2% in Q3 this year.