FX Weekly Strategy: June 3rd-7th

EUR unlikely to be moved much by ECB meeting

Modest downside risks for the CAD on BoC

JPY remains out of line

US employment data may give the USD a brief lift

Strategy for the week ahead

EUR unlikely to be moved much by ECB meeting

Modest downside risks for the CAD on BoC

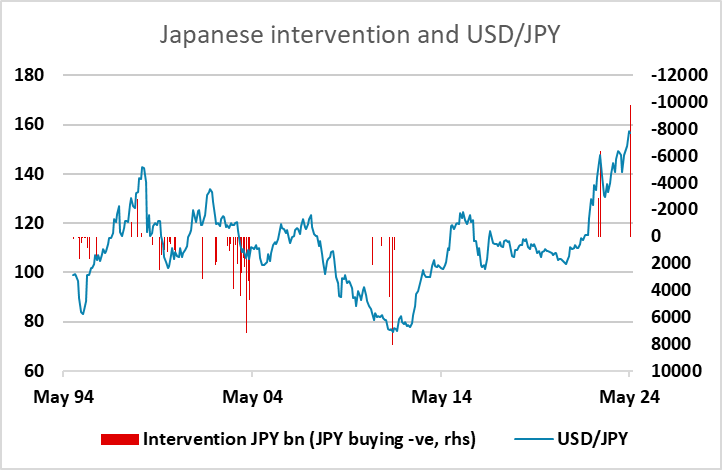

JPY remains out of line

US employment data may give the USD a brief lift

Monetary policy decisions from the ECB and the BoC and the US employment report will be the main market focuses this week.

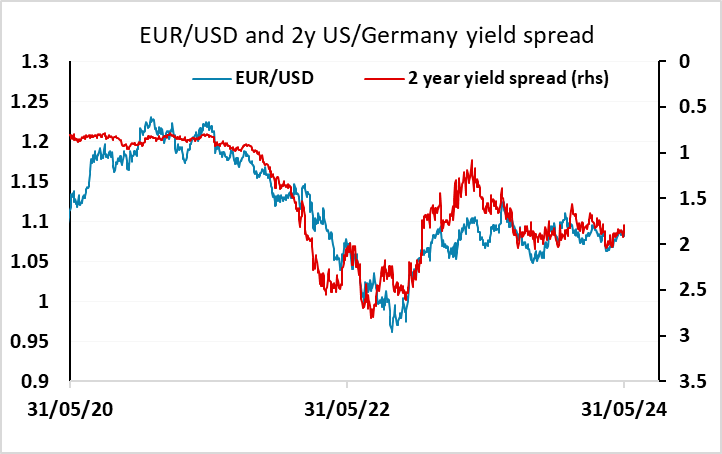

The ECB decision is not really in doubt. A 25bp cut is all but guaranteed based on the comments from various ECB Council members since the last meeting. The question markets are considering is what subsequent moves will follow this widely expected 25 bp cut. Given splits within the ECB Council no formal guidance is likely at the press conference, save to underline that policy will be data dependent and independent of the likes of the Fed. But updated ECB forecasts are likely to corroborate market thinking of an ECB depo rate falling well below 3%, if not lower if an earlier and more sizeable undershoot of the inflation target is flagged. This would chime with ECB Chief Economist Lane’s thinking that inflation moving durably to target as expected in 2025 would allow policy to veer away from restrictiveness and thus toward a neutral setting of circa-2%! Currently, the market is pricing a policy rate of 2.75% at the end of 2025, and after the slightly stronger than expected provisional May CPI data and the new low in the unemployment rate announced last week, we doubt the market will push towards lower yields without some explicit guidance. Even so, the risks for this year look to be on the low side of the current pricing of just one further rate cut, so we don’t see a case for EUR strength based on ECB policy. Even so, yields spreads are already at levels that look supportive for EUR/USD, so we see pressure likely to be on the top rather than the bottom of the 1.08-1.09 range ahead of the US employment report.

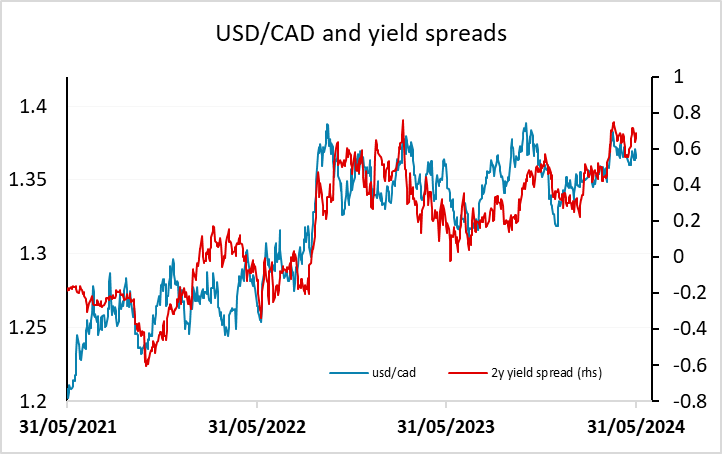

The BoC decision is not quite as fully priced, with a cut seen as just an 80% probability, but the weaker than expected Q1 GDP data did shift market expectations in favour of a cut. While we have been calling for a cut for some time, we don’t see the GDP data as making a great deal of difference, as the details were stronger than the headline, with domestic demand picking up markedly and the weakness due to a lower inventory build. The delivery of a rate cut has only modest scope to boost USD/CAD, and 1.37 still looks likely to be out of reach unless the US employment numbers prove a lot stronger than expected.

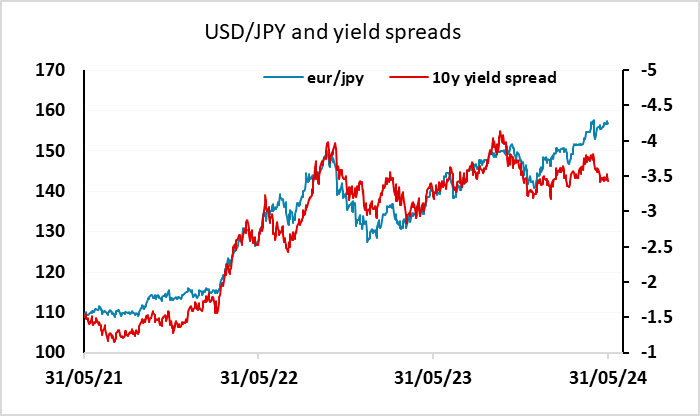

While EUR/USD and USD/CAD have been fairly well behaved in the sense that they have stuck fairly closely to moves in yields spreads, the same cannot be said for USD/JPY. USD/JPY remains wildly overvalued on any measure of yield spreads, even without taking account of the low Japanese inflation rate which has led to an additional real depreciation in the JPY. JPY weakness relative to PPP is a record for any major currency in the floating era, and in addition, the Japanese authorities are opposing further JPY weakness with physical intervention in record amounts, as detailed in last week’s intervention data. Nevertheless, it seems the market needs something more to trigger a JPY revival. Evidence of rising wages in the Japanese cash earnings data this week could be part of that trigger if it increases expectations of BoJ tightening, but in any case USD/JPY ought to be capped near 158.

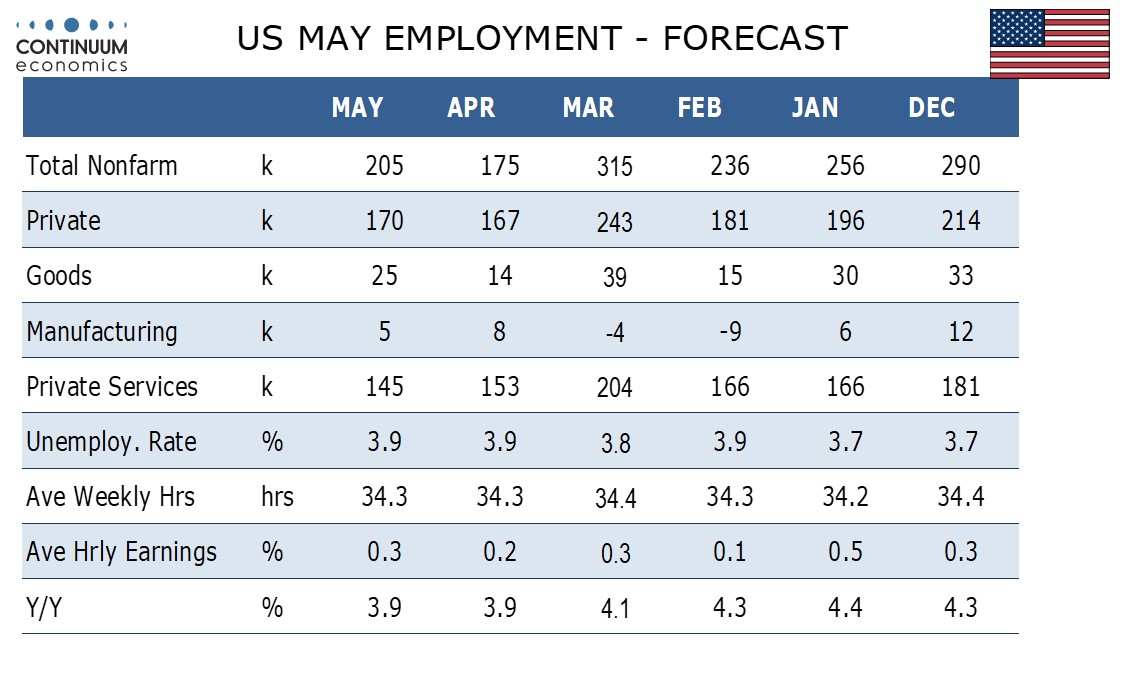

We aren’t expecting the US employment report to provide a reason for the USD to weaken, with our forecasts slightly on the strong side of market consensus. But even the consensus data should be consistent with the Fed easing at least as much as the market is pricing in for this year, now that there are only one and a half cuts priced in. So while the USD may manage a small rise on the data if it is in line without forecasts, we don’t expect any gains will persist and still favour the USD downside.

Data and events for the week ahead

USA

The key US release will be May’s non-farm payroll on Friday. We expect a 205k increase, slower than April’s below trend 175k but closer to April than March’s above trend 315k, and this consistent with a modest loss of underlying momentum. We expect a 170k increase in private payrolls, a moderate 0.3% increase in average hourly earnings and an unchanged unemployment rate of 3.9%. After a rare outperformance in April we expect ADP’s private sector payroll estimate, due on Wednesday, to resume a tendency to underperform the non-farm payroll with a rise of 140k. Other labor market signals to watch include April’s JOLTS report on labor turnover on Tuesday and weekly initial claims on Thursday.

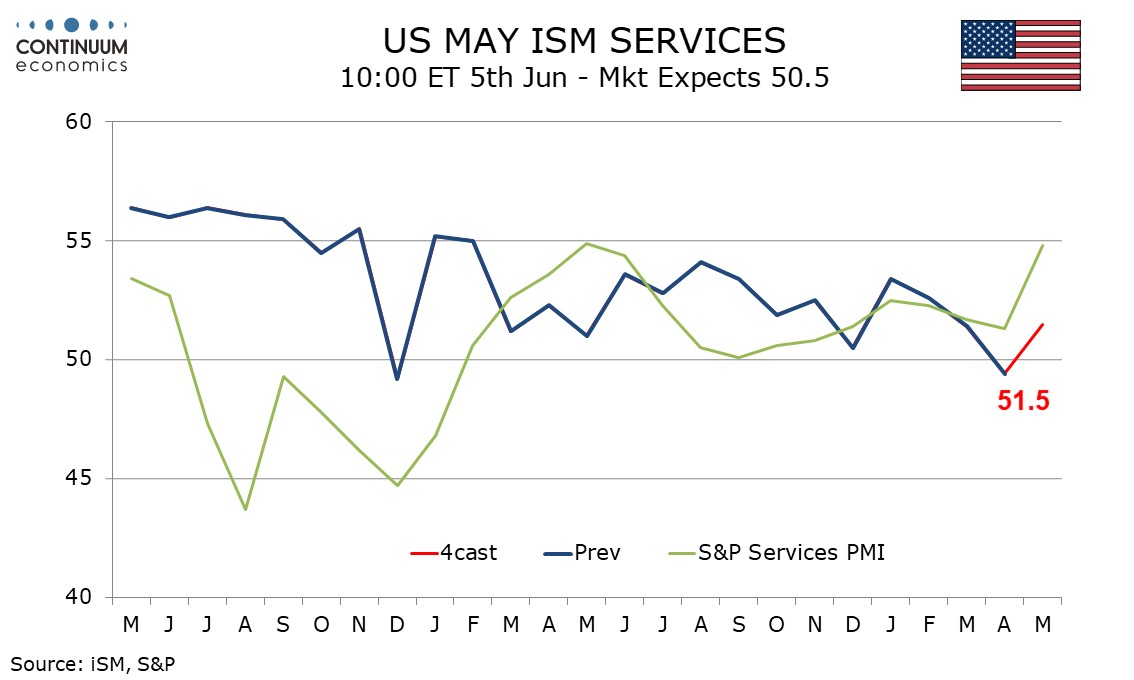

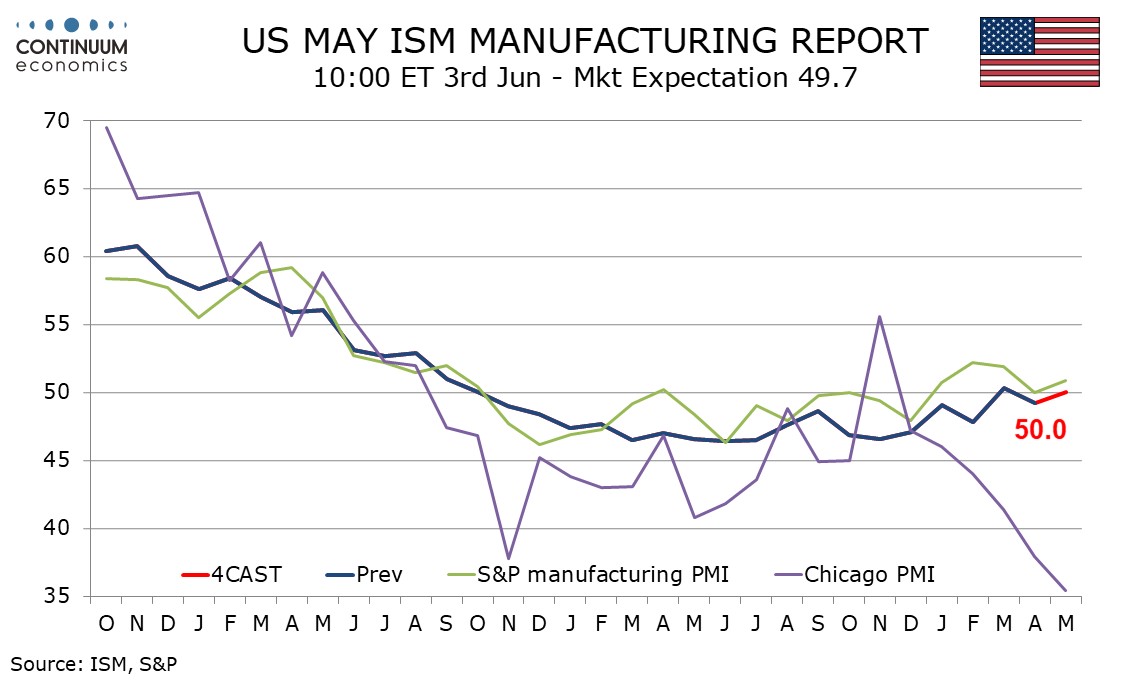

We expect firmer ISM indices for May, with manufacturing on Monday rising to 50.0 from 49.2 and services on Wednesday rising to 51.5 from 49.4. Minor releases scheduled include April construction spending on Monday and April factory orders on Tuesday. On Thursday we expect April’s trade deficit to rise sharply to $76.9bn from $69.4bn. April wholesale data is due on Friday. Fed speakers are expected to be quiet as the June 12 decision draws closer.

Canada

The Bank of Canada meets on Wednesday and we expect a 25bps easing to 4.75%. The call is a close one and if easing is delivered the BoC is likely to continue to stress that upside risks on inflation persist. However at its last meeting on April 10 the BoC stated it was looking for evidence that downward momentum on inflation is sustained, and recent data is likely to be seen as having provided it.

Canada also has a busy data calendar, with May employment data on Friday the highlight. May PMI surveys are due, with the S and P releasing its manufacturing index on Monday and services on Wednesday, while the Ivey manufacturing PMI is due on Thursday. Q1 productivity is due on Wednesday. April’s trade balance follows on Thursday with Q1 capacity utilization due on Friday.

UK

A less busy week sees final PMI survey data arrive (Mon/Wed) and with additional survey insights coming from BoE compiled industry figures (Thu) as well as the BRS sales numbers (Tue). BoE insights are still short on the ground given the effective purdah ahead of the general election.

Eurozone

The ECB decision is the obvious focal point this week. Given the almost unanimous hints from Council members, something unexpected is needed to prevent the ECB from starting to cut its policy rates on Thursday, most notably the key deposit rate currently at an unprecedented 4.0%. The question markets are considering is how/when this widely expected 25 bp cut will be followed by subsequent moves. Given splits within the ECB Council no formal guidance may be forthcoming at the press conference, save to underline that policy will be data dependent and independent of the likes of the Fed. But updated ECB forecasts are likely to corroborate market thinking of an ECB depo rate falling well below 3%, if not lower if an earlier and more sizeable undershoot of the inflation target is flagged.

Data is thin on the ground, but more weak retail sales (Thu) and PPI (Wed) numbers may be followed by more construction sector weakness in the sector PMI numbers, these coming on Thursday, ie after final PMI survey data arrive (Mon/Wed). German industrial production (Tue) likely to see perhaps a consolidation as may manufacturing orders numbers due a day earlier. Friday sees the key wage compensation data the ECB has been awaiting in revised Q1 national accounts numbers that have already been effectively superseded by the likes of monthly wage tracking numbers which suggest such cost pressures have fallen to around 3% into early Q2.

Rest of Western Europe

There are limited events in Sweden, with Riksbank First Deputy Governor Breman overviewing the economic situation and current monetary policy (Tue). Switzerland sees CPI data (Tue) and where we some possible further rise from the 1.4% April upside surprise may occur due to base effects.

Japan

Labor Cash Earning on Wednesday, June 5 and Household Spending on Friday, June 7 are the critical release for Japan next week. The March Wage data has disappointed as we did not see a pick up in pace, despite record negotiation result. We expect wage to pick up in the coming months and it will be critical for the next BoJ steps. Household spending would also be important but to a lesser extent for it is only a watch point for Japanese economics growth primarily. With imports rebounding, it is likely that we could see a similar pick up in household spending.

Australia

A slate of data will be on the Australian calendar next week. GDP on Wednesday, June 5 and Trade Balance on Thursday, June 6 would be more important, but neither should affect RBA’s policy path. We also have PMIs and private inflation data on Wednesday and Building permits on Thursday.

NZ

Tier two data for New Zealand next week. GDT price index will be released, so as terms of trade, commodity price and manufacturing sales.