USD, EUR, CAD flows: Muted respose to ECB, US GDP data

ECB cut 25bps as expected. US GDP 2.3% may be stronger than expected after Wednesday's release of a record trade deficit

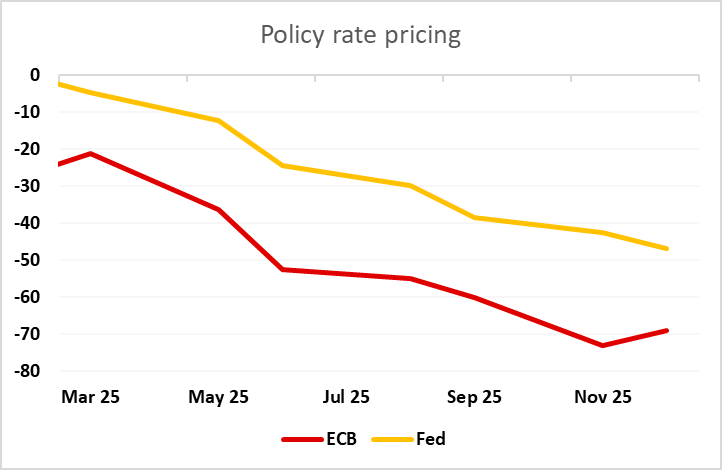

Muted reactions to the ECB and the US GDP data. The ECB cut was as expected, and provides little reason for the market to change its pricing of ECB easing this year. The disinflation process is seen to be well on track so that inflation will settle at around the target on a sustained basis. But the ECB stressed financing conditions continue to be tight, because monetary policy remains restrictive – the latter may not be something the hawks would agree with! Little was made of the weaker real economy, with it not being acknowledged that an inflation backdrop that was in line with expectations had actually come about amid a much weaker growth backdrop in the last few months. Given that weakness and the economic headwinds the ECB sees existing implies around three more 25 bp cuts in H1 this year, with an ensuing around-neutral 2% policy rate resulting, as is priced in the market.

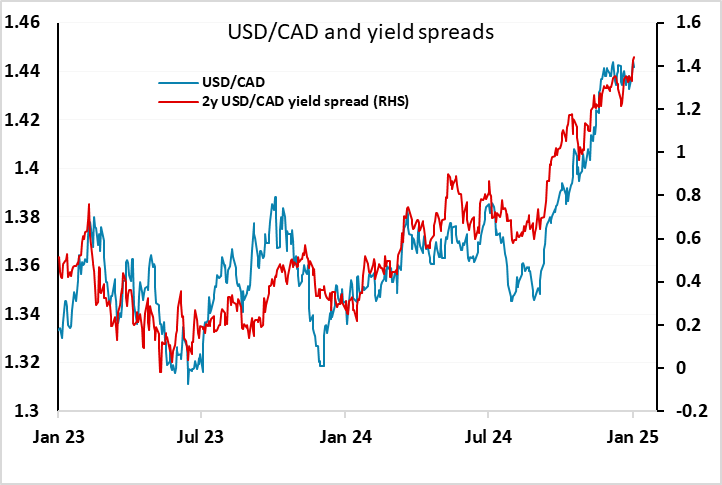

The US GDP data may have been a little above expectations in the wake of yesterday’s huge US trade deficit and weak inventory data which led us and others to revise down forecasts. While the surveyed median was 2.7%, we and others revised down our forecasts by around 0.9% so the real expectations may have been closer to 2.0% than the 2.3% outcome. The 2.3% q/q annualised gains still solid enough, and includes still strong domestic demand, but does represent a mild slowdown, and if we continue to see trade deterioration this may increase the tendency for Trump to either raise tariffs or call for a weaker USD. Nevertheless with the claims data also suggesting a strong labour market, the data won’t put downward pressure on US yields and for now may be USD supportive. Inasmuch as this week’s data has increased the danger of tariffs, the CAD could be particularly under threat ahead of Saturday’s deadline for imposing tariffs on Canada and Mexico.