FX Daily Strategy: Europe, March 19th

BoJ Exit Negative Interest Rate

A bigger JPY positive impact in a long run

Canadian CPI to weigh modestly on the CAD

GBP vulnerable as positions reached new highs

BoJ Exit Negative Interest Rate

A bigger JPY positive impact in a long run

Canadian CPI to weigh modestly on the CAD

GBP vulnerable as positions reached new highs

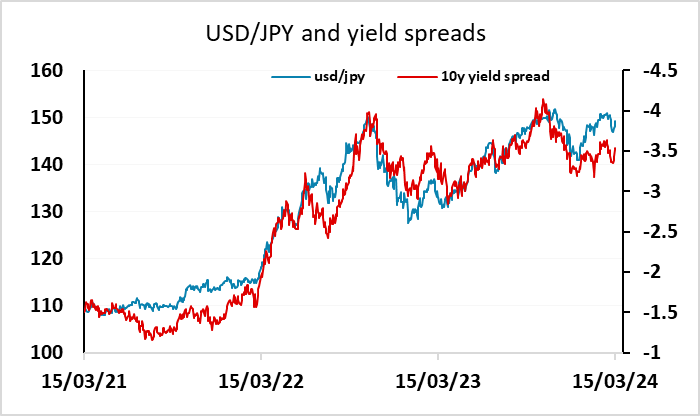

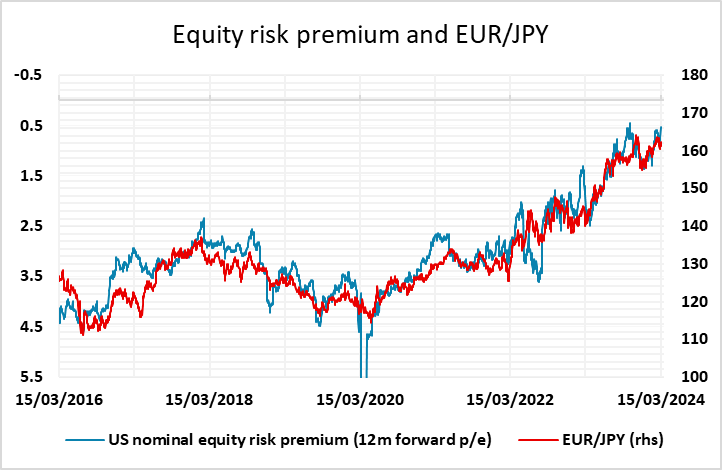

The BoJ meeting is the main focus for Tuesday. There is more focus on the BoJ than the RBA, with the RBA generally deemed unlikely to change anything since the last meeting. But there is a lot of speculation around the BoJ meeting, with some seeing a rise in the policy rate, some an official end to YCC and some no change at all.

The market is priced for around a 45% chance of the policy rate being raised to zero at this meeting, while a Reuters survey showed twelve of 34 economists, or 35%, expected a hike this month, with the majority (including ourselves) expecting a hike in April. Similarly, of 26 economists who predicted YCC's demise in total, 31% selected March and 62% picked April. Nearly all of the respondents said an end to negative rates would happen simultaneously in that respective month.

The BoJ decided to exit negative interest rate in the March meeting. The BoJ has raised short term interest rate from -0.1 - 0% to 0 - +0.1%, signalling YCC is officially removed, yet bond purchase operation persists at the same magnitude and any spike in long term JGB yield will be met with BoJ's response (intervention). The BoJ will also discontinue the purchase of ETFs and REITs as "it came in sight that the price stability target of 2 percent would be achieved in a sustainable and stable manner toward the end of the projection period of the January 2024 Outlook". The forward guidance changed to " Given the current outlook for economic activity and prices, it anticipates that accommodative financial conditions will be maintained for the time being." suggests the BoJ do not see tightening with the current outlook.

Overnight, the BoJ announced they would conduct an unscheduled bond buying operation. This could be interpreted as a signal that the BoJ expect yields to rise after the meeting, which some see as a hint that YCC will end, but it could easily be interpreted the opposite way. Bigger picture, we still see the main risks for USD/JPY. A bigger decline could be expected if the BoJ pull the trigger.

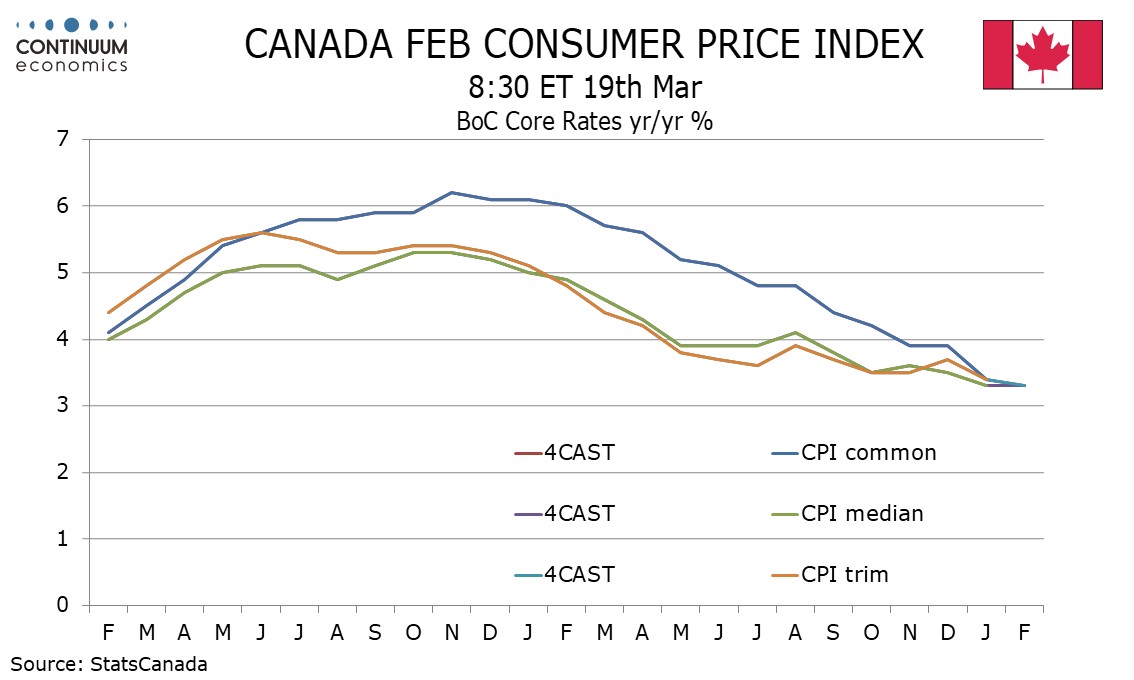

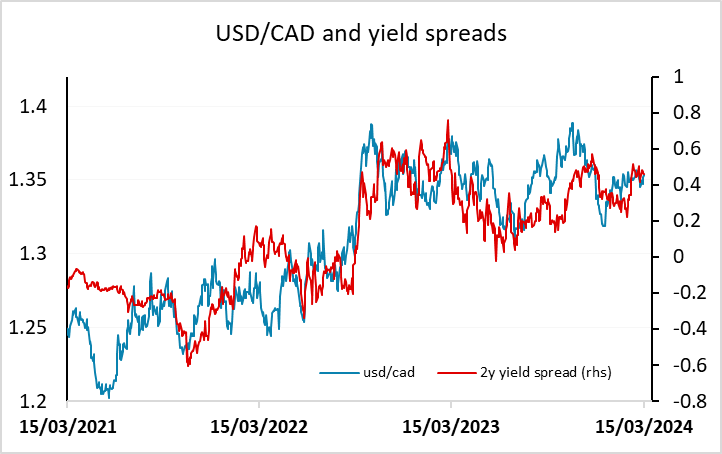

Canadian February CPI looks to be the only data of real significance on Tuesday, with the market consensus looking for a small rise in the headline y/y rate to 3.1%, but with all the core rates that the BoC watch expected to be unchanged from the January y/y rates. We see mild downside risks to inflation relative to the consensus, suggesting the CAD may have some downside risks, but we doubt they will be large.

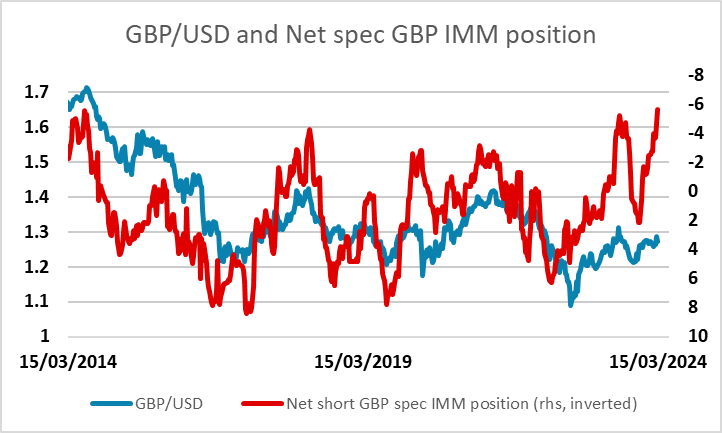

Monday saw relatively quiet trading, with the focus very much on central bank meetings this week. However, one thing to note ahead of the BoE meeting on Thursday is the CFTC data on net speculative GBP/USD positioning. This hit its highest level for at least 12 years last Tuesday, and suggests there may be some significant downside risks for the pound if the BoE turn more dovish this time around and open up the possibility of a rate cut as early as May, which is currently priced as very much an outside chance at around 12%.