FX Daily Strategy: N America, July 2nd

USD may manage some recovery ahead of major data

GBP to remains under some downward pressure as BoE turns more dovish

CHF remains very expensive and hard to favour without significant geopolitical risk

AUD/CAD and NOK/SEK both have scope to gain

USD may manage some recovery ahead of major data

GBP to remains under some downward pressure as BoE turns more dovish

CHF remains very expensive and hard to favour without significant geopolitical risk

AUD/CAD and NOK/SEK both have scope to gain

Wednesday looks like being a relatively quiet day ahead of the main data of the week on Thursday. The USD recovered modestly after Powell’s comments at the ECB conference in Sintra on Tuesday, with US front end yields moving higher as he throws some doubt on the prospects of a July rate cut. The other central banker comments were mixed with Bailey sounding mildly dovish, Lagarde trying to sound hawkish an Ueda still indicating a hawkish bias. But the USD has fallen a long way in the last week and ahead of Thursday’s employment report some further squaring of shorts may be seen.

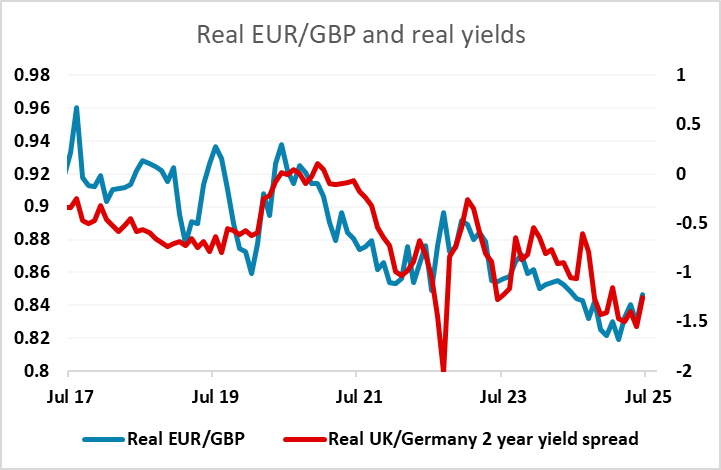

GBP came under a little pressure against the EUR Tuesday afternoon as UK yields edged lower. Comments from Bailey may have been a factor. Although he still indicated that BoE easing would be gradual, he also said firms were putting off investment decisions due to uncertainty, with trade decisions a major factor. EUR/GBP is testing towards 0.86, and there is scope for further gains if yield spreads with the Eurozone continue to narrow. Ultimately, if real yields with the Eurozone were to equalize, there is scope for a move above 0.90. However, if BoE easing remains gradual – i.e. at 25bps a quarter – GBP declines are likely to be slow.

Elsewhere, the CHF has continued to lead the way in the USD decline, which suggests it may be one of the more vulnerable currencies if we see any squaring of USD shorts. The SNB are likely to be getting concerned about the strength of the CHF, with the real trade-weighted index close to the highs of the last 10 years and EUR/CHF approaching its 10 year nominal terms low at 0.92 (the all time low excluding the 2015 spike). With the policy rate at zero and the SNB suggesting the possibility of negative rates, it’s hard to find a reason to hold the CHF at these levels without significant geopolitical risk.

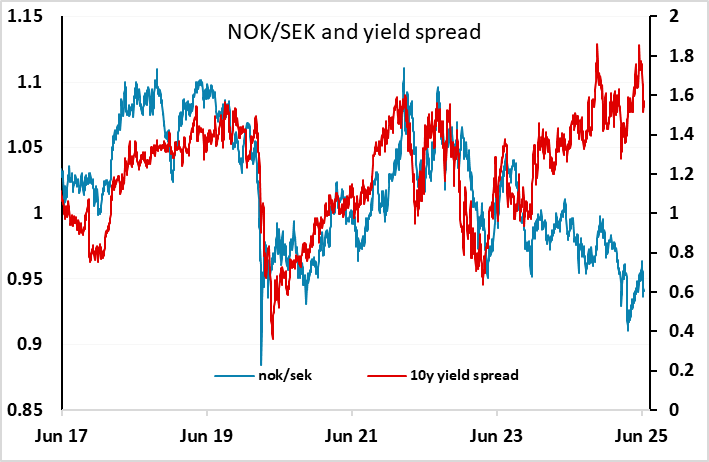

We continue to favour the AUD over the CAD, partly because of the USD negative environment and partly because of yield spreads looking attractive. We also continue to see upside scope for NOK/SEK, with the latest weak Swedish data providing more ammunition for SEK bears, and NOK/SEK continuing to looks very cheap relative both to history and to current yield spreads.