FX Daily Strategy: APAC, January 8th

USD focus on Friday’s employment report and Supreme Court ruling

Risks are tow way, but nerves around the Supreme Court could weigh initially

Jobless claims data unlikely to support a USD negative picture

EUR starting to look vulnerable

USD focus on Friday’s employment report and Supreme Court ruling

Risks are tow way, but nerves around the Supreme Court could weigh initially

Jobless claims data unlikely to support a USD negative picture

EUR starting to look vulnerable

Cumulative Tariff Revenue (USD Blns)

Source: U.S. Treasury

Thursday will likely see generally quiet markets ahead of the US employment report on Friday. There is also a Supreme Court decision on reciprocal tariffs due on Friday, so the market may also position for that. Supreme Court hearings in 2025 prompted a view in the market that a high risk exists of the court rejecting part or all of the Trump administration’s reciprocal and fentanyl tariffs. We would attach a 70% probability to this scenario which is in line with betting markets. The Trump administration could argue that the ruling only applies to companies that brought the original lawsuit, rather than the whole U.S. economy, but even a partial ruling against reciprocal and fentanyl tariffs would likely cause some short-term volatility. A full rejection of reciprocal and fentanyl tariffs would be more difficult to fully replace, which would worsen the 2026 budget deficit by around 0.5% of GDP to 6.5%. This would reduce Trump’s negotiating leverage with China and India and to a lesser degree Mexico and Canada, so the risks around the decision do seem likely to be USD negative.

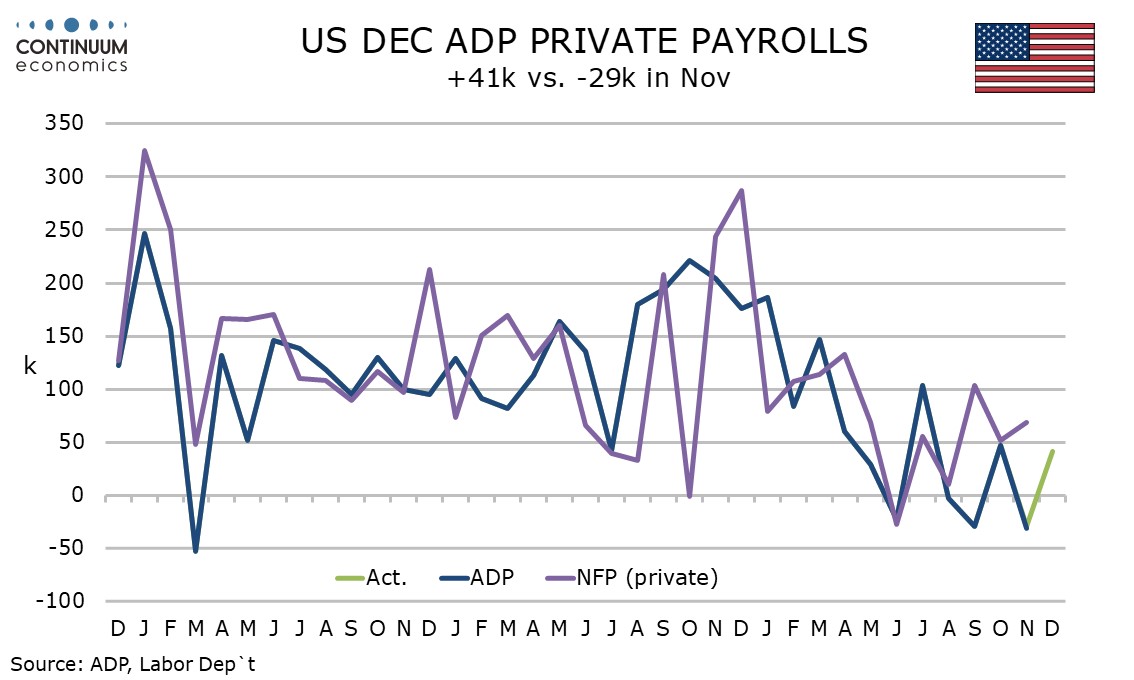

However, we have a mildly positive view of the employment data due Friday relative to the market consensus, and the ISM data on Wednesday was strong enough to suggest that the US economy continues to perform solidly. With the Eurozone data coming in on the soft side of late, we still favour some USD upside risk against the EUR and other European currencies, notably GBP. There is less scope for USD gains against the AUD and JPY where yield spreads have moved sharply against the USD, but EUR/USD is looking a little toppy technically and recent GBP strength is hard to justify given generally soft UK data of late.

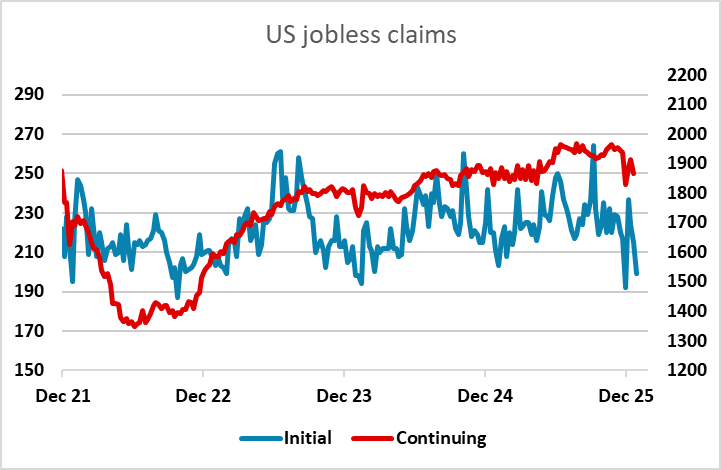

The usual US jobless claims data will be a focus as will the Challenger jobs data ahead of the employment report, although neither will specifically relate to this month’s report. But it remains difficult to be too negative about the US labour market as long as initial claims continue to hover near the lows.

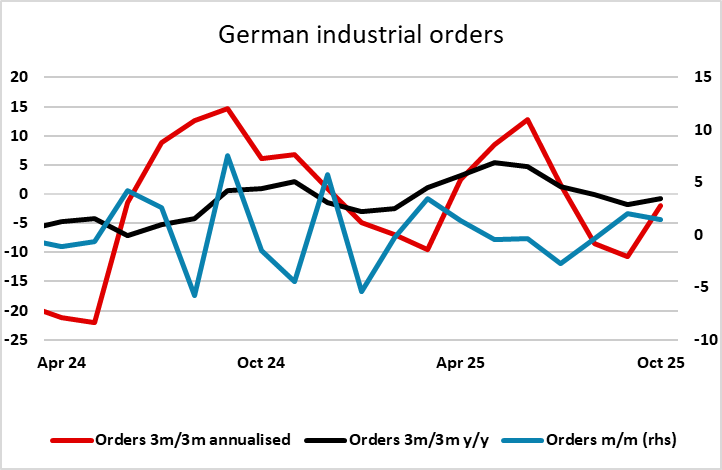

In the European morning there is Swedish preliminary CPI data for December and German factory orders data for November. The Swedish data is expected to show a modest rise in the targeted core inflation CPIF measure to 2.5% y/y, while the German numbers are seen recording a monthly decline. Neither seem likely to move the markets much, as the Riksbank looks to be very much on hold and unlikely to be swayed by one month’s inflation numbers, and the German orders data are choppy but showing a fairly flat underlying trend. However, the consensus decline would support the perception of a sluggish economy and might weigh slightly on the EUR. There is also the European Commission business and consumer survey, which has been edging up a little in recent months but we doubt will provide much reason for optimism this time around.