FX Daily Strategy: Europe, July 4th

US holiday means Thursday is likely to be quiet

Weaker US data this week puts the USD on the back foot

Some risk of further unwinding of long USD positioning

GBP focus on UK election but little impact seen

US holiday means Thursday is likely to be quiet

Weaker US data this week puts the USD on the back foot

Some risk of further unwinding of long USD positioning

GBP focus on UK election but little impact seen

The US holiday means Thursday is likely to be a relatively quiet day although the softer US data on Wednesday creates some risks that we see some position unwinding head of the employment report on Friday.

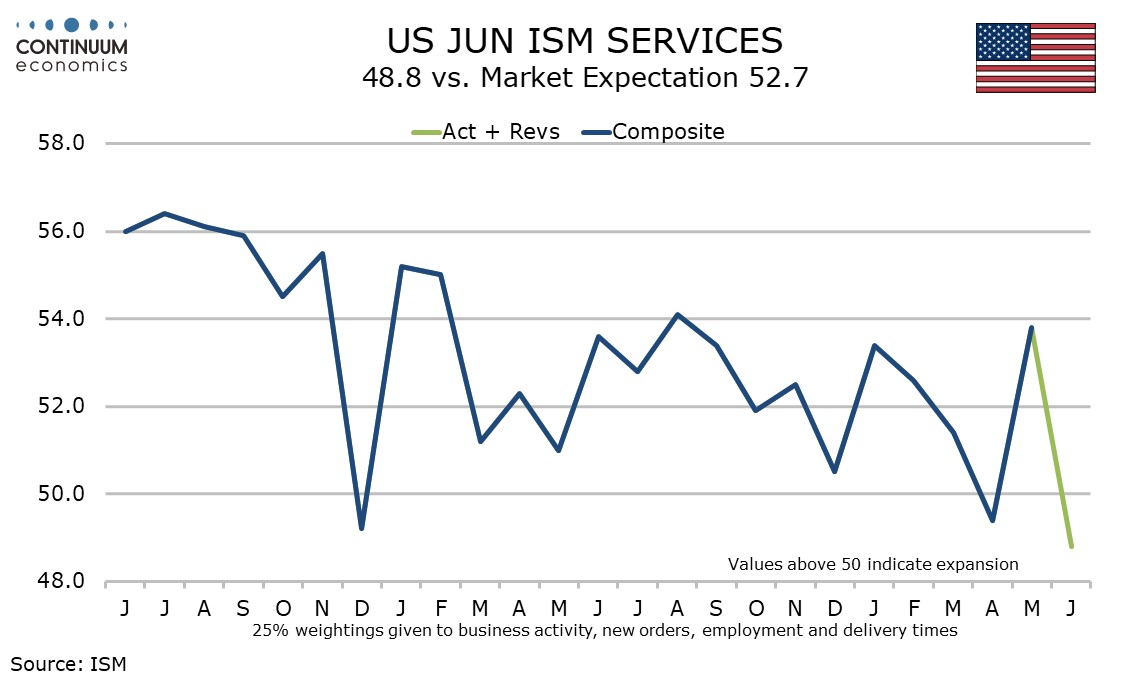

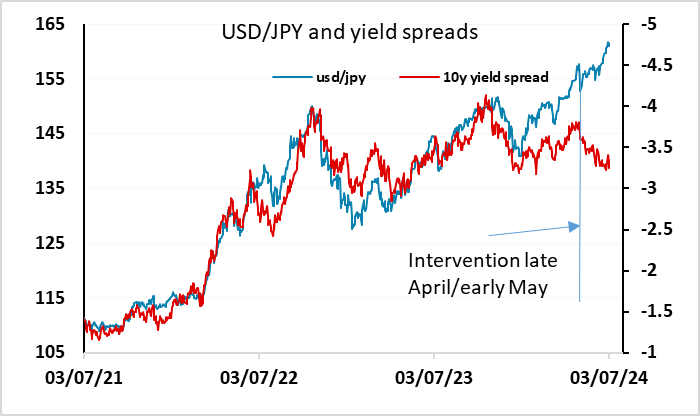

We saw weaker ADP, higher jobless claims and most notably a much weaker than expected non-manufacturing ISM survey on Wednesday. This is generally taken more seriously than the S&P PMI, and US yields fell as a result. EUR/USD broke above 1.08, and even USD/JPY fell more than half a figure. With European yields also lower, this would normally have been seen as JPY positive across the board, but the current negative JPY sentiment meant that EUR/JPY was not much changed. However, with the July 4 holiday and the employment report approaching, there is potential for some further unwinding of short JPY positions, so the risk may be shifting to the JPY upside. Some speculate that the Japanese authorities may take advantage of the thinner conditions on the US holiday to intervene, but we see this as unlikely.

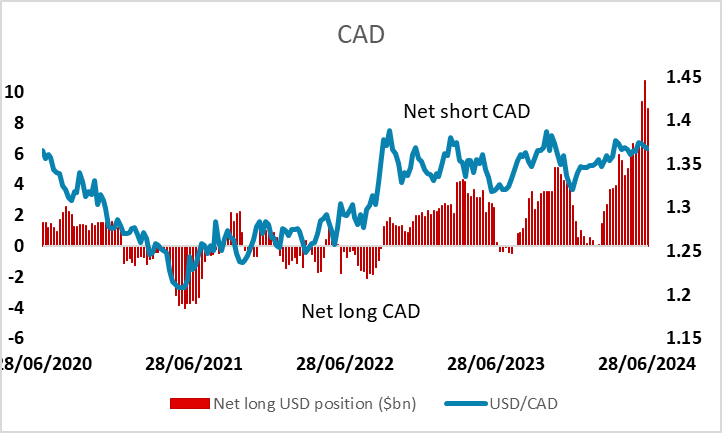

As well as the JPY, the IMM data suggests there are significant long USD positions in USD/CAD and USD/CHF which could be vulnerable if there is a position unwind. The IMM data are by no means a complete summary of positions, but can be indicative of some of the vulnerability, with USD/CAD probably most likely to come under pressure.

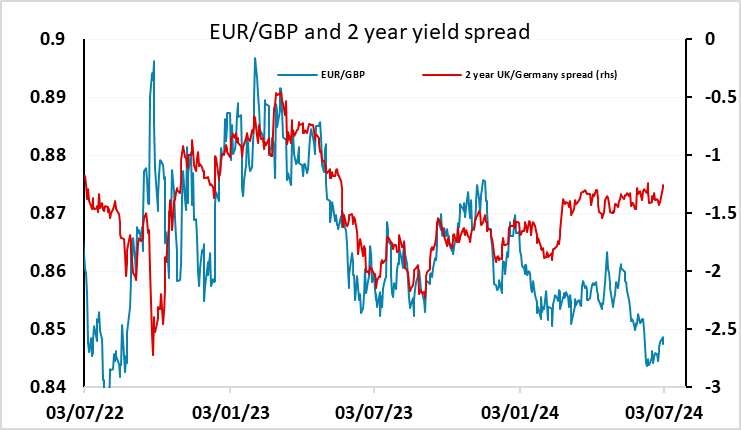

Net speculative short positions on the IMM

The main July 4 event will be the UK election, but the markets are currently showing little interest in this as a market moving event. A victory for the opposition Labour Party is fully anticipated, with the uncertainties mainly about the size of the victory and the distribution of seats among the opposition parties. A very large Labour victory may be seen as less positive than a smaller win, as some may see this as making radical socialist policies more likely over the course of the parliament. If anything, GBP looks a little high against the EUR given recent gains and fairly static yield spreads, especially if the USD is generally softer. But we wouldn’t expect a major GBP reaction to the election