Brazil: Real Wage Growth to Boost Consumption

Brazil's labor market showed remarkable resilience in 2023, with a notable decrease in unemployment to 7.4% from 8.6%. Increased occupation drove consumption and growth, though real wage growth outpaced job creation. Despite challenges, strong syndicates and minimum wage policies will sustain upward pressure on salaries. Looking ahead, continued growth in salaries, especially real wages, may fuel demand pressures, potentially complicating efforts to achieve the 3% inflation target.

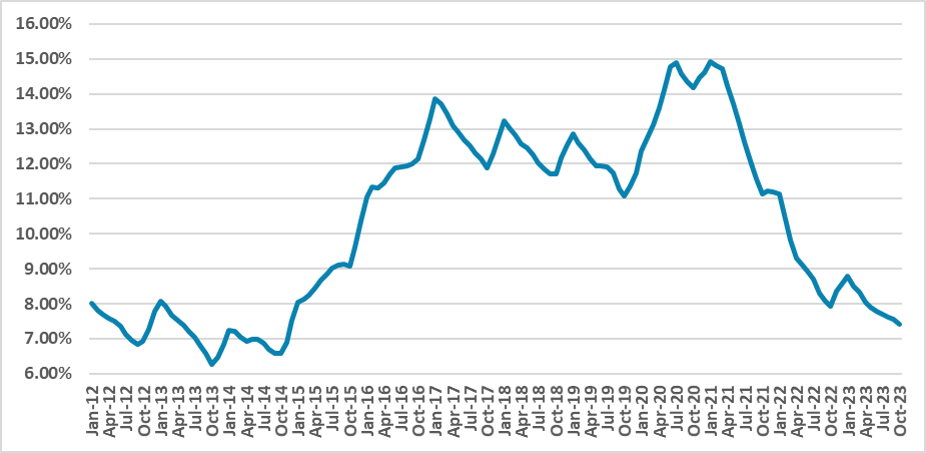

Figure 1: Unemployment Rate (%)

Source: IBGE

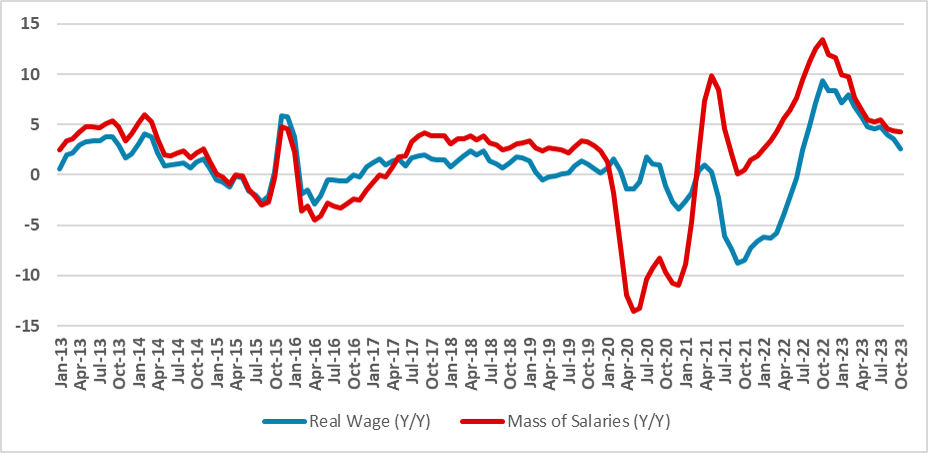

The labor market resilience was one of the biggest surprises for Brazil last year. The unemployment rate has reduced to 7.4% from 8.6%, and one of the biggest drivers was the increase in occupation, boosting consumption and, in some parts, growth in 2023. The mass of salaries has increased by 6.3% in real terms during 2023. However, when we look at the composition of this growth, much was related to real wage growth rather than the increase in occupation. Indeed, occupation in Brazil has grown only 1.6% in 2023 while real wages have grown 3.2%.

Figure 2: Real Wages and Mass of Salaries Growth (%, Y/Y)

Source: IBGE and Continuum Ecnomics

A heated labor market or an indexed economy? It is difficult to make a case for the Brazilian labor market being overheated. Although a 7.4% unemployment rate is low in Brazilian terms, the Brazilian economy has registered lower levels in the past decade, and there is still a significant part of the population seeking jobs and not finding them in Brazil. Another possibility is that most wages are only responding to the high inflation levels of past years with lags. This means wages tend to continue above inflation for a significantly longer period, boosting the mass of salaries. This, of course, will translate into high demand pressures, and whether this means more inflation will likely depend on supply.

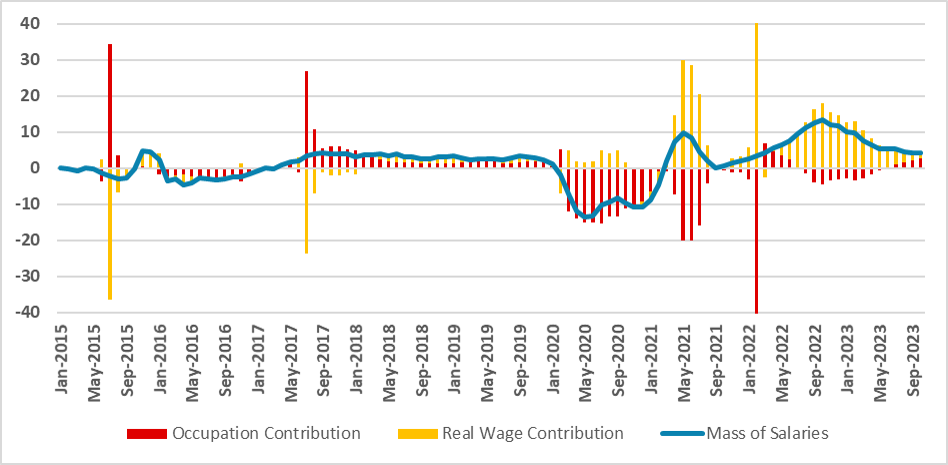

Figure 3: Occupation and Real Wage Contribution for Mass of Salaries (Y/Y, %)

Source: IBGE and Continuum Economics

Strong syndicates and government minimum wage policy will continue to pressure salaries upward. Several syndicates adjust their wages on an annual basis, usually in January or February, taking into account the purchasing power lost in the past years. Therefore, several jobs will continue to see their salaries increasing above the inflation rate. The new minimum wage formula will also add fuel to wages. The new formula will adjust the minimum wage according to the growth from the past two years and past year inflation. This means the strong growth in recent years will guarantee the minimum wage will grow above the inflation level in the next two years.

We believe the mass of salaries will continue to grow in 2024, pushed especially by real wages and, in some part, occupation. This will add some demand pressures, pushing growth and inflation up. As a consequence, we see inflation being stickier in the next years, making it more difficult for the BCB to bring inflation towards the 3% target.