NOK, JPY flows: NOK little changed after CPI, JPY makes modest recovery

Norwegna CPI much as expected, NOK remains in the centre of the range. JPY makes a modest recovery as political picture in Japan becomes more uncertain

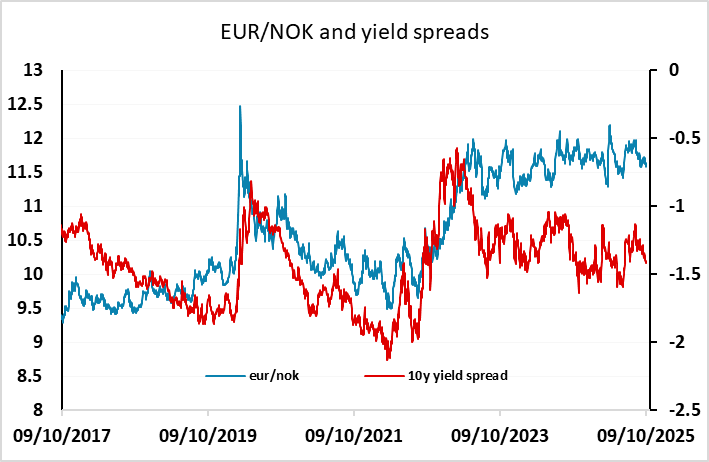

Not much change in EUR/NOK after Norwegian CPI, which showed a slightly higher than expected headline inflation rate of 3.6% y/y, but a slightly lower than expected core rate of 3.0% y/y. The data are unlikely to impact the Norges Bank’s policy stance, which anticipates one more cut in rates in the next year, which is also essentially what the market prices in. EUR/NOK remains in the middle of an 11.30-12 range that contains the vast majority of trading in the last two years since the break higher in early 2023. We still see a case for a move back down longer term due to the solid performance of the Norwegian economy and the huge fiscal and current account surpluses it enjoys, but poor liquidity, a vulnerability in risk negative markets and persistent NOK selling form the government pension fund continue to discourage NOK buyers.

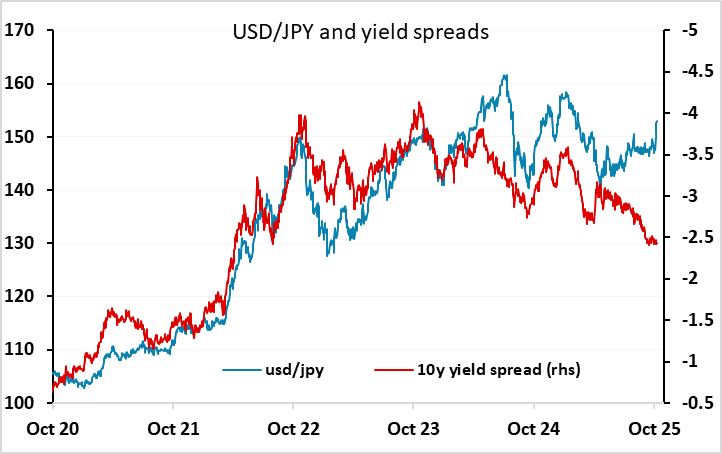

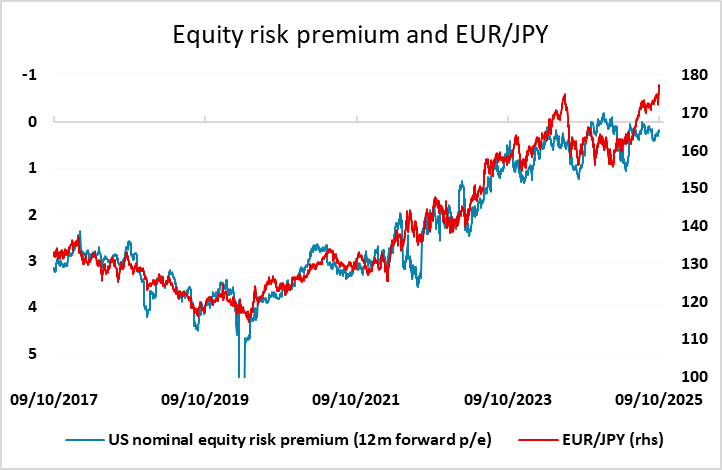

Elsewhere, the withdrawal of Komeito from Japan’s ruling coalition creates some political uncertainty in Japan as new LDP leader Takaichi will need to find new partners to form a government. The comments from Takaichi last night, saying she didn’t intend to weaken the JPY, and from Finance Minister Kato, noting recent moves were one-sided (typically a precursor to intervention) provided the JPY with some relief. While USD/JPY remains near the recent highs, the JPY has made a modest recovery on the crosses as the USD has made gains elsewhere. There may be some extension of the JPY recovery into the weekend as short term speculative longs are pared back.