U.S. October Industrial Production - Decline largely due to Boeing strike and hurricanes

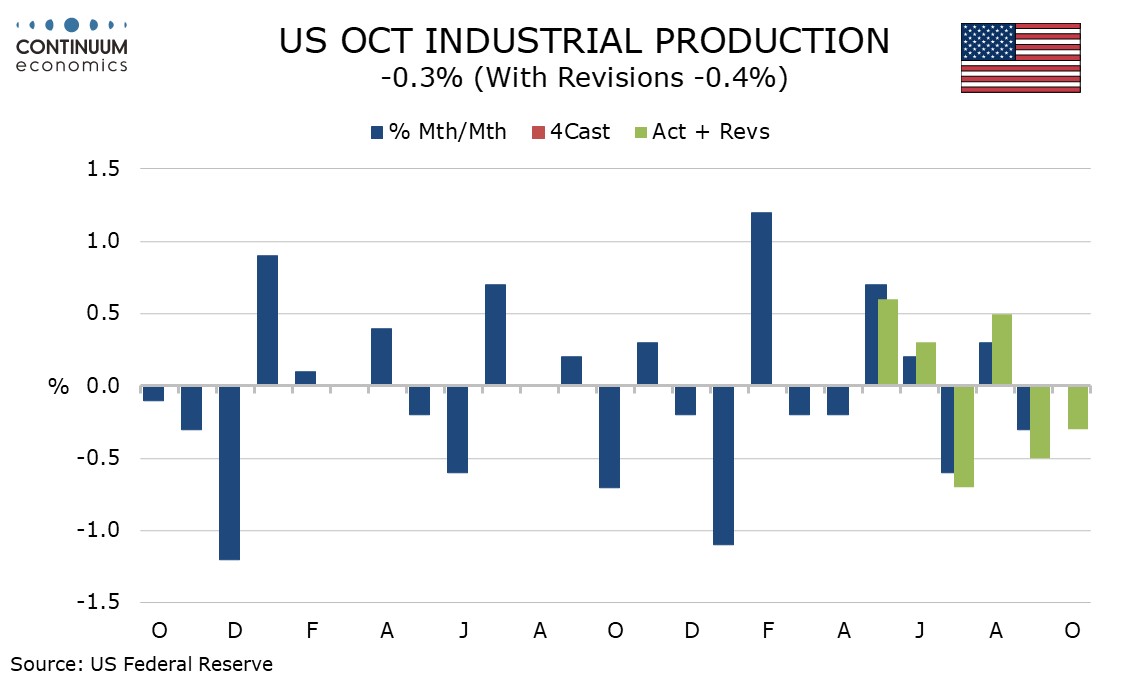

October industrial production fell by 0.3% after falling by 0.5% (revised from -0.3%) in September. The now settled strike at Boeing reduced October output by 0.2% after a hit of 0.3% in September. Hurricanes were only a modest negative in October, taking off 0.1% after taking 0.3% off in September.

This means October was unchanged on an underlying basis while September increased by 0.1% excluding the impact of the strike and hurricanes. This means a subdued, but not negative underlying picture.

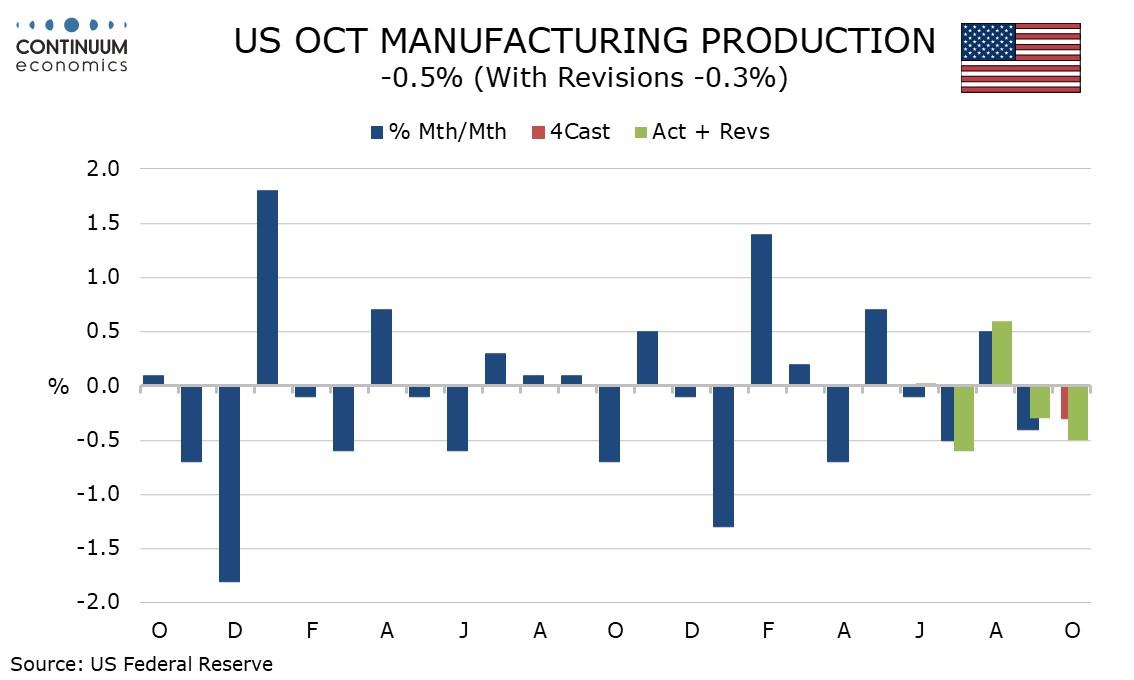

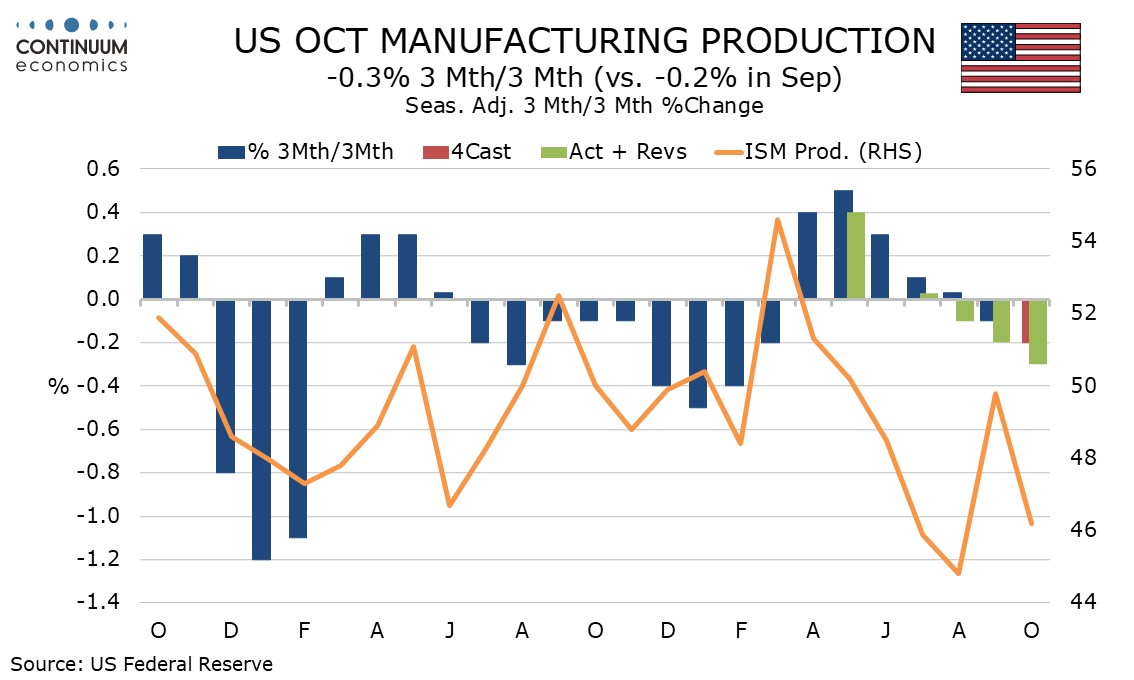

Manufacturing fell by 0.5% in October after a 0.3% fall in September. Autos saw a weak month in October, with manufacturing ex autos down by 0.3%. Utilities with a 0.7% increase supported October data while mining saw a modest 0.3% rise after a hurricane-impacted 1.9% September fall.

While the underlying industrial production picture looks subdued November is likely to see a bounce as Boeing returns to work and strike impacts unwind.

There may be some underlying improvement implied by November’s Empire State manufacturing survey, its 31.2 outcome up from -11.9 in October and the highest since December 2021. Still, the volatility of the series suggests this data should be treated cautiously.