FX Daily Strategy: Asia, October 31st

BoJ meeting a key focus – some hawkish aspect needed to halt JPY decline

Longer term JPY buyers should see current levels as attractive

Eurozone CPI data should help consolidate EUR recovery

US data likely to be ignored ahead of employment report and election

BoJ meeting a key focus – some hawkish aspect needed to halt JPY decline

Longer term JPY buyers should see current levels as attractive

Eurozone CPI data should help consolidate EUR recovery

US data likely to be ignored ahead of employment report and election

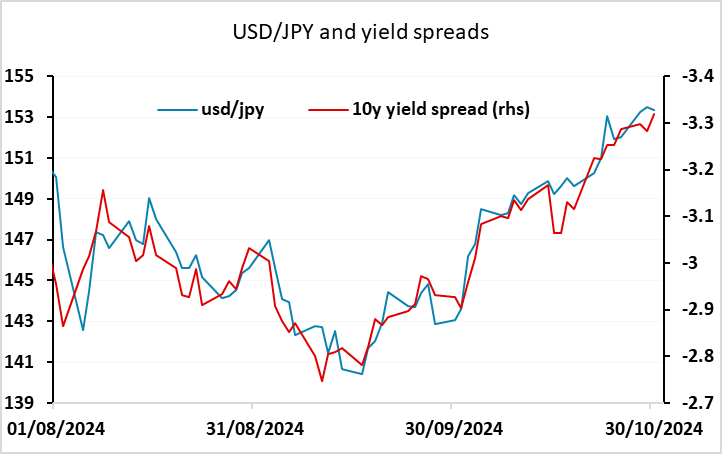

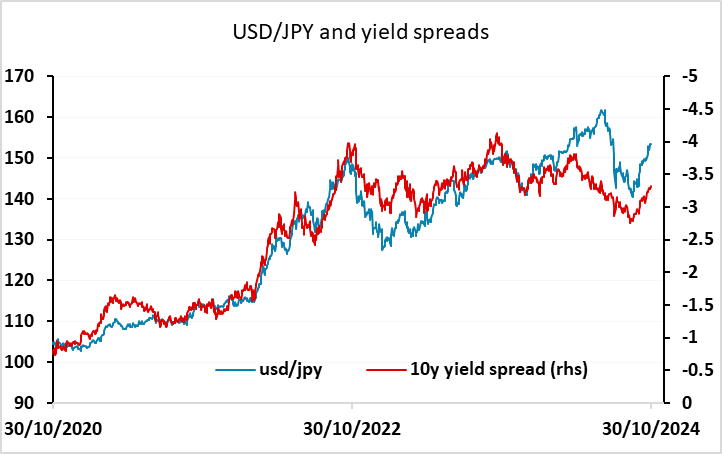

Thursday kicks off with the BoJ meeting, and although the market continues to price essentially no chance of a change in policy, it is potentially still a very significant event. First of all, we wouldn’t completely rule out a BoJ rate hike, despite the more dovish stance taken by Ueda at the beginning of the month. USD/JPY has gained 10 figures over the month, which significantly loosens financial conditions. Ueda has said that FX moves have increased in significance, and the 5% decline in the trade-weighted JPY over the month changes the picture. While wage growth is still not clearly strong enough to justify tightening, the unemployment rate has fallen to its lowest since January, and the jobs to applicants ratio has edged up, so the labour market is tightening. So there is a case for higher rates, and even if rates are not hiked, we would expect the statement to make it clear that hikes are likely in the near future. At the moment there are only 6bps of tightening priced in at the December meeting, while a 25bp rate hike at that meeting looks quite possible in our view.

For USD/JPY, some sort of hawkish action looks necessary to halt the decline seen over this month. We have hit several key retracement levels against a variety of currencies as the JPY has fallen back from the highs seen at the end of the summer, and this looks like a good level for longer term JPY buyers. But unless there is some encouragement from the BoJ, those buyers are still likely to have to suffer some short term pain. Even so, any rise in USD/JPY from current levels carries the risks of attracting BoJ intervention, especially if it isn’t supported by further rises in the yield spread, which already looks too low to justify the current extraordinarily high level of USD/JPY based on historic correlations.

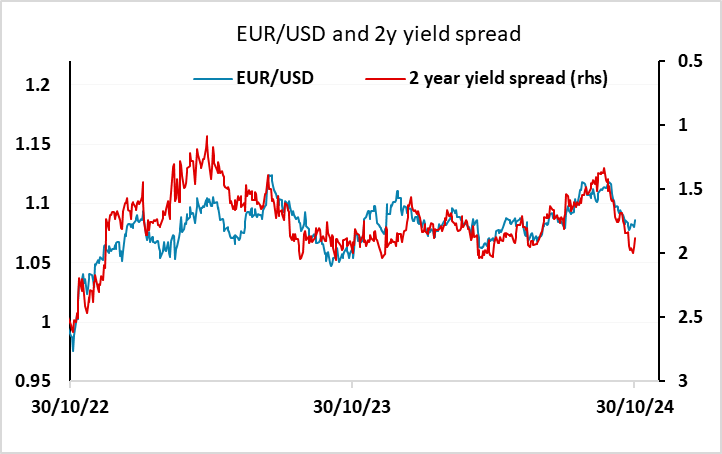

After the BoJ meeting we have the remaining preliminary CPI data from the major Eurozone countries and the Eurozone CPI itself. The German numbers on Wednesday were clearly on the strong side of expectations, and along with the stronger Eurozone GDP data, helped to reduce market expectations of more rapid ECB easing. This in turn limits the EUR downside, and although yield spreads still suggest some EUR/USD downside risk, it is looking increasingly hard to make any progress below 1.08 without a significant change in market expectations for Fed policy. This of course might come on the back of the employment report, but more likely won’t be seen this side of the election.

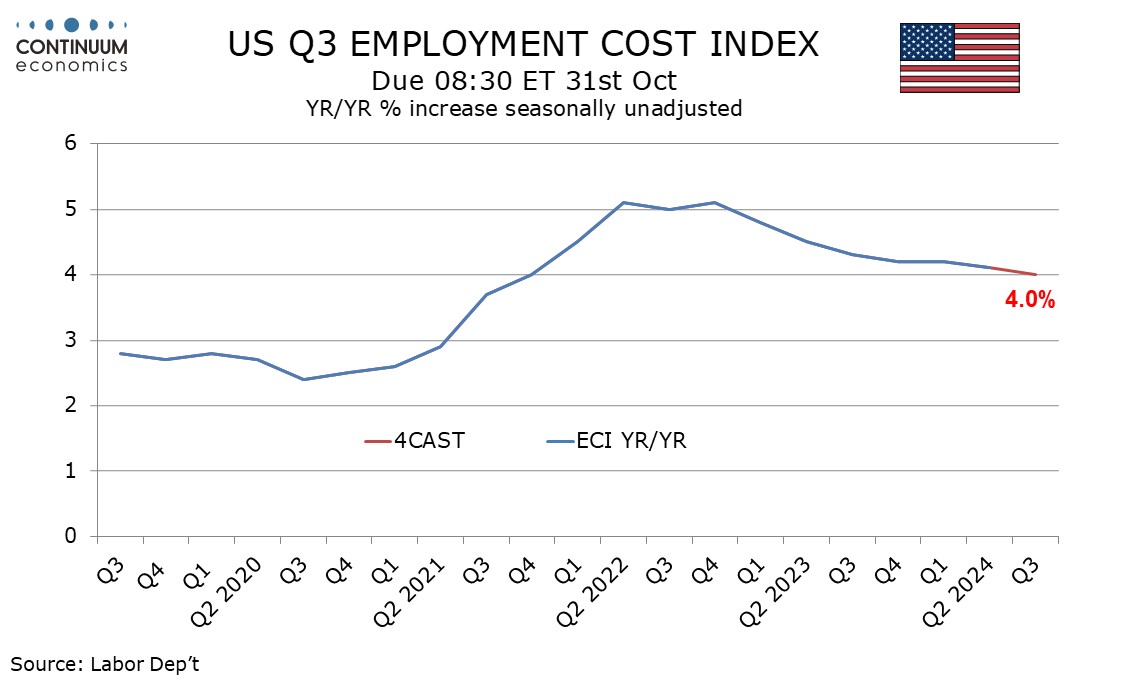

On the US side, Thursday sees the PCE price index for September and the employment cost index for Q3, both of which could be significant for Fed policy going forward. We look for the Q3 employment cost index (ECI) to increase by 0.9%, matching the gain of Q2, though with slightly firmer growth in wages and salaries offset by a slowing in benefit costs. This is in line with consensus, so probably won; trigger a significant reaction, but supports the Fed easing trajectory inasmuch as it shows the y/y rate of growth slowing to 4.0%, so if anything this may be mildly USD negative, although with the focus on the employment report and the election next week, reaction should be small.