FX Daily Strategy: N America, March 15th

Friday calendar too bare to move the markets

Expectations of next week’s central bank meetings to drive sentiment

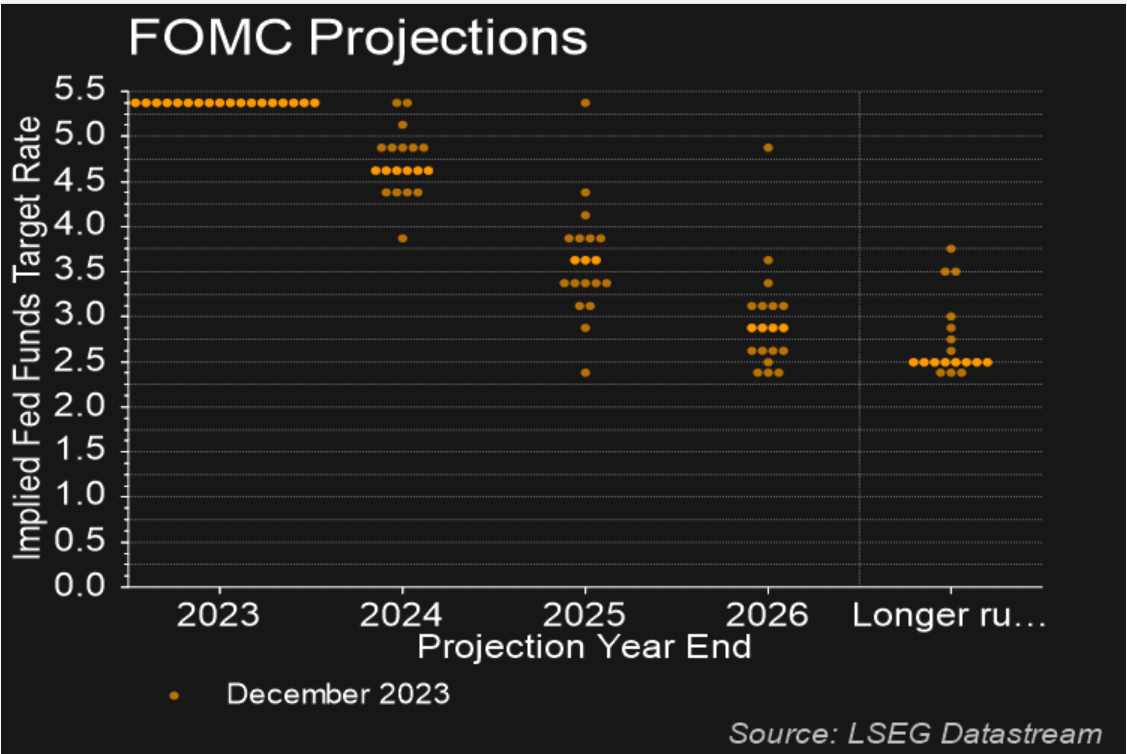

Market now priced in line with the Fed’s December “dots”

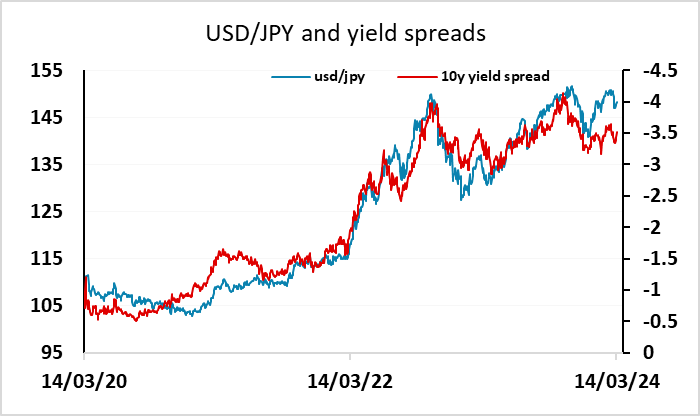

JPY should prove most resilient to any USD strength

Friday calendar too bare to move the markets

Expectations of next week’s central bank meetings to drive sentiment

Market now priced in line with the Fed’s December “dots”

JPY should prove most resilient to any USD strength

There’s little of note on Friday’s calendar, so FX movement is likely to reflect positioning ahead of next week’s central bank meetings rather than a reaction to any news.

Thursday saw the USD make a modest recovery after a soft performance through much of the week in spite of the stronger than expected CPI data on Tuesday. Thursday’s data was slightly on the strong side of expectations, although retail sales were soft, with PPI and jobless claims data both helping to push US yields and the USD higher. It has been notable in recent months that the market has reacted as much if not more to PPI data rather than CPI data, which is a little strange since the Fed is certainly more focused on CPI, and PPI doesn’t reflect wage costs as much as the CPI. But the rise in US yields was in any case justified in our view given the stronger CPI data this week and the generally strong US data in recent months which makes it likely that the FOMC meeting next week will show a mildly hawkish bias, with potential for the Fed dots to be revised higher from the December meeting. In December, the median expectation was for three 25bp cuts this year, and after the rise in yields on Thursday, the market is now pricing exactly that, with 75bps of rate cuts seen by the December meeting. There would therefore need to be a rise in the median expectation for Fed funds for any further impact on front end US yields and the USD. Ahead of the FOMC, there is therefore only very modest potential for further rises in US yields, and while the USD might get some support from some further corrective action in equity markets, we would expect EUR/USD to hold close to 1.09.

There should be even less scope for gains in USD/JPY, as next week also has potential to see the BoJ start its tightening cycle, if not with an actual rate hike then with forward guidance in that direction for the April meeting, either towards a rise in the policy rate or an end to YCC (or both). Yield spreads are already at a level that suggests USD/JPY is stretched here, and there is more potential for a rise in JGB yields in the coming months than a rise in US treasury yields. USD/JPY and EUR/JPY are consequently looking toppy unless the BoJ decide to disappoint everyone and declare that policy is set to remain unchanged for some more months.

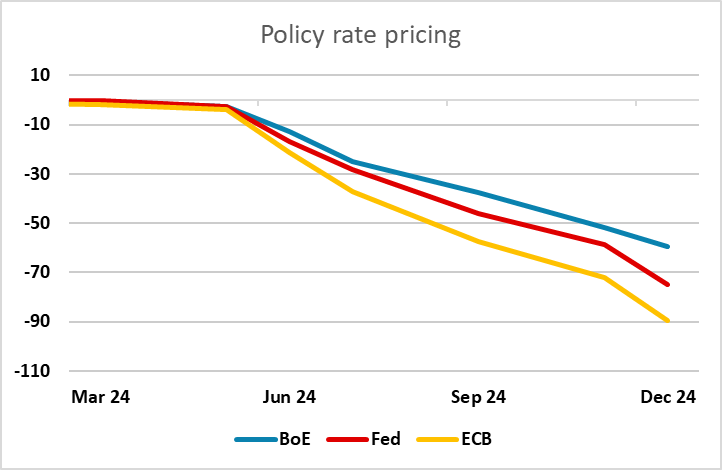

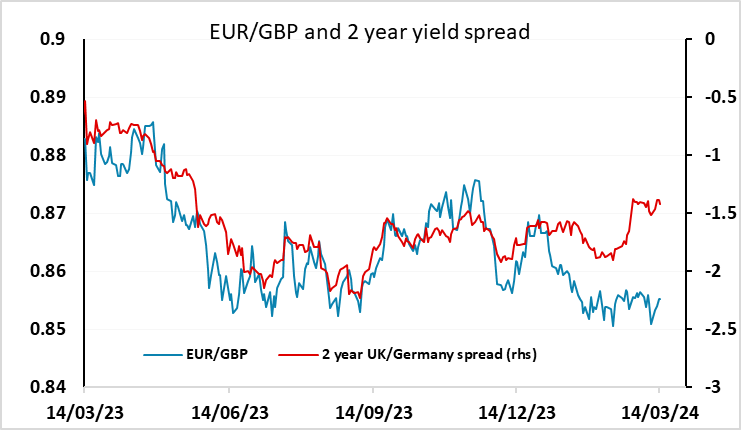

The Bank of England MPC meeting next week also has potential to move market expectations of policy. For the moment, the market still prices a more hawkish BoE stance relative to the Fed and ECB, encouraged by some continued votes for higher rates from the hawks on the committee and the evidence that the labour market is still tight. But this evidence is less convincing in recent data, with average earnings looking to be plateauing in recent months, while GDP remains essentially flat. However, while we see every reason for the BoE to be more dovish and GBP to weaken, governor Bailey was making some optimistic noises about the economy after the last meeting. He needs to change his tune if GBP bears like ourselves are to get any joy.

For Friday itself it’s hard to find much that is likely to be market moving, but there is US industrial production data and the University of Michigan confidence data. Of the two, the confidence numbers, and particularly the inflation expectations data, has more potential to move the market, but we doubt there will be significant moves until next week.