JPY, EUR flows: JPY firm as BoJ expectations rise, EUR upside limited for now

JPY gains ground after stronger cash earnings data and higher reported wage settlements. Furtehr upside scope seen. EUR limited by weak German orders, but still has potential for gains - or losses - on ECB today.

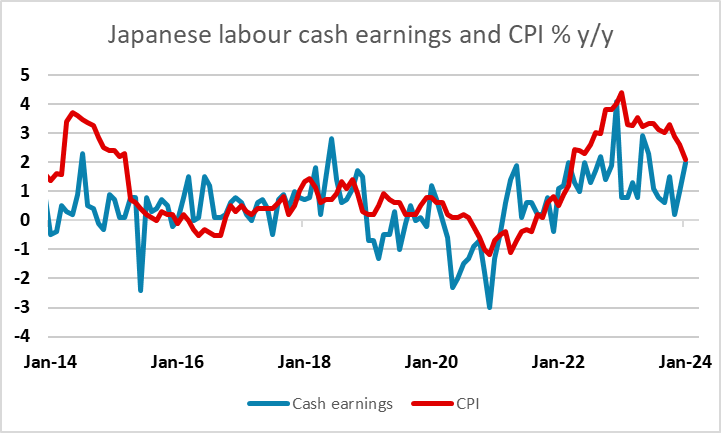

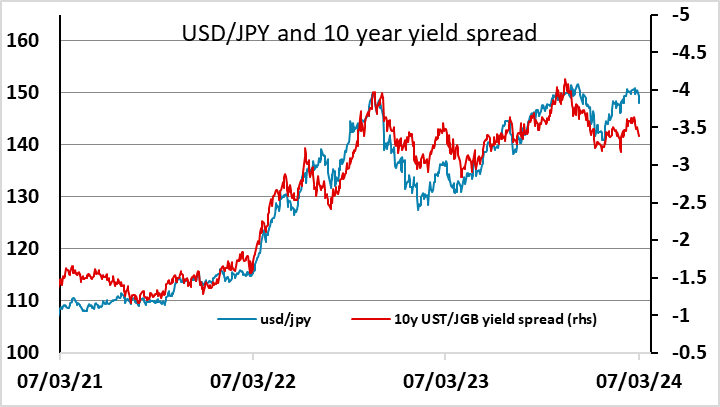

JPY strength was the main feature overnight, with the stronger than expected Japanese cash earnings data and reports of higher wage settlements helping to increase expectations of BoJ tightening. USD/JPY is a figure lower from European closing levels yesterday, but remains well above the level suggested by the USD/JPY yield spread correlation that has held in recent years. This suggests scope to the low 140s, but some weakening in risk sentiment looks likely to be necessary to provide further downside momentum. There is initial support in the 148 area, but a test down to the retracement level at 146.80 and the 200 day moving average at 146.10 look possible if USD sentiment remains negative.

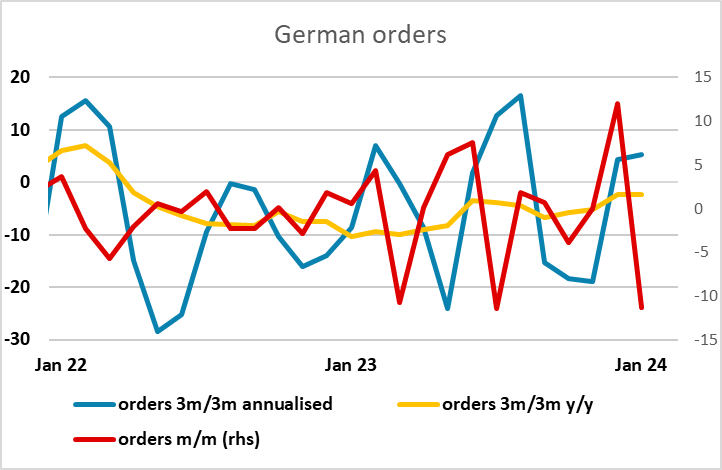

The EUR has underperformed the JPY and AUD in the last 24 hours, and has not been helped this morning by the sharp decline reported in German January factory orders. However, this only reverses the sharp December rise in this volatile series, and we still see some upside scope for EUR/USD if the tone of the ECB meeting today remains hawkish as we expect. But if Lagarde were to suggest the possibility of an April rate cut was still open, there is plenty of downside risk, with this currently only priced as around a 20% chance.