USD, EUR, JPY flows: USD firm, JPY intervention risk increases

USD firm helped by positive equity response to tech results. JPY gets brief support from Katayama comments. Little independent EUR movement after as expected German sales data

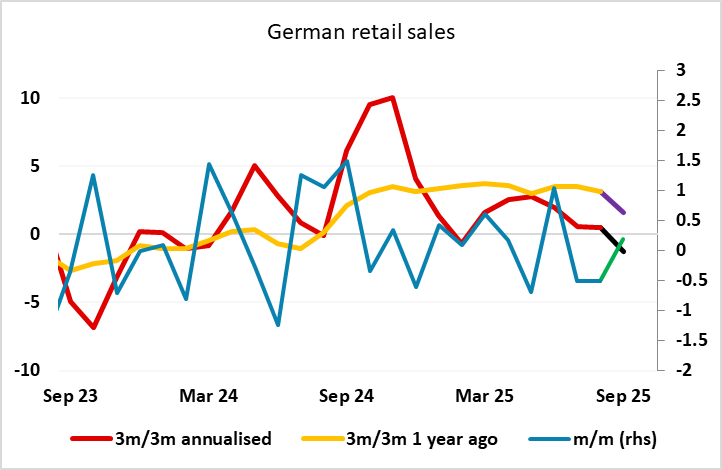

German September retail sales have come in in line with consensus at 0.2% m/m, but the underlying trend looks to be weakening slightly with the level of sales still below where we were in March. EUR/USD is unlikely to be much affected, with the USD generally firm, helped by strong results from Apple and Amazon released overnight. The October EUR/USD lows at 1.1540 are under pressure, but recent broadly solid Eurozone data suggests any break lower is likely to be a USD rather than EUR story.

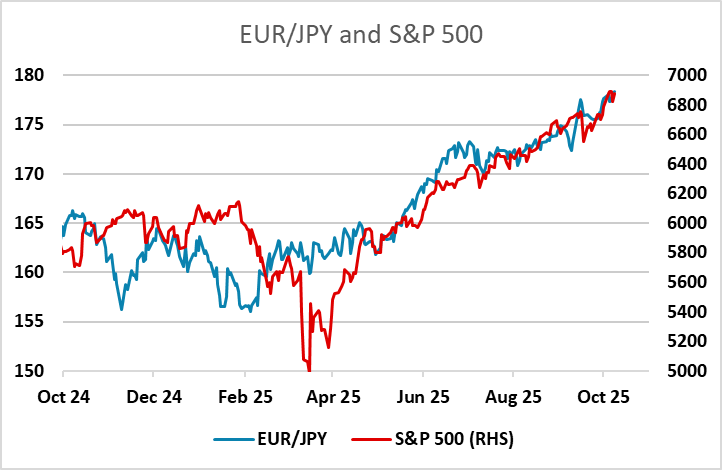

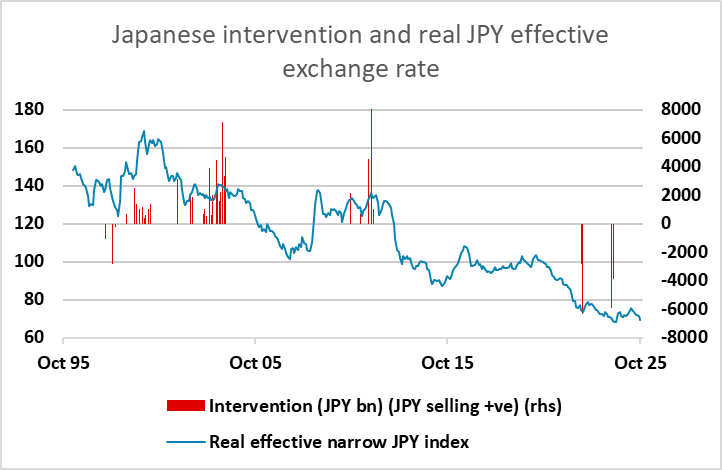

USD/JPY got a brief boost overnight from verbal intervention from the new Japanese finance minister Katayama, who said that the recent JPY moves have been one-sided and rapid, but the JPY gains were short-lived. This has in the past been a precursor to actual FX intervention, and the JPY is certainly at a level that triggered action from the previous administration. However, there is no sign of any action just yet, and if there is none, the JPY is likely to continue to suffer if equities continue to strengthen, with EUR/JPY broadly tracking the S&P500 in recent weeks. But there is significant resistance at 154.40 in USD/JPY, and this may limit JPY downside short term.