FX Daily Strategy: N America, May 7th

RBA kept rates unchanged at 4.35%

Further downside seen for USD/JPY

USD could also slip lower against riskier currencies

RBA left cash rate unchanged at 4.35% aligned with our forecast on Australian inflation dynamics. Despite the slower than expected moderation in CPI, the room for further tightening is small considering the health Australian economy, even when the RBA leaves the door open to policy changes. There were no big changes in the statement with forward guidance "The path of interest rates that will best ensure that inflation returns to target in a reasonable time frame remains uncertain and the Board is not ruling anything in or out. The Board will rely upon the data and the evolving assessment of risks." is a new set of wordings but ndoesnt really signal anything new. In the press conference, Bullock suggested further tightening is not ruled out but not in the central forecast.

The focus in the last week has very much been on the JPY, with the BoJ intervention reversing the JPY weakness of the previous few weeks. USD/JPY and EUR/JPY are both back to the levels seen on April 10, the day that USD/JPY broke through the previous highs from October 2022. It is significant that the BoJ have forced USD/back to those levels, as it was at those levels that the BoJ intervened in October 2022. The message is that you need to take notice of BoJ intervention levels, and speculating on JPY weakness beyond those intervention levels will not be profitable. While the official data on the size of BoJ JPY buying will not be available for another month, BoJ data suggests something in the region of $35bn, which is somewhat less than the $60bn spent in October 2022. But the size is of limited relevance. The message is that, whatever they say in public about volatility, USD/JPY gains beyond 150 are not welcome and will not be allowed to persist.

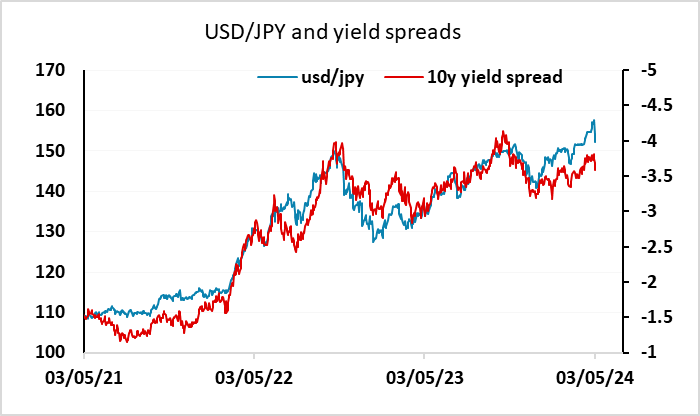

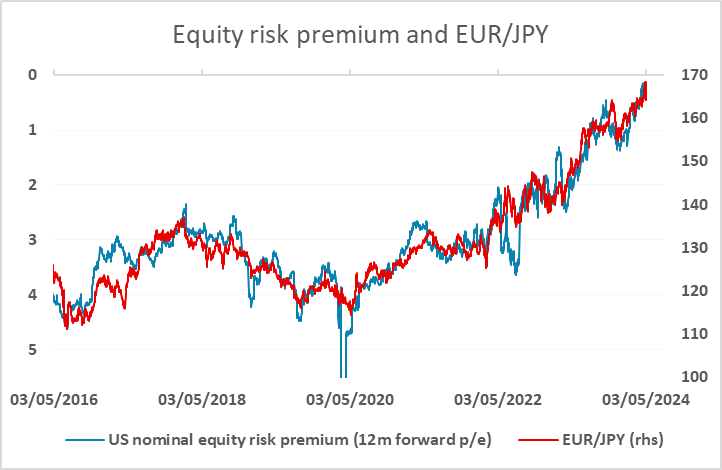

From here, we may now see some further JPY gains, as the correlation with yield spreads suggests scope for USD/JPY to fall back to the high-140s. The correlation with equity risk premia has, however, held up rather better in recent weeks, and suggests there is more limited downside scope for EUR/JPY, with current risk premia suggesting EUR/JPY should hold somewhere in the mid-160s. This suggests there may also be further upside for EUR/USD. While front end yields don’t suggest major upside potential for the EUR, the positive equity tone is supportive, and the relatively weak US survey data from the PMIs and the ISM also provide some rationale for a generally weaker USD.

Datawise, there isn’t much this week from the US and Eurozone, but there is the Japanese labour cash earnings data, which is seen as significant for BoJ policy. The data is only for March, and there is more focus on the wage agreements made in April for the coming year, but this could nevertheless be a trigger for JPY moves.