FX Weekly Strategy: Asia, April 21st-25th

Markets to continue to react to implications of US tariffs

USD to remain under pressure as overweight positions are trimmed

Downside risks to PMI data suggest safe havens to be preferred…

…but some currencies can still recover from extreme levels triggered by the equity sell-off

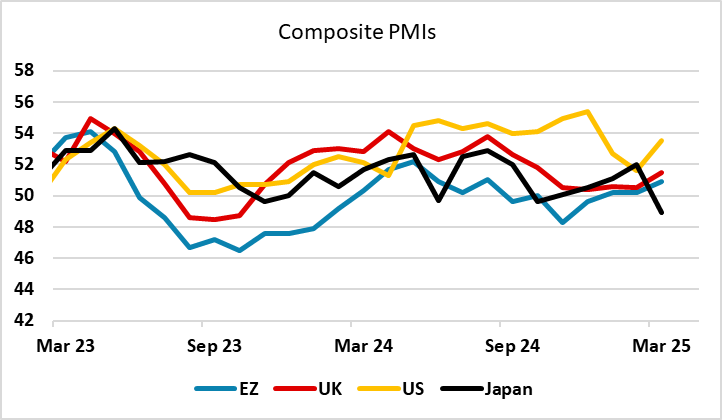

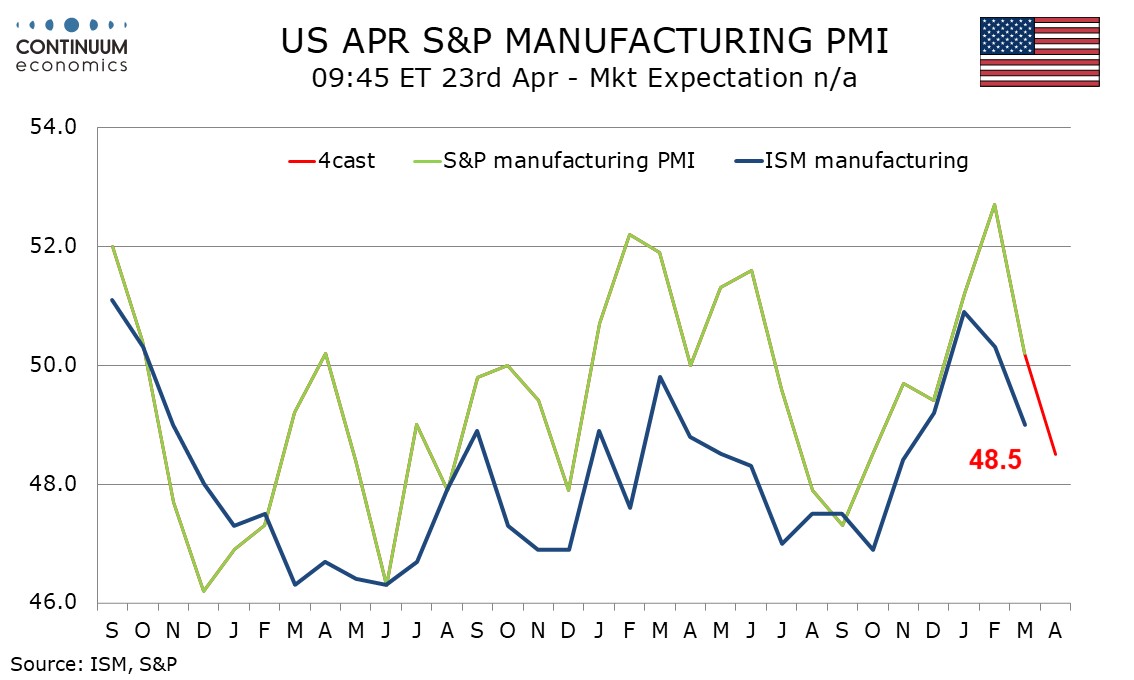

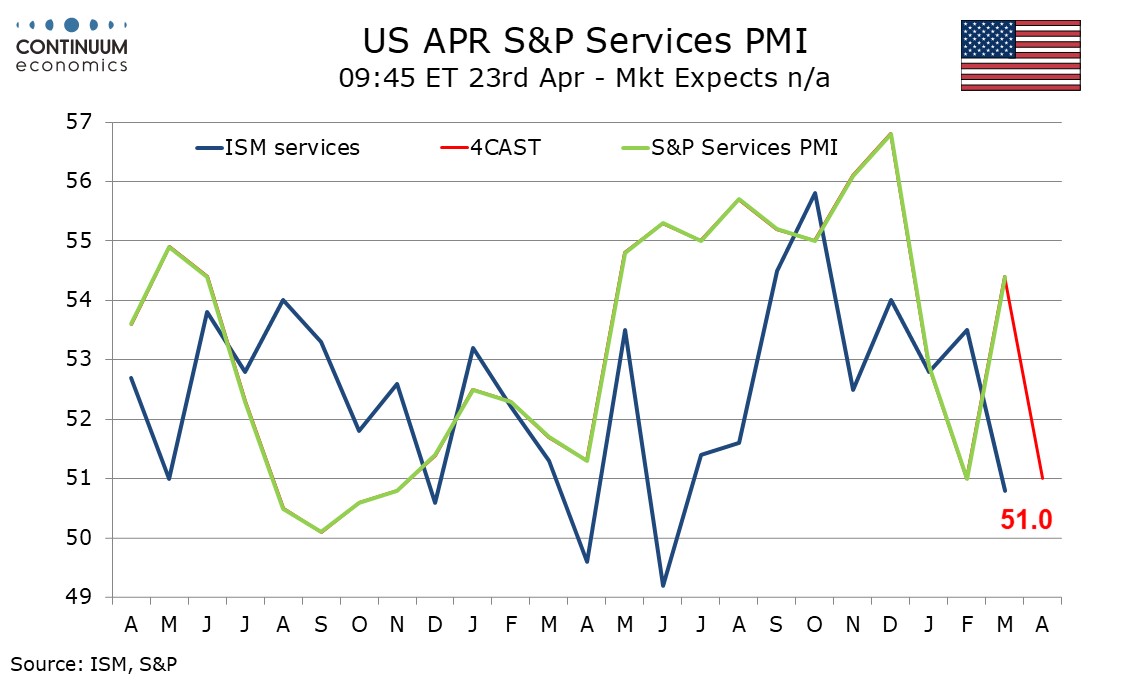

The initial impact of the tariff shock has been felt, and the US equity market looks to have regained some stability with the S&P 500 trading in the middle of the 4800-5800 range. We still see risks of a break to the downside of this range, as the US equity risk premium remains low by historic standards, and the low level is hard to justify if the US economy is weakening and possibly even flirting with recession. However, we will need to see more evidence of weakness in US data for a break to occur, and it is likely to be hard to interpret many of the numbers in the near term as the introduction of tariffs has altered the timing of a lot of decisions. For instance, Q1 imports have surged, presumably to avoid tariffs, but retail sales have also picked up in March for the same reason. Nevertheless, there are signs of weakening confidence as a result of tariffs, and this week’s PMI data will therefore be more significant than usual. There was a sharp dip in the Philly Fed manufacturing survey for April reported last week, and while other surveys have been mixed, the risks look to be on the downside.

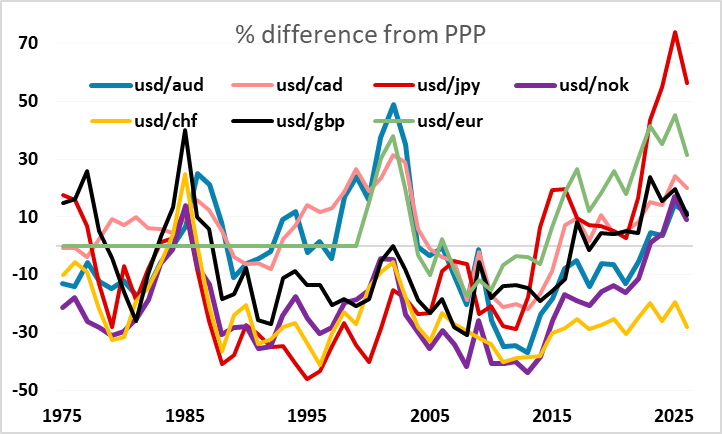

This seems likely to maintain the downward pressure on the USD, which has also been exacerbated by reports of general loss of confidence in US assets. A record number of global investors intend to cut their holdings of US equities, according to Bank of America’s global fund manager survey, which also notes stock allocation to the country saw its largest two-month drop ever. 73% of respondents say “US exceptionalism” has peaked and the outlook for the dollar and US profits rated worst since 2006/07. The USD isn’t helped by its high starting point, particularly against the JPY and the EUR. So unless we see better than expected surveys, the USD seems likely to remain under pressure, particularly against the safe havens.

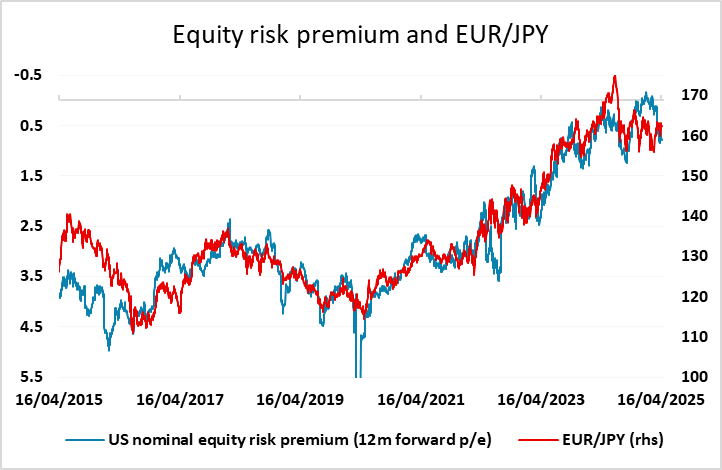

However, demand for the EUR could also be affected by the release of the European PMIs this week. The recent improvement in the European PMIs looks likely to end in April, with the tariff threat taking effect. While this is no doubt expected, it will be hard to be too positive on equity markets if PMIs are falling around the world, and while the EUR may outperform the USD, it is less likely to outperform the JPY in a weaker equity market environment. EUR/JPY has held up relatively well in the last few weeks in spite of the weakness in equities, but the long term correlation of EUR/JPY and other JPY crosses with the US equity risk premium suggests downside risks if we see further equity declines, especially if they are accompanied by lower yields. EUR yields fell back modestly after the ECB meeting but a June ECB rate cut is still not fully priced in so there is still scope for further declines.

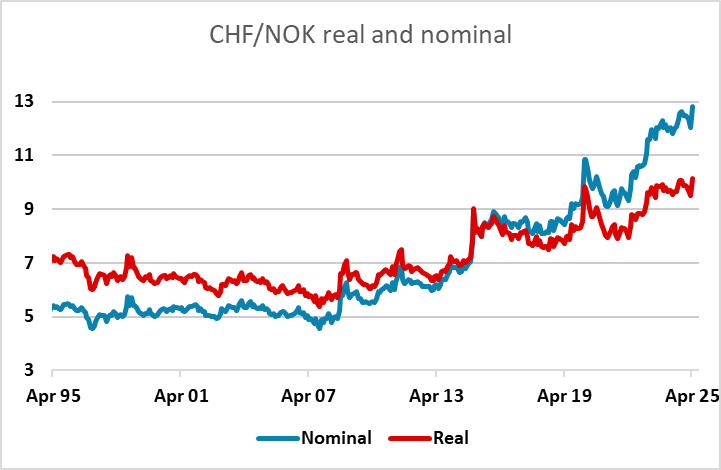

Other than the PMIs there isn’t a lot on the calendar in a holiday shortened week, but there is still potential for some of the market distortions created by the announcements of tariff policy to be corrected. In FX, the weakness of the NOK looks the most notably out of line with fundamentals. The NOK tends to suffer on any sharp sell off due to low liquidity and its status as a risk positive currency due to its relatively high yields, but it’s hard to see the fundamental case for the current weakness with the Norwegian economy still among the most stable in the G10 because of its huge budget and current account surpluses. CHF/NOK reached an all time high last week, but if volatility declines has scope to fall back quite sharply, while there is also scope for a major NOK/SEK recovery.

Data and events for the week ahead

USA

March’s leading indicator is due on Monday. Fed’s Jefferson and Harker speak on Tuesday. The most significant data releases of the week may be April’s S and P PMIs on Wednesday, which will show any response to the escalating trade war. We expect slippage in both manufacturing, to 48.5 from 50.2, and services, to 51.0 from 54.4. The Fed’s Beige Book is also due on Wednesday and Fed’s Hammack will speak. Weekly initial claims are due on Thursday. We also expect a 1.5% increase in March durable goods orders but a 0.2% fall ex transport, and 6.1% fall in March existing home sales, to 4.00m. Friday sees final April Michigan CSI data. The preliminary release was weak with a sharp rise in inflation expectations.

Canada

Canada releases March’s IPPI and RMPI on Tuesday. Friday sees February retail sales, for which the preliminary estimate was for a decline of 0.4%.

Europe

European policy makers will be speaking aplenty as the IMF spring meeting begins on Monday. For the UK, Dep Governor Breeden and BoE Governor Bailey speak on Wednesday, while on the same day ECB’s Knot and Lane offer likely different policy perspectives. A Swedish insight comes from Riksbank Govern Thedeen on Monday.

UK

BoE Chief Economist Pill speaks on Monday. But the main interest will be the flash PMI on Wednesday this coming alongside public borrowing numbers. The latter may still show an overshoot compared to year-before outcomes. As for the PMI, at 51.5 in March, the Composite Output Index was the highest for five months but signalled only a relatively subdued rate of expansion and was still well down on the long-run series average (53.6). A tariff-inspired decline of around 0.5 point is envisaged in this April update, with Thursday CBI Industry survey offering a similar, if not a gloomier message. Friday sees both GfK consumer confidence and retail sales data that we see both correcting back, the latter by up to 1% m/m, the uncertainty greater given the unclear impact that very warm weather through March may have had.

Eurozone

More ECB updates arrive vis the Survey of Professional forecasters on Tuesday and probably the monthly wage tracker update later in the week. Trade and construction numbers (Tue) will provide little new, leaving the week’s focus on flash PMI data (Wed). The Composite PMI ticked up to 50.9 in March, from 50.2 in February, marking a third successive month in which the headline figure has posted in alleged expansion territory – we see this being reversed in the April numbers with more signs of disinflation alongside.

Rest of Western Europe

There are few key events in Sweden, most notably what have been volatile labor market data (Tue). Otherwise that day after SNB results President Schlegel speaks on Friday, possibly offering some policy insight in lieu of what the ECB may have done in the interim.

Japan

Tokyo CPI will be released on Thursday. Headline is expected to remain well above the 2% target with ex fresh food likely closely follow. The April data would be interesting to see as tariffs would be closely followed and could prompt some stockpiling behaviour. We expect ex fresh food and energy to be below 2%. However, we have pushed back our call for a May hike given the uncertainty from tariffs, thus we see the April CPI read to leave only short-term impact to JPY. There are also tier two data on Wednesday.

Australia

Business confidence on Monday, PMI on Thursday pretty much sum up the week for Australia, neither data point would be market moving.

NZ

Trade Balance on Monday only for Kiwi next week.