U.S. February PPI - Core goods accelerate, but outweighed by weakness in services

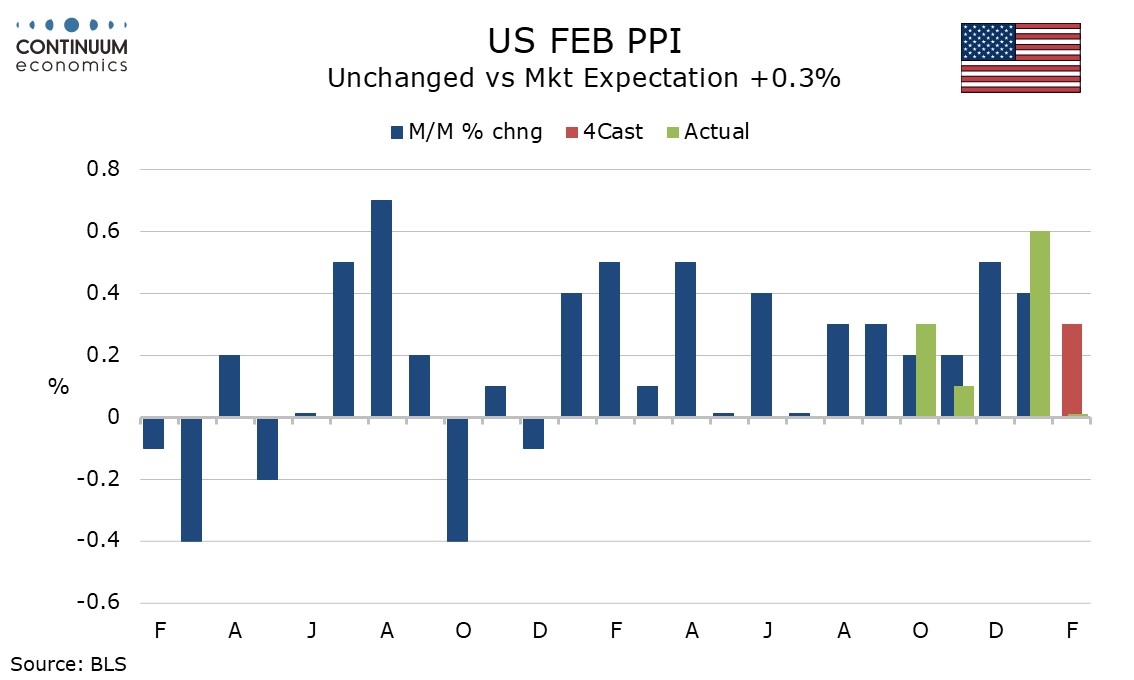

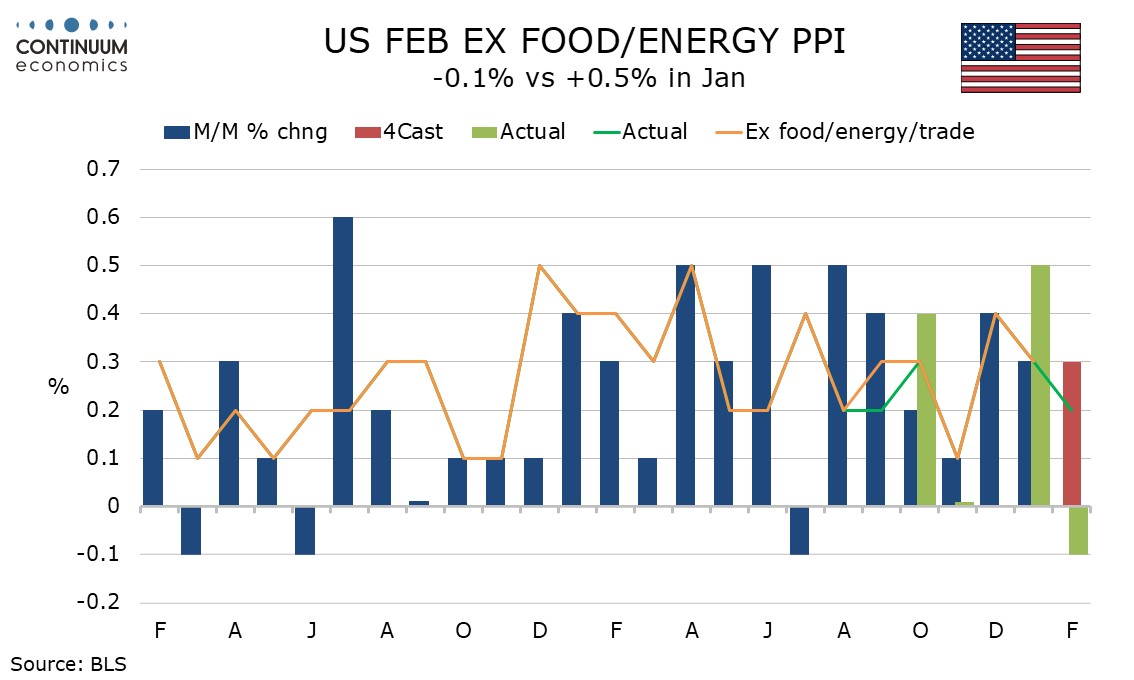

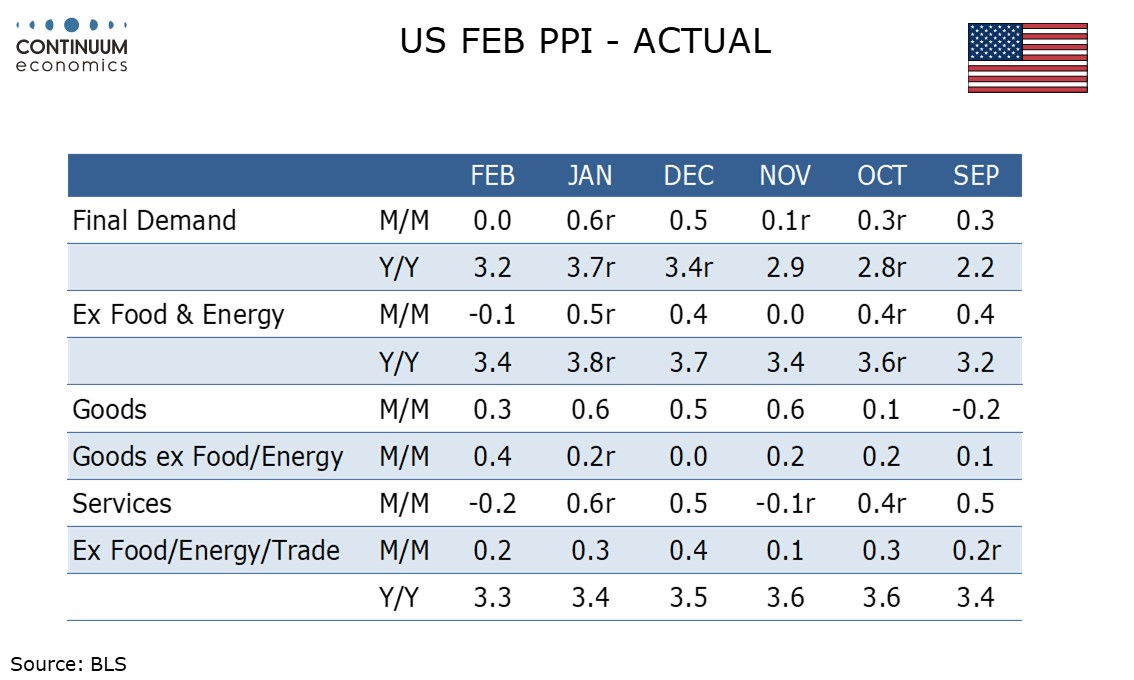

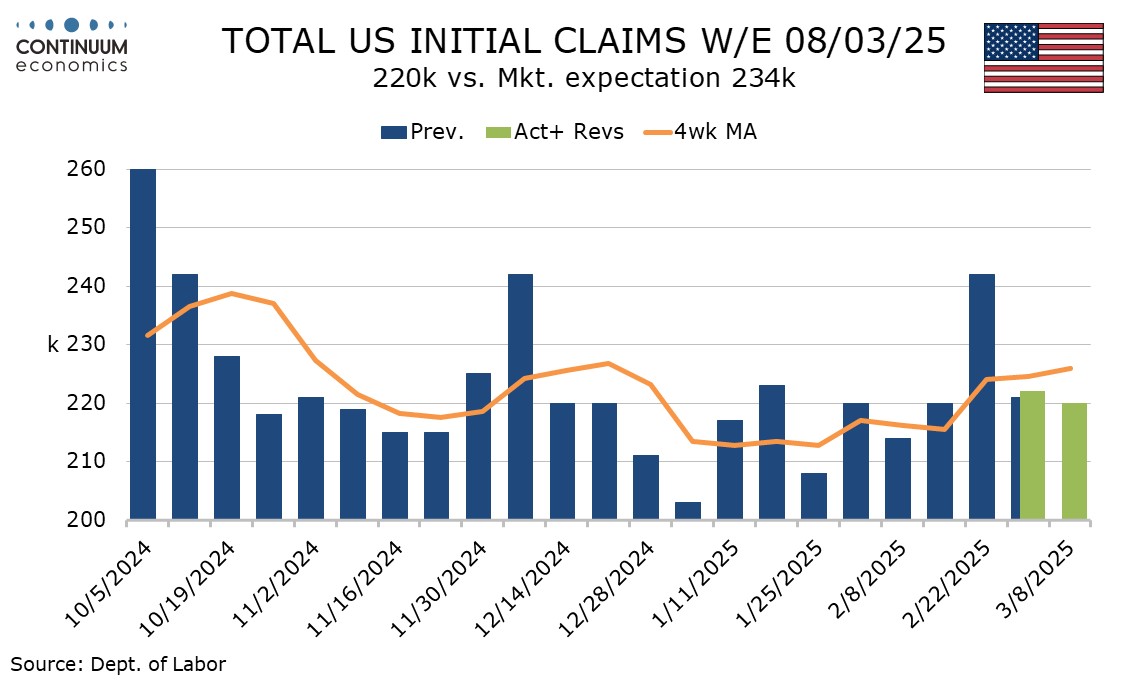

February PPI is surprisingly subdued at unchanged overall with an even softer 0.1% decline ex food and energy. Much of the surprise comes from trade prices with ex food, energy and trade up by 0.2%, but even this is moderate. Initial claims at 220k from 222k suggest the labor market remains healthy.

The weakness of February PPI is partially offset by upward revisions to January, overall to 0.6% from 0.4% and ex food and energy to 0.5% from 0.3%.

Food remains strong with a 1.7% rise led by a further 28.1% surge in eggs but energy fell by 1.2%, led by a 4.7% fall in gasoline.

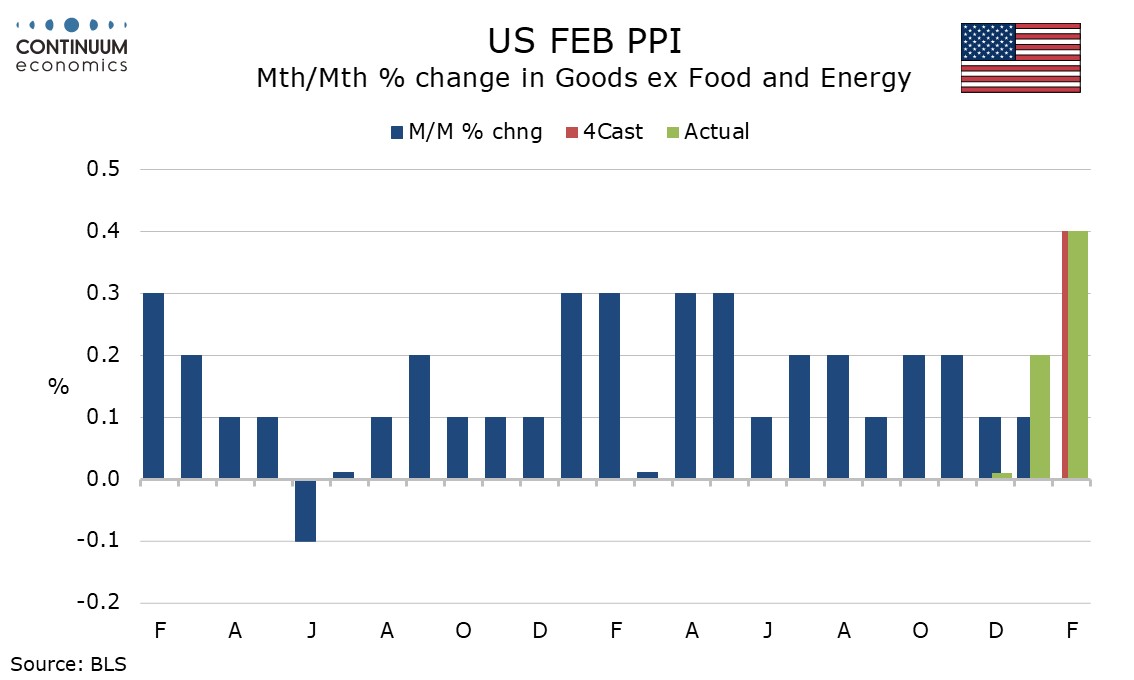

The PPI is actually quite disappointing on core goods prices, with a 0.4% increase, the strongest since January 2023, and it is in goods that tariff risks will be felt.

Service prices are soft, most obviously trade which fell by 1.0% after a 1.2% increase in January, but transport and warehousing as unchanged and other services up a modest 0.2%.

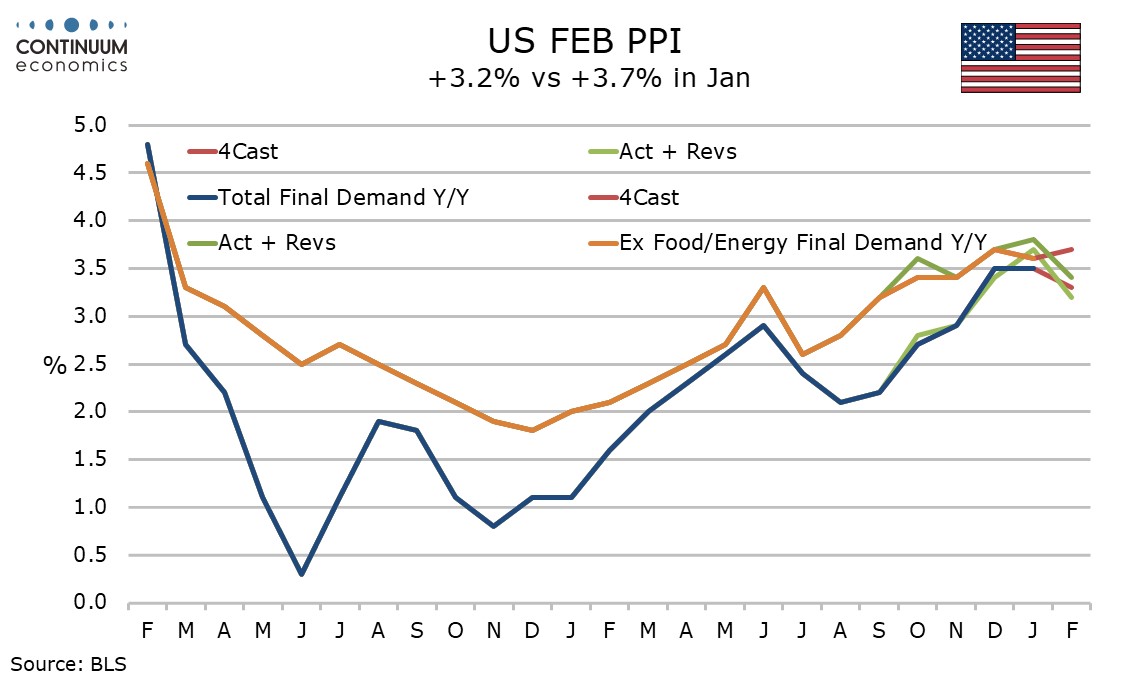

Yr/yr rates are softer, overall at 3.2% from 3.7%, ex food and energy at 3.4% from 3.8% and ex food, energy and trade at 3.3% from 3.4%, but all remain well ahead of the Fed’s 2.0% target.

Intermediate data was clearly soft for services, falling by 0.2% for a second straight month, but goods intermediate data was quite firm, processed goods up 0.5%, 0.3% ex food and energy, and unprocessed goods up 1.3%, 2.2% ex food and energy.

The initial claims data suggests the unexpectedly high figure two weeks ago was more due weather or Presidents Day seasonal adjustment issues that DOGE layoffs or any emerging private sector weakness.

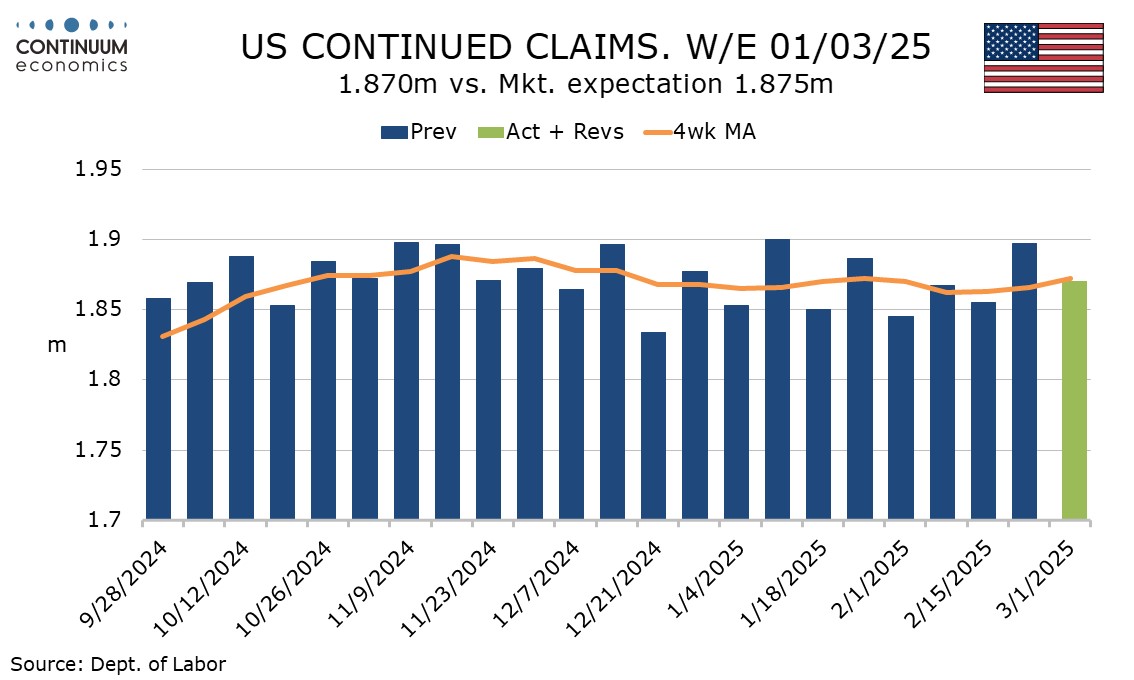

Continued claims fell by 27k to 1.87m, correcting a 42k rise in the preceding week (which covered the high week for initial claims, two weeks ago with continued claims covering the week before initial claims).