FX Daily Strategy: APAC, October 24th

PMI data the main focus on Thursday

European data may put more downward pressure on the EUR

UK data less reliable but GBP likely to stay firm

US focus more on the election

PMI data the main focus on Thursday

European data may put more downward pressure on the EUR

UK data less reliable but GBP likely to stay firm

US focus more on the election

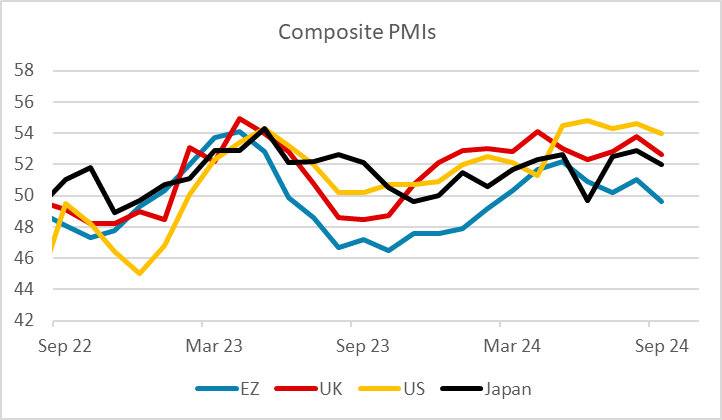

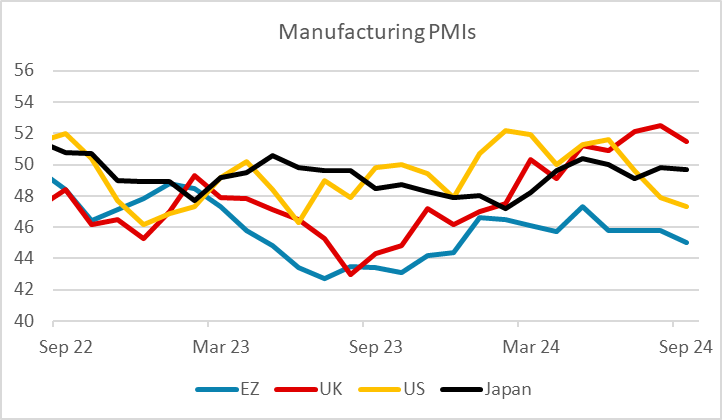

After a week largely devoid of data, Thursday sees PMI surveys for October. There has been much discussion about whether the European data is showing a significant slowdown, and the PMI data is seen as one of the coincident indicators of growth, so will be material to that debate. ECB chief economist Lane said on Wednesday that he didn’t see a dramatic weakening of the economy, but that some recent data raises questions about growth projection. The Eurozone PMI data has been broadly consistent with that view, showing a gradual decline but still holding well above the lows of last year. We see scope for recovery in European consumption, which has been persistently weak, as there has been a build-up of savings which may be unwound as rates decline. But at this stage it seems unlikely that there will be much improvement in the PMI data, which we expect to be fairly stable at current low levels. But we do see scope for more signals of disinflation, and this would also be consistent with Lane’s comment son Wednesday.

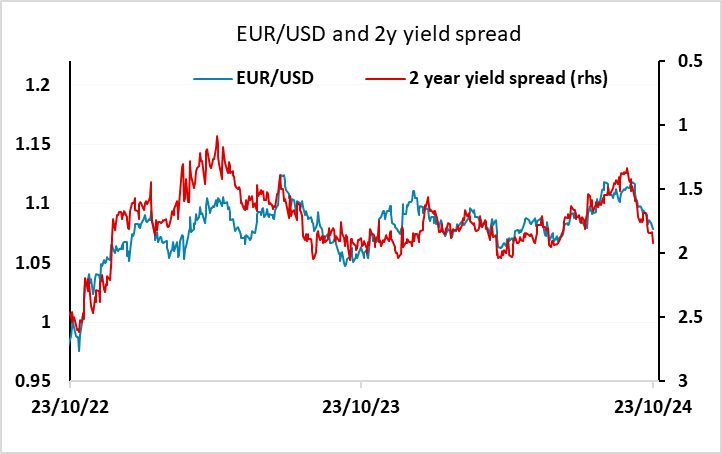

All this suggests that the recent decline in the EUR may well have further to run. Already short term yield spreads suggests there is more downside scope for EUR/USD, with the market currently only pricing in a 20% chance of a 50bp rate cut from the ECB in December. More signals of disinflationary pressure may lead the market o price in more aggressive easing, implying risks of even sharper EUR/USD declines. Initially there is some support around the 1.0750 area, but any further widening of spreads in favour of the USD could see this broken and the lows of the year at 1.06 come under pressure.

GBP has benefited from the relatively strong readings in the UK PMIs this year, but while there are some good reasons for positive views on GBP, this doesn’t really look like one of them, mainly because the UK PMIs are not a great guide to UK growth performance. In particular, the UK manufacturing PMI, which has risen steeply in the last year, bears no relation to the official manufacturing output data, so should be treated with a bucketful of salt. Nevertheless, GBP looks like holding firm with the USD for now, although the focus is more on next week’s UK budget. If that boost confidence in the UK public finances, the risk premium in GBP that has persisted since the disastrous Truss budget of 2022 may be reduced, allowing GBP gains even with a dovish BoE stance.

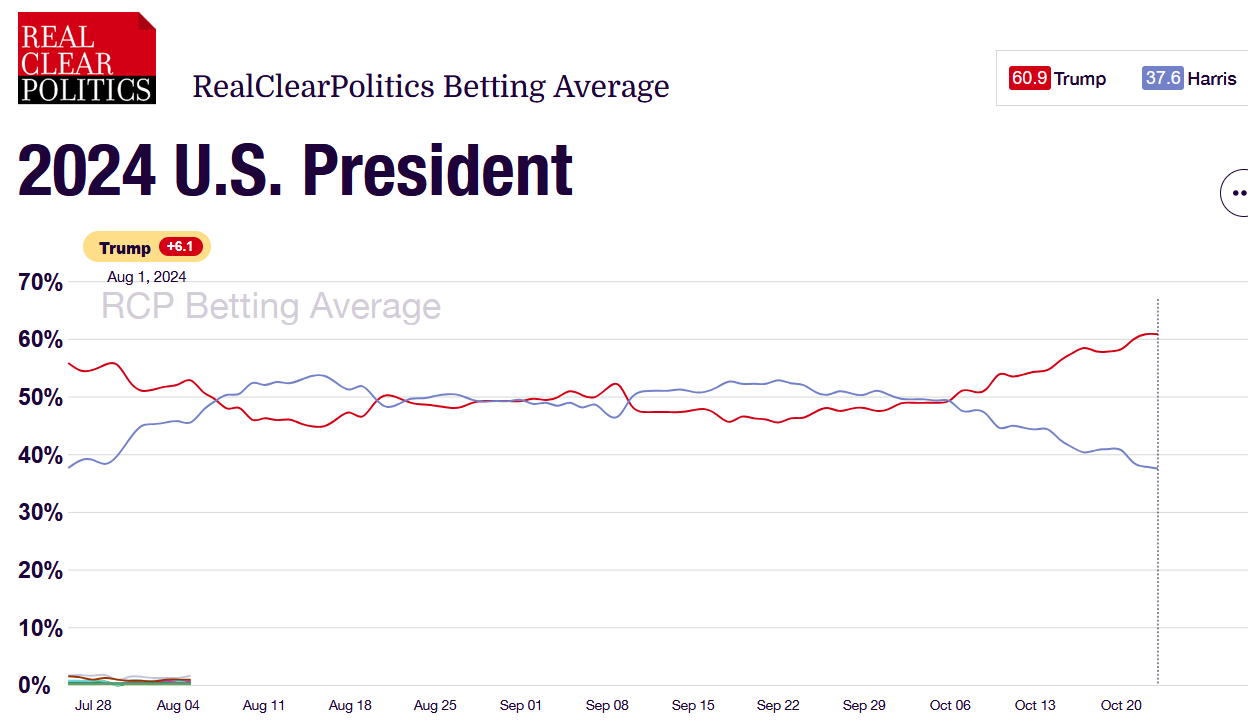

The US PMIs tend to be seen as less significant than the European numbers, but will still be of interest given the current positive market view of the US economy and the recent rise in US yields. But the main US focus now is on the election, and the recent rise in yields looks to be due mainly to the expectation of a Trump victory rather than any specific recent data. In practice we still doubt that Trump’s policies will do much to push up yields unless the Republicans also win the House, so we are wary of the recent USD rise, especially against the JPY.