FX Daily Strategy: Asia, November 4th

GBP has scope to recover after the BoE MPC meeting

USD strength may start to fade with most of the good news now in

JPY weakness needs official action or a turn in equities if it is to reverse

AUD has mild upside risks on RBA

EUR soft but downside momentum modest

Scope for JPY gains but a trigger is needed

CHF weakness corrective for now

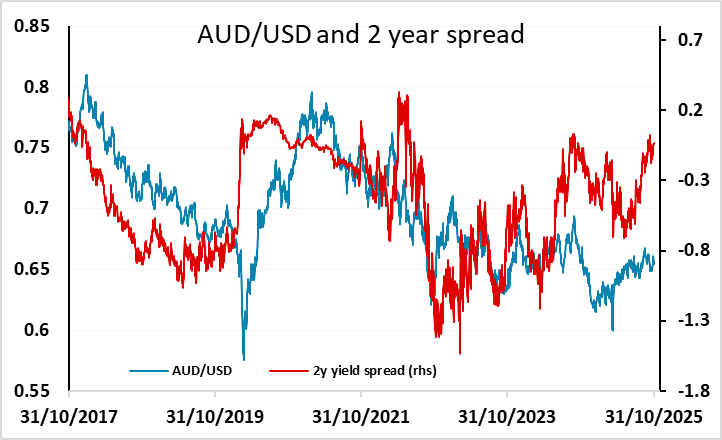

Tuesday’s calendar is light. The RBA meeting would normally be a focus, but there is effectively no market expectation of a rate move, with the chance of a move in December now also priced at less than 20%. However, the RBA may provide some sort of signal about their future intentions, and given that the market is now pricing so little chance of easing, the risks should be on the AUD upside, particularly given the decline in the AUD on Monday, which had little obvious rationale. Yield spreads and Asian equity performance both suggests some AUD upside risk, so unless we see some independent source that undermine s global risk sentiment, we would favour an AUD bounce.

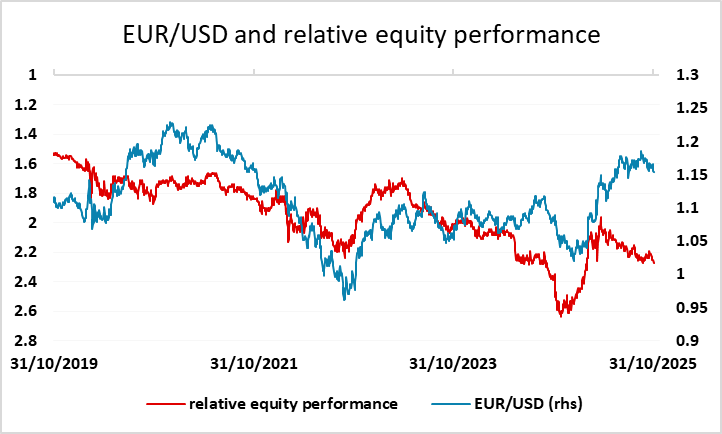

Otherwise, there is very little to focus on. Monday saw the EUR slip back to its lowest since July, once again without much obvious rationale, but the break below the 1.1540 level on Friday and the failure to recover back above it has turned the technical picture bearish. European funds who increased their USD hedges this year and led to the EUR outperformance of the old yield spread correlation are unlikely to reduce them once again despite the recent strong USD performance and the outperformance of US equities, so we wouldn’t expect a sharp EUR move lower. But for the moment the EUR is trading heavy and we could see a drift towards the 1.14 support area.

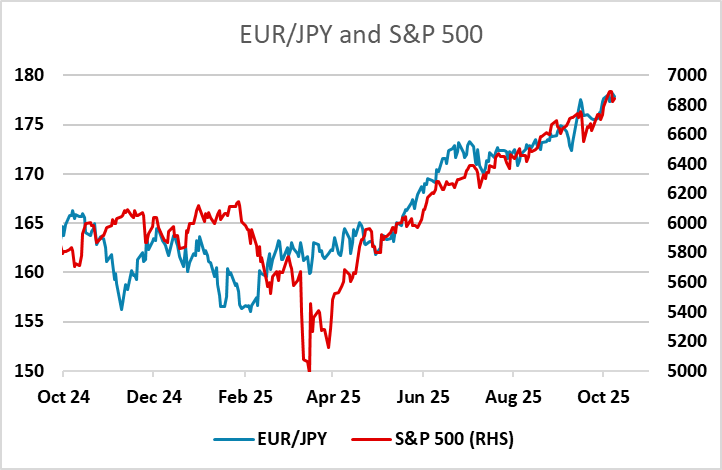

There is more of a case for a decline in EUR/JPY than EUR/USD, with JPY weakness looking increasingly hard to justify now that the new Finance minister has indicated that the recent JPY moves are “rapid and one sided”. Yields spreads and equity risk premia already suggest scope for substantial JPY gains, but EUR/JPY has recently simple been moving up with equities. An equity correction or official intervention still look like a necessary trigger for a major JPY turn, although last week’s comments from Finance minister Katayama do seem to have at least created a short term USD/JPY ceiling at 154.40.

The CHF was the most significant mover on Monday, following the weaker than expected Swiss October CPI data, triggering a EUR/CHF gain back above 0.93. Even so, there is little chance of the SNB seeing the low inflation rate as a reason to reinstitute negative rates, and FX intervention also looks to be off the agenda for now, so extending CHF losses may prove difficult. Of course, it does now make the 0.92 level in EUR/CHF look even better support, and that might encourage some short CHF positioning. There is certainly a case for CHF losses from a value perspective, and from a yield spread perspective, while the economic picture also looks less friendly given the high US tariff on Switzerland. The problem is that these things have not really prevented CHF strength up to now, so for the moment, CHF weakness looks corrective rather than the beginning of a new trend.