FX Daily Strategy: N America, December 12th

UK GDP weaker than expected in October

GBP downside favoured longer term, but little near term risk

JPY could benefit from tech jitters

NOK/SEK dip towards year’s lows looks hard to extend

UK GDP weaker than expected in October

GBP downside favoured longer term, but little near term risk

JPY could benefit from tech jitters

NOK/SEK dip towards year’s lows looks hard to extend

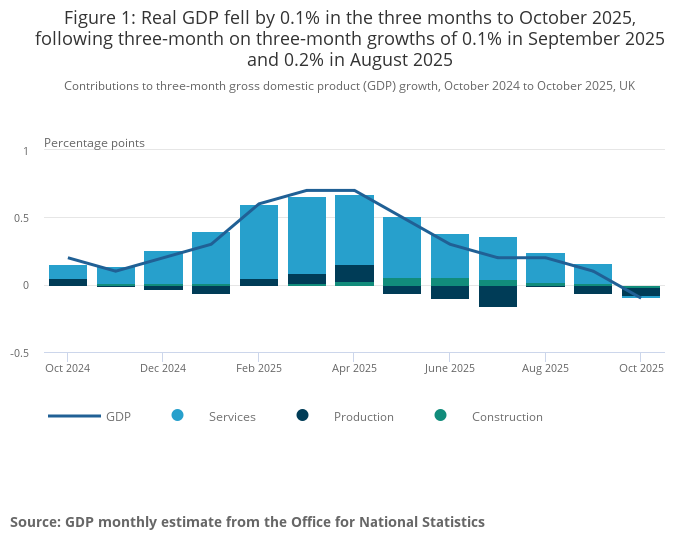

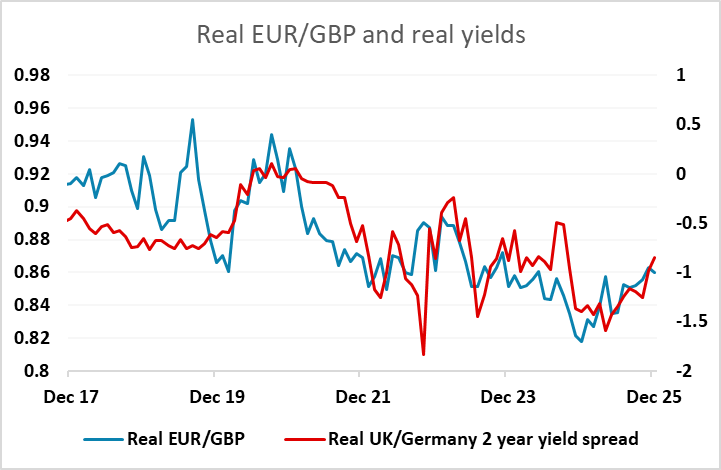

UK GDP has come in weaker than expected in October, falling 0.1% m/m due to a 0.3% decline in services and a 0.6% decline in construction. These offset the 0.5% recovery in manufacturing production helped by the return to production at JLR after the September cyberattack, and a 1.1% rise in total industrial production helped by strong energy production. The weakness in services and construction is concerning, and more relevant than the volatility in the industrial data. GBP is lower as a result, but with a rate cut essentially already fully priced in for next week, we wouldn’t see a lot of downside, with the 0.88 level unlikely to be threatened.

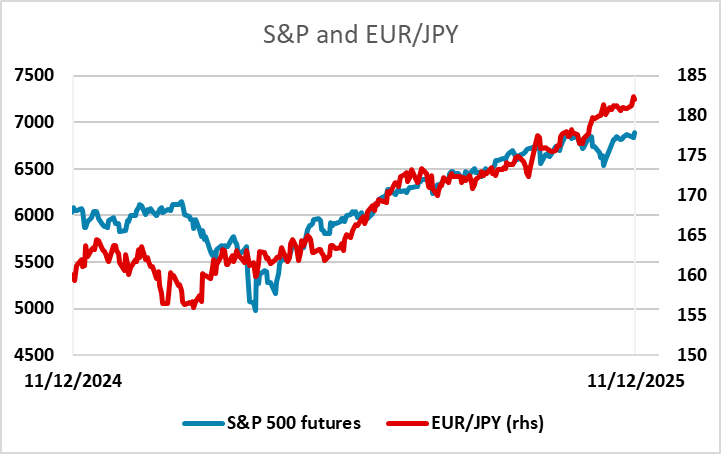

Otherwise, there isn’t a great deal on the calendar, but equity markets will be a focus with the US tech sector a little on the back foot after the Oracle dip this week on AI concerns after their latest earnings. If nerves continue this should favour the JPY on the crosses, with the JPY managing some modest gains on the crosses through Thursday after initially failing a test towards the all time EUR/JPY high of 1.8265 seen on Tuesday. There remains a lot of potential for JPY gains across the board if the equity correction is sharp.

The other notable move on Thursday was another decline in NOK/SEK towards the lows of the year. The rationale is unclear. Lower oil and gas prices may be a factor, but there is little in yield spreads to justify the move, and NOK weakness remains something of a mystery. However, if we do see any general risk sell-off, the NOK will tend to suffer due to low liquidity, so there are risks of a test of the year’s low. But other than the pandemic, 0.90 has been the historic low for NOK/SEK, so it’s hard to see the case for a break without something more fundamental occurring.