FX Daily Strategy: N America, May 14th

GBP rises on earnings data but falls back on Pill comments

US NFIB data could support softer USD tone

GBP rises on earnings data but falls back on Pill comments

US NFIB data could support softer USD tone

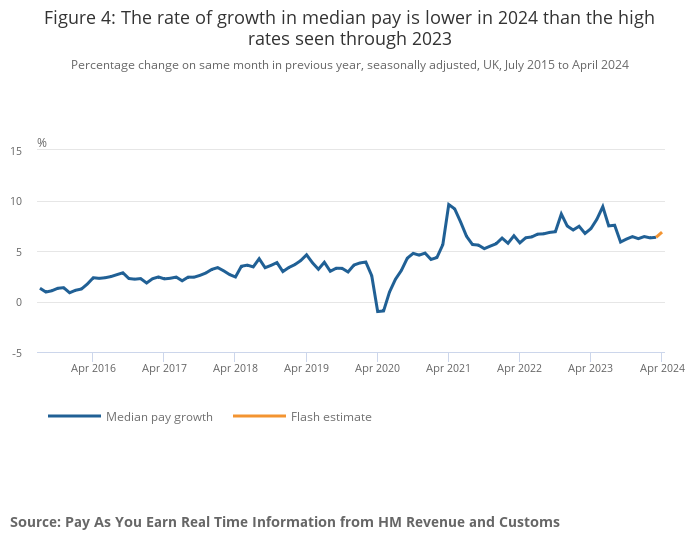

Stronger than expected UK average earnings data pushed GBP a little higher in early trade. Both the HMRC data and the ONS data showed a stronger than expected earnings number, with the ONS data showing earnings holding at 5.7% y/y in the 3 months to March, while the HMRC data showed a rise in earnings growth to 6.9% y/y in April from 6.4% in March. However, there was still weakness in the employment data, with the HMRC data showing a second consecutive decline, and vacancies fell again. t

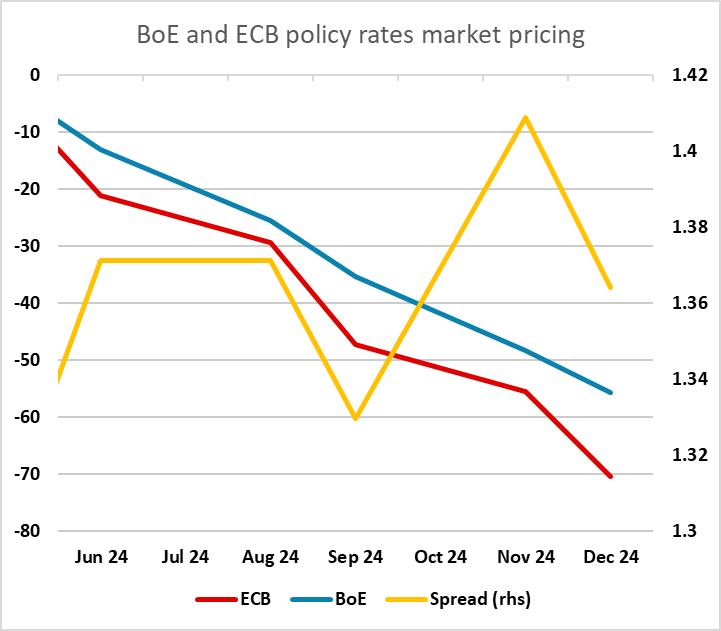

After initilaly rising on the stronger than expected UK earnings data, GBP has fallen back after comments from BoE chief economist Pill who said it’s “not unreasonable to consider rate cuts over summer”. Although he also noted that the labour market remains tight, he said that the BoE can cut interest rates while maintaining a restrictive policy stance. EUR/GBP has more than reversed the modest losses seen after the labour market data and has moved back above 0.86. The market’s view on the June meeting has edged slightly more dovish, with a rate cut now seen as a slightly better than 50-50 chance from slightly favouring no change, but the move has been small. But a cut is now fully priced for August. We would still tend to expect the MPC to wait until August given today’s stronger than expected average earnings data, but the CPI data next week could change that if weak.

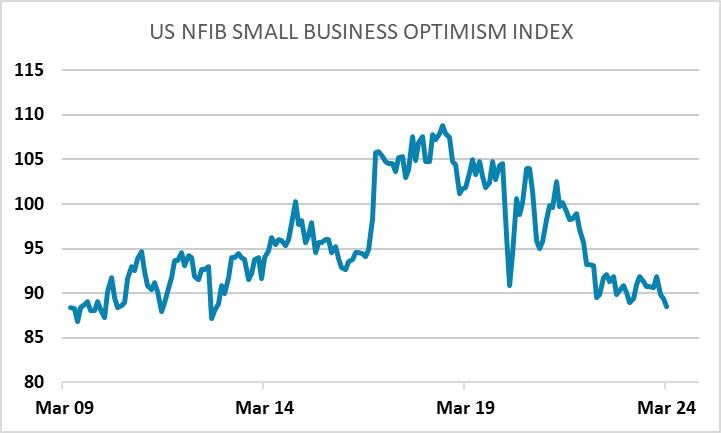

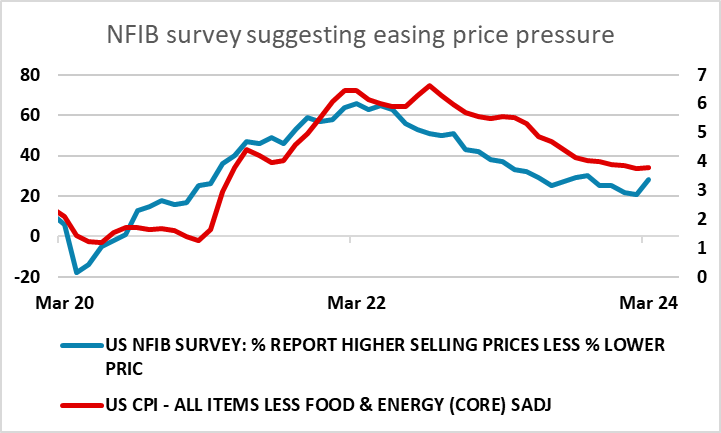

Also on Tuesday we have the German ZEW survey, the US NFIB small business survey and the US PPI data. We don’t see the ZEW survey as particularly useful, as it tends to correlate more with equity market performance than economic performance, but it is likely to be reasonably upbeat and should consequently be mildly EUR positive. The NFIB survey my be more interesting, as the March survey showed a drop in the optimism index to its lowest since 2012. If we see more weakness, it will support the trend of weaker US data seen in the last week and may weight on the USD. However, the price expectations index will also be a factor, as this has been less weak, rising to its highest since October last month. However, even if the price survey still hold up, evidence of weaker optimism will play to a weaker USD story.

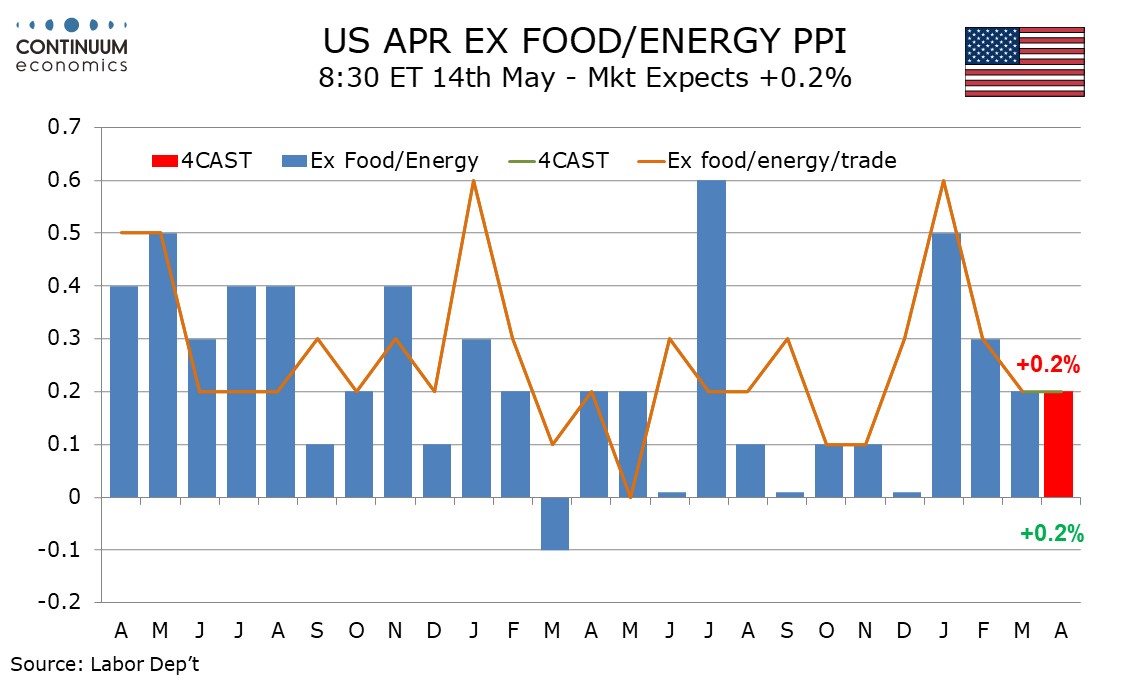

We expect a 0.3% increase in April’s PPI, with gains of 0.2% in the core rates ex food and energy and ex food, energy and trade. The core rates would match March’s outcome which slowed from above trend gains in January and February. The New Year is often a time for price increases with January’s at 0.5% ex food and energy and 0.6% ex food, energy and trade particularly strong, before February followed with gains of 0.3% in both series. Two straight gains of 0.2% will still outpace the final five months of 2023 ex food and energy, though would be more consistent with ex food, energy and trade data for those months.